Best Dividend Growth Stocks for the 11 US Sectors

As counter-intuitive as it sounds, the best time to buy stocks is when the market is falling. The best gains come when you make a stock purchase while you feel like puking (in fear that after you have purchased the stock, the stock will go to 0). There is an important caveat to this: you have to purchase fundamentally strong stocks that are trading below fair value.

In this article, I will share 11 attractive Dividend Growth Stocks from 11 different sectors. These companies are selected due to best-in-class metrics: 1) Consistent ability to grow revenues and earnings over a sustainable period, 2) more than 10 years of consecutive dividend growth, 3) solid balance sheet and 4) attractive valuation.

While these stocks might not have reached an absolute bottom, most of their current valuations present attractive entry points for a starter position.

Best Dividend Growth Stocks for Financial – Visa (V):

Overview:

Visa is a worldwide payments technology company that facilitates digital payments among various entities (consumers, merchants, financial institutions, businesses, strategic partners, and government entities). It provides card products, platforms, and value-added services.

Visa should be a familiar name to you: it is a very common payment facilitator that you can see on websites that facilitate online payment of goods and services. It is also on your debit/credit cards. The more times you transact using Visa, Visa earns a greater share of revenue and profits. This has allowed Visa to grow revenue, earnings and dividends over time.

Financial Metrics and Valuation:

- 5-year Revenue Growth: 5.61%

- 5-year EPS Growth: 14.87%

- Dividend Yield: 0.75%

- Consecutive Years of Dividend Growth: 13

- Payout ratio: 21.54%

- 5-year dividend growth rate: 17.87%

- Forward P/E: 27

Visa is trading at the middle / lower valuation for the past 10 years which presents an attractive entry point for a starter position.

Risk:

A fall in Visa’s users and the number of transactions made on Visa’s network will hamper the company.

Best Dividend Growth Stocks for Real Estate – Realty Income Group (O):

Overview:

O is a real estate company that has over 6700 properties under management in the US and Europe. A vast majority of their tenants are solid blue-chip companies that are visited by many Americans and Europeans. This group of tenants includes 7-eleven, Walgreens (chain of pharmacies like Guardians / Watson), FedEx, and Dollar General (discount product store like Value Shop).

These businesses enjoy strong patronage from consumers regardless of the business cycle. Even in a recession, American consumers still need to shop from Walgreens to get their prescription medicine, Dollar General to get groceries, and 7-eleven if they are craving a late-night snack. This allows O to grow its revenues, cashflows, and dividends steadily since its inception.

Financial Metrics and Valuation:

- 5-year Revenue Growth: 11.25%

- 5-year AFFO / Share: 3.25%

- Dividend Yield: 4.49%

- Consecutive Years of Dividend Growth: 27

- Payout ratio: 88.42%

- 5-year dividend growth rate: 3.75%

- Forward AFFO / Share: 16.7

AFFO / Share is the equivalent of the P/E ratio for REITs. O seems to be a decent value given the quality of its tenants and track record (delivering 15.3% total CAGR since its 1994 listing). O’s payout ratio, while high, is not uncommon for REITs.

Risk:

As O is a REIT with significant real estate exposure, investors have to be mindful of any unsustainable increase in its debts and interest rates.

Best Dividend Growth Stocks for Communications – Verizon Communications (VZ):

Overview:

Verizon Communications is the biggest telecom provider in the United States. Think of it as the Singtel of the US with millions of businesses and individuals who rely on their services for the internet and phone usage.

While you might not get rich owning this name, it does provide a solid defensive option for your portfolio due to its ability to generate consistent cash flows and dividends. The recent selloff provides an attractive entry opportunity especially when the company would benefit strongly from the rollout of 5G.

Financial Metrics and Valuation:

- 5-year Revenue Growth: 1.17%

- 5-year EPS Growth: -6.31%

- Dividend Yield: 4.96%

- Consecutive Years of Dividend Growth: 15

- Payout ratio: 49.56%

- 5-year dividend growth rate: 1.51%

- Forward P/E: 9.09

EPS tumbled in 2017 due to increased competition. However, since 2018, EPS has grown from 3.76 to 5.32. I believe with the advent of 5G and its rather low payout ratio, VZ is in good shape to continue delivering annual dividend increases for shareholders.

Risk:

VZ carries a lot of debt on its balance sheet which is normal for a telecom provider.

Best Dividend Growth Stocks for Consumer Discretionary: McDonald’s (MCD):

Overview:

Mcdonald’s is my favourite fast-food restaurant since I was a young child. This sentiment is shared by millions of consumers worldwide; their set meals – consisting of a burger, fries, and a soft drink, are sold in the hundreds of millions worldwide annually.

This has allowed MCD to grow revenues and earnings consistently over decades. Shareholders have been rewarded with an increasing dividend since 1976!

