Table of Contents

Best Accumulating ETFs

Most investors would have heard of the term Exchange Traded Funds or ETFs for short. Investing in ETFs is a simple method to gain a diversified approach by having exposure to a basket of stocks all through a single ETF ticker.

Since ETF trades on the stock market just like any other stocks out there, it is extremely easy for a retail investor to buy into ETFs.

There are many different types of ETFs out there. However, I will like to bring my readers’ attention to a special “breed” of ETFs that are known as accumulating ETFs.

What exactly are accumulating ETFs and which are some of the best accumulating ETFs that you can partake in to build your retirement portfolio today?

Distributing ETFs vs. Accumulating ETFs

Distributing ETFs

Most ETFs out there are distribution ETFs. Just like dividend-paying stocks, they pay out a regular stream of cash (aka distributions) straight to your brokerage investment account where you can withdraw to fund your daily expenses.

These types of ETFs are ideal for those who want to generate regular income from your portfolio, for example, retirees.

Many US-domiciled ETFs are distributing ETFs.

Accumulating ETFs

Accumulating ETFs are those that do not pay out a regular stream of distributions. Instead, these distributions are being reinvested back into the fund at no extra expense to increase the Net Asset Value (NAV) of the ETF. This helps to compound your returns over the long run.

Those looking to maximize their future investment returns without the need for short-term income might go for accumulating ETFs.

Tax Effect

Besides compounding your returns faster through an accumulating ETF, there are also tax benefits for a Singaporean investor for example, who is subject to paying dividend withholding tax (DWT) on distributions received.

Take for example, if a Singaporean investor invests in a US-domiciled distributing ETF and that ETF pays a dividend of $100, 30% will be retained as DWT and the Singaporean investor only receives $70 from the payout.

He or she can choose to reinvest that $70 back into the fund, but the bottom line is that a fraction of that payout ($30) will be lost to the US government.

On the other hand, a US-domiciled accumulating ETF will not have this DWT issue since dividends are being reinvested back into the fund and there is no payout, hence DWT is not applicable in this case.

US-domiciled vs. Ireland-domiciled (UCITS)

If the ETF is US-domiciled, then a distributing ETF will be subject to a withholding tax of 30% (for a Singaporean investor) but not be impacted by the DWT if it is an accumulating ETF

If the ETF is Ireland-domiciled, then both a distributing ETF and the accumulating ETF will not be subject to DWT from the fund level (Level 2). The decision to invest in either one of them should be based on your preference to receive a regular stream of income (distributing) or reinvest them back into the fund (accumulating).

Which are the best accumulating ETFs

Most of the largest and best accumulating ETFs are Ireland-domiciled UCITS ETFs. It is quite “rare” to find a blue-chip US-domiciled ETF that is accumulating in nature.

