Undervalued Dividend Kings using Dividend Yield Theory

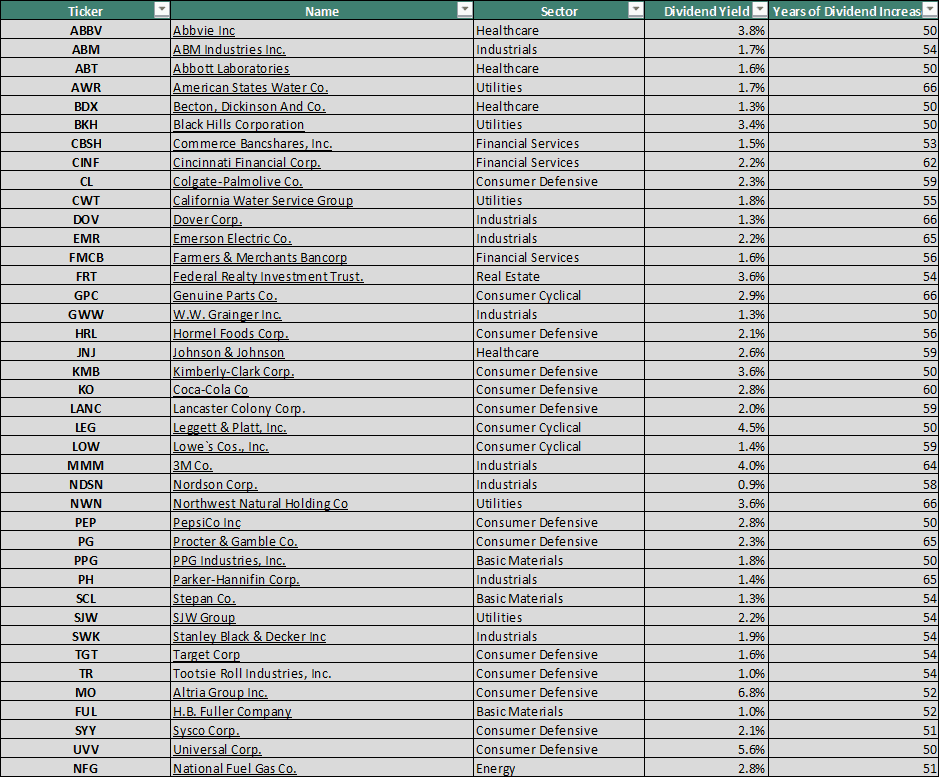

Dividend Kings are a rare breed of stocks listed in the US that has managed to grow their dividend payment CONSECUTIVELY every single year for at least 50 years! Such an accolade is indeed rare but one will be surprised to know that there are in fact 40 Dividend Kings at present.

The table below shows the full list of Dividend Kings, their number of years of consecutive dividend growth and their current dividend yield.

One might be wondering if there is an easy way to purchase a basket of these Dividend King stocks through a Dividend King ETF. Unfortunately, there is no Dividend King ETF, at present, with the closest comparison being the S&P 500 Dividend Aristocrat ETF (ticker: NOBL). Dividend Aristocrats are stocks that have managed to increase their dividend payments consecutively for at least 25 years.

In this article, I will be highlighting 3 Dividend King stocks that might be undervalued based on the Dividend Yield Theory. For those who are interested to read up on the Dividend Yield Theory, do check out the link below:

Additional Reading: Dividend Yield Theory – The underappreciated valuation tool

I will then highlight a simple method to potentially supercharge the dividend yield potential of these stocks.

Before I highlight which are the 3 potential undervalued Dividend Kings, let me first briefly illustrate the concept of dividend growth investing.

Dividend Growth Investing

Dividend Growth Investing is an investing strategy that is predicated on buying revenue-growing, solidly profitable, free cashflow producing companies that are committed to paying increasing dividends over a consecutive number of years.

