Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

Investor Education Series: Poor Man’s Covered Call [2023 update]

Some of you might have heard of the term “covered call”, an options strategy that aims to generate a steady stream of income every month. However, do you know of its alternative, the “Poor Man’s Covered Call” strategy which is targeted at investors who “are poor”, or who does not wish to commit a large amount of capital?

The poor man’s covered call strategy is a relatively “low-risk” option strategy that allows one to enjoy the benefit of leverage while potentially generating a steady stream of “passive income” if done appropriately.

Before I go into the details of what a poor man’s covered call strategy is all about, let me briefly run through the basics of a “covered call” option strategy.

The Covered Call Strategy

The covered call strategy combines the purchase of shares as well as the usage of options. To trade a covered call on a particular stock, an investor would need to purchase at least 100 shares of the stock.

Let’s take for example the shares of Facebook (META), currently trading at $150/share. Owning 100 shares of META will entail a capital outlay of $150 * 100 shares = $15,000. That is a pretty hefty amount for a typical investor.

Assuming that an investor has at least 100 shares of META, he can then execute the covered call strategy to SELL 1 CALL option contract on META at a particular STRIKE price (note that each option contract represents 100 shares of the underlying, that is why the investor will need to own at least 100 physical shares).

So what does selling the 1 Call option contract mean to the investor? By being a SELLER of the call option contract, the investor is entitled to a premium of $x. This is money that goes straight into his pocket. However, after receiving this premium, the investor now has got an OBLIGATION to potentially fulfill. What is this obligation exactly?