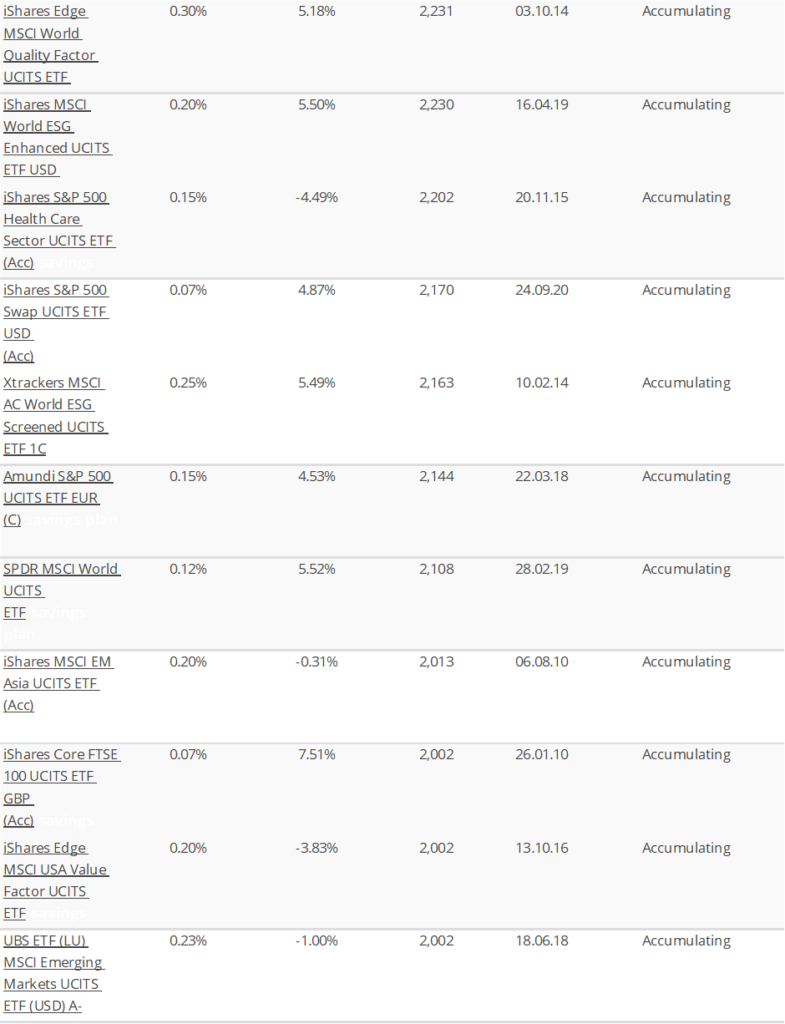

In this list of best accumulating ETFs, they are selected based on a fund size criterion of at least EUR$2bn.

