Can we enjoy our Latte and still retire well?

If you are like millions of people around the world who spend a $5-6/day, 5 days a week, on a nice cup of latte, is that an act of financial irresponsibility that could potentially derail your retirement plans?

Well, depends on who you ask that question. If that question is being directed to personal finance guru Suze Orman, she will probably be giving you that disapproving look, chiding that you have literally “piss” away $1m in your life?

How can one possibly waste $1m by having a cup of $5 coffee, 5 days a week?

The simple maths goes like this:

$5 X 5 days a week X 4 weeks = $100/month

$100/month saved over 40 years at an average compound rate of 12%/annum = $1 million.

Simple ya.

Well, if only life is that simple and if only generating a consistent 12%/annum over 40 years is that simple.

More realistically, let’s assume that instead of spending $100/month ($1,200/year) buying a latte, you contribute this money to an investment fund generating an average after-inflation return of 6% over the course of the next 40-years.

Your $1,200/year savings will be worth close to $200,000 at the end of 40-years.

That is definitely a nice addition to your retirement savings but nowhere near the $1m mark that Suze says you will be literally pissing away.

It will take a lot more coffee buying to realistically be able to turn your latte saving into $1m.

Personally, I have no qualms about people spending on their lattes (I am a Starbucks shareholder, just for disclosure purposes) as long as they are first taking care of other priorities such as paying their bills on time and saving for their retirement.

Our life on this earth is a very finite amount. Where is all the fun if our only purpose is cutting back on the little pleasures of life?

So what might be the solution?

The simple solution could be summarized into a 2-steps process. Firstly, follow the notion of paying-yourself-first. This step should be executed on an automated basis instead of relying on one’s will power to manually transfer funds on a monthly basis. How much should be used to fund your emergency fund? How much should you be investing?

Secondly, get the big-spending decision sorted out. Are you making monthly payments on big-ticket items like a home mortgage and car installment payments etc that is putting a serious drain on your cash flow? Do you have a credit card or student loan debts that are still outstanding?

Once you have “mastered” the above two steps, you will know how much lattes you can afford to drink every month. Go ahead and enjoy!

Let’s go through the 2-step process in detail.

2 steps process to enjoy your latte and retire well

1. Make your retirement savings a priority and automate your savings and investments

You have probably heard of the notion “Paying-yourself-first”. This is a phrase popular in personal finance and retirement-planning literature that means routing a specified savings contribution from each paycheck at the time it is received. This process should be done AUTOMATICALLY.

Because the savings contributions are automatically transferred from each paycheck to your savings or investment account, you are hence paying yourself first.

In other words, prioritize paying for your future financial wellbeing first before making payments on your current financial liabilities and your spending WANTS.

One can follow the popular “20-50-30 formula” when it comes to money management and figuring out how much you should spend and save. Let us start from the 20-figure.

20% of your income goes towards savings and investments

This is where you “pay-yourself-first”. 20% of your net income should be allocated towards paying yourself first in the form of building up your emergency savings, savings to purchase a big-ticket item, investing for retirement, etc. If your gross income is $3,000/month, $600 should be automatically be taken out and put into a separate LT-savings/investment account the moment your paycheck hits your checking account.

For a lot of people, saving/investing 20% of their net paycheck is just not possible due to the mountainous amount of bills to be paid. This is where many usually allocate their monetary resources to pay their financial obligations first before “paying-themselves”.

Are you one of them? Try to work towards this 20% figure as a non-negotiable financial commitment. Your future self will thank you.

Let’s now jump to the 50-figure.

50% of your income goes towards paying down your needs

Half of your take-home pay should go towards necessities. That’s your rent, car loans, utilities, groceries, childcare, insurance, etc.

This is often where you incur big-ticket fixed expenses such as mortgage loan payments, car installment payments, credit card debt, student loans, etc.

If you find yourself channeling significantly more than 50% of your net pay towards paying down your needs, that is when you should re-evaluate your big spending decisions. This will be carried out in Step 2.

Before we proceed to that, let’s look at the 30-figure

30% of your income goes to fun

This is the category where you can spend all the money on your caffeine fix! If you take home $3,000/month, that means $900 to buy coffee or approx. 150 lattes/month or 5 lattes/day.

Just kidding.

This is the “leftover” fund that you can use to meet your wants, splurging on coffee might be one of them.

But do think about what really matters to you before spending this money. It has been shown that spending money on experiences brings more happiness than spending money on material objects.

No one-size fit all solution

After all that is said and done, there isn’t really a one-size fit all solution. The key is to have a plan and stick to it.

Some might prioritize saving more than 20% while cutting back on the 30% fun part. Others might find it a struggle to “only” allocate 50% of their income on needs. Usually, this portion already takes up the majority of one’s pay.

This is where it is critical to get your big spending decision right.

3. Getting the big-spending decisions right

Spending money on a cup of coffee every day isn’t going to be a life-altering decision unless one is living from paycheck-to-paycheck.

Instead, focus on the big-ticket spending in your life where you might actually be overextending yourself. This is often in the area of housing, automobiles, and higher education. If you find that you are using significantly more than 50% of your take-home pay to settle these payments every month, then it could be time to re-evaluate your lifestyle needs.

