Term life vs. Whole Life Insurance

Quite a lot of us have developed considerably strong and muscular trapezius because of the number of puzzling shrugs we have done throughout our life every time the question pops up. Well, it’s not entirely our fault because personal finance is not exactly taught in schools.

For what it’s worth, sometimes even the most intelligent ones among us have similarly strong and muscular trapezius because they have not had time to be exposed to this art of deciphering ‘whether term life or whole life insurance is better.

Fitness aside, life insurance is commonly known to help us leave a legacy to our family in the event we are no longer around. However, simply knowing that is not enough because a small and innocent misstep in strategy could lead to huge exposure to financial risks during some of the most vulnerable years!

Indulge me for a minute and imagine the sole breadwinner of a family passing away at 58 years old leaving behind his/her better half and 2 kids. The elder of the 2 is finishing his National Service and will be enrolling in a University next year while the younger one is taking ‘O’ levels this year and intends to enroll in Polytechnic next year.

Will the surviving spouse who is not working be able to see the kids through at least the next 5 years and make sure that they complete their education? Will he or she have to look for a job? How much will he or she be able to make after so many years of being inactive? Or will the elder of the 2 have to abandon his education to provide for the family? A whole lot of uncertainties prevail.

Even if the family had bought insurance, it might not be enough. This is because very often during the early stages of basic financial planning, most young households will just “want to get covered at the lowest cost possible”, ignoring the other important intricacies in the journey of planning.

They then end up with a cheap term life insurance that covers them for say maybe $500,000 for the next 20 years when they start a family at 35 years old. It sounds about right but ultimately it exposes the family to financial risks in the next 5-7 years after the insurance expires.

That is why it is important to understand the distinction between the different kinds of life insurance so that we can cover our financial gaps in the most efficient way possible.

Pardon me for the long introduction as it is very imperative to me that people see the process of planning as a way to mitigate our financial risk exposure as much as possible instead of it being something entirely transactional and looking at it as just ‘buying insurance’.

I had a client that I have been working with for a while reach out to me saying he wanted to buy an endowment for his special needs son so that he can set aside some money for when he is no longer around. While a whole or term life insurance would have made more sense, it was simply too expensive as he was already in his late 50s.

However, the fact is that the endowment was just a placebo and not a solution. What he needed was to find the most cost-efficient and affordable way to set up a trust with his assets so that his special needs son will be provided for when my client is no longer around.

We ended up working with Special Needs Trust Company (SNTC) which is a government organization where my client was able to set up a subsidized trust and purchase subsidized insurance to add on to the assets left for his son when he and his wife are no longer around. While such planning might be less common and unorthodox, it is what I consider proper planning as the needs of the person being planned for were put as a priority.

With that out of the way, let us look into the distinctions between term life insurance and whole life insurance.

Differences between term and whole life insurance policies

Term of coverage

The first distinction is the term of coverage which is when the coverage expires. As the name suggests, a whole life insurance policy covers us for the whole of our lives as long as the policy is in force.

Similarly, term life insurance covers us for a specific term which usually ranges from as short as 10 years till we are 100 years old.

What are the implications?

Coverage expiry

In the situation of a term plan, with the coverage expiry after a particular term, it is important to take note that the riders that come along with it expire together as well. For example, if an early critical illness rider is attached to a term plan that expires at 55 years old, there will no longer be any early critical illness coverage after that.

On the contrary, riders that are attached to whole life insurance plans provide coverage for the whole of life or at least until it is surrendered or claimed.

This is important because if one’s family has a history of critical illnesses, then they would be especially concerned about critical illness after 55 years old. However, in the case of a term plan, it unfortunately expires and leaves him/her exposed to financial risks.

Participating VS Non-Participating Polices

The second distinction is that whole life insurance policies are participating policies while Term life insurances are non-participating policies.

Now, what exactly is the difference between a participating and non-participating policy?

