Straco had just been hit by the perfect storm that will almost certainly impact its upcoming 4Q19 results as well as 1Q20 results.

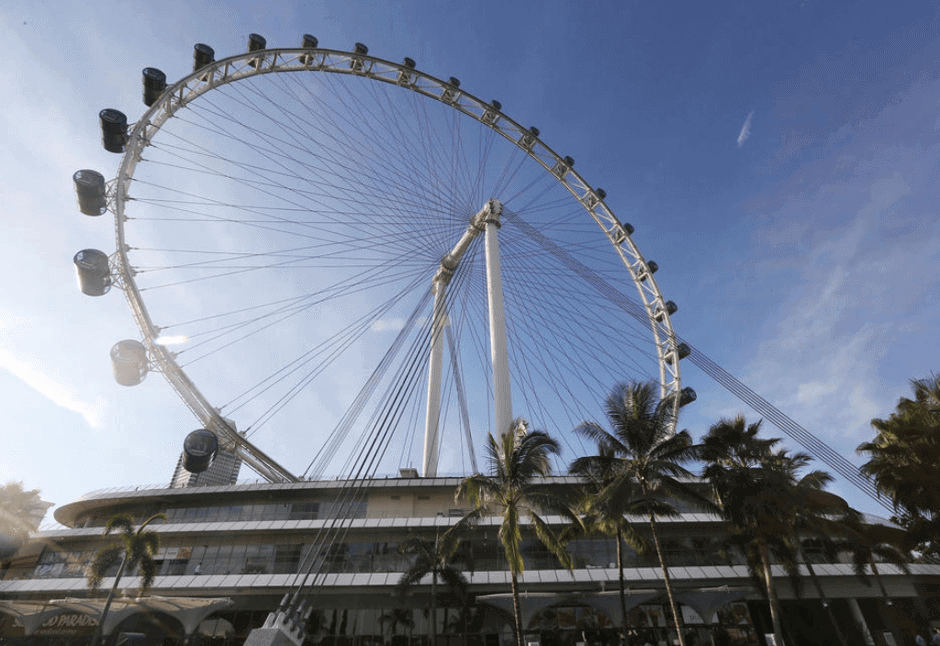

Flyer suspension

The bad news started streaming in back in late-Nov 2019 when a spokesperson for the Singapore Flyer said in a media statement on 26 Nov 2019 that the Singapore Flyer would be suspended after a technical issue involving one of the spoke cables was detected on 19 Nov.

Straco itself made no announcement pertaining to this suspension on SGX which to me, as a shareholder, was a disappointing “gesture”.

Recall that this was not the first time that the Flyer was suspended. Back in Jan 2018, operations were also suspended for two months due to a “technical issue”. This weighed on Straco Corp’s full-year earnings, which fell 12.4% to S$41.8m for 2018.

The Flyer saw segment profits dropping from S$11m in 2017 to only S$5m in 2018. The drop was significant due to the huge operating leverage effect that the asset had.

Given that we are now more than 2 months into this suspension brought about by technical issues, the negative impact on earnings will likely be as much as or more than S$6m, spread over 4Q19 and 1Q20, in our view.

According to a TODAY’s article, the Building and Construction Authority (BCA), which regulates amusement rides in Singapore, said that investigations into the latest technical issue were still in progress and the ride will remain closed until the investigation is complete and the ride operator completes the necessary rectification works recommended by the professional engineer to the satisfaction of the BCA.

It is unclear when the attraction would reopen, but a spokesperson for the Flyer said qualified professionals are helping it to find a suitable replacement for the affected cable.

Again, I find the lack of updates by Straco’s management pertaining to this issue as hugely disappointing. Management should at least provide shareholders a “deadline” for a potential resolution of this issue vs. leaving the issue hanging.

It will also be useful if management is able to quantify the potential negative impact on earnings in advance or whether the incident is covered by insurance.

Recall that for the first breakdown in early-2018, the company provided an update on the insurance claims on 25 June 2018, highlighting that the claim was being denied by the insurer as the reasons for the breakdown and the principal reason for the loss of profit fall under certain exclusions set out in the Policy. Despite its claim being denied, Straco highlighted that the company is taking all steps and measures to protect its interest under the Policy.

Since then, no announcements were made pertaining to the insurance claim follow-up. We can hence, assume that Straco is not going to be compensated for the 2018 breakdown.

Did management learn their lesson and seek to avoid a repeat of this insurance fiasco which again comes into question, given the breakdown of the Flyer a second time around?

Wuhan virus results in the suspension of all 3 China attractions

Straco’s share price collapsed by more than 10% on 28 Jan after trading resumes from the CNY long weekend. Management consequently issued an announcement that evening, noting that a decision was made to temporarily close all three of its China attractions, namely Shanghai Ocean Aquarium, Underwater World Xiamen and Lixing Cable Car since 25 Jan 2020.

The closure of its 3 China attractions, which account for 73% of the company’s revenue, effectively means that the company is left with ZERO income-generating assets during this interim period.

This is likely to result in substantial losses for the 1Q20 quarter, assuming that the suspensions for all 3 China attractions last for more than a month.

