Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

What is stagflation and what investment advice is around it?

[Update: This article was first written back in Sep 2022, highlighting to my readers the rising risk pertaining to stagflation. This is an updated article on my view pertaining to this phenomenon, which could very well be the base case scenario ahead for most developed countries]

There has been increasing chatter that stagflation is upon us. Stagflation is a term that is used to describe the phenomenon of increasing inflation and declining growth. The last time that stagflation reared its ugly head was back in the 1970s and that decade was marked by runaway inflationary pressures and stagnating economies (with high unemployment rates) for many developed economies, triggered by an oil shock.

Of late, we are increasingly reading reports that the risk of stagflation and slow economic growth due to this. While we are not yet at the stage of declaring a full-blown recession (aka negative GDP growth for two consecutive quarters), this is definitely a risk that is “on the table”. Thanks to high inflation, unless you have been hiding in a cave, you would have noticed that rising prices are now pretty much the “order of the day”. At this moment of writing in sunny Singapore, the hottest topic at present is our beloved chicken rice might no longer be affordable to most, a direct consequence of our “friendly neighbor” deciding to restrict its export of chicken due to domestic supply issues.

While not wishing to be the bearer of bad news, just like when I first wrote this article, I believe the “stagflation” situation is now direr and it is time to seriously ponder how you can protect your portfolio against the negative consequences of stagflation.

Hence, I thought it will be useful to highlight the notion of stagflation investing and the best investment strategies around it.

Reflation vs. Stagflation

Reflation is the scenario where a strong pick-up in economic growth translates to inflationary pressure. This is the de-facto environment that most economists expect the world to be in the post-COVID-19 era.

However, no one seems to be “optimistic” about how strongly the global economy will be growing, but instead, there are talks of a global recession happening in 2022. China, for example, is likely to witness one of its slowest GDP growth ever in the modern era, triggered partially by its aggressive “zero COVID-19” stance that has undoubtedly hampered much of its economic growth of late.

It is not just China. Most developed nations are witnessing slow economic growth. The UK, according to this Bloomberg report, is expected to witness one of the worst stagflation shocks in the world.

Several other signs warrant caution.

We once thought that the supply side “crunch” as a direct result of COVID-19, will slowly moderate. That doesn’t seem to be the case as yet, particularly when it comes to the critical semiconductor industry where Intel’s CEO, highlighted recently that the chip shortage is just “halfway through”.

Similarly, major Chinese port closures as a result of the COVID-19 spread in China have translated to transportation delays and higher shipping costs.

Not forgetting to mention the Russia-Ukraine war, which remains an ongoing affair. The impact this war has on global commodity supply is yet to be evident, in my view, and will likely hit the world in 2022. I do believe that higher commodity prices might be the order of the day.

In the US, the job market is seemingly strong, for now at least, which has contributed to upward pressure on wages. Such inflationary pressure is likely to be “sticky” (after you have gotten a wage rise, you don’t expect an immediately cut the following year in most scenarios).

While no one can be certain that stagflation is going to become the order of the day, particularly in our current context where there are so many variables at play, it pays to be prudent to incorporate stagflation investing as one of the recommended investment strategies for your portfolio.

Stagflation investing: Which assets will do well and how to play them?

Commodity

Commodities have usually performed well during inflationary periods. Precious metals such as Gold and silver, which are seen as good inflation hedges are expected to do well compared to multiple growth stocks in a stagnating economy that is also crippled by rising inflation

Gold, for example, tends to do well when the dollar weakens. In an inflationary environment, particularly one which is US-centric, that could result in a weak US dollar that will help assist Gold to further “prosper”. In the short term, however, the US greenback is maintaining its strength, due to its de-facto status as the “currency of the world” as well as higher yield potential. This has moderated the performance of precious metals at present.

However, that could all change when the narrative is firmly in the “stagflation camp”.

The outlook for other commodity assets ain’t that clear as slowing economic activity will reduce the demand for key hard commodities such as steel, copper, aluminum, etc, and push their prices back down. Soft commodities on the other hand could maintain their price strength as demand for staples will likely remain robust.

Commodity Stocks

There are various ways to have exposure to commodities. We can buy into the value stocks and corporate bonds of commodity producers such as Archer-Daniels-Midland Co. (ADM) which is one of the largest food processing and commodities trading corporations in the world. Barrick Gold (GOLD) is one of the largest gold mining companies in the world and buying its stock could be seen as a leveraged exposure to the price of gold.

Oil-related stocks like Exxon (XOM) and Chevron (CVX) have been one of the best performers on a YTD 2022 basis as a result of elevated and rising oil prices.

Do note the risk associated with buying into commodity-related stocks. They are typically more volatile and might not track the performance of the underlying commodity in question. Unless one is innately familiar with the stock in question, the best investment advice is to always partake in a basket of stocks through an ETF.

Commodity ETFs

If one does not wish to take a company-specific risk, then perhaps one can buy into commodity ETFs. There are several types of commodity ETFs. Some are indexes of commodity producers such as the VanEck Gold Miners Equity ETF (GDX) which invest in a basket of Gold producers while some invest in the commodities themselves, such as the iShares Silver Trust (SLV).

Some other commodity ETFs invest in commodity futures such as the iShares S&P GSCI Commodity Indexed Trust (GSG) which tracks the S&P GSCI.

For those who are interested in buying Gold ETFs to hedge against the impact of stagflation, I have written an article on how to buy the cheapest Gold ETF in this article.

Physical commodities

Another way to gain exposure is to buy the physical commodities themselves and store them under your pillow. One can buy precious metals such as gold, silver, platinum, palladium, etc, in either coin or bar form from precious metals dealers.