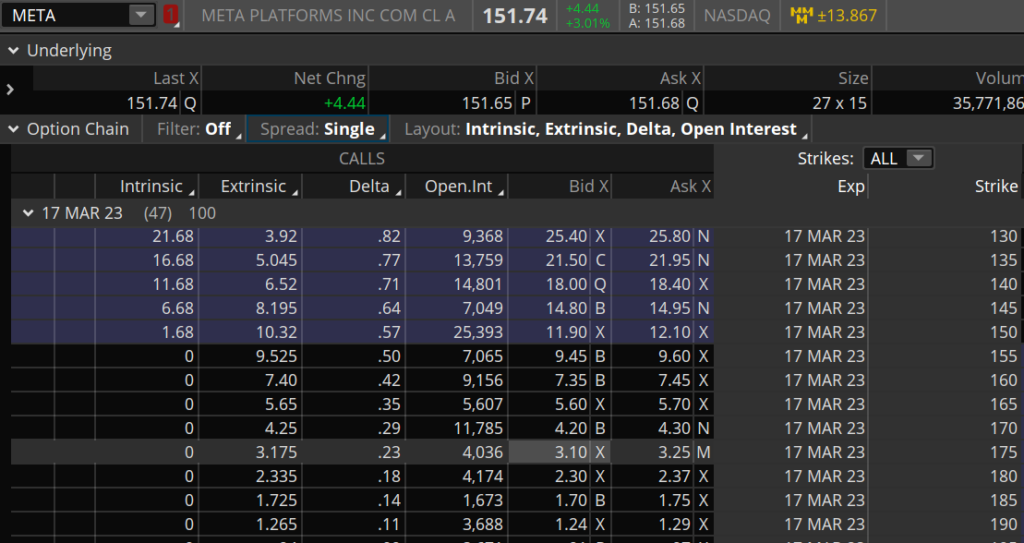

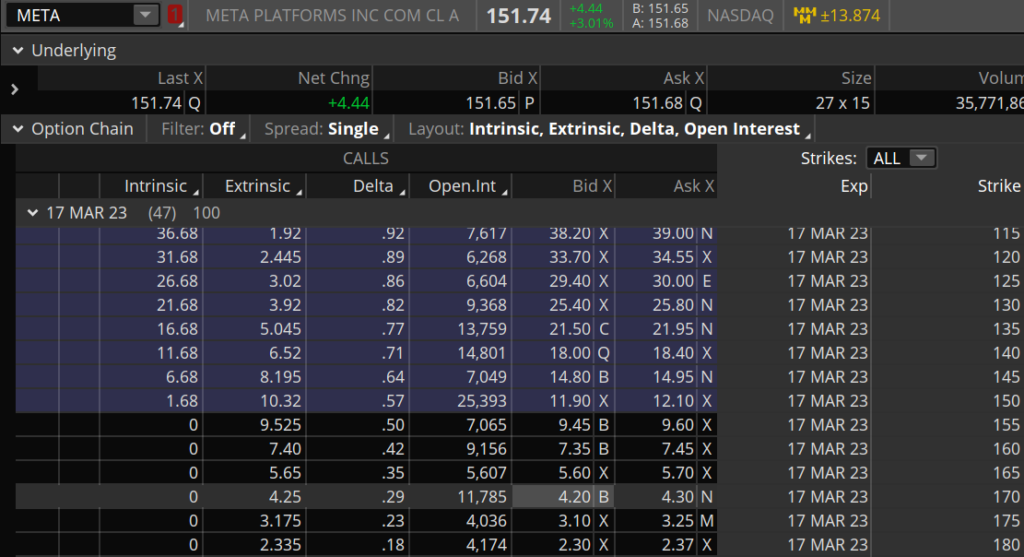

Assuming that the current price of META is $150. He bought $100 shares for a total cost of $15,000 and SOLD 1 Call Options contract at a STRIKE price of $175 for a contract with an expiration on 17th Mar 2023 (47 days). He received a premium of $3.10/share or $310/contract. He has essentially executed a covered call strategy.

Covered Call = Long Shares of underlying (at least 100 shares) + Sell Short Duration Call Option (usually at a higher strike level vs. cost of underlying shares)

Now, if the share price of META remains below $175/share when the contract expires on 17th Mar, this call option contract which the investor sells (at a strike level of $175) will become “worthless”. He continues to own 100 shares of META and his cost price has effectively been reduced from $150/share to ($150-$3.10) $146.90/share.

He can then repeat the “covered call” selling process and sell another options contract over the next month with expiration in April 2023 and generate another round of premium which will go towards further reducing his cost price.

This is where the passive income potential comes in. Done properly, the investor can consistently generate income by selling covered calls consistently every month.

However, if META price exceeds $175/share when the option contract expires on 17th Mar, that is where his “obligation” sets in. He is now obligated to sell 100 META shares at the price of $175/share.

Since he already owns 100 shares of META at a new cost of $146.90/share (plus the premium received from selling the call option), his total profit from this trade will be $175-$146.90 = $28.10/share or $2,810 in total. This is a total return on capital of c.19% over one month. Not too shabby.

Risks associated with the Covered Call Strategy

There are 2 main risks that investors/traders should be aware of when using the Covered Call strategy.

First, this is not a hedging strategy. While one collects a premium upfront from the sale of the call option, this does not fully protect the investor against a significant decline in the price of META, using the above example.

Second, there is an “opportunity cost” risk. In the event that META’s price appreciates significantly above $175 by 17th Mar, the investor might not be able to partake in the counter’s strong price appreciation, since his/her profit is now “capped” at $175/share.

Hence, the most ideal scenario for an investor executing the covered call strategy is for a gradual price appreciation in META (to slightly below $175) on the call option contract expiration (17th Mar). This will allow the call option to expire worthless, allowing the option seller to realize max profit, and more importantly, to sell a 2nd round of call options to generate even more income.

However, what if one doesn’t have $15,000 of capital to own 100 shares of META in the first place? Can one still get to execute this income strategy while continuing to ride the price of META higher?

This is where the poor man’s covered call strategy comes into play.

Poor man’s covered call strategy

The key differentiating point between the poor man’s covered call strategy vs. the traditional covered call strategy is that the former does not entail the purchase of (at least) 100 shares of the stock.

The poor man’s covered call strategy involves the PURCHASE of 1 call option and the SALE of 1 call option. This strategy is similar to an option Vertical/spread. However, the difference is that both options have different EXPIRATION dates.

