So you want to invest like Warren Buffett? Maybe his current stocks holdings might give you the inspiration. Generations of investors have tried to emulate the “Oracle of Omaha” and it is not surprising why. Since buying his first stock at the ripe old age of 11, Warren Buffett has since invested his way to become the third wealthiest person in the world.

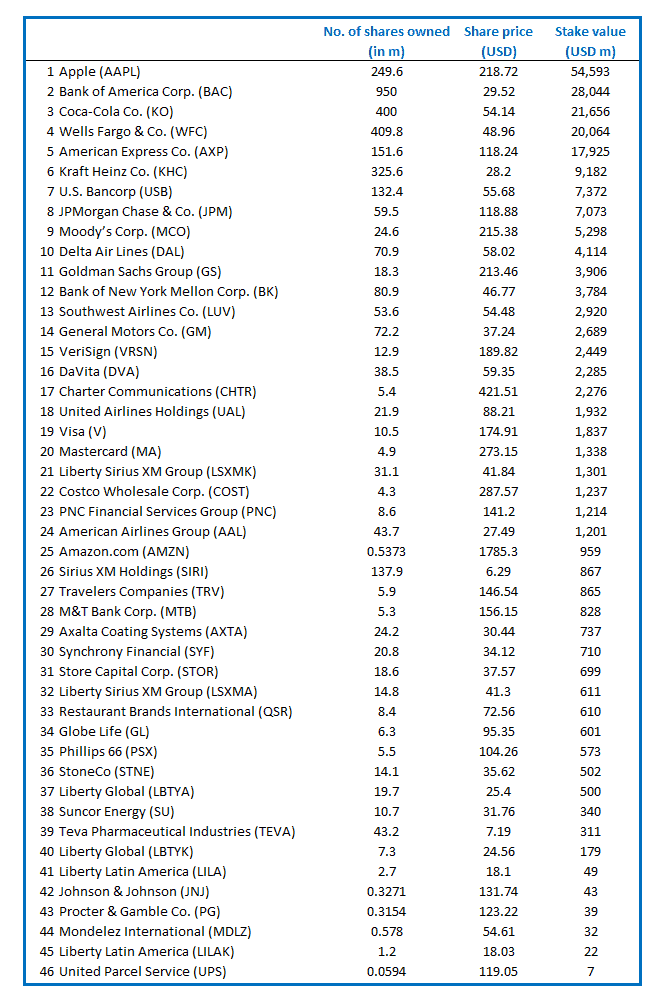

Here is a list of the stocks that Warren Buffett currently owned, according to Berkshire’s latest SEC filings.

*Stock list is ranked by the largest stake ownership to the smallest.

*Share price as of 24 September 2019

We will be providing some basic introduction of the Top 20 stakes in Warren’s portfolio which together accounts for close to USD200bn in value or c.93% of total Berkshire’s stock portfolio valuation.

Apple (AAPL)

Apple is one of the largest publicly traded stocks on Wall Street with a market cap of nearly $1 trn. The company’s most well known product is its series of iPhone that have revolutionized phone ownership all around the world.

Its newest line of iPhone 11 is set to hit stores soon. Shipment times on several models of iPhone have already been extended out to the middle of October, suggesting strong pre-sale demand and fueling optimism that demand can remain robust.

Bank of America Corp (BAC)

Bank of America is the second-largest US bank and is also Buffett’s second-largest public stock holding with Berkshire’s stake valued at c.USD28bn. Buffett first acquired BAC back in 2011 with a USD5bn stake in preferred BAC stock. That has generated a handsome 24% CAGR based solely on capital gains over a short-course of 8 years.

Coca-Cola (KO)

Coca-Cola has been one of Buffett’s longest stock holding, alongside Wells Fargo. He first invested in the stock in 1988. Since that time, KO stock is up more than 2000%, from USD2.45/share to USD54/share currently. The company remains the largest and most valuable soda brand in the world.

KO currently generates more than 70% of its profits outside of the US and is truly a globalized company. With a huge and extremely efficient network of distribution, a superb balance sheet, strong cash flow and excellent management, it is unlikely that Warren Buffett will be looking to dispose his stake in KO anytime soon.

Wells Fargo (WFC)

Wells Fargo is one of the four largest US banks and is currently Warren Buffett’s fourth largest holding, worth USD20bn and also one of his longest holding. Following the recent departure of CEO Tim Sloan in March 2019 only after a short span of 3-years at the helm, WFC’s share price has been rather lackluster. The stock has been trading between the range of USD43-USD52 since the start of the year.

American Express (AXP)

American Express is a global credit card, payments and travel company and has been Buffett’s holding since 1991. The stock is up nearly 270% over the past decade but likely to remain as Buffett’s core holdings for the long haul. The company trades at a very reasonable PER of 14.5x compared to some of its credit card peers. Warren’s stake in AXP is currently worth USD17.9bn.

Kraft Heinz (KHC)

KHC is likely one of the “dog” in Warren’s portfolio, with the share price near the all-time low since Kraft merged with Heinz back in late 2012. In February this year, the company acknowledged an SEC accounting investigation. KHC cut its dividend and took a USD15.4bn write-down for its Kraft and Oscar Meyer brands.

