Integrated Shield Plans (ISP) in Singapore

One year in, pretty much all of us are aware that there were sweeping changes made to our integrated shield plans (ISP). However, the truth is, that a large part of us are only privy to the changes on the surface and are still confused by the overwhelming amount of information out there.

This is not ideal because there is no time for us to scour for information during a medical emergency. While we have access to information right at our fingertips with our phones, it is tough for me to picture myself looking through my insurance documents in a zen-like state while in an ambulance on my way to the hospital. Regardless of whether I am the one that requires medical attention or just accompanying somebody, I would imagine myself to be extremely flustered and worried.

It is nearly impossible to condense what I would consider a rather major overhaul to the mechanics of our integrated shield plan into one article but what I hope to do is to share with you what I feel are the most important considerations in a way that is as concise and as layman as possible.

Towards the end of the article, I am also going to add a couple of helpful strategies for what I see are the most common issues faced.

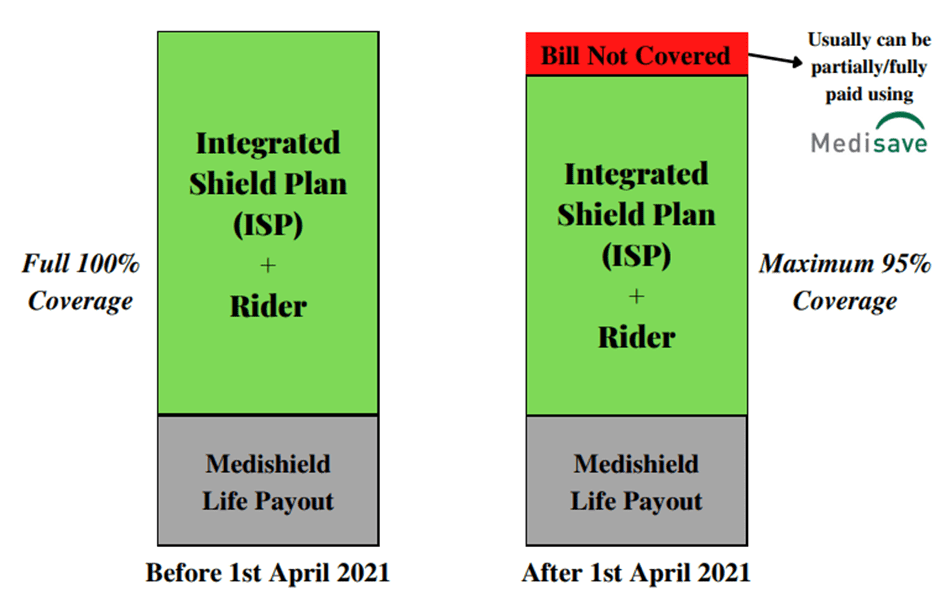

Major Change 1: The maximum our ISPs + riders cover is now capped at 95%

What it is?

As a cost management measure, our ISPs + riders now cover us for a maximum of 95% of our hospitalization.

That means to say if my bill is $10,000, I would be covered for $9,500 and will have to fork out the remaining $500. However, for most parts, this $500 can usually be offset with our Medisave therefore still making the whole bill ‘cashless’.

How does it affect me?

As the co-payment is expressed in the form of a percentage, it can be worrying if the hospitalization and treatment are for a chronic condition which will cost the medical bill to balloon. For example, for a medical bill of $200,000, the out-of-pocket expense will be $10,000!

What are the measures in place?

However, fret not because there are cost management measures in place to prevent hospital bills from wrecking us financially. For most parts, if we are going to a government restructured ward or a panel specialist/hospital (which will be explained more in the following point) under our insurer, our co-payment will be capped at $3,000.

That means even if our bill is a whopping $500,000, the maximum co-payment, in this case, is $3,000. Phew!

Major Change 2: Introduction of Panel and Non-Panel Specialists

What is it?

The introduction of the segregation of private hospital specialists into Panel and Non-Panel specialists. This is an expression of the preferred healthcare specialists of the respective insurers.

The panel of specialists and what they call it differs from insurer to insurer. For example, the panel specialists are called Quality Healthcare Partners in AIA while Great Eastern calls their panel Health Connect.

How does it affect me?

Going back to the first major change, there is NO cap of $3,000 on my co-payment in the event we decide to go to a non-panel specialist. This usually occurs in the situation of either a medical emergency where time is of the essence or if the private specialist that one has always been seeing is not on the panel.

What are the measures in place?

The main measure in place is of course the implementation of each insurer’s Panel of Specialists. However, do not misconstrue and assume that Panel and Non-Panel Specialists are the distinctions between proficient and non-proficient doctors!

