Passive Income with crypto

In Part 1 of this 2-parts series article, I detailed how one can look to generate some passive income from your crypto assets through the process of 1) Staking and 2) Yield farming.

In this article, I will be detailing the process of how you can lend out your crypto assets, and in the process generate passive income, through crypto lending platforms.

I will wrap up the article with a few of my personal “strategies” for generating passive income. This is, however, by no means a recommendation that you should engage the same approach as my risk profile could be vastly different from you.

It is recommended that you take “baby steps” and try out 1 to 2 “safer” options (mainly staking through CEX) of earning passive income with crypto to get yourself acquainted with the process and only when you are truly comfortable with the “ins and out” should you proceed to explore the “riskier” avenues.

Passive Income with Crypto#3: Lending Platforms

Instead of the normal crypto staking process which is executed on the CEX itself, one can also look to lend out your cryptocurrencies in crypto lending platforms that are specialized in this P2P process. The main differentiating point of these lending platforms vs. a typical CEX platform is that the former’s key selling proposition is typically in the arena of crypto lending.

If you are a business owner (borrower) in need of funding and have crypto assets on hand, you can collateralize them on a lending platform like Nexo to get access to fiat/stablecoin funding. In this case, your private key (and thus ownership) now resides with Nexo (custodial lending platform)

If you are a crypto owner and wish to lend out your crypto (lender) to generate higher interest, you are essentially lending out your crypto assets to these borrowers. If these borrowers’ projects fail and they are unable to repay their loan, their collateralized crypto assets will be used to repay you as the lender.

If, however, the collateralized crypto significantly declined in value as a result of a price decline, then the collateralized amount might be insufficient to pay you back your crypto lending plus interest.

The risks of capital loss are higher on these lending platforms vs. the typical CEX.

How good are these returns? Much higher than leaving it in a bank at a measly 0.04%. The interest earned on most of these earnings platforms is also paid out quite frequently (e.g. Weekly) and you earn interest on interest. Furthermore, if the value of the cryptocurrency goes up, so does your interest amount!

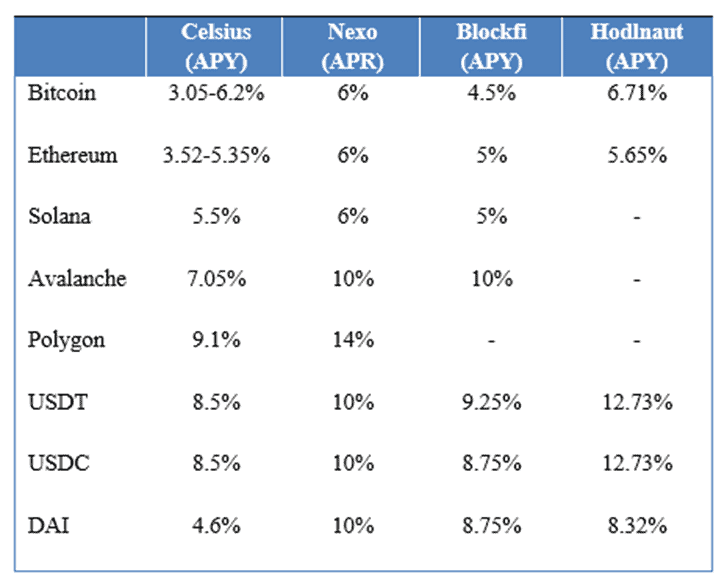

Here is a list of some lending platforms offering some of the higher APRs and APYs for various popular cryptocurrencies:

The platforms in the list above are not extensive, but some popular sites you can use Celsius or Hodlnaut (Singapore-based).

Here’s how you can do it:

Celsius

- Sign up for an account on Celsius on either their website celsius.network, or mobile application.

- On the Celsius application, select the token you wish to earn interest on, and select “Receive”. A wallet address would appear:

- If you have your tokens stored on an exchange, withdraw them into the wallet address shown on your app. (Depending on what exchange you use, you may get charged a withdrawal fee).

