Earn passive income with crypto

In the ever-growing world of DeFi, there are countless opportunities for you to earn money apart from simply “HODLing” a cryptocurrency for an eternity. If you are looking to earn some passive income on cryptos you already own, then look no further because I would be breaking down some money-making methods in the DeFi space.

Some methods widely used in the DeFi space are:

- Staking

- Yield Farming

- Crypto Lending

In part 1 of this 2-parts article, I will be touching on the simplest and easiest way to get started on generating passive income from your crypto holdings through the process of staking on centralized exchanges (CEX)

I will then proceed to talk about a more advanced level, called yield farming, which could potentially generate you interest of >100% per annum (vs. your 0.05%/annum savings account interest. Yeah!) But of course, do note the saying of “greater returns, greater risks” definitely still applies here.

In Part 2, I will talk about generating higher passive income by lending your blue-chip coins such as BTC and ETH to lending platforms vs. staking them on CEX, with the former allowing you to generate up to 10%/annum on some of these blue-chip tier-1 coins such as Avalanche vs. the 1% through CEX.

I will wrap up Part 2 with a quick disclosure of where I am currently generating passive income from my crypto holdings. Do note that there are a lot of methods to earn passive income with crypto but I am just highlighting the seemingly “lower risks” ones.

Do note again that investing in cryptocurrencies, at the end of the day, is still a high-risk venture and do not simply be enticed by the “high returns” for many of these crypto opportunities without being fully aware that the interest that you generate from these high yield opportunities might ultimately be more than offset by substantial declines in crypto prices.

Without further ado, let’s get started on the very first method to earn passive income with crypto. I will also provide a detailed step-by-step rundown on the process to generate this income.

Additional Reading: Best Cryptocurrency Exchanges in Singapore

Passive Income With Crypto #1: Staking

To simply put it, Staking is a process where you lock up your crypto assets to earn interest, similar to how you would put money in a fixed deposit and earn interest. When you stake your crypto, it goes towards helping a blockchain network validate transactions. Does this sound familiar? Yes, it is essentially the proof-of-stake concept.

Whenever a new block is created by validating transactions, new cryptocurrencies are minted and rewarded to the validator. A factor that influences the chances of a validator being selected to validate a block is the value of cryptocurrencies staked.

To increase the chance of being selected and earning rewards, there is what’s called a staking pool where multiple stakeholders pool together their cryptos. The block rewards will then be distributed according to your percentage contribution to that pool. It is important to note that most staking pools would also charge a small fee.

When it comes to staking, most people would opt to stake directly on the blockchain protocol, and here are some popular cryptos you can consider staking (bear in mind you can only stake cryptos using a Proof-of-Stake mechanism. Bitcoin isn’t one of them):

- Avalanche

- Solana

- Polkadot

- Ethereum (ETH 2.0)

- Cardano

Staking “blue-chip” coins on centralized exchanges

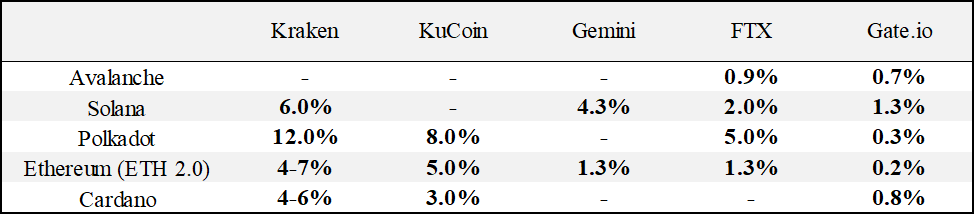

Exchange platforms may also offer staking services, but bear in mind, you may incur a fee for this. The table below highlights some of the “blue-chip” crypto coins that you might wish to consider staking on the exchanges that you are using in order to make them “work harder for you”.

Do note that these returns might change on a day-to-day basis and isn’t fixed. The good thing is that unlike a fixed deposit where you are “locked up” for a specific duration (say 1-year etc) to earn that stated advertised interest, these interests here are accrued on a daily basis and you can select to remove your crypto from the staking pool AT ANYTIME if you so wish to sell them and convert it back into fiat currency.

While these rates are definitely higher than what your local bank might be offering you, they are not overly “exciting” for the risks one would have to take by holding onto cryptocurrencies.

For those who have a higher risk appetite, you might want to take a look at staking TOKENS instead of the standard blue-chip coins highlighted in the list above. Let me give an example below

Staking tokens on decentralized exchanges (DEX)

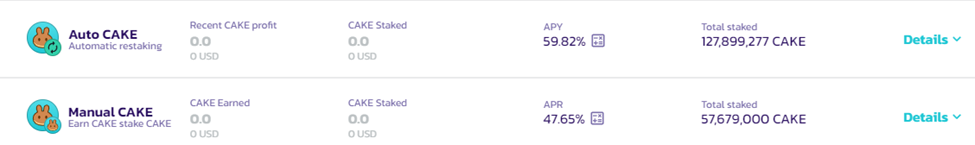

Decentralized exchanges also offer staking options with a ridiculously high APY. One such exchange is PancakeSwap, and they offer 60% (at the time of writing) APY for staking their native CAKE tokens due to their auto compounding feature which happens multiple times a day.

