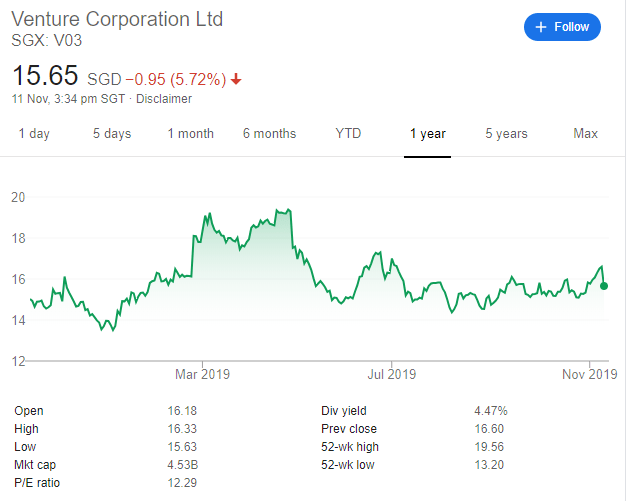

Venture announced its 3Q19 results after market hours on 8 November. Market was not impressed despite a 5% YoY earnings growth and consequently, its shares were sold down c.6%. Several brokerage also downgraded the counter to a Neutral rating. We have previously written about Venture in our article: VENTURE CORP DECLINED BY 4% DESPITE SOLID PHILIP MORRIS 3Q19 RESULTS. HERE’S WHY.

Separately, SATS Ltd is looking to announce its 2QFY20 results after market closes on 12 November. We believe that this quarter’s results could remain weak as persistent cargo weakness and potential losses in SATS’s Hong Kong associate (AAT) remain a drag on its margins and consequently bottom-line.

Venture

Venture’s 3Q19 net profit of S$85.2m was 5.5% higher vs. 3Q18 net profit of S$80.8m. However, this was likely below market’s expectations as this quarter net profit included S$3.2m in FX gains and S$1.2m in write-back of tax over-provision. Adjusted net profit of S$80.8m what likely below what the market expected.

Key takeaways from 3Q19

Margin pressure

Venture’s net margin declined from 10.1% in 2Q19 to 9.8% in 3Q19. According to Phillip Securities, the brokerage highlighted that Venture’s clients could have been using the trade war as an excuse to pressure their electronics supply chain suppliers to lower prices. The brokerage house expect this trend to continue and hence see near-term margins weakness.

Gaining more customers

On the flip side, the company has been gaining traction in terms of winning new clients. According to Phillip, Venture now serve approx. 130 clients globally, up from c.100 previously guided by management.

The company commented: ” Venture will be supporting several partners in their new and key product launches over the next 12 months .” This could help to support future revenue growth.

Weak 4Q19 outlook

Most in the street expect’s Venture to report a weak set of comparative results in 4Q19. DBS commented that Venture reported robust 4Q18 net profit of S$107.7m and this will likely make for a difficult comparison base next quarter. DBS is forecasting Venture to report 4Q19E earnings of only S$80m.

Likewise, CIMB is forecasting 4Q19E earnings of S$85.5m and believes that the street’s earnings will have to be adjusted downwards.

Street could be right in being cautious

We believe that the street could be right in being cautious of Venture at this juncture, although valuations are seemingly undemanding, trading at a forward PER multiple of c.13x.

This is due to weak earnings outlook where Venture’s 4Q19 performance will likely be lackluster, especially comparing against a high-base. We have previously also highlighted that despite robust overall IQOS demand, IQOS device demand could be softening, as guided by Philip Morris’s management. This could significantly impact Venture’s top-line, given that Philip Morris is believed to be a key customer of the company.

Nonetheless, further share price weakness, possibly to the S$14.70 level, could present a buying opportunity for long-term shareholders, with dividends likely to be sustain or even improve, given Venture’s strong balance sheet position. We will also not rule out a potential M&A in one of Ventures’s key cluster.

SATS Ltd

SATS’s last quarter (1QFY20) performance was a major disappointment, resulting in the stock being sold off from the then high of S$5.42 to S$4.68. The stock has since recovered to trade at S$5.09 as of this writing.

