Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

Syfe Select: The Customizable Way to Invest in ETFs?

Syfe recently launched its new Syfe Select portfolio and is the first Robo advisor in Singapore to allow its clients to build a fully customizable ETF portfolio based on one’s preference. With no minimum investment and no lock-ups, Syfe Select portfolio is a structure that makes it simple for a beginner investor to construct his/her customized portfolio from a curated list of over 100 best-in-class ETFs.

I have always been “lamenting” that our local Robo advisors lack customizable features. Endowus, another popular Robo advisor here in Singapore, started the ball rolling by allowing its clients to select their preferred unit trusts and structure their customizable portfolio through their Fund Smart option.

The problem I see with Endowus’s “customizable structure” is that there are just too many unit trusts made available to clients with no particular thematic focus that is communicated to its clients in a simple manner.

Most investors, when faced with a deluge of options, will typically result in “selection paralysis”. They don’t know where and what to look out for when trying to select or customize their portfolio. The result is only a handful of more savvy investors who know exactly which unit trusts they will like to invest in will find Endowus’s Fund Smart option helpful.

For the vast majority who invest with Endowus, they will probably go for the pre-selected options picked by Endowus through its core portfolios.

Syfe looks to provide a more “customizable-friendly” option for its clients through its Syfe Select portfolio. This is a good start, in my own humble opinion, for clients to customize their portfolio and make it “unique” to their own.

While clients are still not able to structure their portfolio consisting of individual stocks (fractional investing), which is my ideal portfolio customization (but riskier, no doubt), what Syfe Select portfolio is offering is possibly the next-best method, which is allowing the customization through ETFs.

For those who are interested, here are some of my previous Syfe review articles that I have written:

- Guide to Syfe and how to open an account in less than 10 minutes

- Syfe Equity 100 Review: does this portfolio make sense to you?

- Syfe Review: Which of its portfolio offering will I select?

- Syfe Review: Is this now the most comprehensive Robo Advisor in Singapore?

Before I dive into my thoughts on their new portfolio structure, let me briefly highlight the offerings of Syfe Select. It can be broken down into 2 key segments: 1) Syfe Select Themes and 2) Syfe Select Custom.

Syfe Select Themes

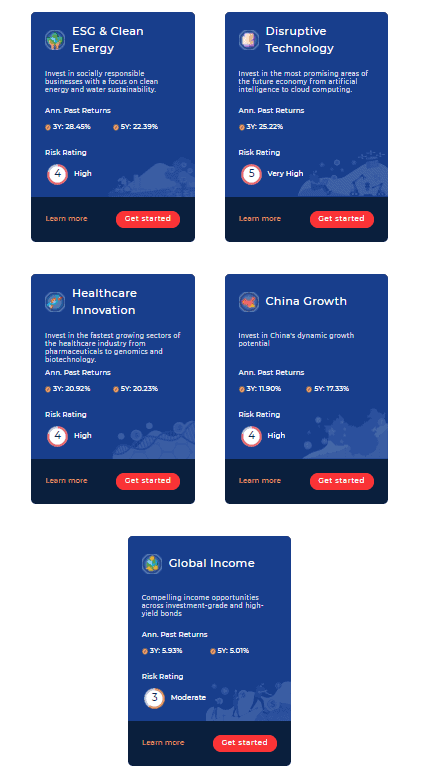

This option is based on Syfe’s pre-selected five thematic portfolios that the Robo advisors believe might be of interest to its clients. The 5 themes are:

- ESG & Clean Energy (High Risk)

- Disruptive Technology (Very High Risk)

- Healthcare Innovation (High Risk)

- China Growth (High Risk)

- Global Income (Moderate Risk)

As can be seen, the risk profile of the 5 themes can be quite different, ranging from moderate risk level (3) to very high risk (5).

When one selects a particular thematic portfolio, for example, the ESG & Clean Energy thematic portfolio, Syfe will break down which are the ETFs this portfolio is currently vested in.

There are currently 8 ETFs which are in their ESG & Clean Energy portfolio where the top ETF is the iShares MSCI EM ESG (ticker ESGE) which has a portfolio weighting of 17.57%.

Another unique feature is that investors can customize this particular ESG & Clean Energy portfolio according to their preference by possibly removing ETFs in this list, add their own preferred ETFs (up to 8), and change the weighting associated with each ETF.