So what to do next?

As Straco’s shareholder, while I do like the company’s tourism business model which I view as recession-proof, this “black swan” event exposed the huge geographical concentration risk of the company. I will be lying if I say that episode has not rattled my conviction of the company’s fundamentals a least a tiny bit.

Management’s lack of forthcoming updates, as seen from the Flyer suspension episode, made this “crisis” even more frustrating.

While I know for certain the company’s upcoming 4Q19 and 1Q20 results will be horrendous, to say the least, this is likely already being “priced” into its share price, which has fallen from around S$0.67/share to the current level of S$0.57/share, valuing the company at a shade under S$500m.

This is the lowest valuation since 2014, prior to the acquisition of the Flyer.

The “blessing in disguise” is that the company is not heavily indebted and hence present no credit risk. On the contrary, the company is flushed with cash, with net cash coming in at S$180m as of end-3Q19, 36% of its market cap. This figure should rise to almost S$190-200m when the company announced its 4Q19 results.

I was previously confident that management will not look to cut its S$0.035/share dividend (which translates to a juicy yield of 6% at current price level) despite weaker operating performances impacted by the Flyer suspension given its high cash level with no short-term M&A plans.

However, the suspension of the 3 China assets now cast my conviction into doubt. If management believes that the suspension of all its assets might be longer than on its own estimate, then it might choose the “conservative” route of reducing dividend payments.

My base case assumption is still, however, an S3.5 cents dividend payment.

Taking a closer look at its balance sheet and cash flow

What if the company is forced to liquidate today? What will its liquidation value be? Looking at its balance sheet, the company has total equity of S$300m. With a market cap of c.S$500m, the company is still trading at a hefty 1.7x Price-to-book. This does not sound like music in the event of a liquidation.

However, it is not a fair valuation method to evaluate Straco on a PBR basis, given that the bulk of its assets is “hidden” in the form of its asset lease concession.

Implied fair value

Its 2 flagship China assets, SOA and UWX have about 15-18 years of leases left while Flyer has about 17 years of leases left.

Let’s assume a 17-year lease for all 3 assets, which together, generates a combined S$65m in operating cash flow after tax (assuming all assets operates at full capacity).

With 17 years of concession lease left, these assets will generate about S$1.1bn in operating cash over the next 17 years (assuming no change in operational cash generation over this period). The present value of these operating cash flows, assuming a WACC of 10% will amount to approx. S$500m

So, the “fair-value” of the company, assuming no operational issues, on a DCF basis with no terminal value and Capex assumption of S$3m/annum, will be close to S$700m after accounting for its net cash position of S$200m

However, it is evident that there are issues with the company and that is why the market is valuing it at close to a 30% discount to our implied fair value. Is that excessive?

Personally, I understand why the market is concern about the company’s prospect as there is no telling how long the Wuhan Virus might persist or if it will evolve into a global pandemic. However, being the optimistic person, I am, I believe the issue will be resolved pretty quickly and all its China assets will be back up running by 2Q20.

Assuming a hypothetical scenario that the Singapore Flyer is sold for a “princely” sum of S$105m today (S$140m minus 7years of depreciation at S$5m/annum), after subtracting the remaining borrowings of c.S$35m, that will generate S$70m in immediate cash for the company, bringing net cash to S$270m

However, the Flyer will no longer contribute to operating cash generation. Again, assuming that the Flyer generates S$15m in operating cash/annum, that will result in a “leftover” operating cash of S$50m for its China operations (no Capex assumption). Discount this over 17 years at a WACC of 12% (higher WACC due to pure China exposure) and add current net cash of S$270m and the fair value becomes S$625m, 25% higher than the current market cap.

Based on this quick back of the envelope calculation, I believe there is definitely still value in Straco. The upcoming 4Q19 results might possibly shed some light on management thoughts pertaining to the length of the suspension (although I will not bet on it) and if shareholders’ dividend payments will be negatively impacted

I like the company’s business but I hope that management can be more shareholder-friendly, not just by rewarding shareholders with its steady dividend payments but to be more forthcoming in dishing out information when the need arises.

Conclusion

I will be sticking to my shares for now as my bet is that the issues the company is facing will not be a structural one, particularly in China.

If it does become so, then we might have a bigger problem on our hand as that will naturally imply a severe global pandemic, potentially putting human’s very survival on the line? Not trying to sound like a pessimist! (did I just say I am an optimist earlier on?)

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

3 thoughts on “Straco: Perfect storm hits. What to do next?”

I am currently vested in Straco too, albeit not as big a position as yours. As much as I like Straco as a company, I’m highly considering to sell off my assets if they have zero revenue for long. How long is your stand for zero revenue before selling off your portions of the stocks?

Hi Xavier, probably waiting for their 4Q19 announcements and then deciphering my next move. If management cuts dividends then that could be a trigger point for me to sell at least part of the stakes. If by March/April there are still no announcements pertaining to resumption of operations for Flyer and China assets, then that could be the last threshold.

Yea that would make sense. Dividend plays a big reason to holding on to this counter