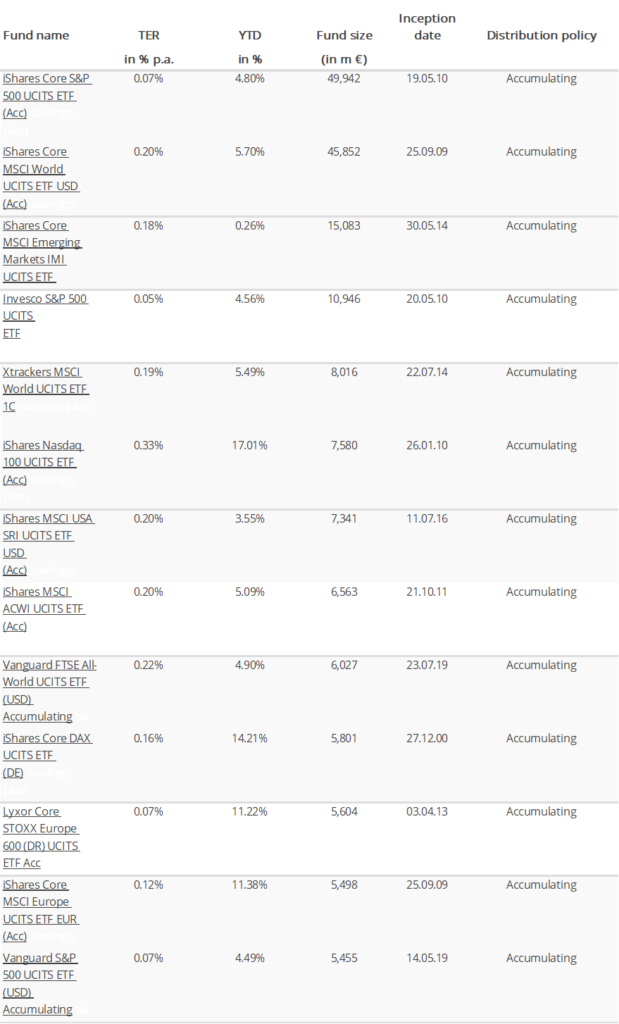

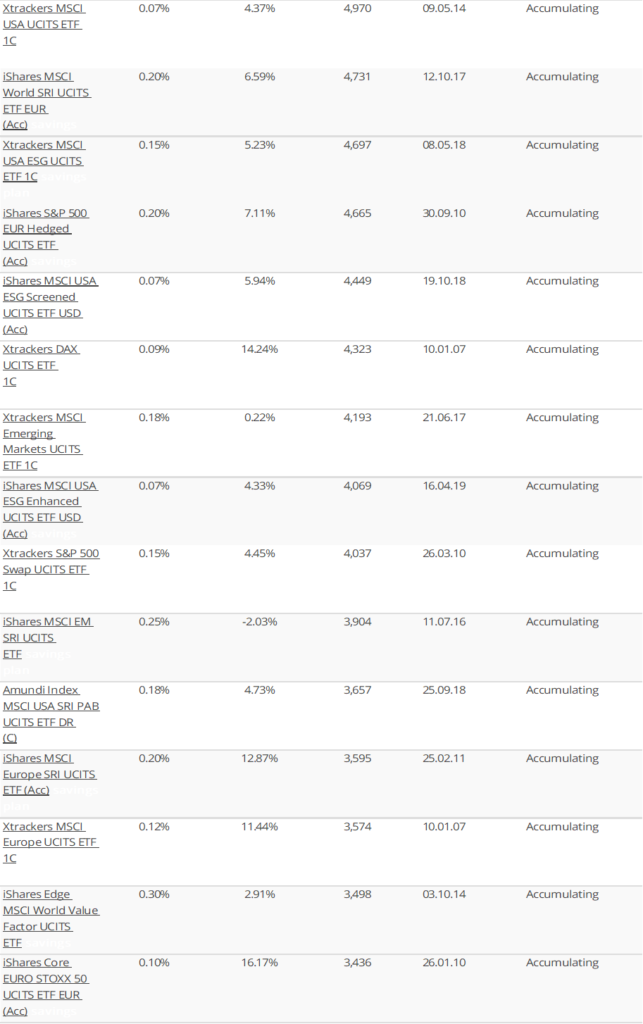

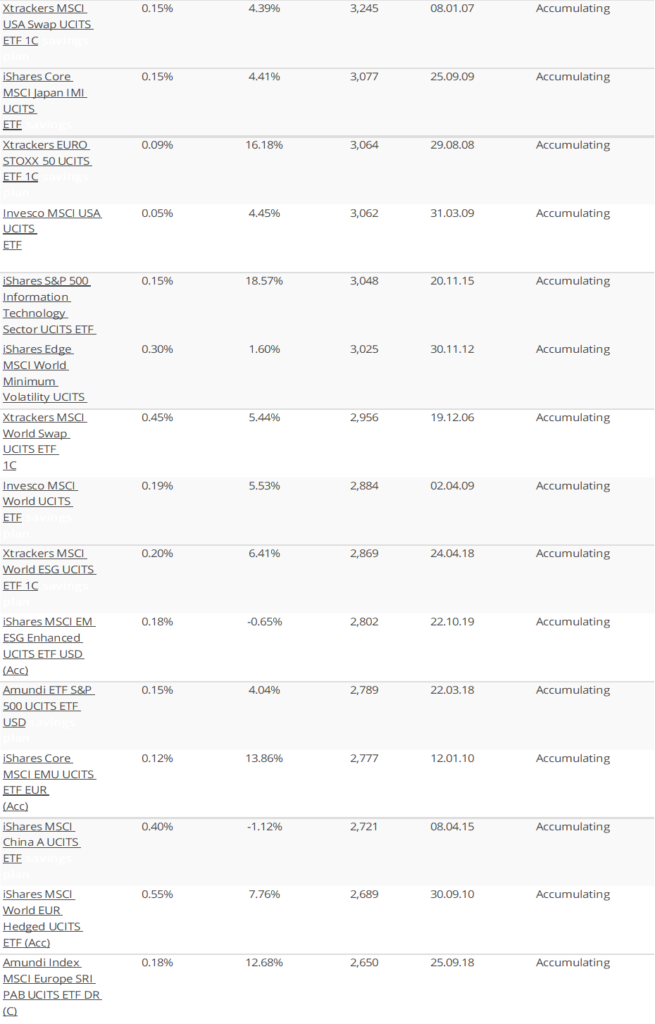

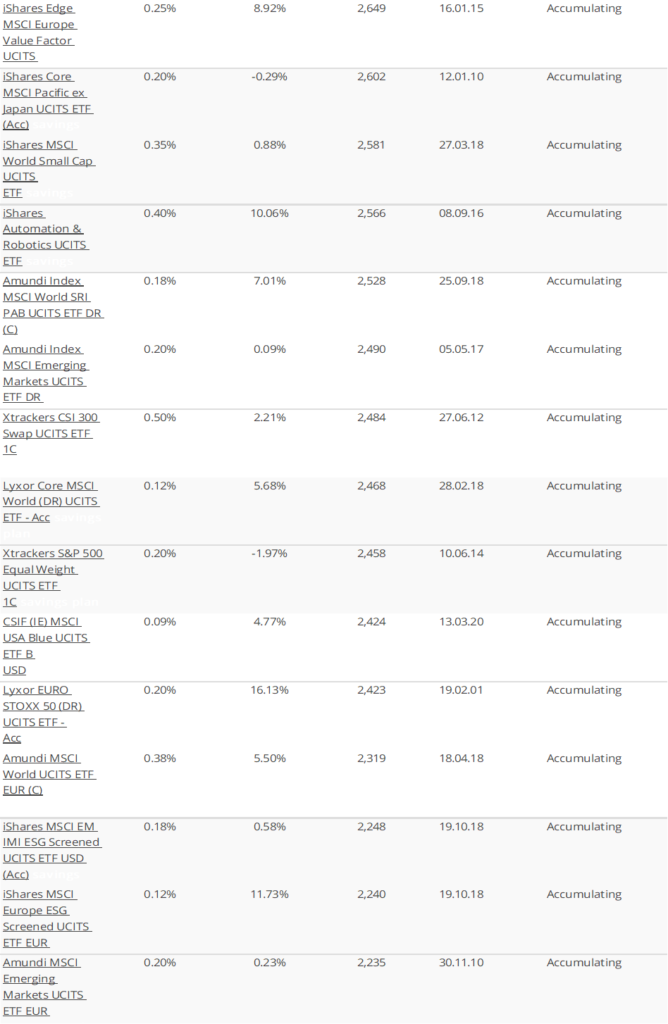

There are 69 accumulating ETFs in this list, with a fund size of at least EUR$2bn, and all of them are UCITS ETFs. See the table below.

Largest accumulating ETF

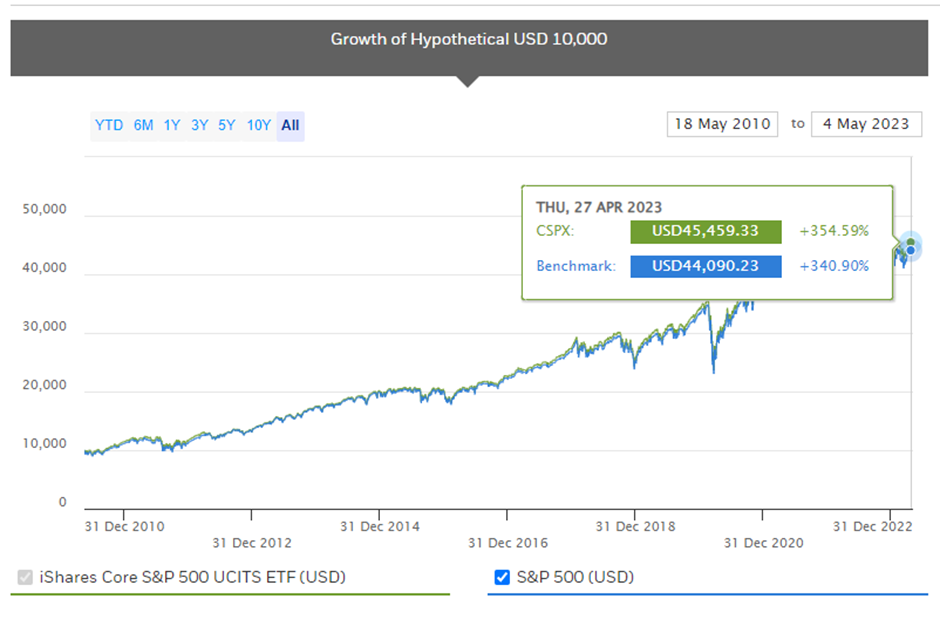

The largest in this list based on fund size is the iShares Core S&P 500 UCITS ETF (ticker: CSPX) with a fund size of EUR$49.9bn. This is one ETF with a relatively low expense ratio of 0.07%. Investors who are interested in a low-fee index-linked ETF which accumulates and compounds your dividend, can look to invest in the CSPX ETF.

As a result of the dividend reinvestment, the CSPX generates a higher return vs. the S&P 500, as a result of compounding.

Best YTD Performance Accumulating ETF

The honor of best YTD performance accumulating ETF belongs to the iShares S&P 500 IT Sector UCITS ETF (IUIT) and the iShares Nasdaq 100 UCITS ETF (CNDX), the latter similar to the more popular QQQ ETF that most investors will be familiar with, the differences being CNDX is UCITS and accumulating while QQQ is US-domiciled and distributing.