Poor Man’s Covered Call = Buy 1 Long Duration Call Option + Sell 1 Short Duration Call Option

Let us see how should one structure a standard Poor Man’s Covered Call.

First, the BUY leg of the call option will generally entail the purchase of a LONG DURATION Deep-ITM option, one which typically has a Delta of at least 0.80 or higher. An option that has a delta of 1.0 essentially replicates the price movement of the underlying exactly, ie: if META price moves from $275 to $280 or a $5 movement, the price of the option will also move by $5.

If the option has a delta of 0.80, that means a $5 underlying META price movement will translate to an option price movement of 0.80*$5 = $4.

What we want to purchase is an option that essentially “mimics” the price movement of the underlying shares. So instead of owning the shares outright, we can essentially own a long-duration call option contract at a fraction of the cost of 100 shares of the underlying.

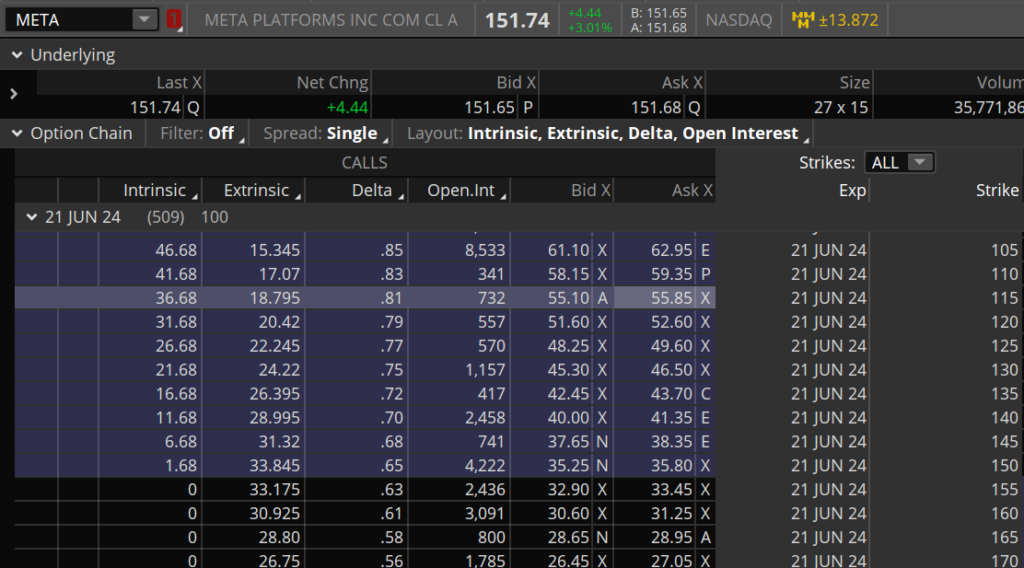

Take the above META option chain with a contract expiry of 509 days. The strike price of 115 has a delta of 0.81 (considered deep-ITM) and that particular option cost approx. $55.85/share or $5,585/contract to own. Compare to owning 100 shares of META at a total cost of c.$15,000, that is almost a 62% cost reduction while yet still essentially “owning” 100 shares of META.

For this particular option which has a delta of 0.81, if META price moves from $150 to $155 or a $5 movement (ROI of 3.3% if one purchases the stock), the option price will move by approx. 0.81 * $5 = $4.05 from $55.85 to $59.90 or a return on capital of 7.2%.

Second, the buy leg of the option, besides being deep ITM, typically also entails one that has a long expiration. In the above example, the expiration period is 509 days which is considered relatively long. META has long-dated options available until Jun 2025.

Third, for the SELL leg of the call option, it typically consists of a “short-dated” contract (47 days, etc in this example). The reason why the sell leg of the call option is one that has a short Day-to-Expiration (DTE) is to take advantage of Theta or Time Value Decay.

