Stocks to Avoid

If you are a new investor trying to navigate the unpredictable waters of stock markets, it is easy to be caught up with the wrong current and end up with a sinking portfolio. Tantalizing adverts and attractive news headlines that promise enormous returns may cause you to invest in the wrong type of stock.

Investing in the wrong stock can make your portfolio’s value plummet, and in some cases, may even cause you to lose your entire investment.

With that in mind, here are 5 kinds of stocks to avoid for a beginner investor.

Stocks to avoid #1: Over-hyped Stocks

Characterized by their irrational and rapid growth, “trending” stocks that are hyped up by the media usually have underlying weak fundamentals.

They draw investors in like moths to a flame. The fear of missing out on the next big event in the markets, or the chance to make millions in a matter of days is why they are irresistible to some.

However, chances are, if you’re seeing news about a super popular stock floating around social media, it is too late for you to enter. Once you have heard of the news, it probably indicates that it has already been widely circulated, and the moment has passed to cash in on the price changes. This investing quote put it best: “A stock’s value to you is what it will earn in the future, not the past.”

Real-Life Examples Of Over-hyped Stocks

GameStop, AMC, Nokia, BlackBerry. If you’ve been following the news, you’ve probably heard of these stocks. Made popular on the Reddit forum r/WallStreetBets, these stocks have made headlines by rising at an astronomical rate in 2021, for no apparent material reason.

In the lead is the company GameStop (NYSE: GME), whose share price soared to a 52-week high of $483 compared to its 52-week low of $2.57 in 2021. The price of GME stock went up based on manipulation and artificial euphoria. In other words, it rose on thin air.

To be sure, a handful of amateur investors did become overnight millionaires from the rally. However, venturing into this kind of speculation is generally not advisable to new investors, because you have to be extremely lucky to make it through. And like going to the lottery, the odds are very much against you.

Stocks to avoid #2: High-Debt Companies

When companies suffer from debt, people who have invested in the firm’s stocks are adversely affected.

In 2020, almost 500 companies in the US filed for bankruptcies.

Amidst the coronavirus crisis, where companies are facing greater risks of going bankrupt, it is especially salient for new investors to be cautious of companies with large amounts of debt in their hands.

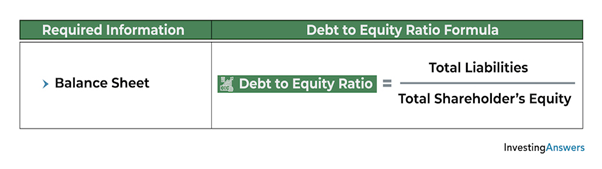

How To Spot High-Debt Companies

You can spot high-debt companies by looking at their debt-to-equity ratio. The debt-equity ratio is calculated by dividing total liabilities by total shareholders’ equity.

A D/E ratio greater than 1 usually indicates that the company has high levels of debt, and could be a sign to avoid it.

With that said, don’t be afraid of all firms that have debt. Debt can be a sign of a healthy business in some cases.

For example, if a firm decides to start a project that might bring massive revenue in the future, it needs to invest in it by incurring some debt at first. If they succeed, the firm can then return the borrowed funds and have enough left to make the borrowing worthwhile in the first place.

However, if a company’s debt only accumulates in the long run, it is time for you to move on.

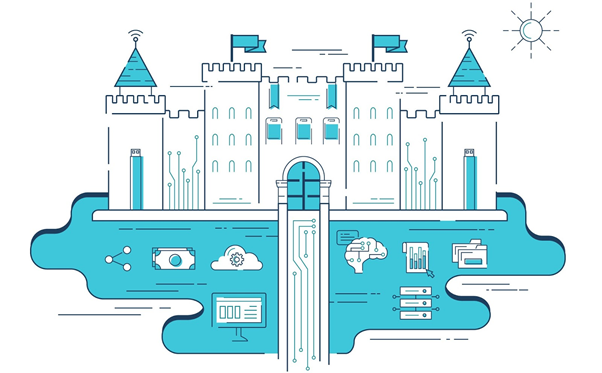

Stocks to avoid #3: No-Moat Firms

What is an Economic Moat?

Coined by Warren Buffett, an economic moat is a distinct advantage a company has over its competitors which allows it to protect its market share and profitability.

It is often a unique advantage that is difficult to mimic or duplicate and thus creates an effective barrier against competition from other firms.

Examples of businesses with wide moats include Nike, with its established brand name, Microsoft, with its far-reaching network effects, and Walmart, which has massive cost advantages that allow it to undercut all its competitors.

How To Spot No-Moat Companies

Companies that lack a wide economic moat usually have these defining characteristics: they do not have large amounts of free cash flow and lack a track record of strong, consistent returns. They are also likely to be losing their market share to competitors.

Conversely, companies with wide moats are often characterized by a steady rise in both operating margins and profitability. I have previously written about companies with strong network effects, one of the most powerful economic moat a company can have.