In simple terms, the premiums from participating policies are pooled together into a participating fund which is managed and invested professionally by the insurer. The policy owner will then get a share of the profits of the participating fund in the form of guaranteed and non-guaranteed bonuses.

Aside from the performance of the participating fund, the bonuses paid out are also affected by other factors like how much were the claims paid out or the level of expenses incurred in running the participating fund.

If you would like to understand in further detail what a participating fund is, you can take a look at this piece of literature called ‘Your Guide to Participating Policies’ via this Life Insurance Association of Singapore (LIA) link here. (https://www.lia.org.sg/media/2520/ygtpp_english_may-2020_low-res.pdf)

The non-participating policy doesn’t do any of the above and is purely purchased for insurance coverage.

What are the implications?

Premiums

This will be very evident in the difference in premiums between the 2 kinds of insurance.

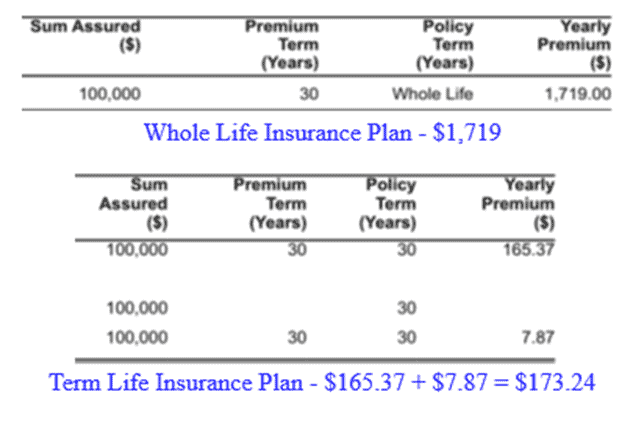

For example, tenure aside, it costs $173.24 for a 35-year-old non-smoking male to get a $100,000 coverage term plan while on the contrary, it costs $1,719 to get that same coverage quantum in the form of a whole life insurance plan.

Do take note that the purpose is really to illustrate the difference in premiums and not to determine which is better. Understanding the differences, the 2 types of policies can then be used strategically to fit into our financial plans and budget.

Ultimately, it can never be an apple to apple comparison because ultimately the mechanics of both types of policies are different.

