Coming to a potential inflection point

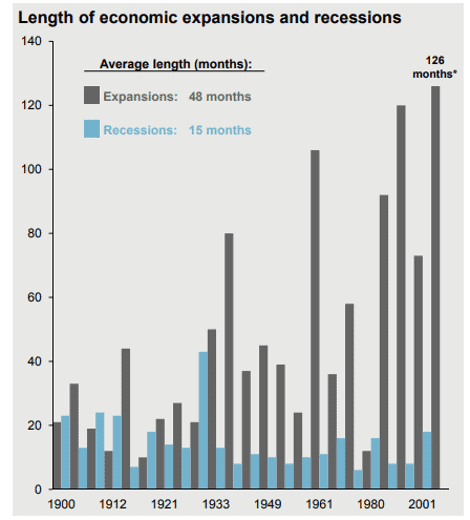

At 126 months, the US is in its longest economic expansion in history, breaking the record of 120 months of economic growth from march 1991 to March 2001.

This data, according to JP Morgan, dates back all the way to 1900. So YES, we are definitely in record territory.

Can the music last? Well, how I wish I have got a crystal ball in front of me. Alas, that is not the case.

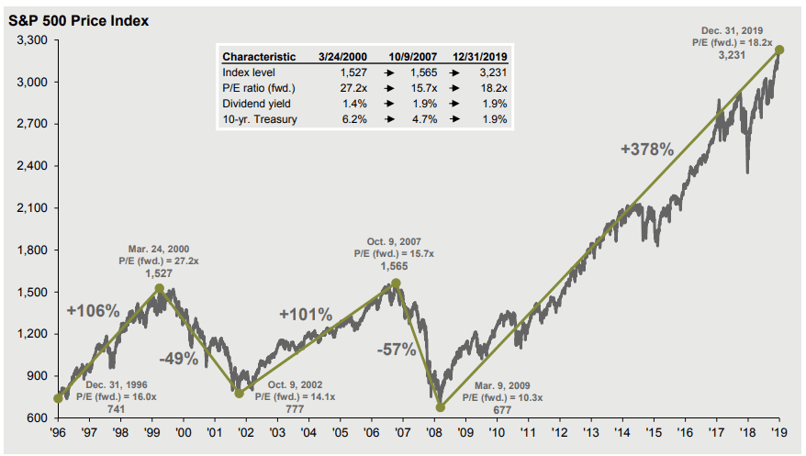

If one is to evaluate based on forward PER ratio, the current S&P500 multiple of 18.2x will not be judged as an extreme when compared to the tech bubble of 2000 where forward PER multiples were around 27.2x.

However, the GFC occurred when the forward PER ratio was only 15.7x, granted it is more of a US-driven banking crisis vs. a stock market over-valuation in hindsight. Investors braved and savvy enough to recognize that US companies remain “operationally cheap” (below a 25-year average forward PER multiple of 16.3x) with the guts to capitalize on the sell-down would have reaped huge rewards over the past decade.

At 18.2x (as of Dec 2019), the S&P 500 is slowly inching towards +1 SD of 19.4x.

Is the market now at an inflection point?

Let us look at a number of economic data points.

Unemployment rate and job openings

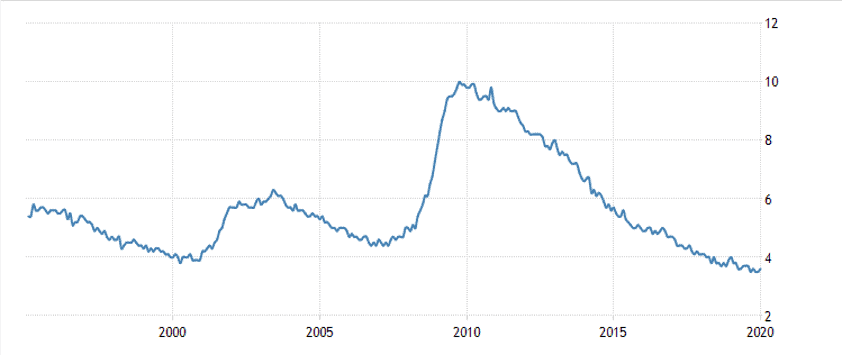

The US unemployment rate, at 3.6% remains near an ALL-TIME low. Well, that is fantastic according to Donald Trump.

The problem is LOW unemployment numbers are actually associated with low forward returns as early as just one year out.

Ben Carlson from A Wealth of Common Sense did a study back in 2014, with the data pointing to the fact that when the unemployment rate is above average, the S&P500 generated significantly higher returns vs. when the unemployment rate is below average.

