Solana Crypto: One of the top Ethereum killers

Created in 2017 by Anatoly Yakovenko, Solana is an open-source blockchain that serves as a platform for trading and launching digital assets like non-fungible tokens (NFTs), decentralized applications (dApps), and various trading protocols.

The growing popularity of cryptocurrencies has caused a high degree of congestion on popular blockchains like Bitcoin and Ethereum, which pushed up transaction fees. Not to mention the low throughput on these networks, meaning transactions are very slow and expensive.

Solana was thus created to solve these underlying problems and was even dubbed one of the most popular “Ethereum killers”, alongside other cryptos such as Cardano, EOS and Polkadot. The native token of the Solana blockchain is SOL and it is used to transfer value or for staking purposes. Solana’s network boasts an industry-leading throughput of 65,000 transactions per second (TPS) with minimal fees, though its current TPS is about 2,500 according to Solana Explorer.

Its speed, as well as the scalable ecosystem, are the reasons for labelling it as “Ethereum Killer”.

As ambitious as this project may sound, Solana has had its fair share of hiccups including network outages due to high levels of network congestion which prevents transactions from going through and traders are unable to offload their tokens.

The Solana Blockchain

Solana’s blockchain runs off a concept called Proof of Stake along with Solana’s very own Proof of History mechanism. These are methods to verify cryptocurrency transactions in the blockchain in a decentralized manner.

Proof of Stake

Proof of Stake is a model whereby users offer, or stake, their tokens as a form of collateral for a chance to validate blocks in the blockchain. Users with staked coins are termed as “validators”.

Validators are randomly selected to validate a block through several factors such as how large their stake is, duration of stake, and many more. Hence, users who stake more coins are more likely to be chosen to validate a new block.

Unlike the Proof of Work model currently used by Bitcoin and Ethereum, Proof of Stake is less energy-intensive as validators are not competing to solve complex mining puzzles and they no longer need to rely on large, expensive mining farms to gain an advantage in validating new blocks.

Proof of History

Proof of History is a concept developed by Solana that incorporates a standardized source of time into blocks in a decentralized manner and organizes transactions in the correct sequence based on timestamps

Unlike in Proof of Stake, where only 1 validator processes the transactions while others verify the transactions and confirm it is accurate. In Proof of History, each block is broken up into sections and validators take turns being the “leader” according to a predetermined, randomly generated schedule, through factors similar to the Proof of Stake concept (e.g. Size of stake, duration of stake, etc.)

For example, assume a block is broken up into 3 sections.

According to the predetermined schedule:

- Validator X was assigned to verify section 1 of the block for the first 10 seconds

- Validator Y was assigned to verify section 2 of the block from the 10 seconds to the 20-second mark.

- Validator Z was assigned to verify section 3 of the block from the 20 second to 30 second mark.

How does the network ensure that Validator Y is supposed to start at the 10 second mark? By using verifiable time delays to prove that Validator Y has waited 10 seconds before working on the block. Subsequent validators would know that Validator Y obeyed the 10 second delay and can start immediately.

Why is this better? Since there is a standardized timestamp within the network, there is no need to verify whether the validator’s external source of time can be trusted, which reduces latency. In Solana’s case, it means a high throughput, a high-performance blockchain that can process a theoretical 65,000 TPS.

Solana Ecosystem

The Solana network enables other projects to be built on its blockchain using smart contracts. Smart contracts are programs that execute when certain conditions are met without delay or needing an intermediary.

Some examples of projects on Solana that use smart contracts are NFT marketplaces such as Solanart or decentralized exchanges such as Orca.