The cost of participating policies ‘decreases’ over the long run

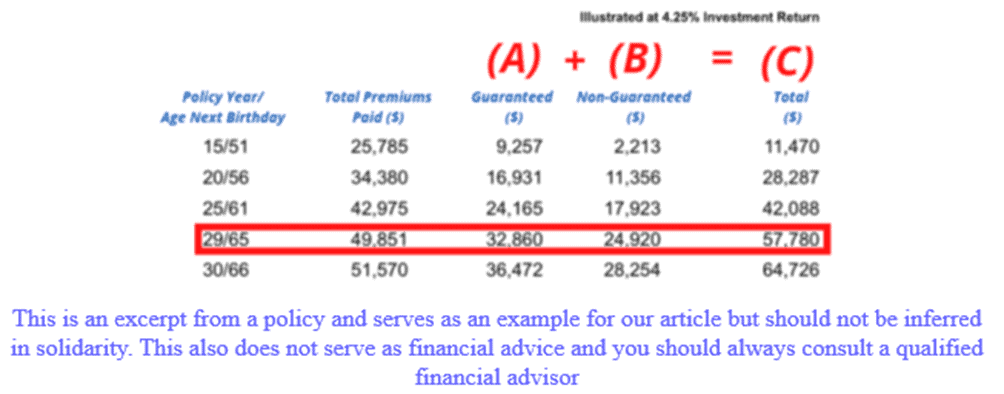

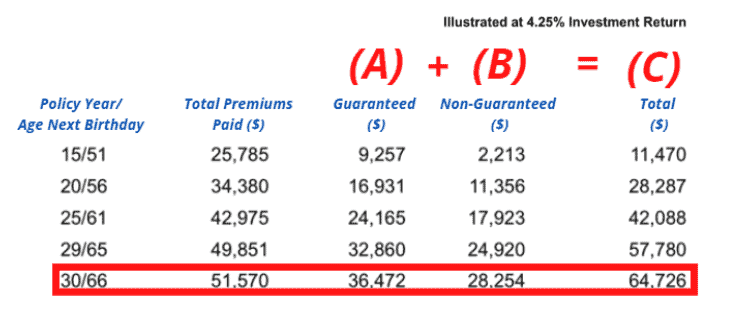

Remember it was mentioned that a participating policy comes with bonuses and the value of the policy grows in the long run. If we use the same participating whole life insurance as an example, we can see that based on the projection that the participating fund performs at a level of 4.25% consistently, the cash surrender value of the policy will be estimated to be $57,780 on the 29th year, a couple of thousand dollars above the capital of $51,570 ($1,719 x 30 years).

What this means to say is that if nothing happens and the policy is surrendered at that juncture, the policy owner will get back an estimated amount of $57,780 which is more than the capital that he or she had put in initially, rendering his coverage all these years FREE! (plus some returns for coffee money)

This would not happen for a term life policy. Upon expiry, the coverage lapses and there is no cash surrender value.

That is one of the reasons why whole life insurance is generally more expensive than term life insurance.

Again, it does not mean to say that something more expensive or cheaper is better because it eventually boils down to our financial needs and preferences.

Soooo, where do I go from here?

While I would always say that there is no one size fits all strategy since all of our financial needs and budgets are different, I feel that the following 2 strategies (with a little bit of our customization), work for most of us.

Strategy 1 – Buy Term, Invest the rest!

Some NAOF readers would already be savvy enough and are already consistently generating decent returns on their monies through investing and might find the proposition of a whole life insurance policy unattractive because of the rate of return on the extra money that they lock up as premiums as compared to a term life policy.

In this case, he or she may adopt the strategy of buying term and investing the rest. Allow me to illustrate with an example.

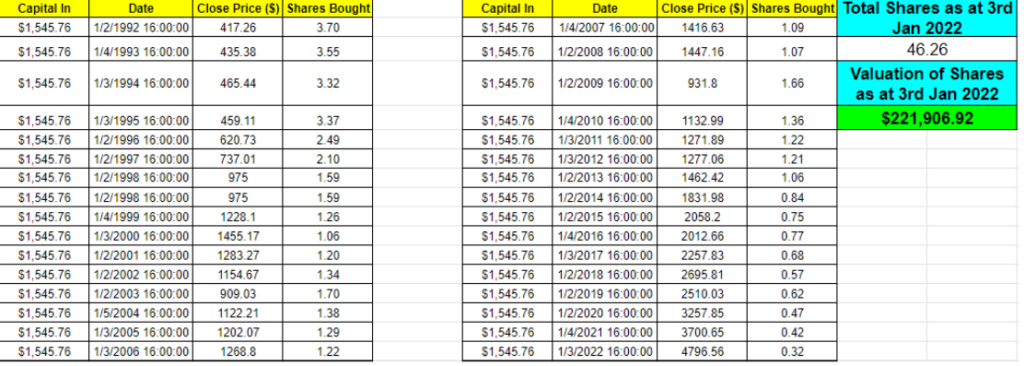

Let’s say it is 1992 and Mr. Warren has the exact budget of $1,719 to purchase insurance coverage of $100,000 for the next 30 years. He can choose between:

- Whole Life Insurance Plan at $1,719 per annum for the next 30 years

- Term Life Insurance Plan at $173.24, leaving him with $1,545.76 every year to invest on his own.

Being that Mr. Warren is savvy, he decides to pick option 2 and put his excess budget to good use.