Stocks to avoid #4: Companies With Narrowing Profit Margins

One important sign that a company’s business model is not going to be sustainable in the long run is the reduction of its profit margins over time.

Profit margin is simply the difference between the cost of the product and the retail price. When the profit margin decreases, the difference between the production cost of the good and the price at which it is sold is reduced.

Often, this can be due to increasing costs incurred by the company without price increases.

The technical term for this phenomenon is Margin Creep or Margin Erosion.

Real-Life Example Of Margin Erosion

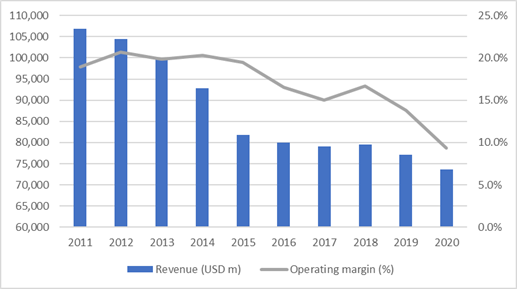

Take for example the stock IBM, or some still call it Big Blue, once the most valuable and most dominant tech company in the world. However, the company started to lose its lead in both PC hardware and software as competitors such as the likes of Apple and Dell, etc eroded its market share.

IBM’s earnings started to slide way back in 1985 and in the last decade, it remains evident that this once dominant tech company continues to struggle with margin erosion, partly the result of declining top-line which is not accompanied by a corresponding magnitude of decline in its expenses.

Since peaking back in 2012, IBM’s share price has been on a long-term downtrend.

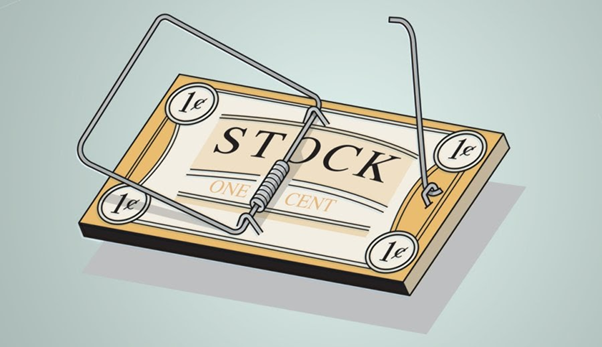

Stocks to avoid #5: Penny Stocks

A penny stock refers to a small company’s stock that typically trades for less than $5 per share.

Although some penny stocks trade on large exchanges such as the NYSE, most penny stocks trade over the counter through the OTC Bulletin Board (OTCBB).

While there can be sizable gains in trading penny stocks, there are also equal risks of losing a significant amount of an investment in a short period.

Bad Fundamentals

The fact that you can grab thousands of shares for a few hundred dollars can be appealing to beginners. That’s trouble because penny stocks are often tied to unproven, unprofitable, and sometimes questionable companies.

Easily Manipulated

Due to their low prices, penny stocks are easily manipulated by scammers. These people buy shares of the stock, hype it up online or in newsletters so that others buy-in and drive up the price — and then sell their shares, causing the price to plunge, leaving the other investors with big losses.

A stock priced at just $1 per share is not necessarily a bargain and is more likely to fall to $0.10 per share than to double or triple. Meanwhile, a $300 stock can be a bargain, with the potential to double or triple within a few years.

Trading halts can destroy your account

When penny stocks move, they have significant percentage gains. The catch is that stocks can get halted when their prices change too rapidly.

The typical halt occurs if the stock moves more than 10% within 5 minutes. There is no way to predict where the stock opens up again, which can have a catastrophic effect on your account because you are effectively barred from making any kind of trade in that period.

The exchange itself can also issue a halt if they sense very unusual movements in price. In the worst case, the stock might even get delisted from the exchange.

Real-Life Example Of Penny Stock Failure

A typical example is Longfin Corp (LFIN), which shot up from $3 to $140 within a few days on Nasdaq. Days later, however, LFIN got halted for a few months because the company was accused of fraud and stock manipulation. It also never opened up on the Nasdaq again and was moved to the over-the-counter(OTC) market.

Arguably, when it comes to penny stocks, the risks usually don’t justify the potential rewards, and new investors should stay away from them.

Conclusion

These are the 5 types of stocks to avoid for new investors. Over-hype stocks take the No.1 spot in this list as most beginner investors will often be susceptible to the lure of “easy money” hyped up by the street. However, in the majority of cases, by the time a retail investor starts buying these hyped-up stocks, the easy money is over and they are often the ones left “holding the baby”.

Here at NAOF, I have provided a quick start guide for new investors to begin their investing journey which one can access in the link below

NAOF Investing Series

A quick start video guide to help new investors get started on investing the right and easy way.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Best commodity asset of the decade and why Bitcoin might prosper in 2020

- How to prepare for a bear market. A simple 3-steps process

- Thematic ETFs partaking in the hottest trends

- Top 5 analysts of the decade and their current favorite stocks

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.