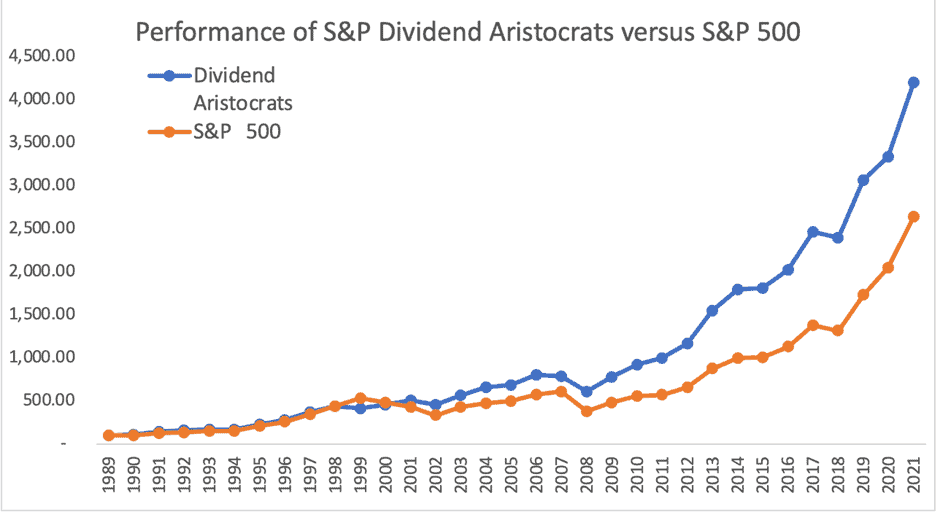

These companies typically have strong economic moats such as branding, barriers of entry, superior cost structures, etc. to continue growing their business and prevent competitors from stealing their market share. These companies tend to outperform the general market (over a long horizon) due to their ability to pay a stable and growing stream of dividends, a highly sought-after trait by passive income investors. See chart below. Examples include companies such as Coca-Cola, MacDonald’s, and 3M.

These companies have also managed to prosper during times of uncertainties such as during economic recessions, wars etc., with investors finding comfort in the companies’ consistent dividend payments. They are thus good candidates to help hedge against inflation and market uncertainty.

I screened a list of Dividend Kings and applied the Dividend Yield Theory to see if there are any undervalued companies. 3 companies stood out to me as undervalued: 3M, Altria, and Kimberly Clark.

As a reminder, the Dividend Yield Theory suggests that if a stock’s current yield is higher than its average historical yield, it represents potential undervaluation. You can find out more information through this previously written article.

Undervalued Dividend King #1: 3M (MMM)

3M (MMM) is a dividend king with 64 consecutive years of dividend increases. This is the 10-year dividend yield of MMM. 3M’s yield hit an average low of 2.09% in 2014 when the counter was trading at roughly $136 to $164. Its highest average yield was 3.66% in 2020 during the pandemic.

Based on the Dividend Yield Theory, here are some assumptions we can make to determine the fair value of 3M:

- 3M has an average 10-year historical yield of 2.73%

- The company has a 5-year dividend growth rate of 5.65%

- The company is expected to pay $5.96 for next year’s dividend.

The fair value of 3M = Expected Dividend / Average historical dividend yield

Fair value = $5.96 / 2.73% = $218.3 / share

Based on the Dividend Yield Theory that asserts a return to long-term historical yield for a blue-chip stock, the fair value of 3M can be derived to be $218.30 / share.

3M is currently trading at $146.73 / share. It is potentially undervalued by ~48%. Is there value? Is its dividend at risk of being reduced? Despite rather lackluster growth in the past 10 years (earnings went from $5.96 to $10.12 or a 5.44% CAGR), it is unlike that 3M will cut its dividend payment and ruin its illustrious track record of 64 years of consecutive payment. With a payout ratio of just 58.5%, there is bandwidth for 3M to increase its dividend payment.

It is not unreasonable to expect the company to continue to grow its dividend at the same rate especially due to its portfolio of iconic industrial products which helps the company to generate a steady stream of income, regardless of a recession or no recession.