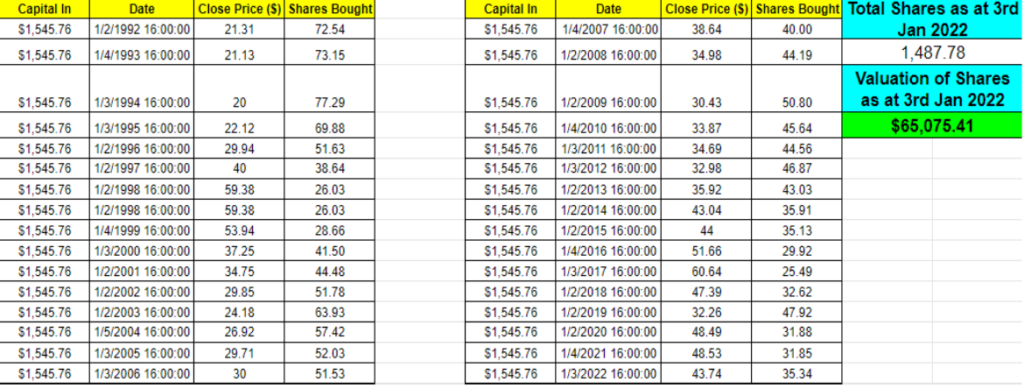

For the sake of this illustration, let’s say Mr. Warren was able to put the excess budget he had directly into the S&P 500 (SPX) for the next 30 years and that everything is denominated in Singapore Dollars. As his policy premiums are paid at the start of the year, he puts the excess budget of $1,545.76 into the markets on the first market day of the year (according to Google Finance data).

Fast forward 30 years, Mr. Warren whips out his laptop and used Google sheets to chart his performance and it is as follows:

In 2022, at the end of 30 years, Mr. Warren’s portfolio will be worth $221,906.82 as compared to the Whole Life Insurance plan which would have a projected value of $64,726 comparatively.

WOW! I know what you are thinking. In this case, everyone should do the same right?

Well, not really.

Right now we are looking at it through the lens of our hindsight which, is 20/20. Imagine you are Warren Junior and start on the same journey your dad did this year and within a couple of months the Russian invasion of Ukraine happens, will you be able to stomach the volatility?

As of now, we don’t know how long that is going to last and how things will be in the coming months, let alone 30 years down the road.

He would be in roughly the same position as that of the whole life insurance plan. In this case, was it worth the effort?

Or he could simply end up with less money than that of the cash surrender value of a whole life insurance plan.

If managed well, the buy term invests the rest strategy can be extremely rewarding but at the same time, it is undeniable that perils exist so navigate with caution.

Second Strategy – Whole + Term Life Insurance to maximize capital efficiency

To have a better understanding of this strategy, it will be easier for us to visualize by charting out how most of our lives progress over the years.

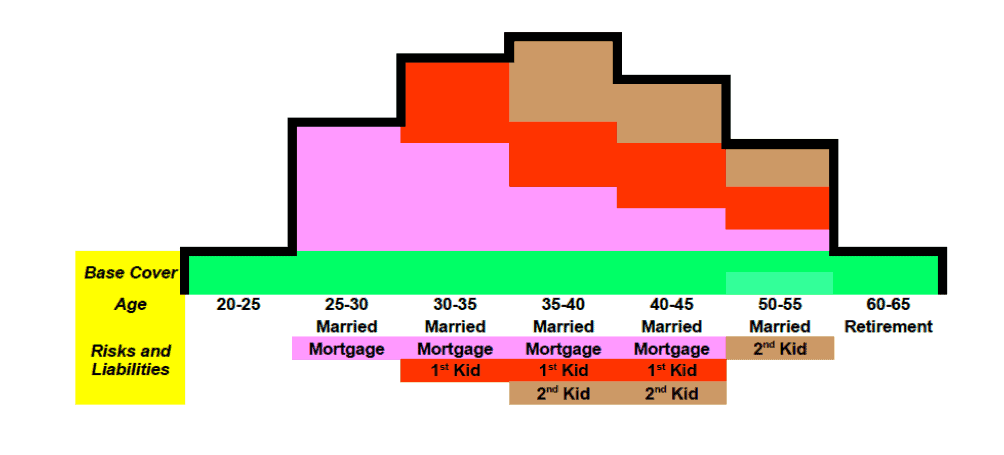

What the chart illustrates is that our liabilities increase correspondingly with our lives’ progression.