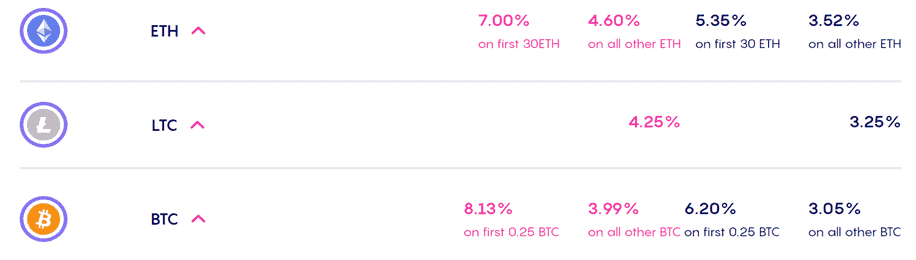

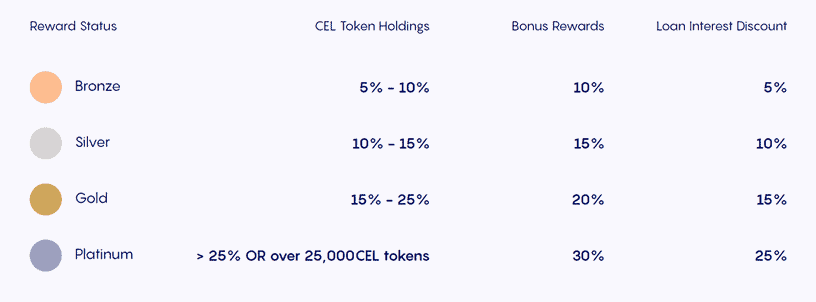

- Once your cryptos arrive, you automatically start earning interest without a lockup period. Some things to note: For BTC and ETH, the rate changes depending on how many tokens you have, here’s what I mean:

The rates you see above in pink with higher rates are if you opt for in-kind rewards, meaning the interest is paid out in their native CEL token. You can earn bonus rewards depending on your CEL token holdings as shown:

Pros

- No lockup period, meaning you can withdraw your cryptocurrencies anytime.

- Interest is paid out weekly every Monday.

- Compound interest.

- On-site crypto swap.

- No deposit/withdrawal fees.

Cons

- Not advisable to buy cryptos within Celsius itself due to high fees.

- Does not have an exchange (i.e. You have to transfer cryptos from an external exchange to Celsius).

- Not much flexibility in payout currency.

Hodlnaut (SG-Based)

- Sign up for an account on Hodlnaut on either their website hodlnaut.com, or mobile application.

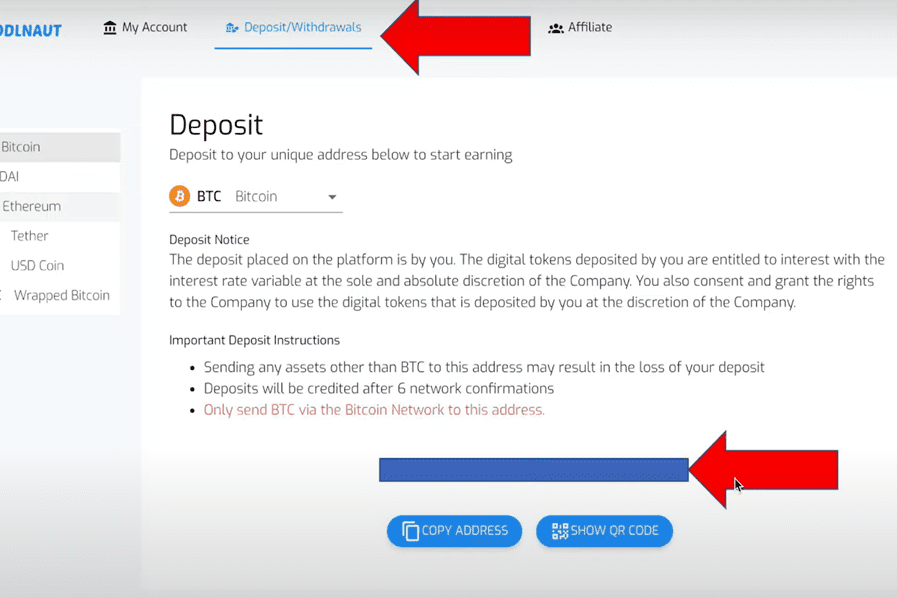

- Head over to “Deposits/Withdrawals” and select which token you wish to deposit. A wallet address will then be generated below:

- If you have your tokens stored on an exchange, withdraw them into the wallet address shown on your app. (Depending on what exchange you use, you may get charged a withdrawal fee).

