uSMART’s SMART Orders

Have you ever been in a situation where you have done so much due diligence and research on a particular investment play such that regardless of what methodology of analysis was used, you have it right down to the numbers and parameters and it looks something like this:

Stock ABC

Target Entry price: $1

Risk / Reward trade-off: 1:3

Take profit after price moves 1 standard deviation upwards: $1.60 (potential profit = $1.6 – $1 = $0.60)

Stop loss: $0.80 ($1 – ($0.60 / 3))

Trade size: 0.5% of capital 50% of capital, let’s do it, I am confident!

You had it all planned out for the trading day.

9 PM

All the specifics, written by hand, neatly in your suede leather trading journal. 30 minutes before the market opens, you recite and internalize your trading strategy and the underlying reason behind the trade.

925pm

With 5 minutes left before the market opens, you take the red-colored headband out from one of the many drawers of your impressive customized multi-screen trading desk.

As you tie the headband around your forehead to get ready for war, you think to yourself, ‘if anybody who is in the room didn’t know any better, they would have thought that they were at a bank’s proprietary trading floor’.

It didn’t matter that your lips were badly cracked from contorting into that arrogant and wry grin because you hadn’t been out for days to make sure your due diligence and trading strategy was foolproof.

928pm

With your red bandana on, you stand up from your premium gaming chair and perform your war cry to a video of the All Blacks doing the Haka. Your parents are worried but they are already used to it.

930pm

The market opens, you key in your entry price and get into your desired trade and now you wait for $1.60 to materialize.

945pm

You get woken up by the sound of price alerts from your trading desktop, your multiple phones, and tablets. You realized that as much as you have had 8 hours of sleep, you had expended too much energy on your pre-market open routine and had dozed off shortly after putting in the trade!

You are reading something about some sort of new virus that is spreading rapidly across the planet and you panic! You open up your trading app to check on your trade and ABC stock is trading at $0.32!

Crap! You forgot to put in your Stop Loss order at $0.80. Now the price is at $0.32…..

Your vision gets blurry, your life flashes right in front of you, you see a bright light and start walking towards it…….

Automation, automation, automation!

Why, why is it that we want automation?

For one, it takes the emotions out of our investment decision-making process.

How would you feel about cutting loss on a trade that you have done so much due diligence on? It’s a catch-22 situation, isn’t it?

Also, once things are automated, you get to have a power nap after you put in your trade so that you can let your glutes and hammies have a rest from doing the Haka. No more rude surprises like seeing your counter’s price collapsing to $0.32 in a matter of minutes!

Seriously though, do you see that it is pretty much nothing but benefits if this part of our trading process is automated?

And, with uSMART’s Smart Orders, you can do that! And more!

Imagine this: 1) do your due diligence, 2) quantify your numbers, 3) put in your trade and 4) set your stop loss/take profit level, and 5) forget (well, not forget but you know what I mean)!

It seriously has never been easier to just follow this 5 steps process in all your trades.

There will be no surprises!

Instead of the traditional preset type of orders, uSMART understands the regular investor and gives us more than the traditional permutation of BUY/SELL orders!

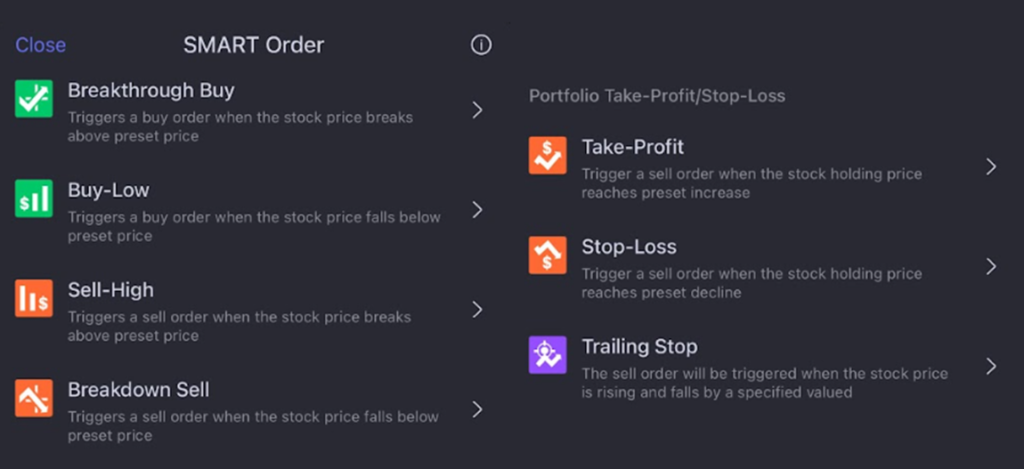

Let’s take a quick look at how these SMART Orders work.

