Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

Safe Option Strategies to boost your trading profits

I have written about incorporating options as part of your investing arsenal on several occasions. Options are often seen as a leverage tool, often viewed through the lens of fear and bewilderment.

However, the truth is that options as an investing tool are not DANGEROUS. People ARE.

Options at the end of the day are just a financial product that provides you immense flexibility to structure your trades based on a myriad of factors such as your bullish/bearish view, time horizon, confidence level, etc.

It is often GREED in humans that makes options trading “risky”.

As mentioned, the primary idea behind options lies in the strategic use of leverage. If done systematically, options trading can be safer than purchasing stocks directly. Why so?

Let’s take for example one is bullish on a stock such as Fastly which is currently trading at US$10.21/share. Purchasing 100 shares of Fastly will entail a capital commitment of US$1,020. One can get the same 100 shares exposure to Fastly by purchasing 1 Call Option (equivalent to 100 shares) but at a fraction of the cost (approx outlay of $100, for example)

Assume one spends US$100 to purchase an Option with a contract expiration of 65 days. This is the max amount that one can lose in this scenario.

On the other hand, by purchasing physical shares, there is a risk of a significant “gap down” which results in more losses than what you might expect. You might have entered at US$10.2, placing a 10% “Stop Loss” level. This is the “maximum” amount of risk you are willing to take, which equates to US$100 in losses, or so you thought.

However, if the price gap down by 50% overnight, your max loss is now at US$500 vs. your original US$100 expectation.

On the other hand, by spending US$100 on the call option contract, you know with 100% certainty that this is the maximum amount of loss you will incur, even if the price of Fastly dips to ZERO.

At the end of the day, a good options strategy to deploy takes into consideration the investor’s goals as well as the overall market climate.

Additional Reading: 4 Option Trading Strategies for Beginners

Additional Reading: Cash Secured Put: Generating passive income the right way

Is Selling Option a superior strategy vs. Buying Option?

In my opinion, selling options is not always “superior” compared to option buying, as widely advertised by options trainer who claims that 90% of options trade expire worthless, so it does not make sense to purchase/buy options as you have only got a 10% probability rate of making some money out of it.

I believe that options buying and selling are both relevant options strategies. You just need to know your investment goal and the context in which you are executing these option strategies. Are you going directional? Do you have a lower risk appetite? Etc.

With that in mind, let’s take a look at some of the safest options strategies out there in the market.

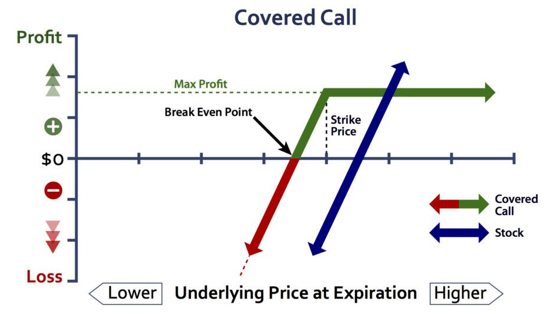

Safe Option Strategies #1: Covered Call

The covered call strategy is one of the safest options strategies that you can execute. In theory, this strategy requires an investor to purchase actual shares of a company (at least 100 shares) while concurrently selling a call option.

Take for example I am bullish on Philip Morris (PM) shares and I own 100 shares of the counter for US$70/share. My total outlay is US$7,000 on this counter.

I can look to reduce my total capital outlay on the counter by SELLING one call option on PM, thus generating an income to offset my total cost. Say, for example, I sell a 4-month call option on PM (expiring in 128 days), generating a premium of US$0.40/share or US$40/contract at a strike price of US$90/share.

On expiration, if the share price of PM remains at or below US$90/share, the call options expire worthless and I get to keep my full premium amount of US$40. I can look to repeat the same process by selling another call option on PM and continue to generate income from this strategy.

If the share price of PM is above US$90/share on expiration, I no longer am able to participate in any further upside of PM since the 100 shares I originally own will be called (or to put it simply sold) away at US$90/share.

In this scenario, my total gain is $90-$70=$20 plus 0.40 (option premium) = $20.40/share or an ROI of 29% over 4 months equivalent to an annualized ROI of c.87%. Pretty decent I would say.

If you are already comfortable owning 100 shares of a particular counter, the covered call strategy adds ZERO downside risk to your holdings. It will help to reduce your overall investment cost. The key “downside” is that you will not be able to partake in the upside if there is a strong rally in the shares.

For those who are interested, check out this video tutorial I did on the covered call strategy.

What type of shares is suitable for covered call strategies?

