Sembcorp Industries Stock: Buy, Sell or Hold? On 7 December, Sembcorp Industries announced profit guidance which seems to become the norm. In the past, the key focus was on Sembcorp Marine, with impairments made to its Energy division being “swept under the rug”. I previously mentioned in this article: Should one by buying Sembcorp at … Read more

sembcorp industries

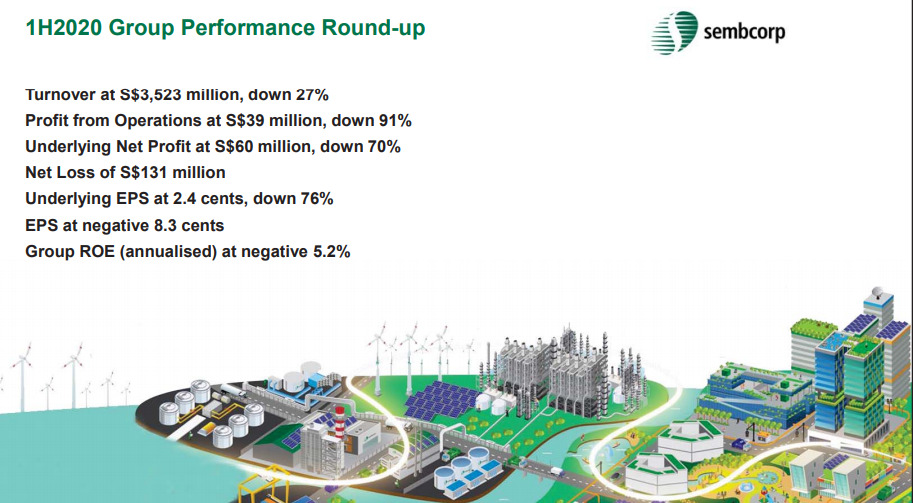

Sembcorp Industries 1H20 results In this article, I provide my view on Sembcorp Industries’ latest 1H20 performance followed by some commentary pertaining to its demerger exercise with Sembcorp Marine. Sembcorp Industries announced after market hours on Friday that the Group has posted a net loss of S$131m and warns of worse to come. Sembcorp Industries … Read more

I wrote about Sembcorp Industries and Sembcorp Marine demerging yesterday in the article below: Sembcorp Industries and Marine demerger: What you need to know and what to do In that article, I concluded that the news should be a positive one to Sembcorp Industries as the company can finally become a pure Utilities/Energy play which … Read more

Sembcorp Industries and Marine demerger The Sembcorp Group of companies finally announced that Sembcorp Industries and Sembcorp Marine will be demerged with the creation of two focused companies. There will be a proposed Sembcorp Marine Rights issue (SCM Issue) in conjunction with the demerger. I have written on both Sembcorp Marine and Sembcorp Industries several … Read more

Sembcorp Industries 4Q19 Sembcorp Industries announced its 4Q19 results before the market opens on 21 February. The losses at S$15m for 4Q19 came in smaller than my expectations, even after accounting for its share of Sembcorp Marine’s substantial losses. These were due to two main reasons. One, Sembcorp Industries’ Urban Development division performed extremely well … Read more

Sembcorp Industries profit warning Sembcorp Industries (SCI) issued a rare profit warning after the market closes on 6 February. The company highlighted that it will be making a material impairment of S$245m in its upcoming 4Q19 results to be announced on 21 February. These impairments are associated with the company’s energy assets. Consequently, the company … Read more