Breakthrough Buy / Breakdown Sell

Want to long a stock but it doesn’t seem to have gained any upside momentum yet because it seems from price movements that there is not enough upside pressure from the buyers to overcome the sellers? Well, the breakthrough buy SMART order is your answer.

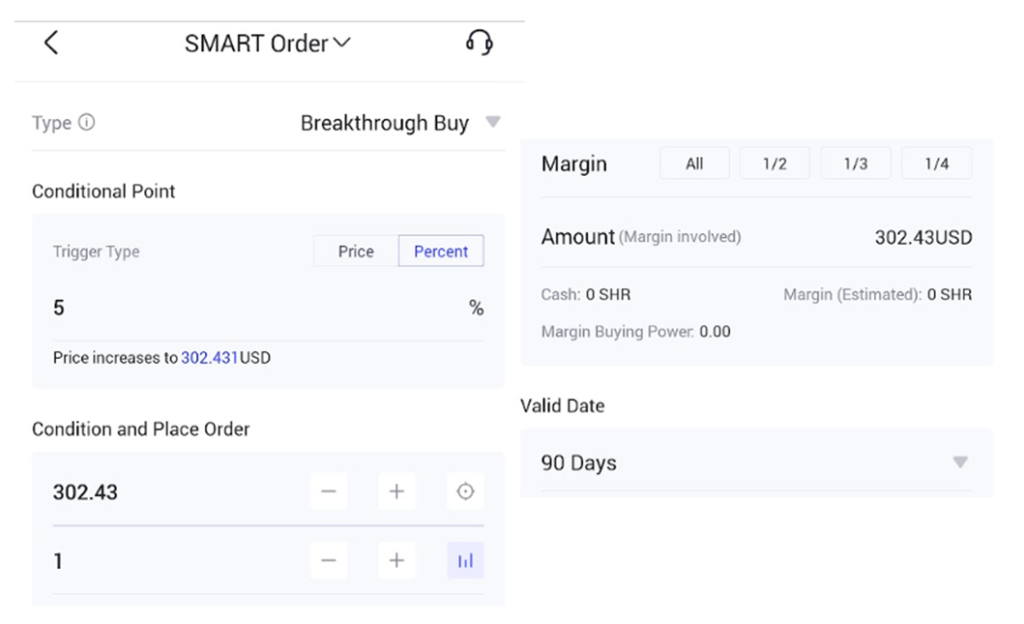

With breakthrough buy, we can set the conditions for buying a particular stock based on the % increase from the current level or the target price itself.

For example, I like ABC Stock right now at $1 but I would only be bullish on it if it gains enough momentum and crosses the 100-day moving average at $1.05.

So, I set a trigger of 5% (or I can select the actual Breakthrough Buy price of $1.05 itself) and the number of shares along with a time frame of 90 days validity as long as the trade doesn’t get filled.

Voila, in the next 90 days, if the price of ABC stock hits my limit, uSMART will automatically buy into the stock for me. If not, the order expires after 90 days. How convenient!

The inverse of the Breakthrough Buy is the Breakdown Sell. Note that this is NOT a short-selling function. Instead, the Breakdown Sell function works similarly to a Stop Loss function. The key difference is that the exit criteria here is premised on the current market price whereas the Stop Loss function is based on your cost price (stock entry price)

Let’s illustrate this with a quick example.

Assuming that you have entered into Gamestop for $200/share and the counter has appreciated to $240/share. You wish to exit the counter if Gamestop loses momentum and dips below $230/share. This is when you can put in a Breakdown Sell order with the conditional point being at $230 (Price) or 4.2% (being the drawdown amount from the current price level of $240/share).

Since $230 is above your cost price of $200/share, the Stop Loss function here is not relevant.

One will need to use the Breakdown Sell order if the price you wish to exit is > than your cost price.

It’s that easy! No more waiting in front of the screen while binging on a pack of chips!