We believe that its 2QFY20 results (to be announced on 12th November) might continue to underwhelm which could present an opportunity to accumulate for long-term shareholders.

Key risks

We see three key risks for the upcoming results:

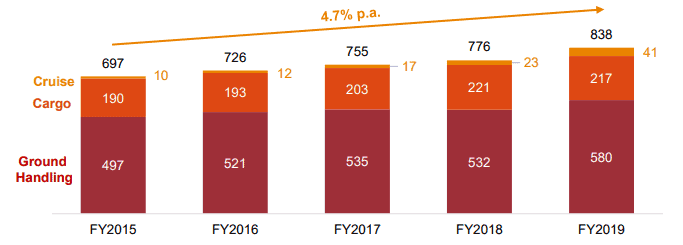

- Cargo weakness likely to persist: We believe that SATS’s cargo business, which encompass approx 11-12% of Group’s revenue, to continue to be under pressure. This is a segment that has high operating leverage, hence any decline in business volume or pricing will have a significantly large impact on margins.

2. Hong Kong protest to affect AAT performance. According to UOB KayHian’s 15 October report, the brokerage highlighted that the unrest in Hong Kong could result in Asia Airfreight Terminal, SATS’s 45%-owned associate to be operating in the red for the quarter.

3. Operating margins to remain weak. The consolidation of he GTR business, while positive in terms of driving revenue growth, will likely result in lower Group’s operating margins as GTR currently commands lower margins compared to the Group’s consolidated businesses.

While management has been positive of GTR, commenting that the business has performed credibly since the JV started less than a year back, we believe the current “ramping up” phase to drive revenue will result in significant head count costs to be incurred, hence driving operating margins lower.

Still a stock with long-term positive fundamentals

We believe SATS remain a stock with decent long-term fundamental growth outlook, driven by growing air travel demand. Management’s plan to expand into the food solution business by setting up Central Kitchens in China and India to serve fast casual restaurants will be a complementary business element in growing its in-flight catering business as well.

However, the stock is not cheap, given weak earnings outlook in FY20 and trading at a forward PER multiple of 22x. In this aspect, we favour ST Engineering, which is trading at a slightly lower forward PER multiple but yet demonstrate stronger earnings growth prospect.

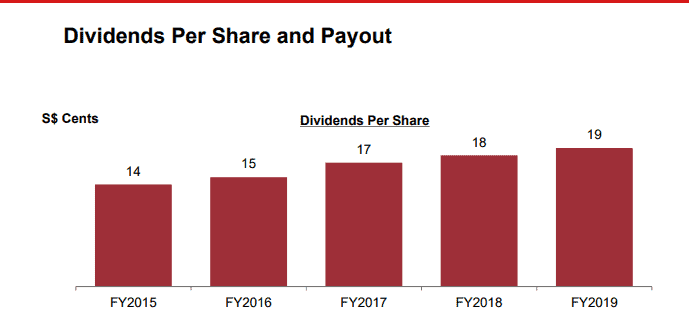

A key positive for SATS has been its growing dividend profile, being one of the very few non-REIT stock that has been consistently growing its dividend per share over the past 5 years. We expect this trend to continue into FY20.

Watch out for its 2QFY20 earnings on 12th November after-market hours.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER STOCKS WRITE-UP

- YANGZIJIANG’S SHARE PRICE IS UP 7%. CAN MOMENTUM PERSIST POST-RESULTS ON 7TH?

- SINGAPORE AIRLINES 2QFY20 PREVIEW. HERE IS WHAT TO EXPECT.

- RIVERSTONE 3Q19 PREVIEW: POTENTIAL TO SURPRISE?

- SHENG SIONG 3Q19. 4 KEY AREAS TO LOOK OUT.

- VALUEMAX: A RECESSION PROOF BUSINESS BUT WE SEE 1 MAJOR RISK

- HOW TO PLAY THE PARTIAL OFFER FOR KEPPEL?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.