Sembcorp Industries profit warning

Sembcorp Industries (SCI) issued a rare profit warning after the market closes on 6 February.

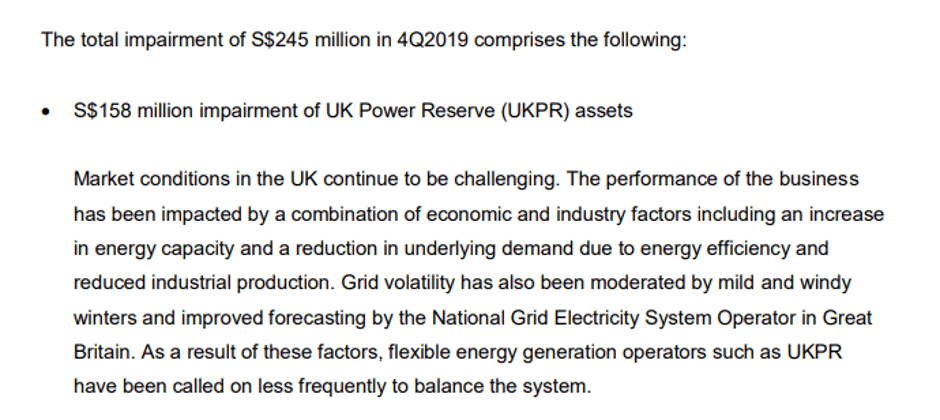

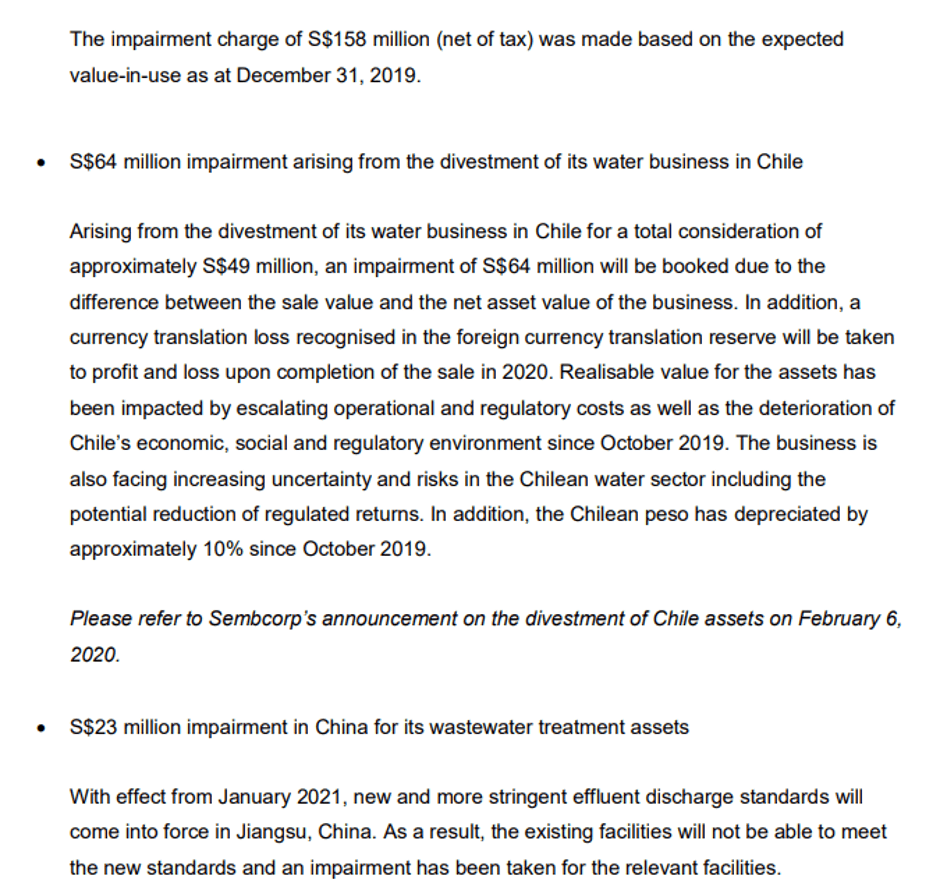

The company highlighted that it will be making a material impairment of S$245m in its upcoming 4Q19 results to be announced on 21 February.

These impairments are associated with the company’s energy assets.

Consequently, the company expects to announce a net loss for its Energy division in 4Q19.