Financial Metrics and Valuation:

- 5-year Revenue Growth: 0.05%

- 5-year EPS Growth: 5%

- Dividend Yield: 2.33%

- Consecutive Years of Dividend Growth: 45

- Payout ratio: 56.39%

- 5-year dividend growth rate: 7.92%

- Forward P/E: 23.15

Revenue has stagnated recently as a result of MCD changing its business structure (more franchises, fewer company-owned stores). This change would result in greater profits earned by the company. MCD can then grow revenue by charging higher royalty fees.

With its average payout ratio and excellent track record, MCD can continue compounding solid returns for shareholders. The current share price provides a decent entry point.

Risk:

A change in consumer preferences toward healthier foods could hurt the company’s business.

Best Dividend Growth Stocks for Consumer Staples: Target (TGT):

Overview:

Target is the US equivalent of Cold Storage. A favorite among middle-class US consumers, this supermarket chain provides a host of products that ranges from necessities (groceries) to discretionary (toys/electronics). An excellent compounder of shareholder returns, Target has been rewarding shareholders with an annually increasing dividend since 1972! The recent selloff in price due to a 1-time excess supply of inventory provides an excellent entry for the company.

Financial Metrics and Valuation:

- 5-year Revenue Growth: 7.82%

- 5-year EPS Growth: 21.7%

- Dividend Yield: 2.89%

- Consecutive Years of Dividend Growth: 50

- Payout ratio: 27.96%

- 5-year dividend growth rate: 8.45%

- Forward P/E: 11.07

TGT has excellent financials with amazing 5-year growth in earnings and dividends. TGT will continue rewarding shareholders with increasing dividends given their low payout ratio and excellent growth in earnings.

Risk:

TGT operates in an industry with heavy competition such as Amazon, Kroger, Costco, and Walmart.

Best Dividend Growth Stocks for Energy: Chevron (CVX):

Overview:

Chevron is one of the biggest producers of oil and gas in the world. There is no way to understate the importance of this company; the oil and gas used to power the US economy from homes to cars to office buildings are possible thanks to Chevron.

Financial Metrics and Valuation:

- 5-year Revenue Growth: 4.07%

- 5-year EPS Growth: 10.83%

- Dividend Yield: 3.14%

- Consecutive Years of Dividend Growth: 34

- Payout ratio: 51.13%

- 5-year dividend growth rate: 5.07%

- Forward P/E: 11.99

Despite the recent runup in the share price, CVX is still undervalued if oil continues to trade >$100 / barrel. Given the lack of supply capacity worldwide, it is likely that oil continues to stay elevated. CVX will provide an excellent commodity hedge for your portfolio.

This is the rare blue-chip Oil Major that did not cut its dividend payment at the height of the COVID-19 crisis.

Risk:

A heavy recession will curtail economic activity which will cause oil and Chevron to drop in price.

Best Dividend Growth Stocks for Healthcare: Bristol-Myers Squibb Company (BMY):

Overview:

BMY produces and sells a portfolio of crucial medicines that are used to treat a host of life-threatening diseases such as cancer, HIV/AIDS, cardiovascular disease, etc. Their medicines enjoy inelastic demand from patients due to their dependence on them to enjoy a higher quality of life. As these medicines are protected by patents, BMY enjoys exclusive economic benefits from their sales. This has allowed BMY to grow sales, earnings, and dividends consistently.

Financial Metrics and Valuation:

- 5-year Revenue Growth: 17.43%

- 5-year EPS Growth: 38.87%

- Dividend Yield: 2.84%

- Consecutive Years of Dividend Growth: 13

- Payout ratio: 26.88%

- 5-year dividend growth rate: 5.99%

- Forward P/E: 9.80

While BMY might not continue growing at such historic rates, management has guided for solid high single-digit / low double-digit growth in earnings for the next 5 years. BMY’s current valuation provides an acceptable entry position.

Risk:

The expiration of the patents (2025-2028) protecting BMY’s medicines will lead to generic versions being produced which will hurt the company. BMY has to acquire/develop new blockbuster drugs to replace its current portfolio of medicines.

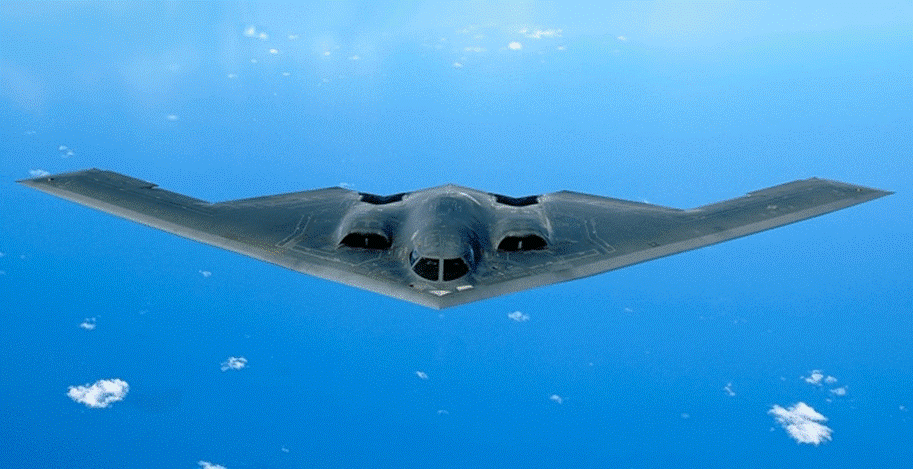

Best Dividend Growth Stocks for Defence: Northrop Grumman Corporation (NOC):