Theta decays happen the fastest in the last month (left with 30 days) of the option contract, that is why as the Seller of the contract, one will benefit the most from the rapid theta decay of the option contract since the investor has already “pocketed” the premium and will want this number to hit ZERO as fast as possible (Sell high and buy back low or ideally at zero).

Fourth, the SELL Leg of the call option typically consists of one that is Out-of-the-money (OTM), ie, the strike price is above the current underlying META’s share price of $150. In our example, we selected to sell the call option at the strike price of $175.

For the BUY leg, one can select a strike price with a Delta value of at least 0.80 or higher (Deep ITM) as a rough guide. This figure balances one’s capital outlay vs. replicating the underlying price performance.

For the SELL leg, which is the right strike price to sell?

There is honestly no “right” strike price. If one has a targeted “fair value” for META in mind, that might be the level at which the investor can structure the Sell Leg. For example, if an investor believes that $175 is the fair value of FB, then he/she can structure a Sell leg with a strike price of $175.

In our example above, selling an option with a strike of $175 generates a premium of $310/contract with a contract duration of 47 days. Do note that the investor risk not participating on the upside of META above the $175 level.

Alternatively, one can also look at the chart and base the Sell strike on the resistant level of the stock.

For META, the resistance is also coincidentally at the $175 level, hence, an investor who wishes to base the Sell strike using technical factors might also look to sell the option with a strike price of $175.

I usually structure the Sell Strike based on a Delta of 0.30. This also corresponds to a 1 Standard Deviation (SD) level.

Again, for META, with a contract expiration of 47 days, the call option with a delta closest to 0.30 corresponds to a Strike price of $170, slightly lower vs. basing it on technicals.

META Poor Man’s Covered Call

So assuming if I wish to structure a poor man’s call option for META, I could purchase the Strike 115 Call Option that expires in 509 days-time, costing me $5,585 while concurrently selling the Strike 175 Call Option that expires in 47 days-time, generating me an income of $310.

If META price stays below $175 on the expiration date in 47 days-time, my call option which I sold expires worthless and I get to pocket the full amount of $310. In this case, my “yield on cost” is 310/5,585 = 5.5% over 1 month. I can then repeat the same process of selling another call option contract for the next month and pocket another round of premium.

Compared to the traditional covered call strategy which entails a capital of $15,500, the ROI potential using the Poor Man’s Covered Call strategy will be much higher (Covered Call: Annual ROI = 24%, Poor Man’s Covered Call: Annual ROI = 66%)

What happens if META price is above the Sell Call strike on expiration?

Recall that for the covered call strategy, if the price of the counter appreciates beyond the SELL strike, as the seller of the call option, the investor will be obligated to sell his 100 shares of META at the Sell Strike price (ie, $175 in this example). Since he already owns 100 shares of META, his net exposure will be ZERO remaining META shares but a total profit of $2,800+.

For the Poor Man’s Covered Call, because the investor does not “directly” own 100 shares of META but has an indirect exposure through the 1-long DTE (509 days) Call option contract, if the price of META exceeds the Sell Strike of $175 on the short call expiration (47 days), he/she will be forced to “sell short” the shares of META at a strike of $175.

This means that his final exposure will be: +1 Long Call META contract and -100 META shares

In this scenario, it will be appropriate for him to close off both his long META call option and negative shares together and book his profit.

Assuming META price closes at $190 on 17th Mar. His “Short Stock” position will incur a loss of ($190-$175)*100 = -$1,500 (losses)

His Long Call Options contract, which he originally purchased at $5,585 (strike $115) will now be worth around $8,500 (Intrinsic value of $7,500 (($190-$115)*100 shares) + time value of $1,000) which he can sell in the open market.

His profit from his Call option is $8,500 – $5,585 = $2,915

So his total net profit = $2,915 (long call option) – $1,500 (short stock) + $310 (premium from selling the call option) = $1,725

On an initial capital of $5,585, that represents an ROI of 31% over a horizon of just 47 days. On an annualized basis, that is an ROI of 240%.

Conclusion

The covered call strategy is a low-risk option strategy to generate income consistently. This strategy involves buying (at least) 100 shares of a stock and selling a short DTE call option contract on the underlying.