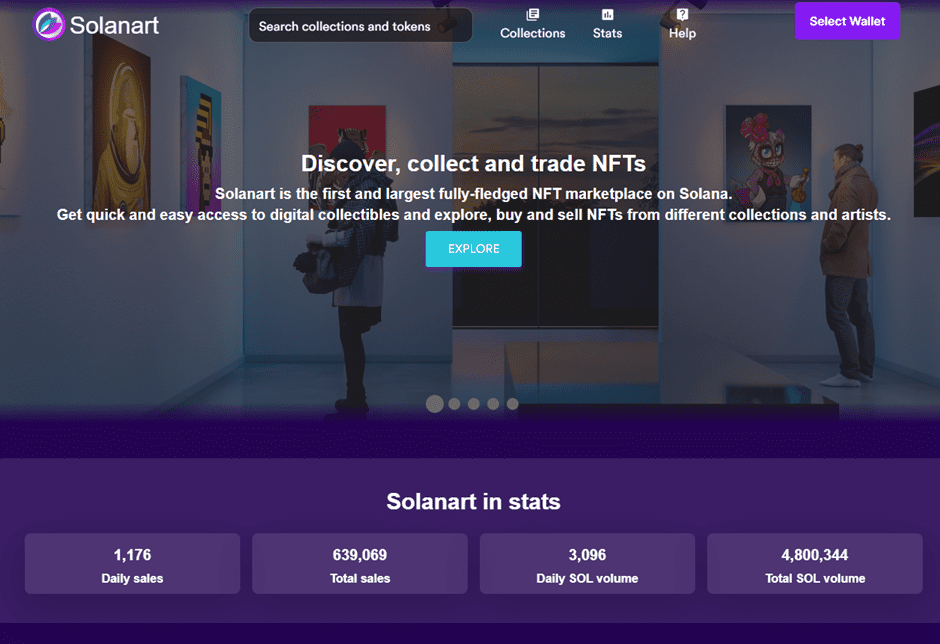

Solanart

Solanart is an NFT marketplace built on the Solana network that transacts using the SOL token. NFT marketplaces enable the trading and minting of NFTs. Smart contracts are used in these marketplaces to help verify the ownership of the NFT and facilitate transactions between buyers and sellers.

When an NFT is newly created or minted, the smart contract would contain the NFT’s unique identifier which cannot be replicated, making it unique and rare. Every subsequent purchase or sale of the NFT executed by the smart contract would be noted within a publicly available blockchain. Users can trace the transaction history to verify the wallet address of the person who claims to own the NFT.

The benefit of Solanart is of course the fast transaction speeds along with low fees since it is built on the Solana network. However, compared to other more popular NFT marketplaces like OpenSea, Solanart has fewer listed projects and a lower trading volume. Highly popular NFT projects such as Bored Ape Yacht Club or CryptoPunks are also not listed on Solanart.

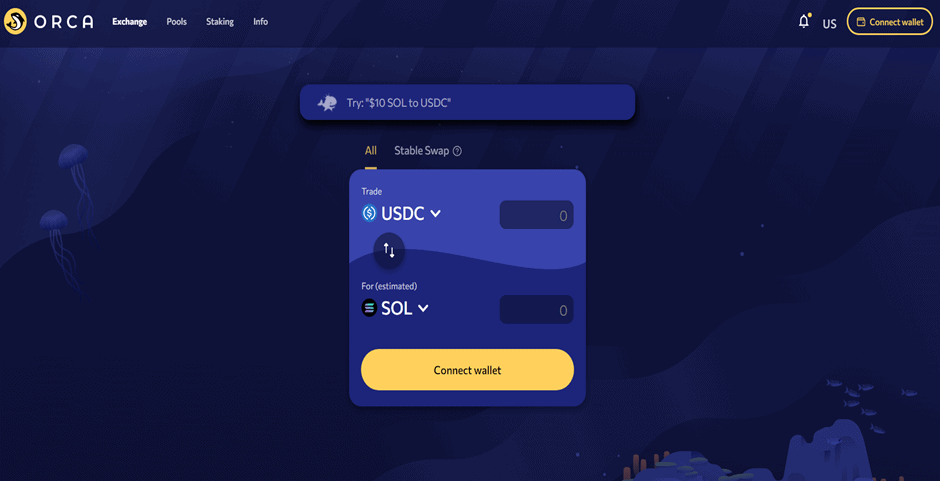

Orca

Orca is a decentralized exchange (DEX). DEXs are peer-to-peer marketplaces that rely on smart contracts to execute trades without the need of an intermediary or custodian. Orca is a liquidity pool-based DEX that does not require a centralized market maker to provide liquidity.

A liquidity pool refers to a pool of tokens (usually 2) locked within a smart contract to provide liquidity in a DEX. These tokens are publicly sourced, and token providers are given incentives to supply assets to the pool, such as a portion of trading fees.

The pricing of the asset pair in the liquidity pool is determined by a model called an Automated Market Maker (AMM). AMMs use a formula X * Y = k.

- k = constant

- X = Token X

- Y = Token Y

For example, if the supply of token X increases, then token Y must decrease for k to remain constant.

Some of Orca’s main features include:

- Token swaps which traders can use the liquidity pool to swap tokens in a pair.

- Liquidity provision where users can contribute token pairs to the liquidity pool and receive a portion of trading fees as rewards.

Avalanche Comparison

How does Solana compare to other networks such as Avalanche?