Buy Low / Sell High

Not into the notion of active trading as much and don’t see yourself using the order types above (which are more typical of momentum traders) because you prefer to scour for value and gems.

Well, look no further, Buy Low and Sell High orders are your answer.

Say there this is supermarket retailer company XYZ whose main clientele base is the average person. During this time of high inflation, it managed to pass the costs down to its customer base. Not only that, but XYZ has also been benefiting from customers “trading down” from higher-end supermarkets as a means to lower their grocery costs.

This is all good news for XYZ!

The only problem is that you read about them having an ongoing litigation with one of its suppliers of which they stand a chance of having to pay a large sum in damages. You want to go ahead with buying XYZ but you have got this nagging feeling in your gut that the risk of the litigation loss has not yet been priced in.

You feel that a good price would be 10% lower than the current level.

What do you do? Simple, you put in a Buy Low order.

It’s quite the same as Breakthrough Buy / Breakdown Sell where you set an order with preset conditions that will be triggered during a certain time frame if the conditions are met.

However, unlike Breakthrough Buy/Breakdown Sell orders which are more “momentum-based”, the Buy Low order here is to take a contrarian view of the market and buy the stock when it is “cheap enough”. You find a fundamentally strong company like XYZ which stands to benefit from a macro tailwind (a possible recession in this case).

Instead of buying the shares outright, you want to place the Buy order at a lower price (10% lower) to account for its litigation risk. The risk here is that if prices did not drop by 10%, you would not have a position in the counter and would have missed out on the counter’s upside potential.

The opposite is true of a counter in which you think that prices have run ahead of fundamentals and you thus decide to deploy the Sell High order to sell your existing shares. Do note once again that this is NOT a short-sell order. To execute a Sell High order, you will need to have existing ownership of the stock in question.

In a nutshell, both Buy Low and Sell High orders can be seen as contrarian orders where you are betting against the current market direction. Using Technical as an additional aid, this is where you believe a key Support Level or Resistance Level will hold strong, thus engaging the Buy Low and Sell High orders respectively.

Breakthrough Buy and Breakdown Sell, on the other hand, work on the premise that the momentum seen in these counters will continue, likely after breaching a key support/resistance level.

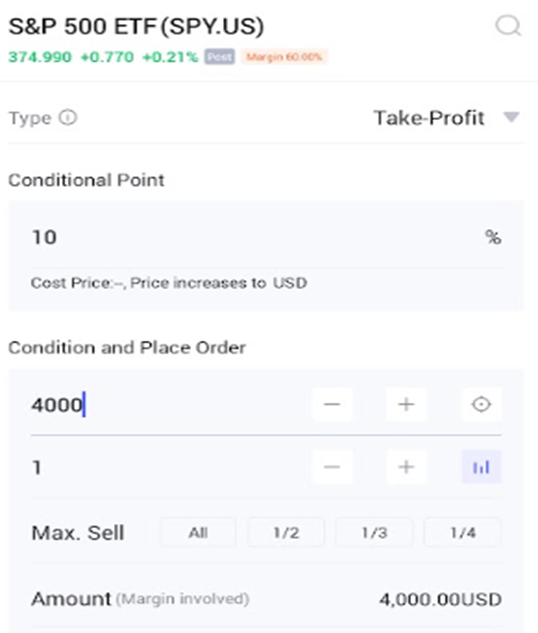

Take-Profit / Stop-Loss orders

If anything, profit-taking and loss-cutting are the souls of the trade altogether. Without a take-profit level, a potential multi-bagger can become a loser.

With the take profit and cut losses feature, you can round out pretty much all the requirements of a trade.

Once you have put in your trades, you can set your profit and stop loss levels so that your trading strategy becomes more mechanical and less emotional.

These features are pretty straightforward, hence I will not be elaborating on them. Do note, however, the key difference between Stop Loss vs. Breakdown Sell.

As earlier mentioned, Breakdown Sell is used when the exit price is > your cost price. Specifically, you want to exit when the counter loses its momentum. In our earlier example on Gamestop, your cost price is $200, the counter appreciated to $240 and you want to exit when it subsequently dips to $230.

The Stop Loss function here is with reference to your cost price of $200/share. Hence, your Stop Loss % has to represent a price < $200/share, say to take your losses when the price dips to $180 (-10% from $200).