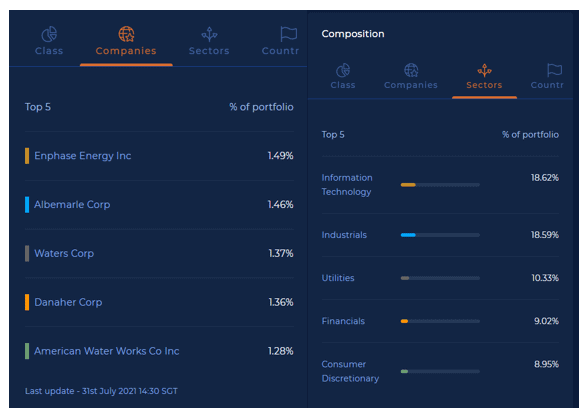

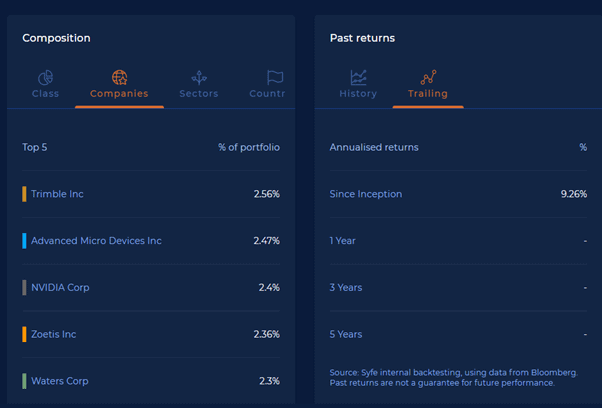

Once the portfolio composition has been confirmed, Syfe will also show the different asset classes, companies, sectors and countries that make up your portfolio.

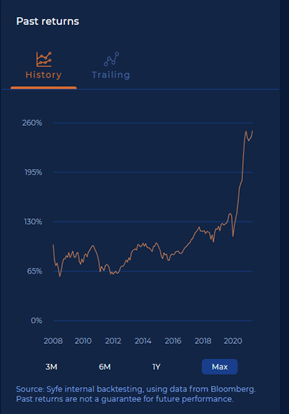

It will also show the backtested historical result of this portfolio which consists of these 8 ETFs.

Do note that past returns are not a guarantee for future performance.

If you like Syfe Select choices of thematic portfolios, this is a quick and easy way to get started with customizable options to make your portfolio truly “unique”

Syfe Select Custom

This is where one can select their preferred investments instead of following a particular theme. For example, if one wishes to have a combination of themes, for example, the ESG & Clean Energy + Disruptive Technology themes, both offered by Syfe Select Themes, one can structure their customized portfolio surrounding these 2 themes by purchasing the ESGE ETF and BOTZ (Global X Robotics & AI) ETF which are ETFs featured heavily in the 2 respective themes (ESGE for ESG & Clean Energy and BOTZ for Disruptive Technology).

There are 3 simple steps to get started.

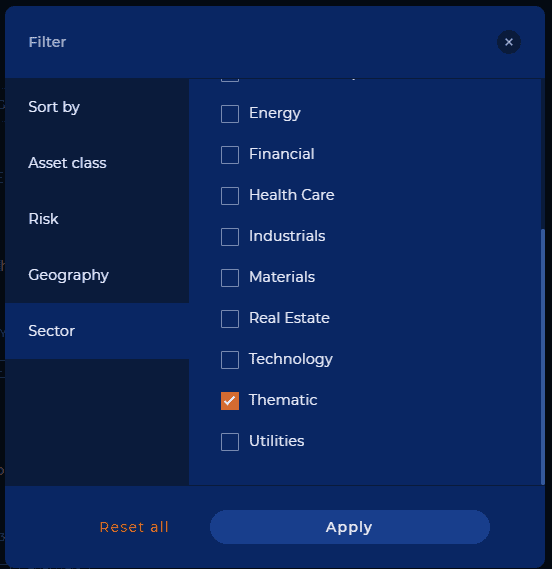

First, pick your preferred investment from a list of over 100 ETFs. Syfe simplifies the selection process by allowing one to filter the ETFs according to 1) Past returns, 2) Risk level, 3) Asset Class, 4) Geography and 5) Sectors.

For those who like to look for thematic ideas and construct your unique portfolio across different investment themes, one can select the thematic option as highlighted in the filter screenshot above and you will be presented with a list of thematic ETFs to select from, consisting of the different ARK portfolios, certain unique themes such as the iShares Exponential Technologies (XT), etc.