When a doctor is enrolled as a Panel Specialist, it simply means to say that they have entered into enforceable agreements to charge within a specific fee range to ensure that fees and claims are kept in a reasonable range.

To find out the specialists that are on your insurer’s panel, you can simply log on to your insurer’s website and look through the catalog.

The amount of specialists that are being onboarded into the panel has also been increasing through the course of last year since the introduction of the changes.

Moreover, there is a small number of insurers that allows you to pre-authorize your medical procedure for all private hospitals, including Non-Panel specialists. Once the insurer approves the pre-authorization, the co-payment will also be capped at $3,000. Thus, it will be helpful to check with your advisor if your ISP has this feature.

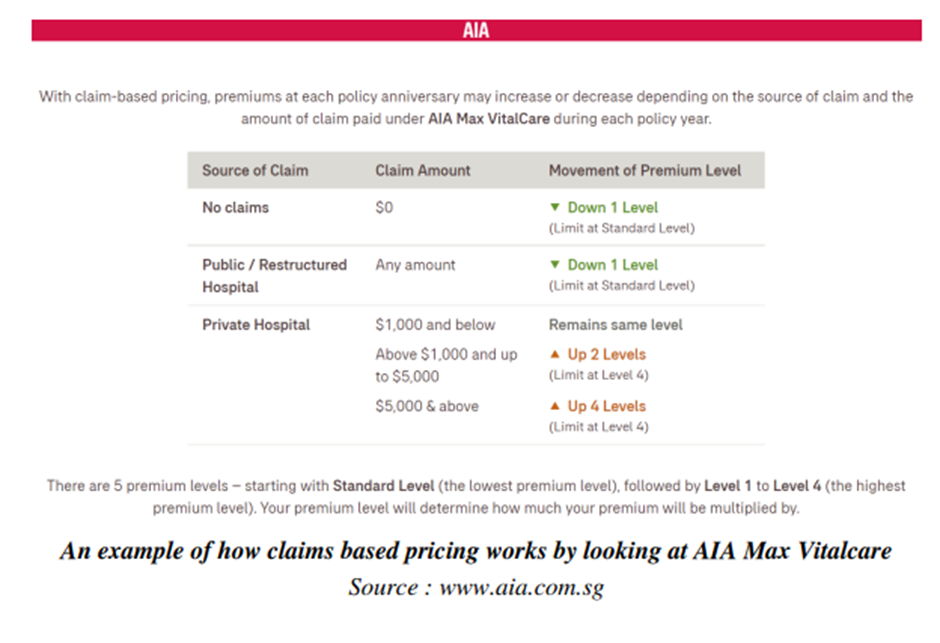

Major Change 3: Claims-Based Pricing

What is it?