Trailing Stop

I find the trailing stop loss a great feature. How does it work you ask me? It’s a far better version of the traditional stop losses which are static. Trailing stop losses automatically adjust your stop losses upwards as the price of the asset increases which allows you to increase your profit potential and ride the upward trend in the stock.

When that stock loses momentum, the trailing stop function will trigger an exit in the counter accordingly.

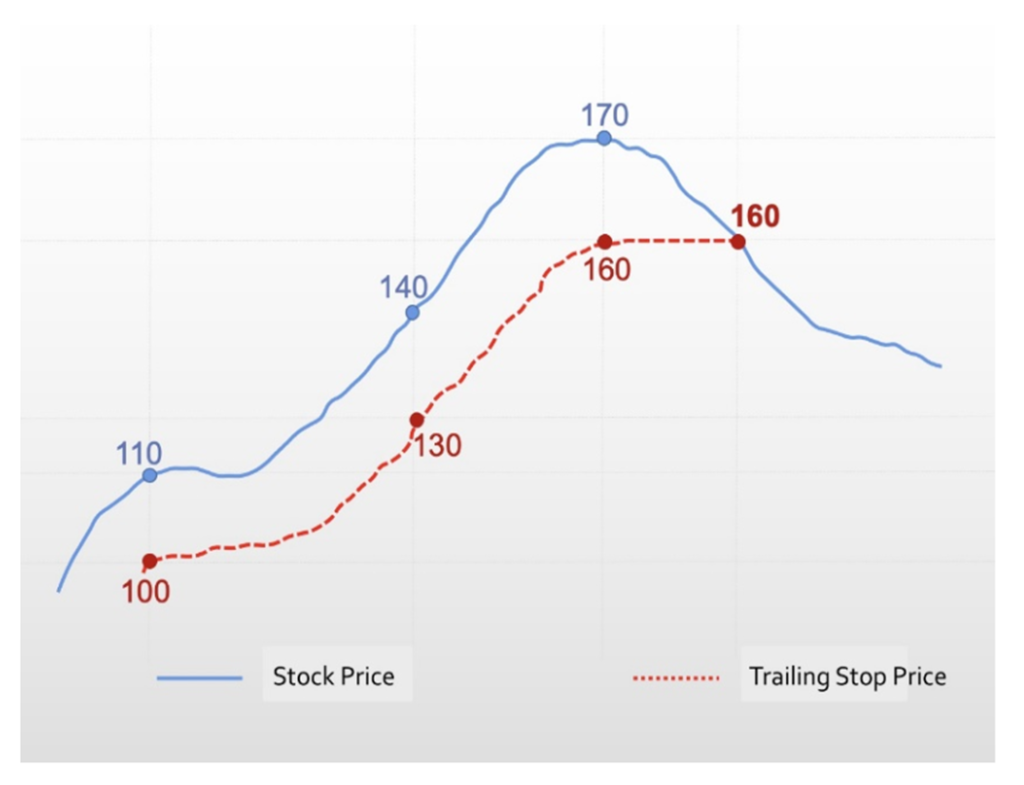

Well, a picture speaks a thousand words so let’s refer to the picture below for a further illustration.

Using the chart above, imagine if I had gotten into this particular stock at $110 and set my target profit price at $200. If I used the standard Stop Loss (SL) function and placed my SL at $100, the price could appreciate strongly to $170 (making me a happy man in the process) but subsequently collapses to $100, triggering my exit.

My “unrealized profits” became realized losses in this case.

If I had placed a Trailing Stop Loss which automatically shifts my Stop Loss price higher every time the counter moves by $30 (you can adjust this price accordingly), I would likely not have to undergo a loss scenario. In this example, when the price appreciates by $30 from $110 to $140, my SL level automatically shifts higher by $30 as well (from $100 to $130).

A further $30 increase in price from $140 to $170 will trigger the second shift in the SL price from $130 to $160. I have “effectively” locked in my exit price at $160 and when the price starts to lose its momentum, I would have taken my profits ($160-$110=$50/share) immediately when the price dips below $160.

Without having to monitor the price of the counter daily, the Trailing Stop Loss SMART order is an easy way to “piggyback” the momentum in a counter and be one of the first to exit when the counter’s momentum wanes.

More complicated orders and instruments

Feel that the previous smart order types that I wrote about are very juvenile?

Fret not, uSMART has 2 more order types that might turn you on.