Here’s how you can participate:

- You first have to download the Metamask wallet extension and add the Binance Smart Chain to support BNB (Binance Coin).

- If you don’t own BNB, you can head over to an exchange such as FTX and purchase some BNB.

- Transfer the BNB to Metamask by following the withdrawal instructions in FTX. Once your BNB coins are in your Metamask, head over to PancakeSwap and connect your Metamask to the site. Once connected, PancakeSwap will be able to “see” your BNB coins in your Metamask wallet.

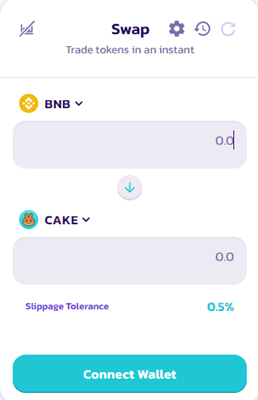

- Next you will need to swap some CAKE tokens with your BNB coins. Head over to Trade and click on SWAP. You can then select to swap your BNB coins for CAKE tokens. Do ensure you do not swap out all your BNB coins as you will still need it to pay for the gas fees.

- Once you have gotten hold of some CAKE tokens, head over to PancakeSwap’s “Syrup Pool” and select Auto CAKE if you want your CAKE profit to be automatically restaked (recommended). Otherwise, select Manual CAKE. You will first need to “enable” the vault, paying a small gas fee (again), then you will be allowed to stake your CAKE tokens (again paying a small gas fee), earning a pretty generous yield of c.60%/annum.

- You can select to exit the staking process at anytime since the returns are accrued multiple times a day.

Staking using wallets

When it comes to online crypto wallets, each is unique to a cryptocurrency (i.e. There are wallets specifically for Solana, Cardano, Avalanche, etc.) and within this wallet, you can also stake your tokens.

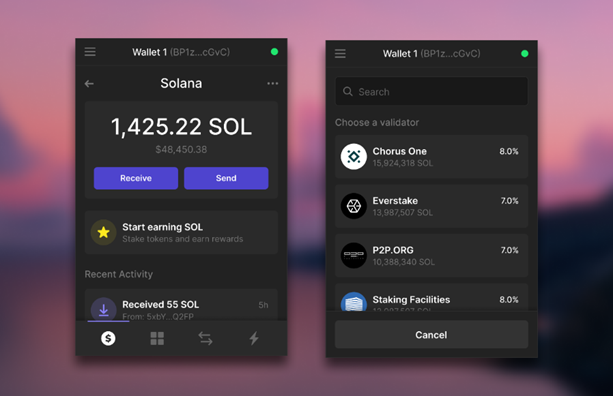

Phantom wallet for Solana

You can stake Solana directly within the Phantom wallet app pretty easily. All you have to do is 1) download the phantom app chrome extension, 2) transfer Solana into the wallet address and click the “Start earning SOL” button to stake Solana. Staking directly on the wallet would however incur a x% commission fee depending on which validator you choose, and the rewards are distributed every 2 days which is automatically restaked.

At this juncture, we have introduced staking of COINS on Centralized Exchanges (CEX) such as Gemini, Kucoin etc which is typically the easiest way to put our blue-chip cryptocurrencies to work harder for us. This is where most people will stop.

A “higher level” staking will be to stake TOKENS such as PancakeSwap’s CAKE token on decentralized exchanges. This will typically involve the transfer of your COINS such as BNB from a CEX into your crypto wallet such as Metamask and convert it into the targeted TOKEN you want on a DEX and then stake it. The returns staking these TOKENS on a DEX will be a lot more attractive vs. COINS on a CEX.

However, as usual, the greater the returns, the higher the risk involved with such staking methods. Let me move on to a more advanced level of generating passive income with your crypto, known as yield farming.

Passive Income With Crypto #2: Yield Farming

Yield farming is a concept involving something called liquidity pools. Liquidity pools often contain a pair of tokens traded against each other (for example BNB-USDT). These tokens are sourced publicly and investors who provide this liquidity are called liquidity providers. Unlike a single coin staking process which I highlighted in the previous segment, liquidity pools typically involved 2 cryptocurrencies to be staked together concurrently.

Let me illustrate with a quick example.

How to engage in yield farming. A quick example.

Yield farming is primarily done on decentralized exchanges such as PancakeSwap (Binance Smart Chain) or SushiSwap (Ethereum network). Let’s again use PancakeSwap to illustrate the concept of yield farming.

Yield farming on PancakeSwap

- Before you start yield farming on PancakeSwap, you want to have funds in your Metamask wallet, namely BNB. (Steps 1-3 on staking)

- Once you connect your Metamask wallet, decide on a token pair you wish to provide liquidity for. (e.g. BNB-CAKE).