The other best YTD-performing accumulating ETFs are mainly euro-linked UCITS ETFs

Best Diversified Accumulating ETF

For those who wish to invest in a diversified accumulating ETF without significant exposure to the US, then the iShares Core MSCI World UCITS ETF (SWDA) might be your preferred solution for global exposure.

Alternatively, one can also consider the iShares Core MSCI Emerging Markets IMI UCITS ETF (EIMI) for emerging market exposure.

Both accumulating ETFs are among the largest in terms of fund size.

Best Dividend Accumulating ETF

There are no dividend-focused accumulating ETFs in this list. Most of the larger dividend-focused UCITS ETFs are distributing in nature. However, since they are UCITS-based, there is no DWT on a fund level by investing in these distributing ETFs.

Hence, as earlier mentioned, the decision to invest in either distributing or accumulating dividend-focused ETF will be based on one’s preference to receive a stream of regular payout (distributing) or to reinvest those for a greater compounding effect (accumulating)

The largest dividend-focused accumulating ETF is the Vanguard FTSE All-World High Dividend Yield UCITS ETF (VHYA.L).

How to purchase accumulating ETFs

Most of these accumulating ETFs are UCITS ETFs, as previously alluded. They are mainly listed on the London Stock Exchange. Hence, investors who wish to invest in these accumulating ETFs will need to have access to the London Bourse.

For Singapore investors, one way to do it is through a platform such as Saxo or Interactive Brokers. The commission costs associated with using the Saxo platform might be rather expensive for those who are just starting with a small capital, with a variable commission rate of 0.10% on most tiers or a minimum amount of GBP$8.

For example, if one wishes to purchase USD$1,000 worth of an accumulating ETF, he or she will have to pay GBP$8 in minimum commission charges (a variable rate of 0.1% amounts to USD$1). That would translate to an effective commission charge of approx. 1%.

On the other hand, purchasing through the Interactive Broker platform is more cost-effective with a variable commission rate of 0.05% and a minimum amount of USD$1.70. Using the same example, the direct commission charges would be just 0.17%. However, do note that there could be other miscellaneous charges involved.

Alternatively, one can use the Syfe Robo Advisor to invest in 5 UCITS ETFs. They are:

- iShares S&P 500 UCITS ETF (CSPX)

- XTrackers S&P 500 Equal Weight UCITS ETF (XDEW)

- iShares MSCI World UCITS ETF (IWDA)

- iShares EM UCITS EYF (EIMI)

- Vanguard All-World UCITS ETF (VWRA)

All of these are accumulating ETFs (except XDEW which is stated as capitalizing). This means that investors who invest in these accumulating ETFs through Syfe will not receive any form of cash inflow. Instead, they will be reinvested on behalf of the investor back into the fund.

Investing through Syfe in this manner will not incur any form of commission charges but will incur the associated platform fees (based on your AUM with Syfe) on top of the expense ratios of these ETFs.

This will be ideal for investors who do not wish to invest a large sum but instead, takes a recurring dollar-cost average approach.

For example, if one only wishes to invest USD$100 into the CSPX ETF, using the IBKR route will result in a minimum fee of USD$1.70 or 1.7% commission charges. However, investing through Syfe is now more affordable (0.60% platform fees).

Building up your retirement portfolio with accumulating ETFs

For those who do not need to depend on a recurring stream of dividend income to fund their monthly expenses, then investing in accumulating ETFs might be a good way to compound your capital faster.

Since these ETFs do not pay out any dividends, there are no associated Dividend Withholding Tax for a Singaporean investor. The same cannot be said for US-domiciled distributing ETFs.

The dividends in accumulating ETFs are being reinvested back at zero costs for you.

However, investing in accumulating ETFs (UCITS ETFs) is often not as convenient as US-domiciled ETFs. These UCITS ETFs are typically listed on the London stock exchange and there are limited brokerage platforms that allow you to invest in London-listed counters.

For the few that do, the commission costs associated might be rather significant. IBKR is likely the cheapest platform in terms of commission costs paid. However, for a small investment amount (USD$100), the commission costs for IBKR might also be quite substantial (1.7% based on min of USD$1.70).

In such a scenario, investing through a robo-advisor platform such as Syfe that allows for investment in UCITS ETF with zero commission costs (clients pay in terms of platform fees) might be more ideal.

For those who are interested to learn more about ETF investing, I have created this FREE ETF Video tutorial which you might be interested in.