Home Purchase

A home purchase is often romanticized as a “must-have”, especially in the Asian context where having your own roof should take precedence over all other financial matters.

Buying a home is often the biggest purchase many of us will make in our lives and hence should be considered seriously. In addition to the upfront expenses like down payment and closing costs that potential home buyers usually focus on, it is also important to be mindful of the ongoing costs associated with owning a home such as, mortgage expenses, monthly utilities expenses, condo fees, etc.

In Singapore, more than 80% of the population live in HDB flats, which is an initiative by the government to provide affordable housing to the masses, first established back in 1960.

Singaporeans’ first home tends to be a BTO and after fulfilling the Minimum Occupation Period (MOP) of 5-years, most will wish to upgrade to private property such as an Executive Condo (EC) or Full-fledge Condo itself.

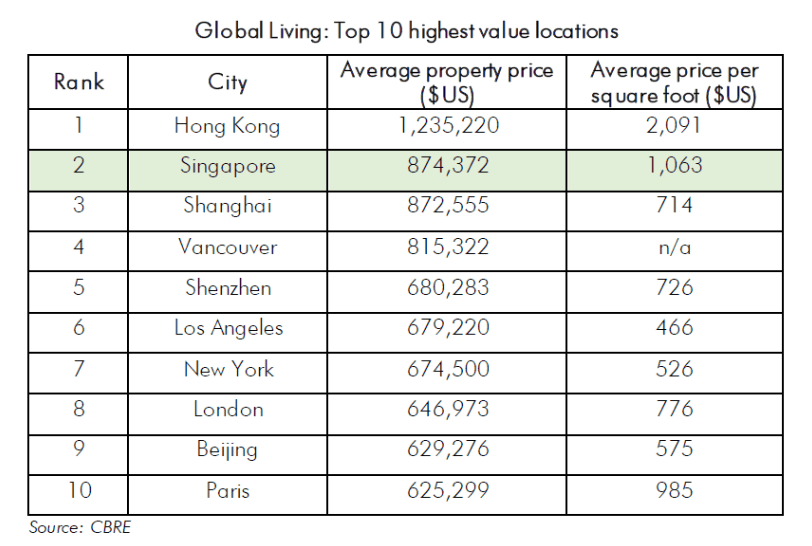

However, it is critical to be aware of the significant jump in mortgage expenses associated with the ownership of a private property. According to the report by real estate firm CBRE, Singapore ranks as the second-most expensive city in the world to buy a private property, with the average transaction value being US$874,372 or US$1,063/sqft.

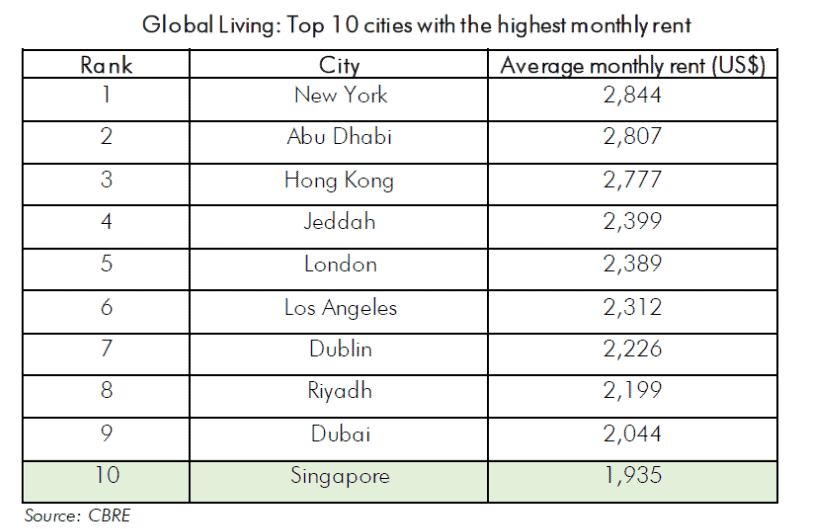

On the other hand, we are “only” at No. 10 in terms of the average monthly rent.

So for those looking to purchase a private property to rent, does it make sense in both a local and global context? This is a topic which I will be interested to further explore in future articles.

Based on the above info, Abu Dhabi, which ranks No.2 in rental terms and out of the Top 10 ranking in terms of home prices, seem to be the best location to purchase for rental?

We have digress slightly but it is critical to be aware of your current housing affordability status. Propertyguru has a mortgage affordability calculator which I thought was pretty simple to use.

The “conclusion” was that a million-dollar condo is only affordable if one’s household gross income is in the region of $12k/month, is able to afford at least $52k in cash upfront with CPF/Cash payment of $208k. The monthly repayment is around $3.5k which is about 29% of total gross household income.

That seems like a pretty hefty amount of downpayment and mortgage payments (not inclusive of other one-off and recurring items) to fork out for a million-dollar condo which I assume is most likely the “base/average” price for new developments nowadays.

If owning a private property is taking a toll on your current financial well-being, then do consider downgrading or possibly the option of renting (while waiting for the housing market to correct, if it ever does).