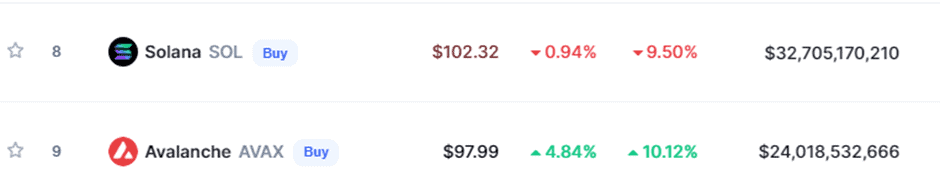

Similar to Solana, the Avalanche network supports the development of other dApps, uses Proof of Stake, and has a relatively high throughput of over 4,500 TPS according to its website. Both projects experienced rapid growth in 2021, being dubbed “Ethereum killers” due to their cheaper fees and significantly faster transaction speeds. Solana’s price rallied by a staggering 14,000%, while Avalanche saw an impressive 4,500% growth.

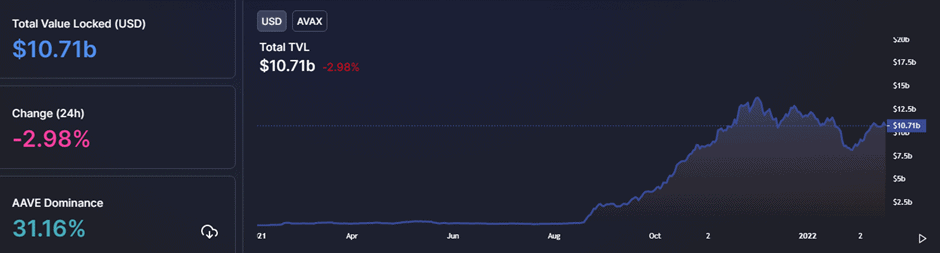

In terms of Total Value Locked (TVL), Solana has $8 Billion while Avalanche has $10.7 Billion locked within their respective ecosystems at the time of writing. TVL represents the total value of assets locked within Defi applications.

Looking at market capitalization, Solana has a market cap of $32 Billion while Avalanche stands at $24 Billion. TVL could be used to find the market cap-to-TVL ratio which is similar to a Price-To-Book ratio for stocks to determine if a token is valued appropriately.

In terms of their ecosystem, Avalanche can support Ethereum-based dApps on their blockchain whereas Solana only supports local dApps. Ethereum dApp developers can easily transfer their projects to Avalanche and deploy their very own blockchain on the Avalanche network for greater control. With Ethereum currently being one of the largest Defi ecosystems, Avalanche’s compatibility with Ethereum could skyrocket its popularity and adoption as developers shift to the Avalanche network.

Future Roadmap

Solana is an exciting project to follow as it strives to become the Visa of cryptocurrency networks. Its high throughput is unmatched by other networks and the low fees make transacting using the Solana network ideal for users.

Solana is even introducing a new payment protocol called “Solana Pay” enabling customers and merchants to transact using digital currencies such as USD Coin (USDC) with near-zero fees.

This exciting development is backed by popular blockchain companies including the likes of Circle, Slope, FTX, Phantom, and more. There may even be a potential Solana Pay integration with Shopify, currently one of the largest eCommerce platforms, which if done successfully could skyrocket Solana’s popularity further.

How can you get involved?

There are various cryptocurrency exchanges in Singapore that allow you to purchase SOL, with the popular ones being Crypto.com, FTX, Coinhako, etc. My recommendation is FTX due to its relatively cheap fees, ease of use, and a large number of coins listed (314 at the time of writing). FTX also has a pretty impressive daily trading volume of $1.6 Billion.

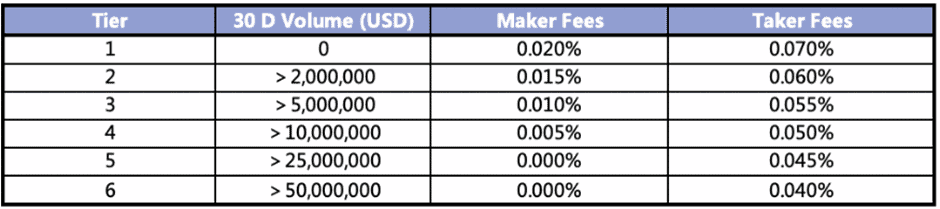

FTX has a tiered fee structure as follows:

For most people, including myself, unless you aped your life savings into Dogecoin in 2020 or own 10 Bored Ape NFTs, you would likely fall in the tier 1 category with a 30-day trading volume of under USD 2 Million. In this category, there is a 0.07% trading fee.