Buffett however, is sticking with the company, saying that the company’s core operations remain strong. However, he also highlighted that Costco’s Kirkland brand is now 50% larger than all of KHC’s brands combined, despite the relatively short operating history of Costco’s private label brand.

US Bancorp (USB)

US Bancorp is the fifth largest commercial bank in the US with USD460bn in assets and is Warren’s seventh largest holding with a stake valued at USD7.4bn. Buffett believes that US banks remain a good investments and will benefit from the 2018 changes in US tax law which will allow large banks to continue generating outsize returns even in an low-interest rate environment.

JP Morgan Chase and Co (JPM)

Yet another bank sits in Warren’s top 10 holdings, with his JPM stake now worth USD7.1bn. JPM is the biggest bank stock of all, boasting a market cap of c.USD350bn. Even after gaining 72% in the past three years, JPM stock still trades at just a forward PER of 11x and yields a dividend of 3%.

Moody’s Corp (MCO)

Moody’s Corp is one of the major US credit ratings agencies and sits at No.9 position in Buffett’s portfolio. Since 2010, Warren has been reducing its stake in Moody’s from a peak of 48m shares back in 2009 to the current 24.6m shares.

However, in a recession, this stock could benefit from the need for more credit/risk analysis and considering that Moody’s is just one of three rating agencies around to provide that service, this stock could be a stock to hold through a recession (unless another GFC scandal breaks out).

Delta Air lines (DAL)

Buffett’s stake in DAL increased to over 10% of DAL’s share-base in early 2019, a “mistake” according to Warren himself. The stake climbed when Delta bought back its own stock and Berkshire increased its holdings. Buffett spurned the airline industry for years after what he acknowledged was a bad bet on US Airways Group Inc in 1989. But he has been piling into airline stocks since 2016, buying up stakes in Delta, Southwest Airlines, American Airlines and United Continental Holdings.

Goldman Sachs Group (GS)

Goldman Sacs Group is the second-largest full-service US investment bank behind JPM. GS stock has under-performed in 2018 due to several headwinds, including legal issues with bond fund fees paid by the Malaysian government and potential fines from the US Justice Department in relation to the failed 1MDB investment fund. However, its stock is up 22% YTD2019.

Bank of New York Mellon Corp (BK)

BK’s primary two business lines are investment services and investment management. The company has suffered from poor share price performance of late. However, Buffett has taken advantage of its share price weakness and added its stakes in the company since 2018. It is estimated that Warren’s cost on BK is approx. USD41/share vs. current share price level of USD46/share.

Southwest Airlines Co (LUV)

Southwest Airlines is the fourth largest US airline, targeting customers looking for low-cost flights and minimal fees. Like Delta airlines, the stock is at an attractive value at a forward PER of just around 10-11x. Analysts have long speculated that Buffett could eventually acquire 100% ownership of one of the big four airlines and LUV could be the ideal buyout target, given its relatively smaller market cap.

General Motors (GM)

With more than 72m shares, Berkshire Hathaway is GM’s fourth-largest investor, holding more than 5% of the car company’s shares outstanding. In many ways, GM looks like a classic Buffett value bet. It is the No.1 domestic automaker and Warren has high praises for its CEO, Mary Barra.

Verisign (VRSN)

Warren bought Verisign back in 2012. The 3.7m shares were purchased at an average of cost of USD38.8/share. VRSN has since returned more than 420% from the initial purchase. Warren continues to increase its stake in the company and currently owns 12.9m in the company, making it the largest institutional investor with a 10.8% ownership. Verisign’s dominance of the internet infrastructure space is likely what keeps Warren continually invested in this name.

DaVita (DVA)

DaVita is the US leader in dialysis, operating 2,400 clinics and serving more than 1.7m patients in the US and 9 other countries. Aging baby boomers and a graying population in many developed markets should provide a strong, secular tailwind for the counter. Berkshire is DaVita’s largest shareholder, with its 38.5m shares accounting for 23% of DVA’s shares outstanding.

Charter Communications (CHTR)

Charter Communications market cable TV, internet, telephone and other services under the Spectrum brand. This is a stock that has lost flavour with Buffett who has been trimming down its stake from 9.4m shares in early 2017 to just 5.4m shares in the latest holding. The company has however been a strong out-performer of late, with its price up a hefty 41% YTD.

United Airlines Holdings (UAL)

Another airline in Buffett’s portfolio. Buffett thinks air carriers today offer much better growth prospects than they did in the last century when there were more than 20 airlines vs. the big four now. Berkshire’s portfolio holds 8.2% of UAL shares outstanding, making it the airline’s second largest shareholder.

Visa (V)

Buffett believes that payments are a “huge deal” worldwide and Berkshire has stakes in all the major credit card operators. Visa operates the world’s largest payment network and this is well-positioned to benefit from the growth of cashless transactions and digital mobile payments. First purchased in 3Q11, Visa has proven to be a winner with an annualized return of more than 30% since 2011.

Mastercard (MA)

Rounding up the Top 20 portfolio stake is Mastercard. Similar to Visa, it’s a company that Warren bought in 2011 and wish he had bought more of. Mastercard stock has gained 172% over the past 3 years, outperforming Visa and AXP.

TAKE A LOOK AT OUR OTHER INVESTMENT COVERAGE

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.