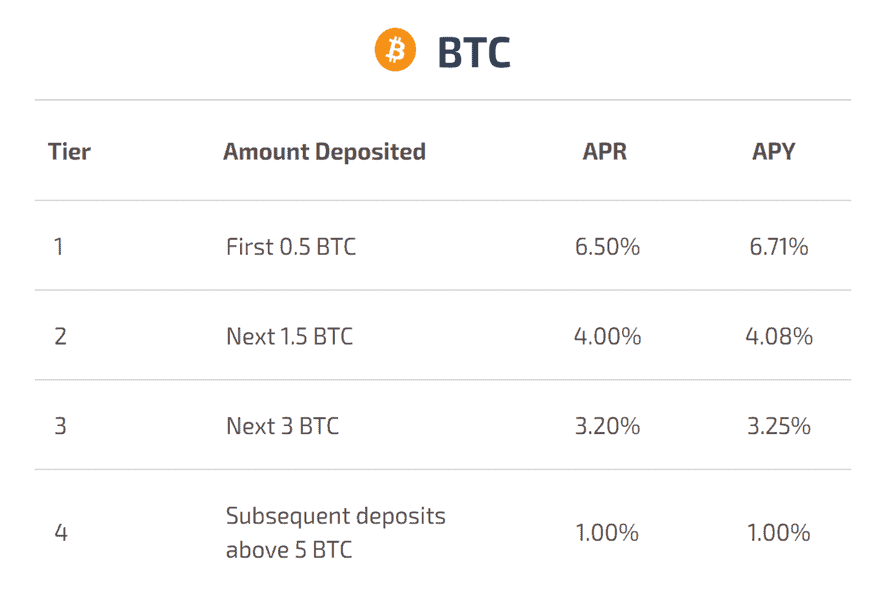

- Once your cryptos arrive, you automatically start earning interest without a lockup period. Some things to note: Depending on how many tokens you have, your interest rate will vary, similar to Celsius:

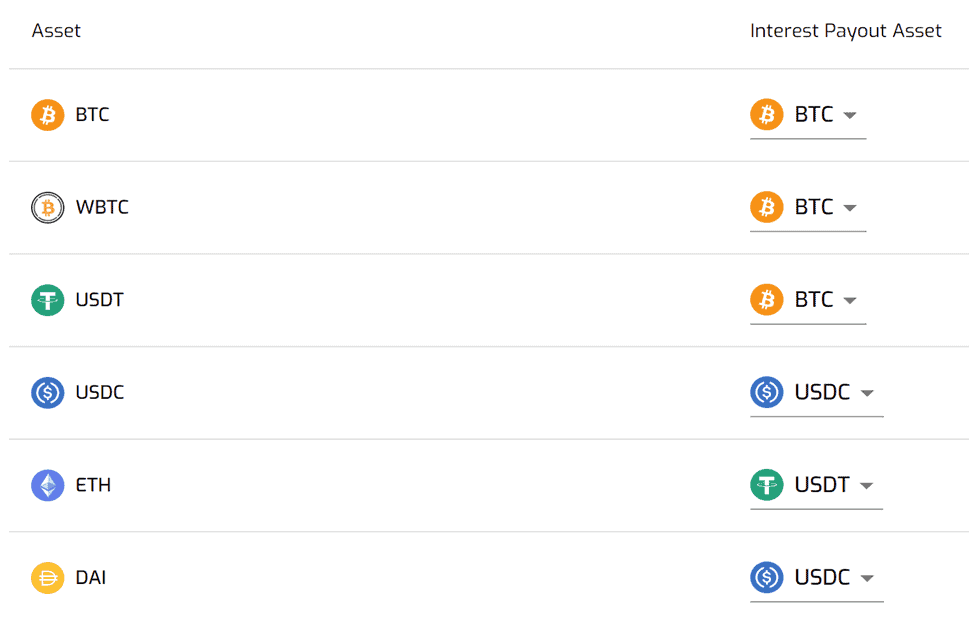

Hodlnaut also has a special feature allowing you to set your payout preference, giving you the flexibility to receive your interest payment in your preferred currency:

Pros

- No lockup period.

- Interest is paid out weekly every Monday

- Compound interest.

- No deposit fees.

- Flexibility in payout currency.

Cons

- Withdrawal fees are charged.

- A limited number of tokens compared to other platforms.

- Does not have an exchange.

Where am I generating my passive income from?