Triggered by related asset

This order type essentially allows you to trigger a trade based on the movements of a correlated asset.

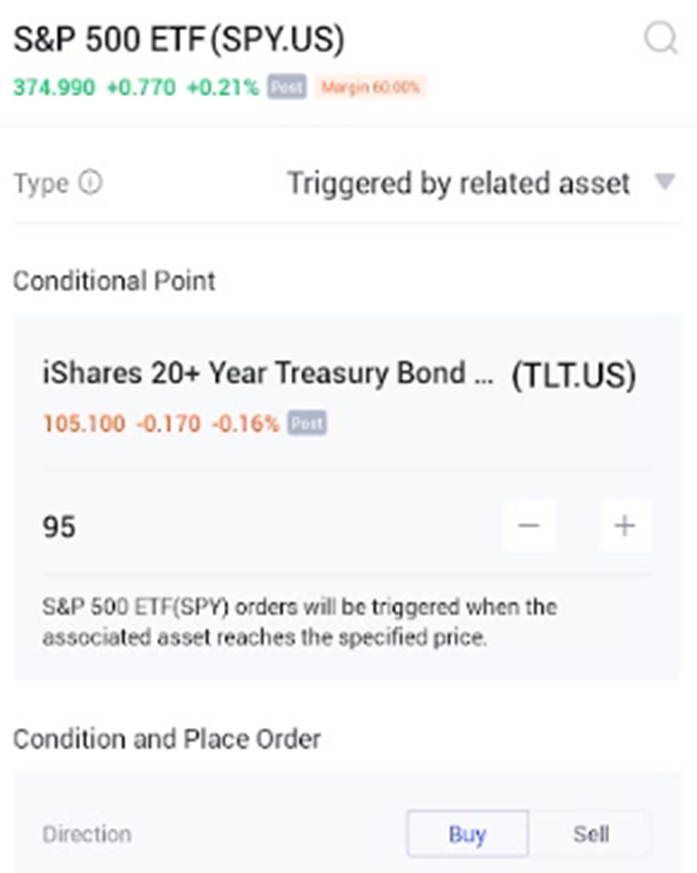

For example, let’s say we are in an alternate utopian universe where equities and bonds have a 1-to-1 inverse correlation. To express this viewpoint, I decided to use the pair of SPY (S&P 500 ETF) and TLT (20-year US treasuries).

What I will do is look up SPY as the asset that I want to trade and set TLT as the conditional point. Assuming that both stocks are perfectly inversely correlated and that I expect interest rate hikes to put so much pressure on TLT’s price such that once it breaks below 95 (about 9.5% down), it is going to gain downward momentum like no tomorrow.

With that, I can place a Triggered by related asset order to buy into SPY when the condition (ie TLT declining by 9.5%) has been met.

And, there you go.

While this is an inversely correlated trade, you can also set a correlated trade.

For example, triggering a purchase order for a high-beta tech stock (data has shown that this tech counter is highly correlated to the Nasdaq index) if you believe that the Nasdaq index is about to break out from the resistance level and head higher.

Price order triggering

Ok, so not only are you far more sophisticated than me in life, but you are also more sophisticated than me in investing as trading warrants are one of your bread and butter. In that case, let me attempt to interest you with the price order triggering.

In a nutshell, it bears some semblance to the ‘triggered by related asset’ order just that it is more specifically for execution on warrants or CBBCs (a product similar to warrants).

This is a more advanced level of SMART order and should only be executed for investors who are familiar with the workings of warrants etc.

For those interested to find out more about uSMART’s SMART orders, you can refer to the link here.

Conclusion

Pretty neat huh? For people like us where investing is not our primary job, being efficient in execution is very important. We should not be spending time “glued to our trading screen” after a hard day at work. Instead, we should be spending that time with our loved ones.

Automating our trades right from Day 1 gives us that efficiency and flexibility.

On top of that, I personally really like the idea of taking emotions out of having to open and close orders because I have seen what it can do to me and my life savings.

So, if you are looking to potentially improve your investing prowess, do check out uSMART’s Smart Orders now!

P.S If you have found this article to be helpful, you can use my referral link to sign up. On top of you receiving the Welcome Package, I will be entitled to a $88 stock voucher.

Get started by signing up for a uSMART account today by clicking on the link below:

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Discord channel for an active discussion on all things finance!

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats