Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Stock Valuation Models: DDM

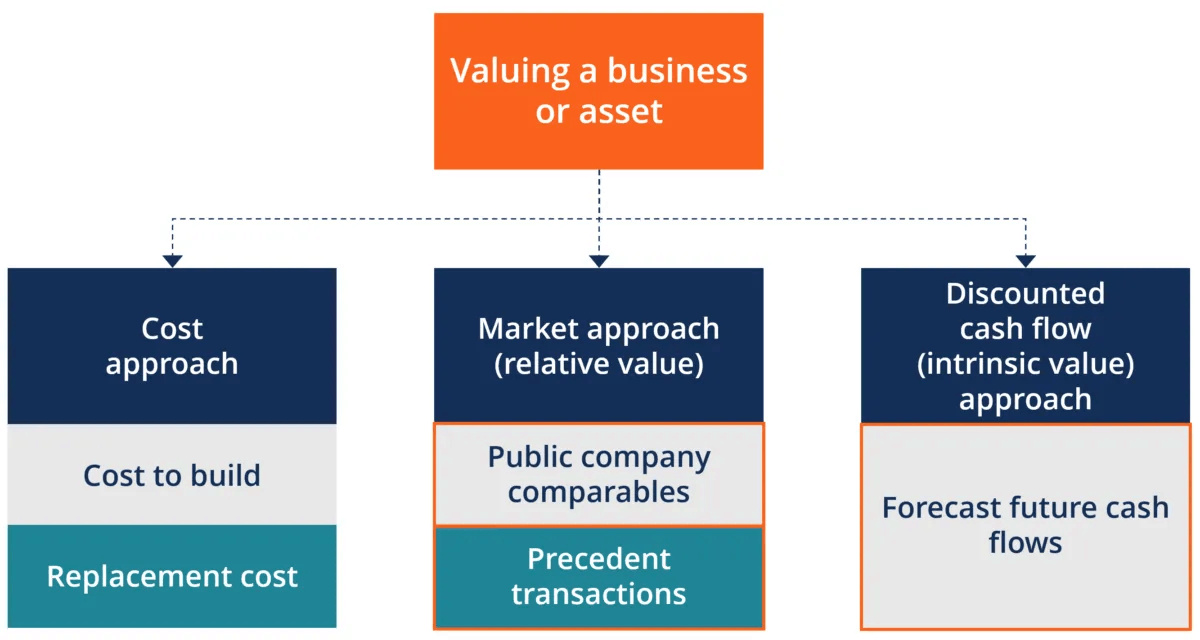

In part 1 of this guide to stock valuation models for the Discounted Cash Flow (DCF) methodology, you have learned how to estimate the intrinsic value of a company using the discounted cash flow methodology.

Part 2 will be an introduction of a simpler version of stock valuation known as the Dividend Discount Model or DDM for short

Key Stock Valuation Model: Dividend Discount Model (DDM)

The dividend discount model (DDM) is based on a similar concept to the discounted cash flow (DCF) model but only applies to firms that have a history of stable dividend payouts.

The Underlying Principle of DDM

The DDM takes the same assumption as the DCF, which is that the intrinsic value of an investment is represented by the present value of all future cash flows of the company. At the same time, the company uses all of its free cash flow to pay dividends to the shareholders, so dividends are essentially the positive cash flows generated by a company at regular intervals.

Gordon Growth Model (GGM)

The most basic and popular version of the DDM is the Gordon growth model (GGM), named after American economist Myron J. Gordon.

The Gordon growth model (GGM) assumes a stable dividend growth rate over the years.

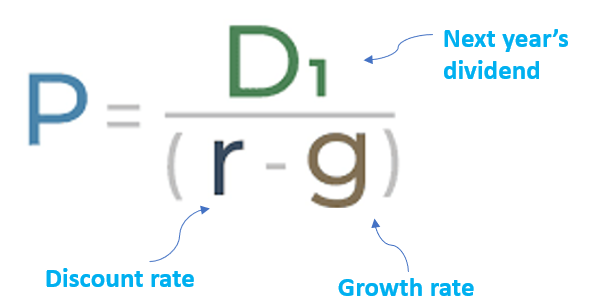

The formula of GGM is expressed in the following way:

Where:

P = the fair value of a stock

D1 = the estimated value of next year’s dividend

r = discount rate (usually calculated using CAPM)

g = the constant growth rate of the company’s dividends

Let’s break it down.

D1 is the estimated value of the following year’s dividends. This estimation can be done by looking at the firm’s historical dividends and any announcements to raise or cut their dividend payouts.

r is the discount rate or the investor’s required rate of return. This is usually calculated using the Capital Asset Pricing Model (CAPT). For most companies, this value can be obtained online via a simple search.

g represents the expected dividend growth rate. One way to calculate g is to multiply the return on equity by the retention rate (1 minus the dividend payout ratio). Another way is to simply observe the past dividend payout trends and estimate the average growth rate from there.

Example Of Gordon Growth Model

Imagine a company with a current stock price of $100. You predict it will pay a $1 dividend per share next year (D1), and this amount is expected to increase by 1% annually (g). An investor with a required rate of return of 5% (r) wants to know if they should buy the stock.

The intrinsic value (P) of the stock is calculated as follows:

According to the Gordon Growth Model, the shares are currently $75 overvalued in the market!

Drawbacks of the Gordon Growth Model

There are some limitations to the GGM:

Dividend Growth Rate Must Be Constant

The model assumes that the dividend growth rate is constant, which is not always an accurate reflection of real life. Constant dividend growth rates are more common among blue-chip companies in established industries. On the other hand, newer companies and industries are prone to fluctuating dividends due to the high risk of volatility as they develop.

Required Rate of Return Must Be Higher Than Growth Rate

The required rate of return/cost of equity (r) must be higher than the dividend growth rate (g). Otherwise, the math is invalid.

There is no simple answer

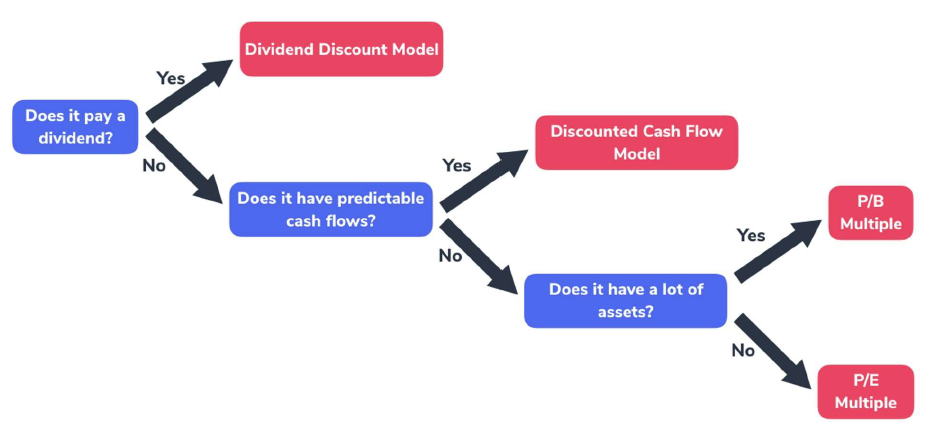

The diagram below is a simple flowchart in selecting your stock valuation models.

One can start off with the simple dividend discount model as the preferred stock valuation model if the company has a good track record of steady dividend payment.

Alternatively, one can deploy the discounted cash flow model which is slightly more tedious due to the various assumptions involved.

Last but not least, you can also deploy the P/B or P/B multiples methodology which is alot more simpler as a stock valuation method for new investors.

Equity research and valuation is one of the most nuanced topics in investing. At the end of the day, these models and formulas are just tools in your shed. It is now up to you to pick up these individual tools and build for yourself the house you envision.

There is no single ratio or number that will “magically” help you choose between buying or selling. Nevertheless, when wielded frequently and to their full extent, they can be powerful references for you in your investing journey.

Finally, you can see for yourself what Warren Buffett meant when he said the words:

I am fearful when others are greedy, and greedy when others are fearful.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.