- You must own both tokens to provide liquidity in a liquidity pool for other users to trade against. Assuming you want to provide liquidity for the BNB-CAKE pair, you would want to first convert some BNB into CAKE using their token swap:

- Do not convert all your BNB into CAKE. To engage in yield farming, you need an equal amount of BNB and CAKE. If say you have got $100 in BNB, it is better to convert $48 into CAKE (end with $52 BNB and $48 CAKE), with the “excess” BNB to be used to pay for gas fees for the various transaction executed on the Binance exchange. The gas fees on the Binance exchange are not as excessive as that of ETH and will typically just be a few cents.

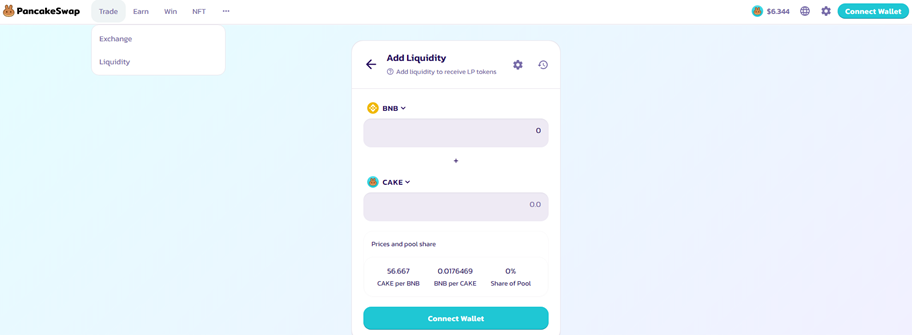

- Then, head over to the “Liquidity” section and enter the amount you wish to provide ($48 equivalent each of both BNB and CAKE). You should leave some BNB again in your Metamask wallet to pay fees that may arise. (Be aware that you may get back a different amount of BNB or CAKE as the value of the tokens change)

- Typically, there will be a “Max” button for you to select. You should click on the Max button for CAKE and the platform will automatically populate the equivalent amount of BNB required for the process. Complete the liquidity provision process.

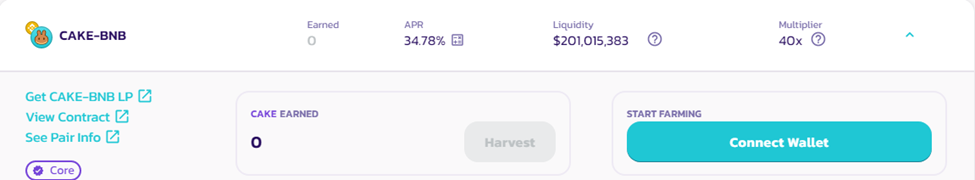

- Once you have provided liquidity, you would start earning Liquidity Provider Tokens (LP Tokens), in this case, CAKE-BNB LP Tokens which is generating acertain amount of return for you. However, you can take 1-step further and re-stake these LP Tokens in PancakeSwap’s FARM to generate free CAKE tokens.

- Every time you harvest CAKE earned on the farm, there would be a very small fee charged. But once you harvest the CAKE, it goes into your Metamask wallet, and with that CAKE, you can head over to PancakeSwap’s “Syrup Pool” and, following the steps above for Staking, stake CAKE to earn additional rewards. Repeat and rinse.

You can see how complex some yield farming strategies can get to maximize profits. This is the main gist of it, but there are other more complex methods out there you can explore if you are interested!

Risks involved in staking/farming

While staking and yield farming may sound like a very profitable venture, it comes with its fair share of risks. If the cryto/s that you are staking/farming declines in value, the yield you are generating on the farming process might not be sufficient to cover the unrealized capital loss incurred on your coin/token.

For the farming process, there is also a second-level risk called impermanent loss. This “loss” occurs when one of the pair of cryptocurrencies see price appreciation/depreciation significantly more than the other crypto. Say one appreciates by 50% and the other remains flat. The impermanent loss will result in lower returns (<50%) for your cryptocurrencies.

You will still be profitable, it is just that you would have been better off just holding onto your cryptocurrency instead of farming them, with the yield generated from the farming process being partially negated by the effect of impermanent loss.

The ideal scenario will be to have both cryptocurrencies in the farm appreciate by the same amount. In that way, there is no impermanent loss.

Do stay tuned for Part 2 of this article on earning passive income with crypto. I will be highlighting the final method which is to stake your blue-chip cryptos on lending platforms which generates a much higher yield compared to the standard CEX platform.

I will also be highlighting a number of ways in which I am earning passive income with crypto. Some of these methods are lower risk such as those highlighted in this article while others are of a higher risk nature.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Is Solana going to be the “Ethereum killer”

- Beginners Guide to crypto currency. How to get started

- GBTC ETF: How you can buy Bitcoin at a discount

- What are NFTs and my NBA Topshot experience

- Why you should invest in Coinbase stock and how to get a free Disney shares while doing it

- Bitcoin prediction: 5 reasons why its rise this time might be sustainable

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only