Automobiles

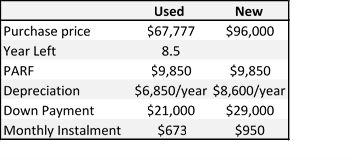

Aside from a home, one of the most important and largest purchases for many families is an automobile. According to website moneysmart, a car that starts out at $19,700 (when you purchase say in the US where it was manufactured) can end up costing as much as $96k here in Singapore. Note that this is just for a mid-range vehicle like the Toyota Corolla Altis 1.6 Standard. In fact, the “actual” cost of this car is in the range of $300k…. WHAT!!!!

One will typically take a car loan up to 70% of the purchase price which translates to a monthly installment payment of close to $1k (based on loan amount of 70% * 96k = 67.2k) based on an interest rate of 2.8% over 7 years. Over the horizon of 7 years, that is $84k, meaning you will have paid $16.8k in interest over the 7 years horizon.

Other miscellaneous payments include road tax, insurance parking, petrol and maintenance which could add up to approx. $500/month. Hence one’s monthly vehicle outlay will be approx. $1,500. Based on a gross household income of $12,000, this expense is a significant 12.5% of gross income.

Hence, housing and automobile costs might typically already encompass 41% of a middle-income household generating $12k in gross income.

Over the duration of 10-years (typical car ownership no. of years in Singapore), the cost of a mid-range car like the Toyota Corolla could cost you $144k. Assuming an average cost of $12k/year, that amount, if re-invested in a fund generating 6%/annum, would have resulted in an end-value of $168k after 10-years.

So the “actual” cost of your Toyota Corolla is, in fact, $310K after taking into account the opportunity cost lost!

We might be a bit dramatic but our point is that one should know how affordable a brand new car is to him/her here in Singapore. If not, consider a second-hand car that might shave the monthly installment by 1/3 for an almost new 8.5 years car of the same model. Again, moneysmart has done a nifty comparison on this.

Higher Education/Student loans

I have written previously an article: 4 ways in which parents can help their children (and themselves) to graduate college debt-free. In that article, I highlighted that parents are increasingly being burdened by the need to support their kids’ tertiary education, often at the expense of their own financial well-being and retirement plans.

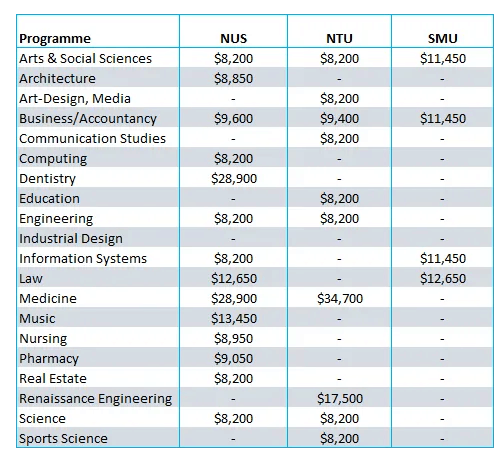

In Singapore, degree courses can range from SGD$24,600 for a 3-years engineering course to about SGD$115,600 for a 4-years medicine course.

And that is in today’s dollar. Assuming a typical Singaporean parent is faced with footing an SGD8,200/annum fee, that will translate to approx. SGD$683/month in additional budget for their kids/ tertiary education. That is about 6% of an SGD$12k gross income.

In my own personal case, I have written that to support my elder kid through a 3-year basic university course which amounts to SGD$24,600 in today’s context will translate to about SGD$40,660 in 17 years, assuming a 3% inflation rate per annum.

This is just accounting for the basic school fees and excludes items such as boarding fees, living expenses, etc. If I include the impact of living expenses, assuming a budget of SGD$500/month, the total cost over the 3-years education process will amount to SGD$71,177.

While education is an important part of any person’s development, it is important to not overlook the financial implications of such a decision. This may make college seem less glamorous than what is being marketed to the public. But the reality is that the college experience should put someone on track to enhance their earnings potential and not burden them with a pile of debt.

In the Asian context, that burden is increasingly falling on their parents’ shoulders.

Instead of waiting for the “inevitable” (which is to fund their kids’ college fees) to hit the fence, one should start planning early on how to fund this amount which can become as low as $100/month if we start the savings process early.

I have talked about 3 funding options in the article.

I believe the “best” solution to this education cost is, in fact, to teach good money habits to your kids which elevates the probability that ultimately both yourself and your kids can, in fact, graduate from college debt-free.

Conclusion

Life is short. We should not deprive ourselves of life simple pleasures, might it be just a Latte a day. While it might not help in keeping our retirement woes away, it is certainly not the major cause of one’s retirement worries.

Instead, we should be engaging a proper system to automate our financial habits to ensure that we always “pay-ourselves-first”. If the final assessment concludes that we are in fact “over-spending” beyond our means, then look to cut back on the big-ticket items. These are the ones that will sink your retirement plans, not your daily cup of latte.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

3 thoughts on “Is drinking Latte really costing you $1 million and the chance to retire well?”

Quite a fee midyakes in the uni table. Medicine course is 5 yrs not 4. NTU offers computing too.

Best view i have ever seen !