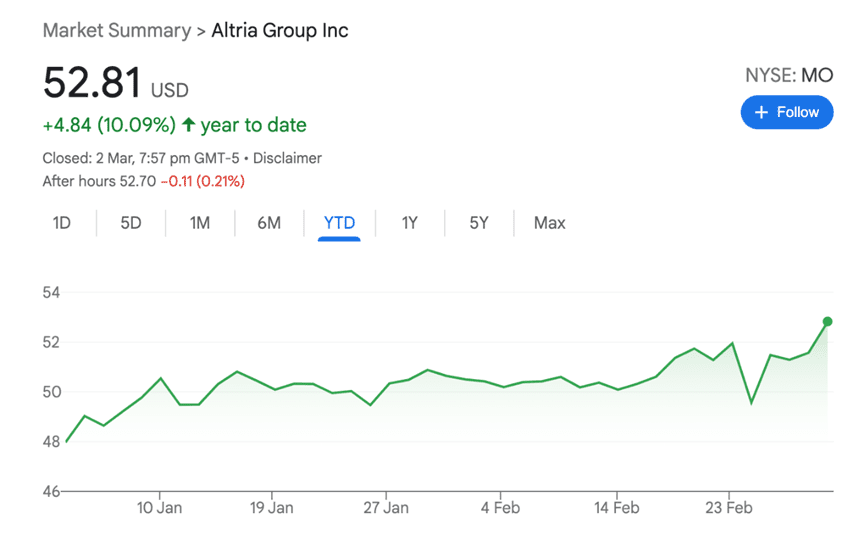

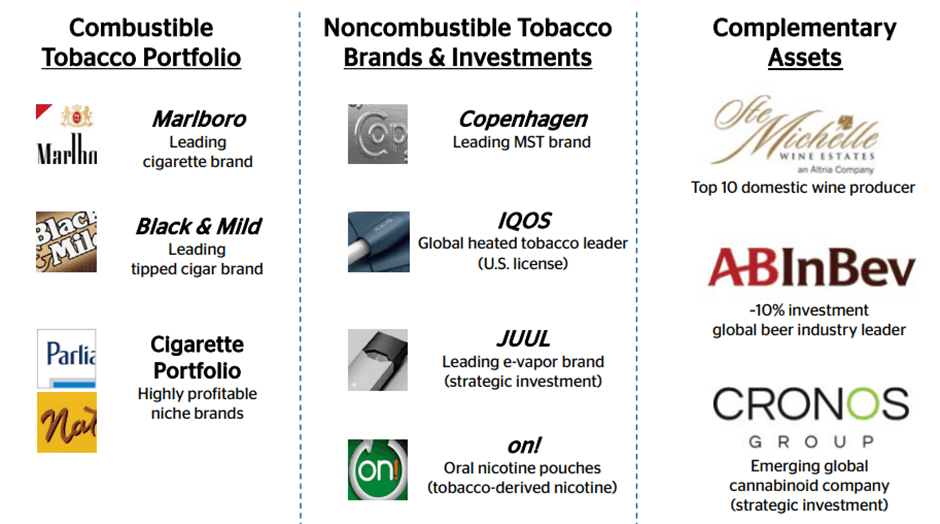

Undervalued Dividend King #2: Altria (MO)

Altria (MO) is a dividend king with 52 consecutive years of dividend increases. This is the 10-year dividend yield of MO. MO’s yield hit an average low of 3.50% in 2017 when the counter was trading at roughly $67 to $77. Its highest average yield was 8.16% in 2020 during the pandemic.

Based on the Dividend Yield Theory, here are some assumptions we can make to determine the fair value of MO:

- MO has an average 10-year historical yield of 5.35%

- The company has a 5-year dividend growth rate of 8.42%

- The company is expected to pay $3.60 for next year’s dividend.

The fair value of MO = Expected Dividend / Average historical dividend yield

Fair value = $3.60 / 5.35% = $67.2 / share

Based on the Dividend Yield Theory that asserts a return to long-term historical yield for a blue-chip stock, the fair value of MO can be derived to be $67.2 / share.

Altria is currently trading at $52.81 / share. It is potentially undervalued by ~27%. Is there value? Well MO earnings have stagnated in the past 10 years (earnings went from $2.06 to $1.24 or a -4.95% CAGR). However, this is misleading as the company’s EPS has been negatively affected by the write-off of its JUUL acquisition (accounting EPS is lower than its true cash EPS).

The company has a payout ratio of 76.36%. Thus, its true cash earning is ~$4.71 / share. The company has guided for an annual increase in earnings of 5-6% due to its portfolio of iconic tobacco-related products. It is reasonable to assume that MO would also continue its healthy dividend growth in the near future unless something disastrous happens on the political front which threatens its operations (there is also that uncertainty when investing in tobacco-related products)

MO also has less of an issue vs. PM whose operating performance will likely be negatively impacted by the Russian-Ukraine war due to the latter’s significant exposure in the Russian market. MO’s key operational market is the US.

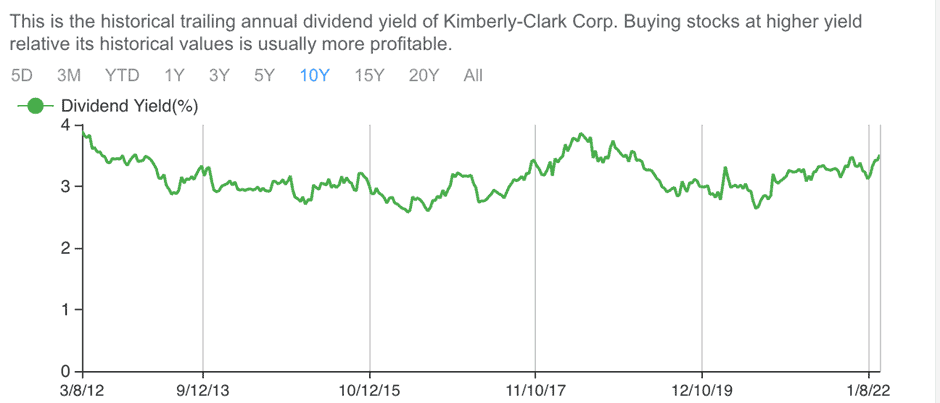

Undervalued Dividend King #3: Kimberly Clark (KMB)

This is Kimberly Clark’s (KMB) first entry as a dividend king with 50 consecutive years of dividend increases. This is the 10-year dividend yield of KMB. KMB’s yield hit an average low of 2.85% in 2016 when the counter was trading at roughly $111 to $138. Its highest average yield was 3.54% in 2012.

