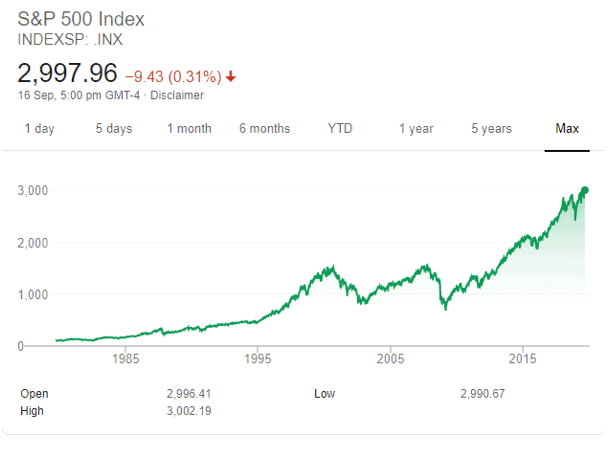

The S&P 500 current level of 2998 is just a shade below its all-time high of 3026. While US recessionary fears have always been on the horizon, the market’s price actions seem to be ignoring the deteriorating fundamentals of the economy. Is stagflation going to be the last straw that breaks the camel’s back?

Stagflation? That’s new.

Despite global economies swirling with liquidity, inflation has never been a significant worry, until now….

We believe a combination of slowing economic growth and accelerating inflation, or what economist commonly termed as stagflation, could be the lethal trigger that heralds a new bear market in the coming quarters, if not months.

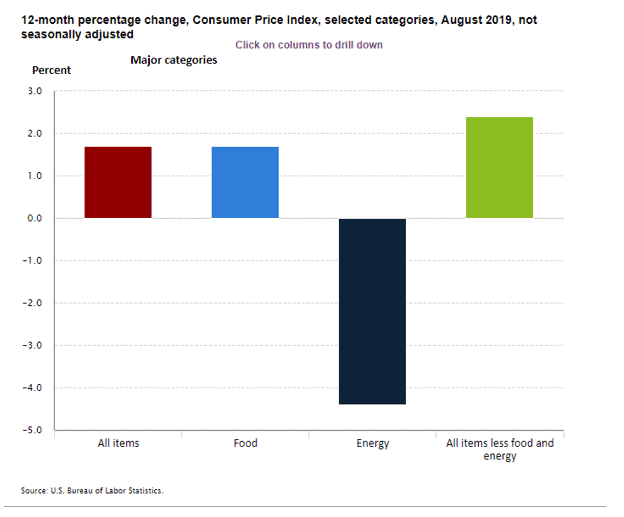

We don’t hear the word “Inflation” often in today’s mainstream media. However, the latest August CPI figures provided subtle hints that US inflation could really start accelerating.

Hell, ain’t the Fed looking to cut rates by another 25 bps this week?

An unbalanced capital market

While we tend to exhibit a negative bias towards the fundamentals of the global and US economy per se, our thesis has been constantly proven “erroneous”, based on the performance of the US equity market.

Global economies are undoubtedly slowing down. We read headline news of downward revisions in global and key nations’ (China, US etc) GDP forecasts.

Why then isn’t that reflected in the equity markets? Why is the US equity market continuing its fine run despite tapering earnings growth forecast?

Aren’t we in the late economic cycle that should warrant a valuation discount vs. a premium re-rating? Well, Powell believes we are still in a “mid-cycle” and already that warrants the start of the next easing process?

More rate cuts to soothe the market

While the strength of the equity market amid deteriorating economic fundamentals seem pretty perplexing to us, we believe the dancing and jiggling can continue to persist. This is as long as the Fed adopts “QE” mindset and lower the short-term interest rates on a consistent basis.

There is a 90% chance that Powell will be reducing the short term rate to 1.75-2.0% this coming Wednesday. Futures are pricing in a 60% probability of another easing by end-2019. This is followed by a 50% likelihood of a 3rd cut by next spring.

That already sounds like music to all the equity bulls out there.

Stagflation creeping in

As long as the Fed has the option of cutting Fed rate down to 0%, following the footsteps of many European nations that are now in negative territory, the bull market ain’t likely to crumble in a significant manner.

However, what happens when circumstances no longer call for such an “easy” route of simply lowering short-term rates to boost market sentiments?

Stagflation, in our opinion, is the key “Black Swan” event that warrants further attention. And it is slowly creeping in when no one is paying particular attention to it… Maybe the Feds are, but they sure as hell are not raising the red flag on it.

US core CPI, based on August 2019 figures stood at 2.4%, the highest level in 11 years. The 3-months annualized rate is now running at 3.4%.

Given the recent acceleration in average hourly wage growth- currently running at a 4.2% annualized rate – the US economy is experiencing its biggest pick-up in inflation pressures since before the global financial crisis.

Tariffs, tariffs and more tariffs

The latest round of tariff hikes which tend to focus on consumer goods, will likely see higher prices associated with items like clothing, shoes, toys, household appliances etc.

According to an August JP Morgan report, the new tariffs will cost the average American Household USD1,000/year

While food price inflation has been modest thus far, we will not be unduly surprise if it trends higher.

More critically, the recent spike in oil prices due to Saudi’s supply disruption could trigger a rise in fuel costs. This is a key item that has been keeping “headline” inflation numbers subdued.

Crude prices rally brings back 1970s nightmarish scenario

Global crude prices jumped more than 10% on 15 September 2019 in response to a Yemen’s drone attack on a Saudi oil facility

That has crippled half of Saudi’s productive capacity, reducing global daily oil supply by 5%.

This brought back memories of past Middle East conflicts that presaged jumps in energy prices in the 1970s. That was one of the key triggers for the 1970s stagflation that lasted for close to a decade.

President Trump said that the US is ‘Locked and Loaded”. US is prepared to go to war with Iran if verification confirmed that the latter is the mastermind behind the attack.

An outright war with Iran could push global crude prices sustain-ably higher, which is a major worry compared to a short-term “blip”.

Such a “nightmarish” scenario will strengthen the proposition of higher inflationary pressure on fuel cost. This will ultimately stoke the US economy into an “unthinkable” stagflation environment that will derail the strong bull market, in our view.

Lowering rates no more…

A run-away inflationary environment will really curtail the Fed’s ability to lower interest rates to 0%. This will effectively remove one of the “most-effective” ammunition that the Fed has in its arsenal.

We believe that if inflation starts to gain momentum in the US, the music that has been on PLAY-MODE over more than a decade will end rather abruptly.

This will potentially set the stage for the next GFC!

The next big opportunity

If and when stagflation happens, we believe it will present us the BIG opportunity to invest for the long term. It is not unthinkable that the stock market will correct by 40-50%.

In such a scenario, you can be sure that patient investors, such as Warren Buffett will be supremely rewarded. Berkshire Hathaway currently has a record USD122bn in cash, a subtle sign from the investment guru that the market is overvalued.

Buffett may just be waiting for a good deal, but if history is any guide, his cash hoard could signal a sell-off is coming soon.