The key reason for this is that when unemployment reaches the natural lower limit, it forces wages and inflation higher. Good news for workers (depending on how fast wages rise relative to inflation), but not so good for corporates as operating margins will be negatively impacted.

The stock market, at the end of the day, is a play on the profits of corporations and when profits go down, it is only natural that the stock market follows suit.

One will probably argue that on a standalone basis, the unemployment rate has been “sliding down” into record territory since 2017, but our so-called recession and economic doomsday scenario has not happened.

That’s true and a problem with the single variable analysis.

Now let’s add in job openings into the context.

Back during the GFC period, Job openings peak sometime in early-2007 and started declining thereafter. It probably led to the subsequent uptick in the unemployment rate by a few months.

The latest Dec 2019 data is especially unnerving, with US job opening falling by 364,000 to 6.42m and well below market expectations of 7.0m. This was the lowest level since Dec 2017.

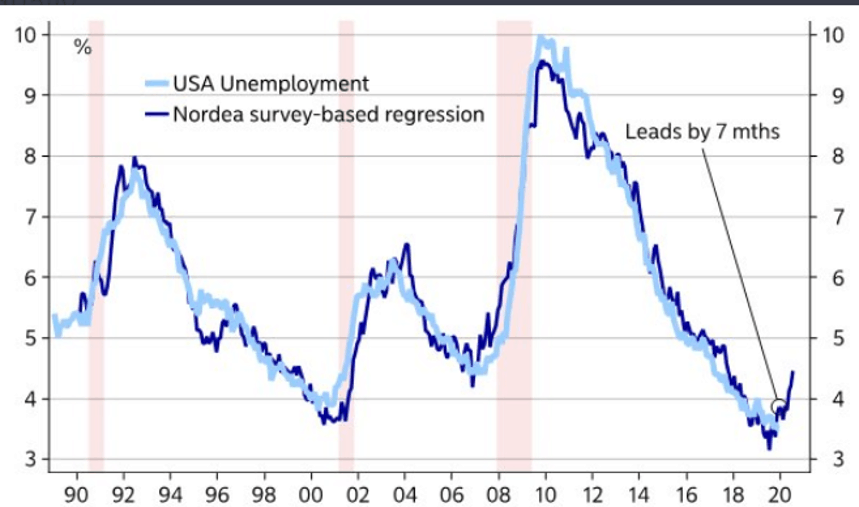

The data from Macrobond and Nordea demonstrates the correlation between US Unemployment and their own survey based on job openings. If the US unemployment rate is to follow suit, that might imply the unemployment rate jumping from the current 3.6% to 4.5% over the course of 2020, an event that only happens during a recession.

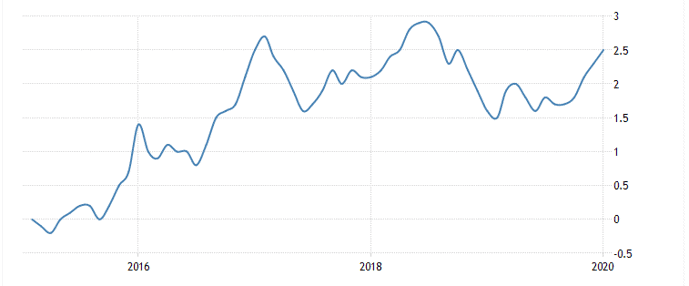

Inflation rate quietly trending higher

I have written about US inflation rates on a number of occasions, particularly in this article. I noted that while I see inflation risk as a major concern, there is currently no evidence of an immediate and rapid spike. I might be proven wrong on the latter.

From the Nov 2019 annualized rate of 2.05%, it crept up to 2.3% in Dec 2019 and again to 2.5% in Jan 2020. The main culprit attributing to the higher inflation rate was gasoline cost which jumped 12.8%. We could, however, witness another dip in Feb 2020 due to oil price volatility. If Feb/Mar 2020 continues to show an uptick despite weak oil prices, then it might really signal an uptrend in inflation. That to me, as I have previously written, could be the straw that breaks the camel’s back.

In such a scenario, it will be almost impossible for the Fed to pump prime the stock market by further lowering short-term interest rates. Instead, the Fed will have to consider rapidly raising rates to curb the devastating effect of inflation.

A rising market environment not supported by economic growth could well result in a market collapse.