In my opinion, such a strategy is quite useful for dividend-paying stocks such as PM. I have written about why the covered call strategy is one of my favorite strategies when it comes to executing a high dividend-yielding stock such as PM in this article: Philip Morris: How to put its 6% yield on steroids.

One, since you own the physical shares of PM, you will be entitled to the dividends paid by the counter. In this case, a juicy 6% yield. This might be the preferred option compared to a Poor Man’s Covered Call (PMCC) where an investor structuring a PMCC will not be entitled to the dividends. More on that later.

Two, it is not particularly expensive to own 100 shares of PM since it is not exactly a “high-priced” counter. Hence, I am comfortable with forking out US$7,000 to purchase 100 shares of PM. This might not be possible for a “high-priced” dividend-paying stock such as Broadcom (AVGO) for example, a counter which is priced at US$375/share, thus owning 100 shares will entail a capital commitment of US$37,500 in this example.

[Update 2023] PM is now trading at $102/share and purchasing 100 shares of the counter will entail an outlay of $10,200

In general, if you have the intention of holding shares of a company long-term while continuing to earn dividend income, a covered call strategy might just be the ideal safe options strategy to turbo-charge your income potential.

You don’t need to execute the covered call strategy only on dividend-paying stocks. Some might also say that such a strategy turns a non-dividend-paying stock into one. Professional traders often use covered calls to improve the earnings from their investments.

Selling call options is also particularly “ideal” when volatility is high. Hence, an investor might wish to sell a call option on his long-term shareholdings when volatility is elevated. Ideally, you should sell a short date-to-expiration (DTE) call option, since time value decay is the fastest in the last 2-3 months of an option contract horizon.

Key Risks

- Not able to partake in further upside appreciation of the stock more than the Sell Call Strike

- Unlike stocks where you can control the number of shares you wish to purchase (ie, you can just go for 1 share if you like), purchasing/selling 1 Option Contract is equivalent to having exposure of 100 shares. To make the covered call strategy safe, you will need to own AT LEAST 100 shares of the underlying stock. This might be a significant commitment and you will still be substantially exposed to a substantial fall in the underlying share price.

Additional Reading: Covered Call Strategy for Income

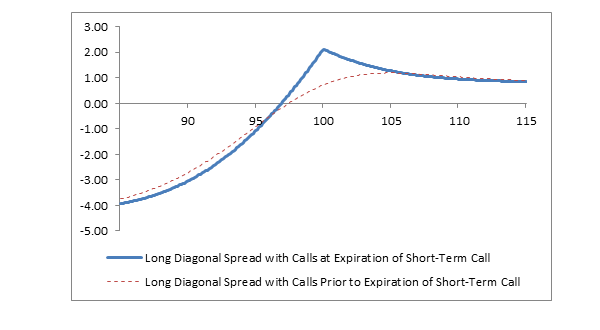

Safe Option Strategies #2: Buying Diagonal Spreads

A diagonal spread strategy involves the investor getting into a long and short option position on the same asset but with different expirations and different strike prices

So, for example, I PURCHASE a long-DTE call option on a stock such as META while simultaneously SELLING a short-DTE call option on the same stock META. Using some numbers as context, META is currently trading at US$178/share. I purchase an ATM option of META with a strike of US$180 which expires in 340 days’ time, paying a premium of $3,200 (time value)

Concurrently, I sell a call option with a strike of US$195 expiring in 35 days-time, generating a premium of US$380. My total outlay for this calendar spread is $3,200 – $380 = $2,820.

The primary idea behind this strategy is that as expiration dates get closer, time decay accelerates. So, in this example, since I SOLD the near-DTE option, I will want its value to get to ZERO ASAP. The accelerating time-value decay for the short-DTE option contract benefits me in this instance.

When the short-DTE option expires (in 35 days’ time) and the price of META remains below US$195/share, the contract which I sold becomes worthless and my profit is the full US$380 amount.

I will be left with an outstanding long-call option with approx. 305 days left to expire. I can then structure another diagonal spread by selling yet another short-DTE call option again (another 30 days) and generate another round of premium which will look to further reduce my cost.

The Poor Man’s Covered Call (PMCC) which I have written quite extensively in this article, is an example of a diagonal spread. One where you buy a long-DTE Deep In-the-money (ITM) call option and sell a short-DTE Out-of-the-money (OTM) call option.

What type of shares is suitable for buying diagonal spreads?

The PMCC is a cheaper alternative compared to the covered call strategy, the latter requiring the ownership of at least 100 shares in a counter.