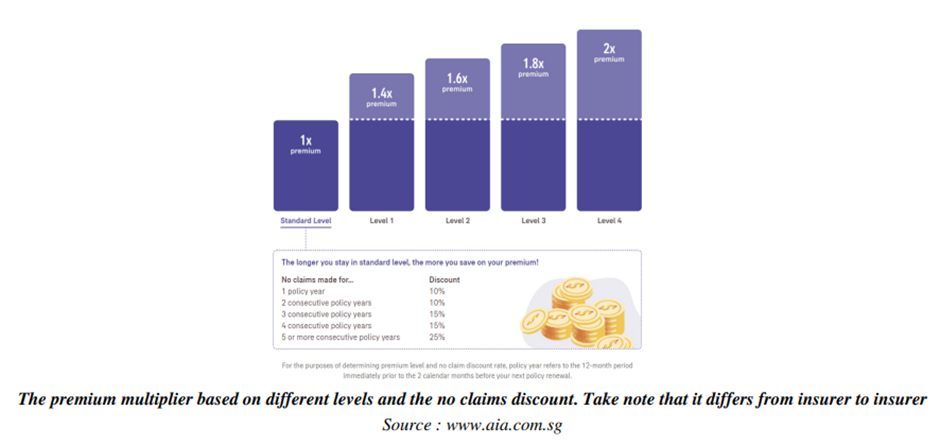

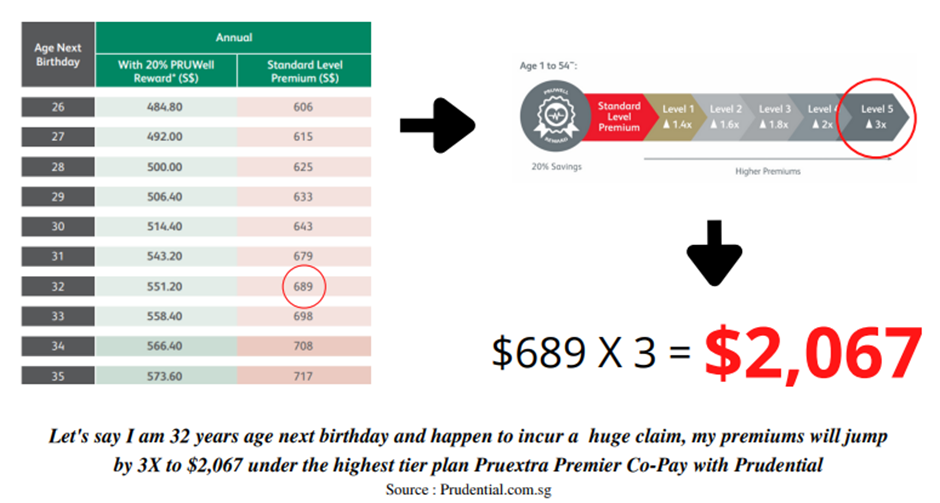

It is simply basing our premiums on our consumption/claims of our ISPs. In a nutshell, depending on the number/amount of claims and what type of specialist (Panel or Non-Panel) I visit in a year, my premiums will get adjusted upwards depending on your insurer. It usually ranges from 1-3X of our premiums.

Once the premiums are adjusted upwards, a review of our claims will be done annually, and should there be low or no claims, the multiplier on the premiums will correspondingly decrease over the years.

On the contrary, I will enjoy a discount on my premiums if I did not make any claims in the previous policy year.

As of now, this is not a feature that is implemented by all insurers as every insurer has a different book of business and thus has different cost management measures. For example, instead of implementing claims-based pricing, some insurers increased premiums across the board while some who have had fewer claims from their policyholders were able to maintain cheaper premiums.

How does it affect me?

In the event claims are high and the premiums increases by 3 times, it can be very exorbitant

What are the measures in place?

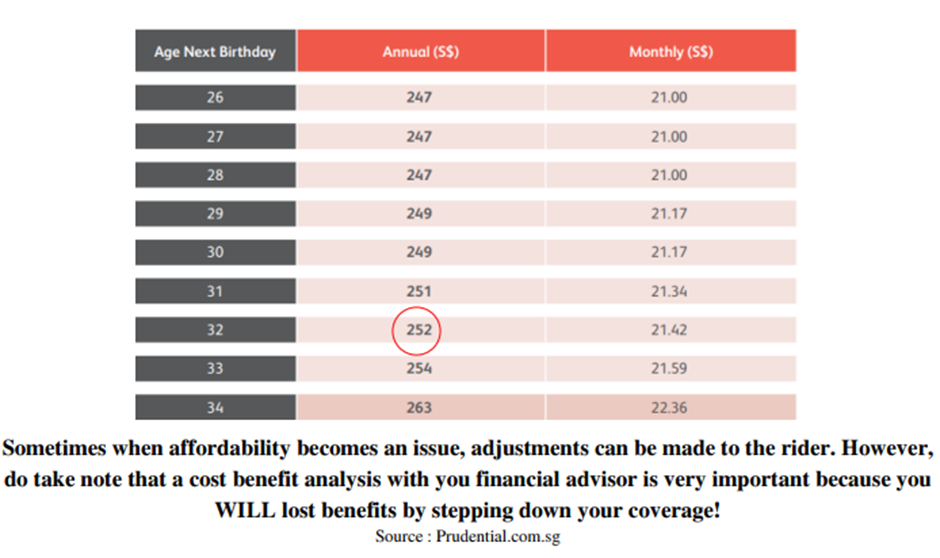

If your ISP happens to be with an insurer that has claims-based pricing and you do not like the volatility that comes with claims-based pricing, there usually is another option in your choice of rider that is not under claims-based pricing regardless of your claims.

They are cheaper in premiums but take note usually the co-payment portion on your deductible will be higher.

To illustrate, take for example for a $3,500 hospitalization bill, instead of only having to pay a 5% co-payment on your deductible for a claims-based pricing rider, you will have to pay 50%. Assuming you were to stay in a private hospital, the outlay will be $1,750 instead of $175.

Take note that the cap of $3,000 still applies for both if you are going to a Panel Specialist.

While the above are mere features of the changes to your ISPs, here are 3 tips that can be immediately helpful.