Conclusion: I believe that commodity, as an asset class, will continue to do well, after significantly outperforming other asset classes in 2021. Despite solid price performances over the past couple of years, it is still an asset class that has generated negative annualized returns when compared over a longer horizon and the current scenario looks ripe for a supercycle in commodities to finally begin in 2023.

Bonds

Bonds typically are not expected to do well in a stagflation environment. To combat rising inflation, governments will typically look to raise interest rates and this is not ideal for bonds that thrive when interest rates are being lowered.

There are, however certain categories of bonds that could benefit or at least hold their value well in a rising interest rate environment linked to inflation.

Short-term TIPS

These are your Treasury Inflation-Protected Securities (TIPS). TIPS is a treasury bond that is indexed to an inflationary gauge to protect investors from the decline in the purchasing power of their money. As inflation rises, TIPS adjusts in price to maintain its real value.

There is a difference between both short and longer-term TIPS. TIPS with less than 5-years remaining until maturity will have less of an interest rate risk exposure and is more directly correlated to the performance with the CPI. But these strategies are likely to offer lower real returns than those that own TIPS across the entire maturity spectrum and are more correlated to equity risk.

One can get exposure to a short-term TIPS through an ETF such as the Vanguard Short-term inflation-protected Secs ETF (VTIP) which has an average duration of less than 3 years. This ETF is one of the largest inflation-protected bond ETFs, with a market cap in excess of USD$60bn and one of the lowest expense ratios of just 0.04%. On a YTD basis, VTIP generated flat returns.

Conclusion: It remains to be seen if bonds are a viable asset class to own in a stagflation scenario. So far, TIPS and short-term bond returns have been rather dismal when looked at in the context of a high inflation rate environment.

Stocks

In a stagflation environment, some categories of stocks will do well while others will suffer. Typically, those that will do well tend to be in sectors such as consumer staples, utilities, materials, real estate, etc. We want to focus on such value stocks with particular characteristics.

Pricing power

We want quality counters with the ability to pass on rising raw material costs to consumers aka, stocks with pricing power.

Take consumer staple stocks for example. Whether the economy is up or down, people will have to eat. However, not all consumer staples stocks are made the same. There are some who will not be able to pass on rising input prices (such as higher wages) to consumers due to the competitive environment. These stocks without pricing power will suffer.

On the other hand, staples that have pricing power, or those we termed as having quality criteria, will likely emerge stronger from the crisis.

Similarly, stocks in other sectors (which tend to do well in a stagflation environment) that have pricing power are likely to outperform the market.

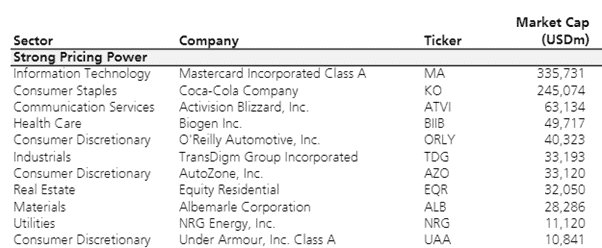

The table below shows some of the stocks with pricing power, according to UBS.

I have also written an article on stocks with pricing power.

Interest-rate sensitive

Besides having pricing power, stocks that are less sensitive to a rising interest rate environment as a result of inflationary pressures will also excel.

For example, low debt stocks are not held “ransom” by higher interest rate payments.

Interest-rate sensitivity can also take another form beyond just exposure to debt. For example, stocks with high valuation and negative earnings expectations are particularly susceptible to a sell-off as a result of higher interest rates, not because these are debt-laden companies, but because their current lofty valuations are calculated based on discounting their future cash flows by the current low-interest rates expectations. High-growth tech stocks without any earnings are those that come to mind.

When interest rates are expected to rise due to inflationary pressures, that will result in a sell-off of these interest-rate-sensitive stocks.

Real asset exposure

We previously highlighted commodity counters which are considered as those possessing “real assets”. These counters will likely benefit from a stagflation environment although the extent might be different for different commodity classes as well as duration.

Natural resources companies are a prime example. One way of partaking in counters with real asset exposure is through an ETF like the SPDR S&P North American Natural Resources ETF, ticker NANR.

Conclusion: Buying stocks is typically seen as the easy solution to hedge against inflation, given their long-term appreciation potential. However, there will be certain categories of stocks that will perform much better in a stagflationary environment.

Stocks that have pricing power and can pass on higher raw material prices to consumers will likely perform well and could in fact emerge stronger from a recessionary environment, has taken market share from peers who are not able to survive. Those with real assets like natural resources companies will continue to do well as their operational performances will likely be pegged to the rising prices of the underlying resources. Companies with low debt might be unfairly sold off alongside the general market, but if their operational outlook remains a robust one, then there could be an opportunity to be buying these companies at a discount.

Conclusion

Are we truly entering into a period of stagflation? This stagflation view remains an increasingly plausible scenario and is no longer viewed as an “outlier”.

While COVID-19 is not seen as the main culprit that triggers stagflation, its negative impact on the global supply chain is undoubtedly one of the major root causes. Others might also blame the “money-printing” actions of the Fed over the past decade and a half, since the GFC, which is now coming to roost. The impact of the Russia-Ukraine war, an unforeseen circumstance, might also have contributed to the current stagflation thesis.

While one has got no magical crystal ball to say with certainty that stagflation is definitely upon us, it is prudent to err on the side of caution. I have highlighted a number of ways that one can look to position his/her portfolio to help mitigate the negative impact a global stagflation scenario.

I have previously written this article: Is stagflation the end game for the bull market back in Sep 2019. Readers might be interested to revisit that article.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only