Overview:

NOC is one of the world’s largest weapons manufacturers and military technology providers. Some of the products that the company supplies to the US and its allies are surveillance systems, defense systems, missile systems, and also the world’s only stealth bomber that can carry large weapons in stealth configuration (B-2 Spirit).

The recent Ukraine-Russia war has led to an increased awareness that countries should make sure their defenses are well prepared for potential aggressors. Multiple European nations have committed to increasing their defense spending by hundreds of billions of dollars. This would benefit defense operators like NOC.

Financial Metrics and Valuation:

- 5-year Revenue Growth: 6.52%

- 5-year EPS Growth: 21.58%

- Dividend Yield: 1.49%

- Consecutive Years of Dividend Growth: 19

- Payout ratio: 17.34%

- 5-year dividend growth rate: 11.72%

- Forward P/E: 18.35

NOC commands a rather premium valuation that is well justified due to its excellence in business execution. The company likely continues to compound well for shareholders, especially with an increase in defense spending worldwide.

Risk:

Over-reliance on government contracts and possible government regulations

Best Dividend Growth Stocks for Technology: Microsoft (MSFT):

Overview:

The king of software and cloud, MSFT products and services are indispensable to businesses and individuals worldwide. I use Microsoft Office (word and excel) daily and they make my daily tasks infinitely easier.

I cannot imagine my life without them. Microsoft is an excellent compounder for the past 10 years and the company should continue delivering solid returns for shareholders in the future due to the growth in gaming (Xbox), cloud (Azure), and its suite of office products.

Financial Metrics and Valuation:

- 5-year Revenue Growth: 11.71%

- 5-year EPS Growth: 19.8%

- Dividend Yield: 0.92%

- Consecutive Years of Dividend Growth: 20

- Payout ratio: 24.63%

- 5-year dividend growth rate: 9.60%

- Forward P/E: 23.42

It is rare to have such a selloff for an excellent company like MSFT. It is attractive at these levels.

Risk:

Anti-competitive regulations by the US government.

Best Dividend Growth Stocks for Industrials: Illinois Tool Works Inc. (ITW):

Overview:

ITW produces and sells industrial products and equipment worldwide that is used by numerous sectors: Automotive, Food Equipment, Electronics, Construction Products, Welding, etc. ITW tools are great in quality; you might have seen/used their products without realizing it. Due to this, the company has been able to grow earnings and dividends for decades.

Financial Metrics and Valuation:

- 5-year Revenue Growth: 0.19%

- 5-year EPS Growth: 11.65%

- Dividend Yield: 2.48%

- Consecutive Years of Dividend Growth: 50

- Payout ratio: 56.40%

- 5-year dividend growth rate: 13.94%

- Forward P/E: 22.22

While this is the best industrial name, its current valuation is still rather rich. I would wait until it trades at a forward P/E of ~15x to start a position.

Risk:

A recession will decimate ITW’s earnings.

Best Dividend Growth Stocks for Utilities: NextEra Energy (NEE):

Overview:

NEE generates, transmits and sells electric power to households and businesses in the US. It is the biggest utility company in the US in terms of market capitalization and it is committed to producing and selling electricity via renewable sources (wind and sun).

NEE represents a bet on clean energy with a significant margin of safety given the company’s history of rewarding shareholders with increased earnings and dividends.

Financial Metrics and Valuation:

- 5-year Revenue Growth: 0.19%

- 5-year Adjusted EPS Growth: 8.77%

- Dividend Yield: 2.13%

- Consecutive Years of Dividend Growth: 27

- Payout ratio: 60.54%

- 5-year dividend growth rate: 11.83%

- Forward P/E: 25.13

The best utility name to own in terms of future growth and growing dividend but the current valuation is a tad too rich for me.

Risk:

By far the riskiest stock on this list, NEE has a lot that has to go right for it to justify its lofty valuation. Revenue growth in the future has to justify the current investment it is making in infrastructure to generate green electricity.

Conclusion

These 11 stocks represent my pick for the best dividend growth stock in each industry. Most of them are at attractive valuations. Do always conduct your due diligence before deciding to trade the abovementioned securities. If you enjoy my writings and would like to participate in a financial community of like-minded individuals discussing personal finance and investing, you can join my discord channel

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Discord channel for an active discussion on all things finance!

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- How to double dividend yield using this simple strategy

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Strong Dividend Growth Stocks Increasing Dividends by up to 19% in 2020

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- A list of “Best” Dividend Growth Stocks

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.