3 Tips you need to know for your Integrated Shield Plans

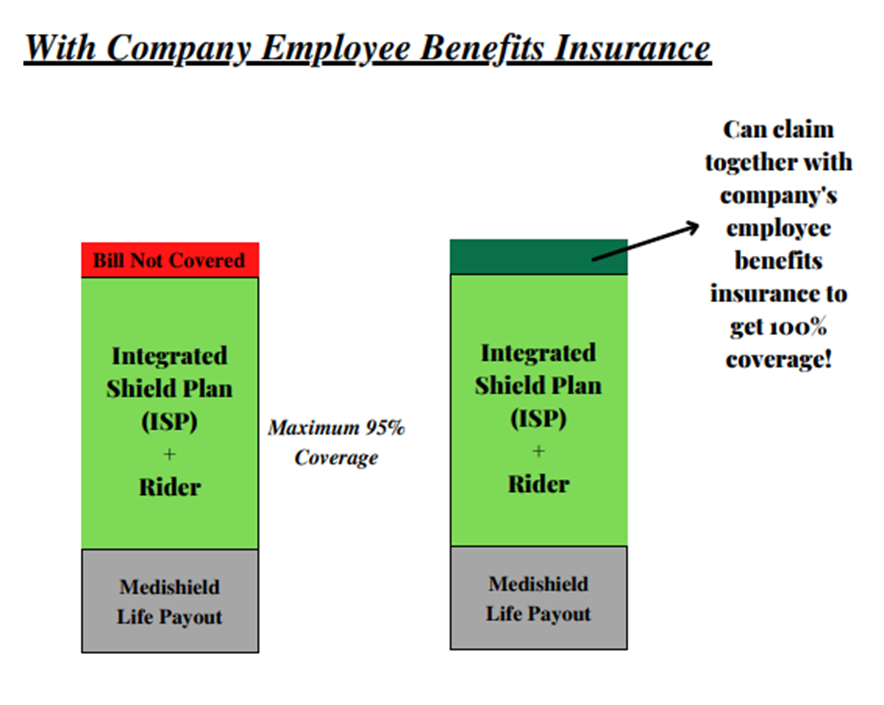

Tip #1: It is still possible to claim 100% of our hospital bills for most of us

As most of us are still working, we often forget that we also have hospitalization coverage as part of our employee benefits. However, we would often find it very confusing how we can best utilize our respective insurances because we are often told that we ‘cannot claim both sides’ which has elements of both truth and untruth.

The truth is, even with the changes, we can claim from both sides for up to 100% of our hospitalization bill. It can either be claimed from my ISP first for say 95% and then claimed with my company for the remaining 5% or vice versa.

Whether the order has importance will depend on factors like for example whether or not your ISP rider has claims-based pricing. If it does have, you will strategically want to claim from your company insurance first and then leave the remaining to your ISP so that your premiums on your ISP rider will not jump as high the following policy year if you were to claim it the other way round.

Some insurers might even in turn reward you for claiming from your company insurance through vouchers on top of the discount for having no claims in the preceding year.

Tip #2: Coverage Adjustment

Another way some people manage cost is to step down on their level of coverage on their riders or entire shield plan as they grow older to manage their insurance cost which is usually during their retirement years.

For example, they will maintain their coverage at a private hospital but will step down to government private ward coverage when they are retired as at present, they can still afford the premiums with a regular income.

As long as they are staying with the same insurer, stepping down from coverage does not require medical underwriting. It is only if you switch to another insurer or are stepping up your coverage that would usually require medical underwriting.

Tip #3: Stuck in exorbitant premiums as a result of claims based pricing

There is a small group of people that were not exactly aware of claims-based pricing or how to best utilize their ISP that made claims on their policies and are now stuck with exorbitant readjusted premiums. This is where sitting down with your financial advisor to do a cost-benefit analysis to explore strategies like for example changing to a non-claims-based pricing rider might be beneficial.

It will be a measure between the extra premiums that you have to pay versus the amount that you save + the benefit that you lose.

WARNING: This might not work for every scenario so it is very important that you have a discussion with your advisor and lay out all the pros and cons in doing so.

The usual scenario for this is when affordability becomes an issue after the premiums were adjusted upwards due to claims-based pricing and the policy owner decides to terminate the coverage instead not knowing there are other options.

In this scenario, having less coverage is way better than having no coverage!

Here is an example:

Conclusion

In all honesty, it was very difficult to condense everything into an article. It didn’t help that every insurer’s ISP and their riders have differing features here and there. However, I did my best to address the most salient of points that I feel affect the most number of people.

While our ISP seemed almost insignificant in our insurance portfolio, it manages the biggest financial risk we face which is our medical bills, especially so when medical inflation is increasing rapidly.

Therefore, the importance of at least having a base understanding of what we have is paramount because one wrong decision can cause a financial calamity. The least we want is to sell off our investments during a time of market downturn to pay for medical bills. That would be a double whammy.

So, please get your ISPs in order.

P.S I understand that some might be frustrated with the increase in premiums of your insurer and are considering switching your ISP to another insurer but PLEASE be careful because sometimes during the transition process, we might omit small medical details that happened decades ago that we might have forgotten about and end up not being covered when the time comes to claim with our new insurer.

If you have any questions, please feel free to drop us an email and we will do our best to get back to you as soon as we can.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!