I am currently generating my passive income from 3 avenues and I will be briefly detailing them in this segment. Once again, do note that this is not a recommendation and despite how “safe” it might look on the surface, do note that we are still detailing with cryptocurrencies at the end of the day, an asset class that has a relatively short history.

Many of the platforms associated with cryptocurrencies cannot be considered stable and there is the possibility that these platforms might “go under”, potentially resulting in a total capital loss. Hence, do only explore with capital that you can afford to lose.

1.Generating 19% APY on UST stablecoin

This method is pretty well-known. Isn’t it awesome that your stablecoin (in this case UST), which is theoretically “pegged” to the USD currency (1UST = 1USD), can generate you a return of 19%/annum (assuming you held on for 1 year) vs. your typical bank yield of <1%?

Seems like a dream come through to park your excess USD currency into this platform to generate that mind-boggling 19% yield, supposedly without any risk of capital loss?

One can do that through the Anchor Protocol platform which allows you to generate that high annual interest on the UST stablecoin.

There are questions about how stable this platform might be and whether that return is sustainable. Nonetheless, this is still a relatively “low-risk” platform for me to generate passive income with crypto, particularly on my excess UST that I own.

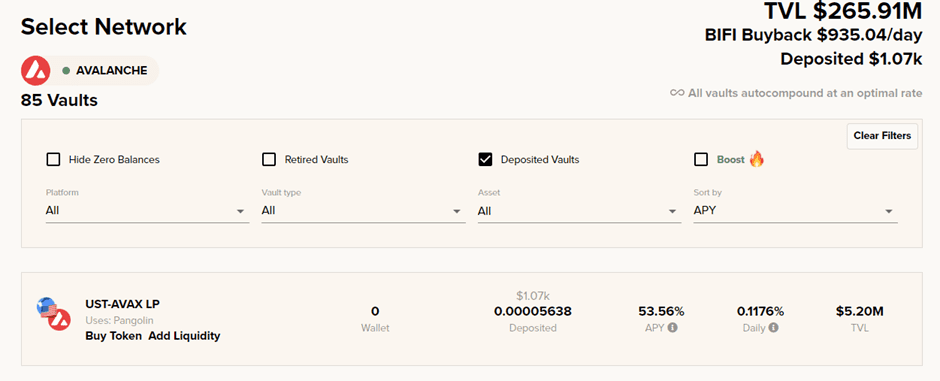

2.Generating 53% APY on UST-AVAX LP farm through Beefy Finance

I am generally bullish on the Avalanche coin (AVAX) and do like to own some for long-term capital appreciation potential.

While waiting for this coin to “moon” I will like to generate some interest in it as well and that is where I am combining the AVAX coin with UST (the stablecoin I highlighted earlier) into an LP token (read part 1 on yield farming) to generate interest of approx. 53% APY (this figure is not fixed and fluctuates).

I do this through the Beefy Finance platform, a decentralized multi-chain yield optimizer platform that allows users to earn compound interest automatically. A key difference between using a Defi platform to yield farm vs. Beefy Finance is that the latter allows the convenience of AUTOMATICALLY compounding your returns without the need to MANUALLY CLAIM your returns necessary on most Defi platforms.

Once you have farmed your LP token through Beefy Finance, there is no need to go in every other day to “claim” your rewards as it is automatically compounded for you. In my next example, I will show you the manual process using Raydium/Solana LP tokens.

3.Generating 40% APY on RAY-SOL LP farm through Raydium platform

I have previously written about Solana on its potential to be the next “ETH Killer” because of its high speed of execution as well as the extremely low cost associated with using its platform.

I do like the SOL coin and will like to similarly find a way to generate some passive income while holding on to this cryptocurrency. This can be done through the Raydium Defi platform which runs on the Solana network.

For me to generate passive income on my SOL holdings through yield farming, I will need to hold an equivalent amount in RAY tokens. This can be done by converting 50% of your SOL coins into RAY tokens through the Raydium platform. However, this will also mean that you are now having exposure to RAY as well, not just in SOL.