The poor man’s covered call strategy is similar. However, instead of owning 100 shares of the stock, one will just purchase a deep ITM option (delta at least 0.80) which has a substantially lower cost (60-70% lower) vs. buying the shares directly. Similarly, one will sell a short DTE call option contract.

Personally, when structuring the Sell Leg of the call option, I will tend to choose a strike with a delta of 0.30 which corresponds to approx. 1 SD. However, there is no single “right” strike to sell the call option at.

Not all stocks should be executed with a poor man’s covered call strategy or at least my preferred choice in choosing the type of stocks are those that are generally more stable (beta at 1 or below) or less volatile. This lowers the likelihood of the price spiking above the Sell Call strike which will allow me to continuously sell call options in the forward months.

Note that if the price appreciates significantly above the sell call strike, one might no longer be able to participate in further upside in the underlying counter.

For high-dividend stocks, do note the following. As a Call Option Holder, you are NOT a shareholder of the company and will not be entitled to any dividends declared. When a dividend goes ex-dividend, it will “typically” benefit the Sell Leg of the Call (although this is generally already priced into the option value).

Do check out this strategy if you are considering purchasing at least 100 shares of a counter in the first place.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

15 thoughts on “What exactly is a Poor Man’s Covered Call? [2023 update]”

Tks for the great write-up. Makes more sense than doing the usual Covered Calls

Also, it is much better and less “commission heavy” compared to doing OTM 30-45 days vertical spreads with target ROI’s of 10% in 1 month

I tried this strategy for the first time on LMND yday. My trade details are:

Sold $125 Call 22/1/21 at $4.86

Bot $65 Call 21/1/22 at $48.51.

Expected ROI 11.1% in 1 month

The main challenge I face is on the Long Call OTM leg with DTE > 1 year and delta 0.80.

These options are illiquid, wide bid/ask, and expensive. Will nearer DTE Options eg 6 mths and closer strikes with delta 0.80 work better?

Hi Milan,

Thanks for dropping by…. Your Long Call is Deep ITM, not OTM. Yes, i think the strategy also works if you shift your delta closer to the strike price. However, I will still stick with a DTE of at least 1 year.

Hey RT,

Are you using any Screeners to help shortlist potential set-ups?

If yes, what are the criterias you use?

Hi Milan,

Not for pmcc structure. I usually do this structure for more stable stocks with beta less than 1. Other than that there is no unique screening criteria specially used for this strategy

Hello, Royston. How does this work on Tiger Brokers? I sold a call option that just expired ITM, but did not have this option converted into -1 lot. Instead, this option is still lingering on my interface. Anyone facing this issue?

Cheers.

Hmm, you got to check with Tiger on this matter. Has it been resolved?

Called them up, they will look into it. May be teething issues on the platform.

what broker do you recommend to perform this strategy on?

Hi Mourad,

Sorry for the late reply. I usually use TD Ameritrade for options

Hi,

I have a question on the PMCC. Does one have to buy the Long DTE and the short DTE separately or simultaneously to do the PMCC.

Or should one buy it separately so that you can continue selling the short DTE month over month for income.

Thanks in advance.

Hi RDL,

Sorry for the late reply. No you do not need to execute them both at the same time… You should be buying the Long DTE option first and then structuring the short DTE (potentially after the long DTE option has appreciated in value)

Understood. Thanks.

Thanks for sharing your PMCC method, just checking

“So his total net profit = $2,550 (long call option) – $500 (short stock) + $740 (premium from selling the call option) = $2,790”

For the -$500 short stock portion, do you mean you just close off the Sell Call option that is in the money now?

Btw, aside to the above, Are you able to do poor man covered call on tiger’s broker?

Thanks!

Hi Jeremy,

thanks for dropping by. Unlikely you can do PMCC for tiger brokers based on my understanding. They view the long call and short call separately and that might mean additional margin amount. Yes the -500 is from the losses due to the sell call which is ITM and hence losing money