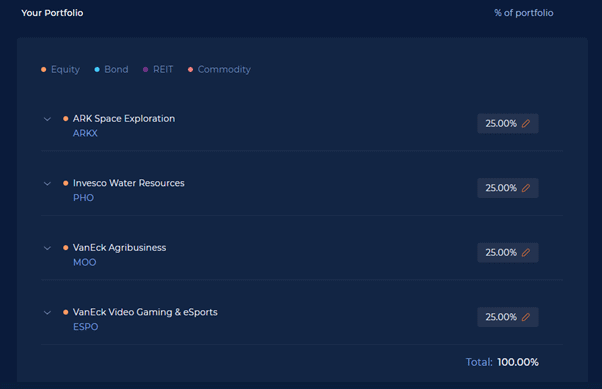

One can select up to 8 ETFs to construct your unique portfolio and determine the respective weighting you wish for your portfolio. In the screenshot below, for example, I selected 4 ETFs to represent my “Dream portfolio”, with equal weighting across all 4 ETFs.

You can also see which are the Top 5 stocks that make up your portfolio and how has this portfolio of 4 ETFs performed over time. The historical performances might however be limited by any of the ETF’s date of inception.

Once you have created your “dream portfolio”, you can then proceed to fund it through the normal funding process for Syfe.

Quick thoughts on Syfe Select

Syfe has made it simple for investors to customize their portfolios with the introduction of their Syfe Select feature.

For those investors who know what they want or which are the key themes they wish to partake in, Syfe now provides a very simple solution for users to DOLLAR COST AVERAGE into their unique thematic portfolio.

This is particularly useful for beginner investors who know what they wish to invest in (in terms of global themes) but yet lack the capital for any significant lump-sum investing approach. Syfe Select provides that simple option to create one’s unique portfolio of ETFs and dollar-cost invest regularly, which is a major “recipe” for investment success, in my view.

However, what I feel is lacking is the fact that Syfe did not disclose the individual expense ratios of the ETFs which they are offering as well as the weighted expense ratio of one’s customized portfolio. This is useful to allow investors to make a more informed decision.

Take note that Syfe’s platform fees are 0.65% (for most entry-level retail investors) and these ETFs’ expense ratios will add a second layer of cost. Most of these ETFs which are not really “passive” in nature (for example the ARK family of ETFs are all actively managed) will likely have a much higher expense ratio compared to your typical index ETFs such as VOO and VT.

For example, the 4 ETFs which I selected above to construct my unique portfolio (do note this is just for illustration purposes and I did not purchase these 4 ETFs) ARKX, PHO, MOO and ESPO have expense ratios of 0.75%, 0.60%, 0.55% and 0.55% respectively for a weighted average expense ratio of 0.613%.

Adding Syfe’s platform fee of 0.65% and one will expect to incur an annual recurring expense of 1.263%. Hence investors will need to judge if paying the annual recurring fees of 1.263% (in this example) for the convenience of structuring a customizable portfolio which one can dollar cost average into is worth the fees.

While there are of course cheaper DIY options such as through the FSMOne platform which allows for dollar-cost averaging into selected ETFs, it could still be a hassle to structure a portfolio of different ETFs to be purchased individually vs. Syfe Select all-in-one approach.

Other suggestions

Another key suggestion which I find is lacking within the Singapore Robo advisory space is the ability to help investors monitor their dividends received monthly across all the Syfe portfolios.

It will also be useful for Syfe to have themes that focus on dividend ETFs (although dividends from the US will incur a 30% withholding tax) for example, where the monitoring of dividends received monthly will also come in useful. Syfe Select does provide investors with the option of investing in some dividend-focused ETFs such as the SDY ETF and DLN ETF.

Conclusion

I believe that Syfe Select is a pretty useful product offering that Syfe is introducing to its clients. In due time, I will look to disclose which are the selected ETFs that I will use to construct my own customized ETFs which I have the intention to dollar cost average into and the rationale behind the selected ETFs.

PROMOTION BY SYFE

I hope I have presented the relevant information in an unbiased format with my own opinion for you to make an informed decision. You might agree or disagree and the decision to invest with Syfe is totally up to you.

Syfe has kindly reached out to NAOF readers and you can choose to sign up through this affiliate link where I may receive a share of the revenue from your sign-ups.

Syfe Wealth

Fee waivers up to a cap of S$30,000 for the first 3 months, regardless of the amount deposited.

Syfe Trade

You will be entitled to a special S$70 in cash credit if you decide to deposit a minimum of S$2,000 and execute 1 trade. Both the funding of the account and trade must be done within 30 days.

Just click on the button below to sign up for your Syfe account today.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only