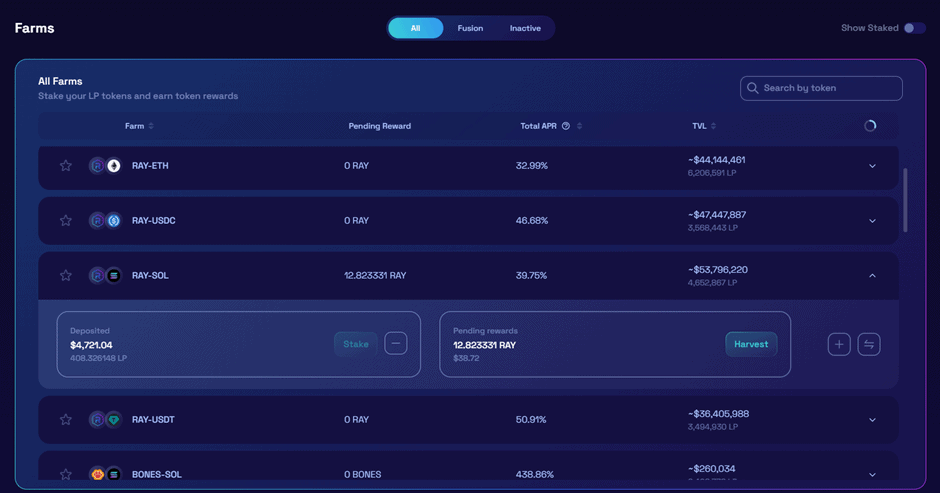

One can then execute the yield farm process as detailed in Part 1. Your interest generated will be in the form of additional RAY tokens and this is accrued almost by the minute.

As seen in the picture above, I have accrued approx. 13 RAY tokens worth $40 over a week of farming $4.7k worth of RAY/SOL LP tokens.

Unlike the Beefy Finance platform where compounding is automated, this process needs to be manually done here. I will need to click on the “harvest” button where my RAY tokens will be harvested and sent to my metamask wallet immediately. These tokens are not being reinvested automatically unlike through Beefy Finance and to reinvest my c.$40 worth of RAY tokens, I will need to have an equivalent amount of c.$40 worth of SOL tokens and repeat the yield farming process.

Conclusion

As can be seen, there are multiple ways to generate passive income on your cryptocurrencies. The simplest method is simply to purchase your cryptos on a CEX and stake them on the platform itself. There is typically no lock-up period required and you can unstake your cryptos anytime when you decide to sell them. The returns, while higher than what your fiat banks are offering, typically aren’t very high for blue-chip COINS.

A more advanced level would be to engage in liquidity pools and yield farming on COINS/TOKENS where the APY generated can be in the 3-digit arena (aka > 100%).

For those looking to generate higher returns for your blue-chip COINS such as bitcoin and Ethereum and willing to take on a higher risk level, you can explore crypto lending platforms such as Hodlnaut (for SG local) or Nexo where the returns generated for you will be a lot higher than staking them on CEX.

You, however, would have to bear the risk of potential capital loss if the collateralized crypto asset is insufficient to repay your crypto amount due to a mismatch in the platforms’ collateralized reserves and the loans made out to lenders like yourself.

For example, their collateralized assets might consist of a lot of BTC. They receive a lot of ETH from lenders. BTC declined significantly vs. ETH which results in the collateralized BTC amount being insufficient to repay the ETH amount which they borrowed from the lenders. This could mean capital losses for the lenders.

For those looking at these lending platforms, I also use Hodlnaut for my Bitcoin and Ethereum holdings as the APY is among the highest compared to other platforms, and for Bitcoin, you can get the highest 6.71% for up to 0.5 BTC compared to Celsius where the rates drop after 0.25 BTC. Hodlnaut also has an added special option of receiving interest payments in other currencies.

However, Hodlnaut charges withdrawal fees on all cryptocurrencies options. I would recommend you use Hodlnaut if you intend to earn interest long-term with no intention of selling them soon. If your holdings consist of altcoins such as Solana, Avalanche, etc., Celsius is a good option as they support a wider range of cryptocurrencies and you can still get pretty good APYs there.

Once again, I do hope that you enjoyed the 3 key methods to generate passive income with crypto detailed in this 2-part series. This is not financial advice and please do the necessary due diligence when it comes to investing in a high-risk asset category like bitcoin.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Is Solana going to be the “Ethereum killer”

- Beginners Guide to crypto currency. How to get started

- GBTC ETF: How you can buy Bitcoin at a discount

- What are NFTs and my NBA Topshot experience

- Why you should invest in Coinbase stock and how to get a free Disney shares while doing it

- Bitcoin prediction: 5 reasons why its rise this time might be sustainable