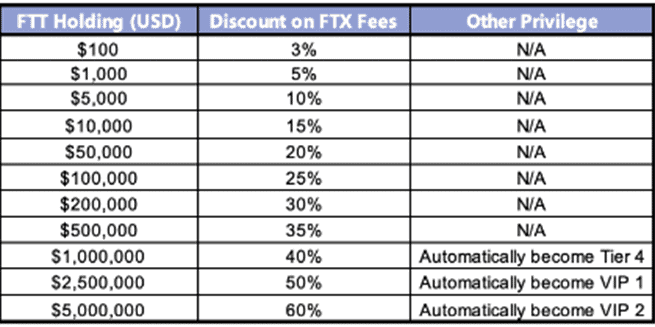

Additionally, by holding FTX’s native FTT token, you can also receive fee discounts as follows:

These are the recommended ways to fund your FTX account:

1. Deposit fiat via wire (Easiest).

You can use DBS Remit to deposit USD or SGD into your FTX account. However, it is recommended that you deposit USD since you would enjoy 0 transfer fees. According to DBS, this would take about 2-4 working days.

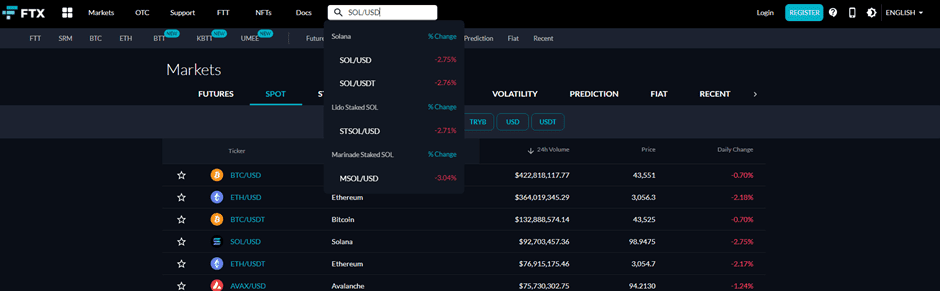

Once your account is funded with USD, you can head over to “Markets” and type in the “SOL/USD” trading pair. After that, simply enter the amount you wish to buy and your order type and you are a proud owner of SOL.

2. Deposit cryptocurrency.

For those who already own cryptocurrency or stablecoins on another exchange, you can use this method to transfer your coins to FTX and convert it to SOL.

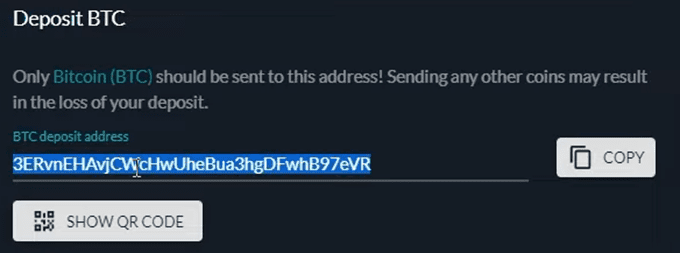

Assuming you want to deposit Bitcoin, you would head over to “Wallets”, and select “Deposit” for Bitcoin.

After which, you would receive a public Bitcoin address on FTX that you should send your Bitcoins to. This address should be entered as the withdrawal address in your other exchange you intend to withdraw Bitcoins from. Ensure that the address is correct, otherwise, you will lose your Bitcoins.

Do take note that you may be charged a withdrawal fee depending on which cryptocurrencies you intend to transfer. A useful website you can use is cryptofeesaver.com/ to help identify which cryptocurrency to transfer to incur minimal fees.

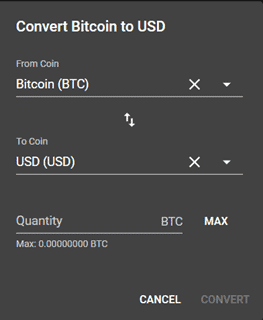

3. Convert BTC to USD, then to SOL

Once the Bitcoin arrives in your FTX wallet, select the “Convert” option on the same wallet page, and you can convert your Bitcoin to USD. Then, head over to “Markets” to get your hands on some SOL.

Conclusion

There are many wannabe “Ethereum Killers” and Solana is definitely one of the top few contenders. However, it still trails Ethereum significantly in terms of both market cap (Solana’s market cap is just 1/10th the size of Ethereum) and global adoption. There is also the potential that if ETH 2.0 is being successfully adopted, transiting to the more energy-efficient Proof-of-stake from the current Proof-of-work concept, alleged assailants such as Solana will have their work cut out for them.

For now, I am interested to partake in the development of Solana as part of a diversified crypto portfolio. It will be interesting to see if Solana crypto’s key strength: its speed will help it to stand atop its competitors in the coming years.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Beginners Guide to crypto currency. How to get started

- GBTC ETF: How you can buy Bitcoin at a discount

- What are NFTs and my NBA Topshot experience

- Why you should invest in Coinbase stock and how to get a free Disney shares while doing it

- Bitcoin prediction: 5 reasons why its rise this time might be sustainable

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only