GE 2015 vs 2020

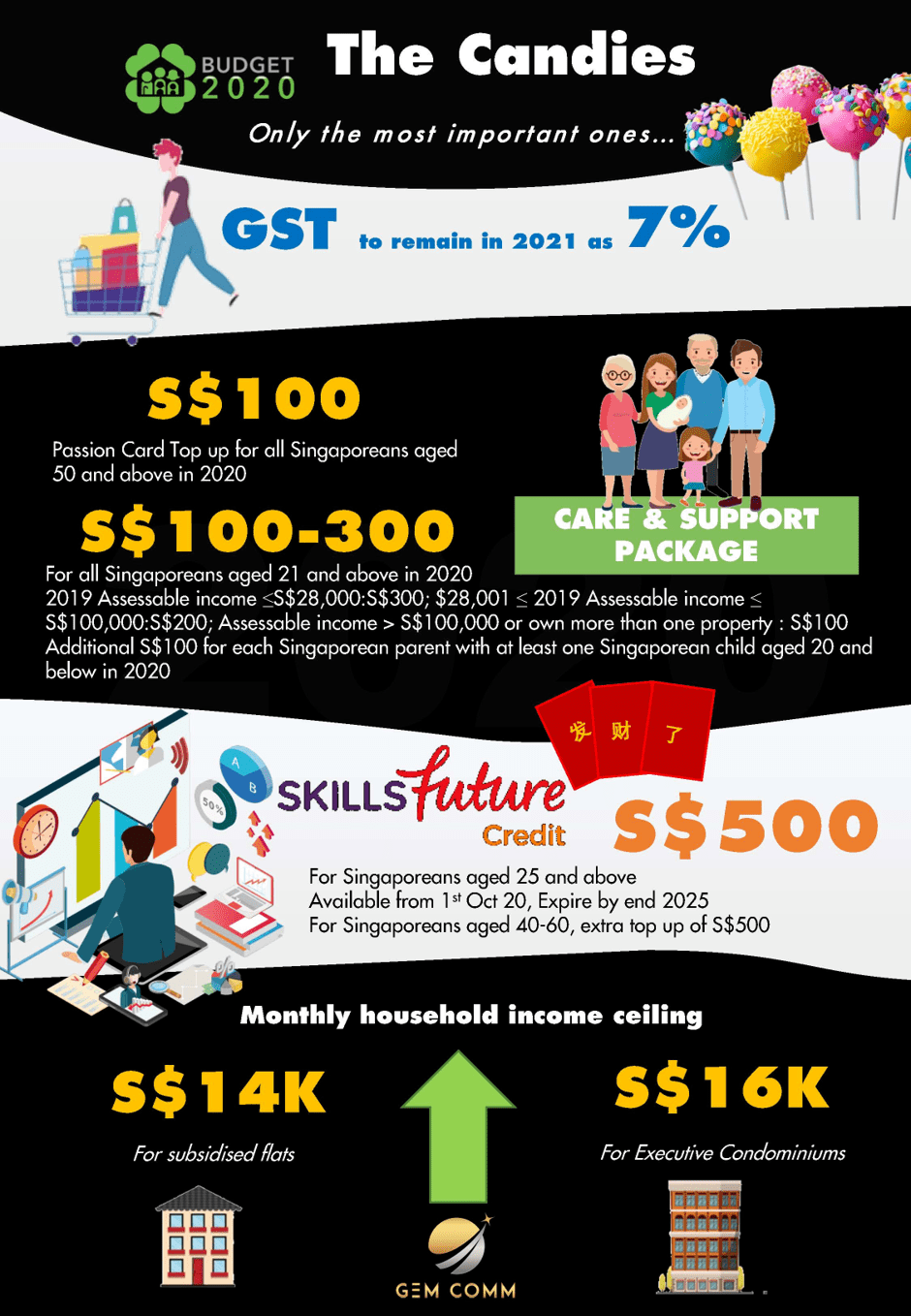

The Government has come up with a generous budget consisting of rebates, bridging loans and cash payouts to help Singaporeans and businesses during these uncertain times.

This Budget is also seen by many as a sweetener for the election-year budget, which is anticipated to be in 2020. We did a GE comparison of 2015 vs 2020 budget (table below) for your reference.

This is an infographic special article brought to you by Gem Comm

With the COVID-19 outbreak expected to have a much greater impact than the 2003 SARS pandemic, will these measures be enough?

While Singapore managed to recover strongly following the SARS outbreak to expand by 4.5% in 2003. The economy still shrank sharply by 4.2% YoY during the April-June quarter (Singapore’s first case of SARS was detected in March 2003, with the outbreak being contained by May 2003). The world is also a much different place compared to 2003.

Prior to the outbreak, China is struggling with its lowest economic growth in 30 years as the world’s second-largest economy expanded only 6.1% in 2019. This is compared to 2003 where the Chinese economic system is growing at a rapid 9.1%, a 7-year high. China’s economic influence over the world and Singapore has also risen significantly since 2003 from 4% of global GDP to about 20%. China is also currently Singapore’s largest non-oil export destination, at 17.3% of Singapore’s overall exports.

The generous budget is well-received and will provide some relief to Singaporeans and businesses, nonetheless, it is expected to be an uphill road ahead for some industries in MICE, Aviation and Tourism.

Can the smaller players survive this phase?

Have faith and walk the miles!

Budget 2020 info-graphics

This article first appeared on Gem Comm

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.