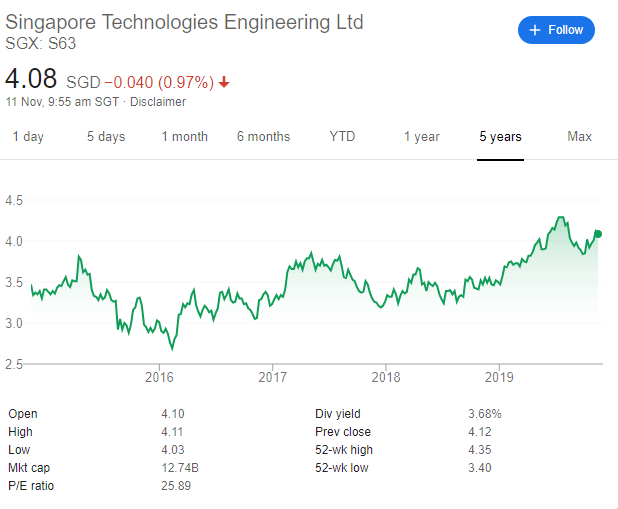

ST Engineering (STE) announced its 3Q19 earnings before market hours on 11 November. While its top-line was a strong 27% YoY growth, STE’s net profit only registered a dismal 3% YoY growth. This was due to a one-off provision for its Marine’s division arbitration outcome. Excluding that negative impact, earnings would have grown by 12% to S$150m.

The street is generally positive on STE, with CIMB previously forecasting that the company will be generating S$150m in profits this quarter, in-line excluding the negative impact from the arbitration provision.

On a FY2019 basis, the street is forecasting earnings in the region of S$580m to S$620m. This is likely not achievable on a reported earnings basis. On an adjusted earnings basis, this will imply approx. 7%-33% growth on a YoY basis.

We suspect there will be some minor downward earnings revision by the street.

Aerospace the key outperfomer

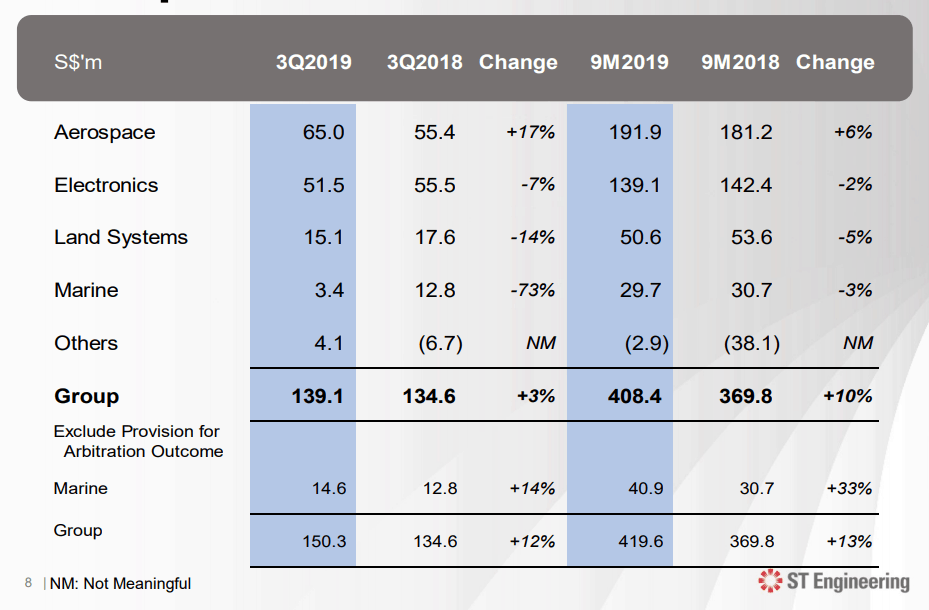

The above table provides a snapshot of STE’s divisional net profit contribution. Its Aerospace division was the only division that registered positive growth this quarter, largely the result of contributions from its MRAS acquisition.

Electronics division saw earnings declined by 7% due to additional investment in new growth areas.

Land Systems’ profit declined by 14% due mainly to absence of prior year tax credit and continued investment in robotics capabilities.

Marine division was the key negative surprise this quarter, with a 73% decline in reported profits due to S$11m in provision charges made in relation to Hornbeck Offshore Services, which the company has previously guided in a 23rd October announcement. Excluding this one-off impact, Marine division would have registered a 14% improvement in net profit instead.