Leading Economic Index

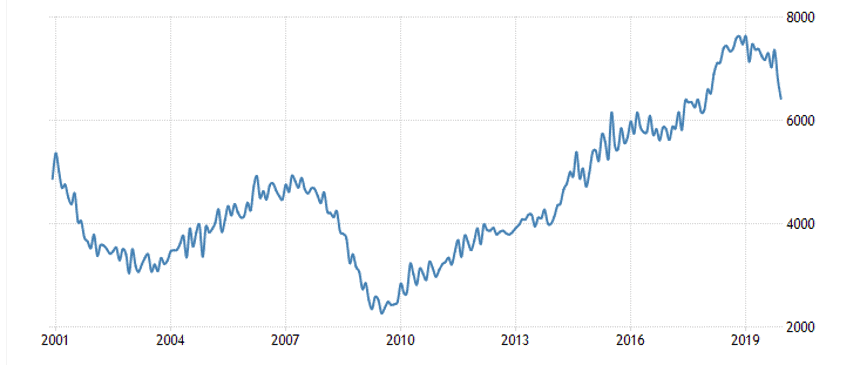

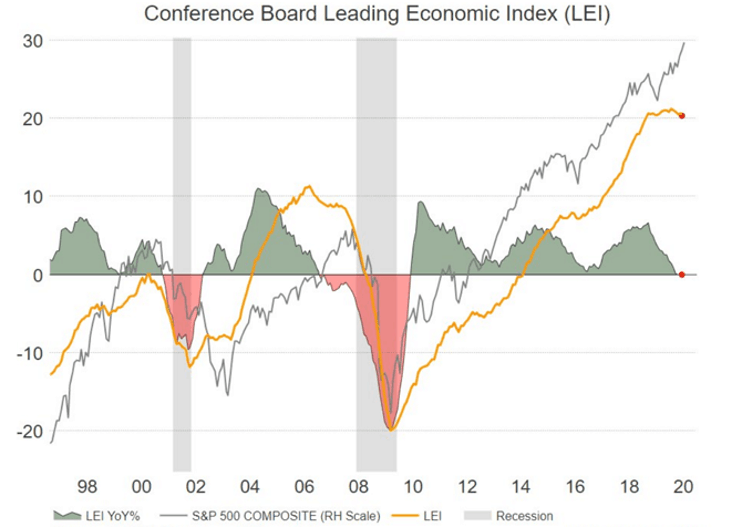

A leading economic indicator that you might not be very familiar with is the Conference Board Leading Economic Index (LEI).

The LEI has just turned negative on a YoY basis for the first time since peaking in July 2019. It has successfully signaled all eight recessions since its inception in 1959.

On average, when the LEI YoY growth turns negative, a recession might happen approx. 11 months later (the portion when the histogram turned red till the start of recession indicated by the grey area).

This might imply a recession sometime in late 2020. The earliest recession has started seven months after the index rolled over.

Bear market: Is this time going to be any different?

Bear comes and bear goes. They are, however, inevitable no matter how it seems like “this time might be different” after all.

While we have got no crystal ball in front of us to accurately predict the exact onset of a bear market, it always pays to be mindful of the little indications that might signal the arrival of Mr. Bear, particularly one whose visit seems way overdue.

That is not to say that one should not be investing at all and stockpiling cash under our pillow. I believe that investing should be a disciplined yet flexible approach.

Discipline in the form of staying invested. Flexibility in the form of being open to restructuring our portfolio according to the macro outlook. While we might hold an initial 100% equity exposure in our portfolio, should we consider now taking a more balanced stance as we approach the last inning of a bull market? 60:40 equity: bond structure perhaps? Or using the NAOF portfolio structure of 20% Equity, 20% long-term bond, 40% REITs and 20% Gold?

At the present stage of the bull cycle, it seems to me that the fear of losing money is lost and it’s replaced by fear of missing out.

Ray Dalio says “Cash is Trash”. In his defense, he is not implying that one should be 100% vested in equities but a more balanced approach with some gold positions.

Nonetheless, a multitude of indicators are currently flashing the “cautious” sign and it always pays to be cautious.

Conclusion

The euphoria in the last stage of the bull market can and does go further which could bring the stock market higher by a further 10% or even 20%.

There are now growing expectations that the Fed might need to lower rates in 2020 instead of standing pat, using the COVID-19 virus wreaking havoc on the global supply chain and tourism industry as a justification.

If that happens, the market is sure to take it very positively despite the negative implications of companies looking at weaker 2020 operating performance.

How long can this music last? I honestly don’t know but this is an opportunity for me to plan and educate myself about what to do when the bear market really hits me.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “Bear market: We could be getting close”