I lifted the specific details of the losses from the company’s announcement:

UKPR – A disastrous acquisition right from the start

Recall that SCI purchased its UKPR assets back in May 2018 for approx S$385m. Post-acquisition, the assets were lost making as it is a very seasonal asset with the bulk of the profits generally recognized in the first quarter of the year.

UKPR faced further headwinds when the Capacity Market in the UK was suspended from Nov 2018 onwards for almost a year before the regulator reinstated the program in Oct 2019, freeing up around GBP$1 billion pounds in deferred payments to energy providers.

This should be good news to UKPR, particularly for 2020 and beyond. Hence it came as a real negative surprise to me that management highlighted the need for an S$158m impairment for this entity due to weaker industry-specific prospects for flexible energy generation operators.

The impairment will bring the fair value of UKPR in SCI’s balance sheet to around S$200-250m, on our forecast.

Further deterioration in the coming quarters, particularly in 1Q20 which is supposedly the seasonally strong quarter for UKPR’s operations, might result in further asset impairment to SCI.

Net losses likely in 4Q19

The company guided that excluding exceptional items totaling -S$165m for its Energy division, its full-year 2019 underlying net profit of the Energy Division is expected to be better than full-year 2018.

For full-year 2018, SCI’s Energy division recorded an underlying net profit of S$312m. So far in 9M19, the net profit of SCI’s Energy division was S$258m or approx S$85m/quarter.

Assuming a normalized profit of S$85m for SCI’s Energy division in 4Q19, this will bring total full-year adjusted (exclude exceptional) net profit for this division to c.S$340m. However, due to -S$165m in exceptional items, we will likely see the Energy division recording losses of c.S$80m for 4Q19 and c.S$180m in reported net profit for full-year 2019.

Given that the Energy division generally accounts for the bulk of the Group’s profits, an S$80m loss for this division in 4Q19 will likely drag the entire Group into losses for 4Q19.

This is also taking into consideration the losses that will likely be incurred for its Marine division in 4Q19, which we forecast to be in the region of -S$15m.

Taken together, total losses from its 2 key divisions: Energy and Marine will total to approx c.S$95-100m in 4Q19 which is unlikely to be compensated by its Urban Development division and “Other Businesses”.

Losses in 4Q19 could actually be more significant, given that the spot electricity prices in India were extremely weak in the quarter, falling to a 2-year low of Rs 2.71/kWh in October. Current prices are around Rs 3/kWh, still a historically low figure.

Key catalysts not materializing

We believe the key catalysts for SCI are: 1) Full divestment of its marine division to become a pure-play Energy business, with a strong focus on renewables and clean energy such as Wind and solar, 2) Securing of more long-term PPA contracts for Sembcorp Energy India and 3) IPO of Sembcorp Energy India.

Full divestment of its marine business will allow the company to become the only pure-play utilities blue-chip in SGX, where there will likely be renewed interests from institutional investors looking for such pure-play exposure. This could translate to a valuation re-rating.

Securing more PPA contracts for Sembcorp Energy India will reduce the volatility associated with spot electricity market prices in India which have shown to be extremely volatile.

Lastly, the IPO of Sembcorp Energy India will look to crystallize the value of its India business, which we believe there is a huge disparity gap between what SCI believes is its fair value vs. what the market is attributing.

We believe that the share price of SCI will likely remain weak if none of these catalysts are to materialize in 2020. Given the volatile nature of its dividend payments (despite being a utility company), investors are also not paid to wait.

Conclusion

The share price of SCI at this writing is at S$2.08, potentially challenging its recent all-time low of S$2.01.

While I personally believe that the sum-of-the-parts value of SCI is significantly higher than what the market is currently attributing to the counter (market cap of S$3.7bn while its stake in SembMarine itself is worth S$1.5bn at today’s price), I can relate to the frustration of long-standing shareholders who are likely disappointed with the “changes” made to the company over the past 3-4 years that has not translate to tangible improvement in the Group’s operations.

While one can argue that India has shown a strong turnaround in 2018-2019, 1-2 years of positive results are not representative of improving fundamentals hereon. If spot electricity prices remain depressed in India, we could witness a significant U-Turn in Sembcorp Energy India’s operations.

As such, I believe the company’s share price might be stuck in the low S$2-region. However, I believe there might be some price support at the S$2 level, with on-going market speculation of a potential consolidation between Keppel O&M and Sembcorp Marine amid a weak new orders outlook that is proving “unsustainable”, particularly in Sembcorp Marine’s case.

An oil price collapse might finally be the trigger point for our local yards to embark on a much-needed consolidation to further stream-line cost efforts and increase SG competitiveness compared to our Korean and Chinese counterparts.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.