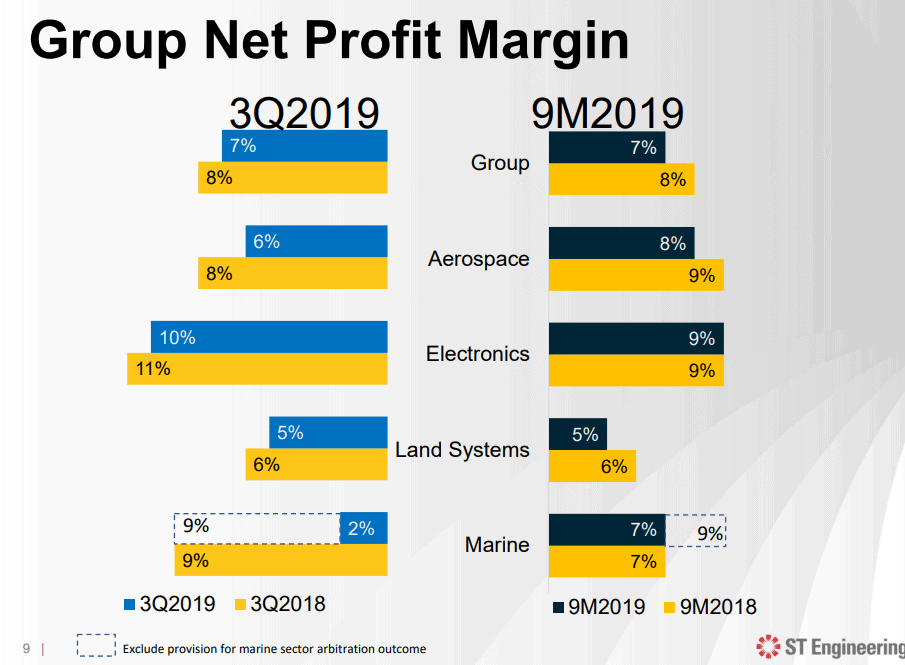

Margins declined across all divisions

A potential worrisome sign has been the fact that STE’s net profit margins for all divisions declined in 3Q19 vs. 3Q18. Despite strong growth in its Aerospace’s division revenue and profit, margins in this division was impacted by higher associated financing cost.

The higher financing cost trend will continue as the Group continues to leverage on its balance sheet to engage in M&As. Looking ahead, the company will be banking on its recent Newtec (c.S$383m) and Glolink (c.S$28m) acquisitions to propel growth.

However, these 2 acquisitions are of a much smaller nature compared to MRAS (c,S$868m) and unlikely to excite the market in terms of their contributions, particularly Glolink. Management has previously guided that Newtac will be earnings accretive in FY2020, with DBS forecasting earning contributions from Newtac to be more than S$10m in FY2021.

One of the few SG blue-chips with still decent earnings growth ahead

Despite a relatively disappointing 3Q19 performance, STE remains one of the few remaining SG blue-chips that still has decent earnings growth potential ahead.

Its Aerospace division will likely continue to spearhead the Group’s earnings performance in the coming quarters/years as MRO demand is expected to remain robust. MRAS’s growth will likely continue to be propelled by strong demand for CFM Leap 1A nacelle, driven by the A320neo aircraft.

Its Electronics division will focus on integrating both Newtac and Glolink in the coming year/(s) which should start contributing more meaningfully in 2021 and beyond. Smart city contracts are likely to be key growth drivers for this division. Management previously highlighted that they will be looking to disclose more information pertaining to its smart city developments and progress towards doubling its smart city revenue to S$1bn by 2022. However, at this juncture, not much information is yet made available.

Its Land System division could see exciting growth ahead, with the progressive delivery of the Hunter Armored Fighting Vehicle in 2H19 and 2020. Autonomous vehicles is a big theme for this division, with STE being a key entity as part of a consortium spearheading autonomous buses adoption in Singapore.

Last but not least, its Marine division, has likely seen its worst days behind them (although this quarter provision has been a major dampener), with strong order backlog for this division bolstering revenue and earnings over the next 2-3 years.

Conclusion

With an existing record order backlog of S$15.6bn, the company should not have issue growing its revenue in the coming years. However, we believe the market will be looking beyond just revenue growth. Management should focus on integrating recent new acquisitions to realise cost synergies and improve margins. Finance cost will remain elevated as the Group leverages more on its balance sheet to drive business growth.

This could mean that both 2020 could turn out to be a transitional year with marginal growth. We see stronger growth materializing in 2021 and beyond.

We believe STE’s share price will hover around the S$4/share based on this set of results. The company will likely maintain its DPS of S$0.15/share which translates to a yield of around 3.7% at current price level. We will be buyers at around the S$3.80-3.90 level.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER STOCKS WRITE-UP

- YANGZIJIANG’S SHARE PRICE IS UP 7%. CAN MOMENTUM PERSIST POST-RESULTS ON 7TH?

- SINGAPORE AIRLINES 2QFY20 PREVIEW. HERE IS WHAT TO EXPECT.

- RIVERSTONE 3Q19 PREVIEW: POTENTIAL TO SURPRISE?

- SHENG SIONG 3Q19. 4 KEY AREAS TO LOOK OUT.

- VALUEMAX: A RECESSION PROOF BUSINESS BUT WE SEE 1 MAJOR RISK

- HOW TO PLAY THE PARTIAL OFFER FOR KEPPEL?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.