For “high-priced” stocks, that might be costly. Instead, buying a Deep ITM call option achieves a similar effect of owning physical shares of the stock but yet at a much cheaper cost. For example, purchasing 100 shares of META might entail an outlay of US$17,800 in today’s context.

Structuring a PMCC might mean paying $5,500 (340 days DTE with 0.80 Delta) for the long leg of the option which is less than 30% of the capital requirement vs. actual stock ownership. This capital outlay can be further reduced by selling a short-DTE (35 days) call option with a strike of $195, generating a premium of $380.

Net Outlay = $5,500 – $380 = $5,120 vs.$17,800 (<30% cost capital of physical stock ownership)

Structuring a diagonal spread like the PMCC is useful for “high price” stocks vs. covered call structures. Since a PMCC structure is not entitled to any dividends (holding a long call option does not entitle you to dividends), there is no added incentive to owning the stock outright for a non-dividend-paying counter.

In this sense, a diagonal spread structure might be a cheaper alternative without “forgoing” the dividends in question because there is none to speak of.

Lastly, my personal stock preference for diagonal spreads is selecting stable counters without significant price fluctuation, ideally counters with a Beta less than 1.0. This will avoid the situation of pre-maturely selling, something which I will cover in the next segment.

Pre-mature exit – an in-depth example

If one is purchasing a diagonal spread structure as illustrated above (buying long-DTE Deep ITM call options and selling short-DTE OTM call options), the major “additional” risk, similar to the covered call scenario, is that of pre-maturely exiting the trade and thus not able to enjoy the full upside potential in the event the stock witnessed a strong short-term bump in price.

In our META example, we bought a long-DTE call option at a strike of $140 (pay $5,500 where $3,700 is intrinsic value and $1,800 is time value) while simultaneously selling a short-DTE call option at a strike of $195 (receive $380). The key risk is that META price appreciates beyond $195/share over the next 1-month. Assume that META share price closes at $200/share on the short-call expiration, as the seller, we will be obligated to sell at $195/share, thus making a loss of $5/share or $500 on this sell contract.

However, this will be more than compensated by the long call option contract which was purchased with a strike of $140, hence there will be at least $60/share in intrinsic value ($200-$140) and since there is still plenty of time left, we assume that the time value dropped from the original $18 to $10/share. So potentially your long call will be worth $60 in intrinsic value and $10 in time value for a total value of $70.

Your net profit will be ($70-$5-$55+$3.80=$13.80). Still a decent ROI of ($13.80/$55 = ~25%) over a short duration (30+ days) but now you will not be able to partake in further upside in the price of META (unless you roll the short leg, which will be an article for another day).

Key risks associated with buying diagonal spreads

- So again, the only “additional” risk associated with purchasing a diagonal spread is that your trade might be pre-maturely “closed”, without you being able to partake in the further upside.

- Similar to the covered call strategy, you will still be making losses if the price of META drops substantially. However, the maximum loss is capped at the net premium which you pay for the diagonal spread. This is significantly lower compared to owning 100 shares of the underlying shares which might head to ZERO, no matter how unlikely that scenario might be.

In our example, if META goes to zero (yes, I know it’s highly unlikely), the max amount of losses we will incur is ~$5,200 through the diagonal spread strategy vs. $27,500 if we own 100 shares of the stock.

- The additional risk associated with BUYING diagonal spreads is generally “low”. The inverse is SELLING diagonal spreads which entail a strategy of selling a long-DTE option at a lower strike and buying a short-DTE option at a higher strike.

Additional Reading: What exactly is a Poor Man’s Covered Call?

Additional Reading: The Wheel Strategy Options: Does this option strategy makes sense?

Video Tutorial on Poor Man’s Covered Call: How to buy Stocks at a 50% Discount

Safe Option Strategies #3: Buying/Selling Verticals

![3 Safe Option Strategies Better Than Stock Buying [2023 Update] 1](https://newacademyoffinance.com/wp-content/uploads/2020/12/Safe-option-strategies-call-debit-spread.png)

![3 Safe Option Strategies Better Than Stock Buying [2023 Update] 2](https://newacademyoffinance.com/wp-content/uploads/2020/12/Safe-option-strategies-put-credit-spread.png)

A vertical options trade consists of 2 legs, similar to the diagonal spread. You go long an option and short an option with different strikes. However, the expiration period is the same. That is the key difference between a vertical as well as a diagonal spread.

Types of verticals – Debit vs. Credit

A vertical can be a debit strategy (one in which you pay a premium) or a credit strategy (one in which you receive a premium). A call debit spread (or a bull call spread) is one in which you pay for the spread. How this is structured is generally purchasing a long call with a strike price that is lower than the strike price of the call you sold.