There is a color code tagged to each of the particular liabilities which is then represented visually in the graph. Note that these liabilities usually decrease over the years. For example, the pink-colored bars represent our mortgage which is usually the single biggest liability that we will ever take on. Over time, you would notice that the number of pink bars decreases as we pay it down.

It is usually the case that we will take up a mortgage and start a family at the same time so our liabilities stack up over time. This is visually represented in the chart where the pink, red, and brown colors coincide during the age of 35-40 where the mortgage is still present when the 1st and 2nd children are born.

The liabilities reach an inflection point at some point in time and peaks out around 35-40 years old. as the mortgage gets paid down and the kids start to grow up and rely less and less on the parents.

Eventually, when the mortgage is paid off and the kids are all grown up and financially independent, there is no more liability and we would usually retire at that point in time.

With that, we see that our needs change at different points of time, and taking reference from the premiums mentioned earlier on for whole life insurance policies, it will cost a bomb to get covered during periods like 35-40 years old. This will then compromise the overall quality of life for the whole family and is not ideal.

The point of insurance is to manage risk, not to put ourselves in a position of compromise financially.

Besides, we will also have to set aside funds for things like children’s education or retirement. If my budget revolves around just buying whole life insurance policies, I will be forsaking my future.

Hence, to be efficient in addressing our financial needs, we can adapt the strategy of using both term and whole life policies.

How can we do that?

This can be done by first picking up a whole life insurance policy during the early years. In this case, between 20-30.

Why?

- While there aren’t any major liabilities at this juncture, it gives us a base coverage that will come in handy in the future

- As whole life insurance is a participating policy, we can have more time for the policy cash value to grow in the long run as it can second as an asset for our retirement 30-40 years down the line when there is no need for the coverage anymore

- Moreover, the riders that include coverage like early critical illness that is added onto the whole life insurance will last as long as the policy is in force.

- Whole life plans usually have limited premium payment terms which means to say that you stop paying for premiums say 25 years down the line while you continue to enjoy coverage for the rest of your life as long as your policy is in force

With that base coverage security, we can be assured that no matter the situation is in the future.

Thereafter, we can sprinkle in term insurance coverage for efficient capital outlay whenever a liability arises.

For example, I can add on term insurance that covers me $500,000 for my mortgage between the age of 25 to 55.

I can then add on necessary coverage of let’s say $1,000,000 between the age of 30-60 when my wife is expecting our 1st child with plans of having a 2nd one.

Why?

- With the oncoming liabilities, cash flow becomes increasingly important to every household. Picking up coverage in the form of term insurance will help to keep the cost of mitigating the risks as capital efficient as possible.

However, do take note that there is no perfect strategy. While this strategy allows us to have an efficient capital allocation, there is medical underwriting risk. Effectively, it means to say that in the event I am uninsurable for whatever medical reasons during the time I need the policy, I will be exposed to huge financial risks.

Conclusion

In essence, we can see that between whole life and term life insurance, there isn’t a case of one being better than the other. Instead, they work to serve different purposes and in certain cases, they work to complement each other to help us attain our financial goals.

Ultimately, there is no one size fit all “best strategy” and we must do our due diligence and find out what is best for ourselves before we make the decision to dive in and execute.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Discord channel for an active discussion on all things finance!

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Integrated Shield Plans: 3 Major changes and 3 Tips you need to know

- HPS Singapore: Why pre-paying your home loan in 2021 is a mistake with Home Protection Scheme in place

- Generating “risk-free” returns using SRS and the art of withdrawal

- Singapore Health Insurance cost 200-300% Lower than US. For Real?