Based on the Dividend Yield Theory, here are some assumptions we can make to determine the fair value of KMB:

- KMB has an average 10-year historical yield of 3.17%

- The company has a 5-year dividend growth rate of 4.19%

- The company is expected to pay $4.64 for next year’s dividend.

The fair value of KMB = Expected Dividend / Average historical dividend yield

Fair value = 4.64 / 3.17% = $146.4 / share

Based on the Dividend Yield Theory that asserts a return to long-term historical yield for a blue-chip stock, the fair value of KMB can be derived to be $146.4 / share.

KMB is currently trading at $129.13 / share. It is potentially undervalued by ~13%. Is there value? Despite slow earnings growth over the past 10 years (earnings went from $4.42 to $5.35 or a 1.93% CAGR), KMB is one of the “blue-chip” consumer staples of the world, selling various iconic products that we are using on a daily basis. While there is no sexy story peg to this company, this is also not a company that is trading at obscene valuation, hence downside risk is minimized (not eliminated though).

With a payout ratio of 73.67%, I believe KMB’s dividend payment growth track record remains safe for now.

For those who are interested in checking out more information on Dividend Investing, do click on the link for free dividend resources

Additional Reading: Dividend Investing for beginners. Ultimate list of free dividend resources

Option strategy to turbo-charge your income

The above 3 companies have a current dividend yield ranging from 3.6-6.8%. That itself is pretty attractive, given that the S&P 500’s yield is less than 2%. However, do note that for Singaporean investors purchasing US dividend-paying stocks, there is a 30% dividend withholding tax that will reduce the effective yield of these 3 stocks to 2.5-4.8%

There is however a way to supercharge your yield potential on these Dividend King stocks, through the usage of options.

Covered Calls on Dividend Kings

An additional way, in addition to collecting dividends, is to sell covered calls. Selling covered calls is a method in which holders of stock can collect additional income (option premium) through the selling of a Call Options contract while still holding the stock. How do you go about implementing it?

One has to first purchase at least 100 shares of a stock. Next, one would sell a call option at a strike price higher than the current stock price to generate a premium. The income generated from this call option sale is like creating a “synthetic dividend” that supercharges your existing dividend yield.

If the stock is trading at a price below the strike price in which u sold the call option, you get to keep the premium collected from selling the call as well as the 100 shares. If the stock is trading at a price above the call strike price you sold, you would be forced to sell 100 shares at the call strike price but you get to collect the option premium as well.

Let me illustrate this concept with a quick example.

Example:

Say I purchase 100 shares of MO at $53.49. Capital spent = $5349. I can then sell a call option of $55 that expires on Apr 8 2022.

Option premium I would collect from selling call: $87

Two Scenarios:

- If MO closes above $55 on Apr 8 2022, I would be forced to sell 100 shares of MO at $55 / share. However, I would also get to keep my option premium of $87. Total Gain = $5500 – $5349 + $87 = $238

- If MO closes below $55 on Apr 8 2022, I would be able to keep my 100 shares of MO while retaining the option premium of $87. Since I continue to own the 100 shares of MO, I can continue to sell a call option on MO with a further expiration (say in May 2022)

Either way, the $87 premium which I generated through the covered call structure is money that goes straight into my pocket. We have effectively increased our original dividend amount of $256 (based on a 4.8% effective yield) to $342, translating to a net yield of 6.4%. We have successfully eliminated the withholding tax component associated with MO’s dividend payment.

The supercharged effect does not stop here. As long as you continue to own the shares of MO (at least 100), you can continue to sell call options on it every month and continue to increase your yield higher.

Risk: This is a low-risk strategy but does note that if the share price of MO appreciates significantly beyond $55/share, you might be forced to sell your 100 MO shares prematurely and will not be able to participate in the upside of MO’s price anymore.

Conclusion:

Dividend growth investing is an investing strategy that works well in almost all market conditions even during times of high inflation and geopolitical uncertainty.

I have provided 3 potentially undervalued dividend kings (MMM, MO, KMB) and an options strategy called covered calls to help turbocharge your dividend income.

Covered call structures are really ideal for high dividend-paying stocks, such as the 3 Dividend Kings highlighted above. You are paid (significantly) to wait for these undervalued stocks to appreciate even in a bear market. Not too shabby.

As always, this is my personal opinion of the companies and I would like to highlight that you should always conduct your own due diligence before deciding to purchase shares of the companies mentioned above.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only