So, again using META as an example, you can structure a call debit spread by purchasing a call option with a strike at $180 with a DTE of 160 days, paying $2,100, and selling a call option with a strike of $220 with the SAME DTE of 160 days, receiving $800 in premium.

Your total net outlay will be $2,100 – $800 = $1,300 (max risk)

Your max profit = $2,700

Depending on how one structures the vertical, the risk: reward potential will be substantially different.

However, again, you have defined maximum risk. In this example, it is $1,300, substantially lower than purchasing a single-leg call option where the premium outlay is $2,100.

What is the difference between buying and selling a vertical?

When we buy a vertical, we pay a premium while selling a vertical will result in us receiving a premium. Both buying and selling will see our RISK as well as PROFIT potential being defined.

If that is the case, why should anyone be wishing to pay for a vertical (debit strategy) instead of selling a vertical (credit strategy) when the latter strategy results in generating cash straight into our pocket?

The key reason is because of the difference in risk: reward potential.

When you BUY a vertical, your IDEAL structure will be one where your reward potential is MORE than your risk level in most circumstances. How much more? That will be a topic for another day.

When you SELL a vertical, typically you will be selling a short-DTE vertical where both legs are OTM to benefit from the effect of accelerating time value decay. In this case, your risk: reward potential will be substantially lower than 1, ie you risk $1 to make $0.30 for example.

Why will anyone do that? That is because the probability of you making the $0.30 is much higher than the probability of you losing that $1.

Again, this is something that proponents of option selling will highlight time and again (a much higher probability to WIN even though the profit potential is much lower than the at-risk amount).

Verticals vs. 1 Leg Option

So why is buying/selling verticals a “safer” strategy compared to just executing a 1 leg option?

First, when you buy a vertical, you reduce your capital outlay vs. simply buying a call/put option. This is also your max loss. With a lower capital outlay (most of the time roughly 30-40% lower vs. 1 leg option), you thus reduce your break-even level and correspondingly increase your Probability of Profit.

Second, the key risk associated with selling a 1 leg (or naked) option is that your losses can be very substantial. When you structure a vertical, you are essentially like an “insurance company buying reinsurance”. That is an analogy that I often use.

For example, when you sell a put option at a strike of $50, you are essentially insuring the buyer of the put option of any downside risk associated with the stock below the price of $50. If the price of the stock collapse to $0, your losses as the insurance company will be massive.

On the other hand, if you purchase reinsurance by using part of the premium that you received from selling the put option at a strike of $50 and now BUY a put option at a lower strike of $45, your losses will be “capped” at $5/share (exclude net premium received) in this example.

The proper structure of a vertical makes it a safe option strategy

Whether you are buying or selling a vertical, your profit and losses are defined. You know right from the start your max potential profit and loss.

Knowing that fact makes the vertical strategy a safe options strategy suitable for a beginner options trader to execute.

While I am not overly concerned about the risk associated with buying verticals, a well-defined strategy is needed when it comes to selling verticals. This is because of its lower reward-to-risk ratio. While one might argue that it has a higher probability of profit vs. buying, a couple of really bad trades could substantially affect your trading account.

Key risks associated with trading verticals

- Potential “over-leveraging” because capital outlay is much smaller than buying 1 leg option or purchasing stocks

- Significantly higher probability of losing your entire capital outlay

Safe Option Strategies for Beginners

The above 3 options strategies, if done in a proper manner, are potentially safe option strategies that a new option trader can look to execute.

The covered call strategy is an ideal method to put your dividend-generating stocks on steroids. However, do note that one will need at least 100 shares of the underlying stock to execute a covered call strategy.

Buying diagonal spreads is a cheaper alternative vs. a covered call. This can be executed on “high price” stocks, non-dividend or low-dividend paying stocks with a beta less than 1.0

Last but not least, verticals are safe option strategies that are not overly complicated, with the trader knowing from the onset his/her max risk and profit potential. When it comes to selling verticals, one should engage a proper trade mechanism to increase your long-term chances of success when it comes to deploying such a strategy to generate a consistent and steady flow of income every month.

2 thoughts on “3 Safe Option Strategies Better Than Stock Buying [2023 Update]”

Hi Sir,

I am from India and trying to learn option strategy for (Nifty and Banknifty). In fact I have lost almost my all savings and currently under debt and U still try to find out the way how can I earn and get back on track.

Can you suggest any strategy so I can learn and earn.

Hi Amit,

In Share Market 95% people will fail and 5 % people will win only, Imagine how you have to take risk and learning style