Most of you would have heard of dividend growth investing, buying companies with a good track of growing their dividends. This is a solid way to grow your income over time.

However, buying a dividend-growth company can turn out to be a “bad investment” if one grossly overpay for it.

So how does one determine the fair value of a company?

There are numerous ways to value a company. One can look at common financial ratios such as Price to Earnings or more commonly term as PER, Price-to-book (PBR), discounted cash flow model, discounted dividend model, etc.

Plenty of models to choose from but at the end of the day, all of them have their own limitations and there is no “one-model” fits all solution.

Investment Quality Trends

Dividend Yield Theory is a lesser-known valuation method that is applied to only stocks that pay a dividend (hence the name). This theory has been popularised by Investment Quality Trends or IQT for short, an investment newsletter publisher.

Since 1966, IQT has provided investors the research, analysis, and tools to identify high quality, blue-chip stocks and to know when they offer good value which is the information one will need to make informed, buy, sell and hold decisions about stocks for their portfolio.

IQT co-founder, Geraldine Weiss, was known for her unconventional value approach investment style by focusing on a company’s dividends rather than earnings. She popularised the theory of using dividend yield as a valuation metric by indicating that there is a strong correlation between a company’s ability to pay dividends over time vs. its stock price performance.

She was the co-author of the book “Dividends Don’t Lie: Finding Value in Blue Chip Stocks”. This book teaches a value-based approach to invest by using the Dividend-Yield Theory as a means to produce consistent returns in the stock market. Rather than focus on the nitty-gritty details of a company’s operations, Weiss places an emphasis on dividend yield patterns as a means of evaluating a stock.

A 2010 sequel Dividends Still Don’t Lie: The Truth About Investing in Blue Chip Stocks and Winning in the Stock Market was published in 2010.

So, what exactly is the Dividend Yield Theory?

Dividend Yield Theory basically says that for blue-chip dividend stocks, particularly those with a stable business model that does not fluctuate drastically, dividend yields tend to revert to the mean.

This means that if you draw a straight line right across the middle of the historical dividend yield profile of a stock, that will be its fair value. Pretty simple and intuitive. If the stock’s current yield is below its historical yield line, that represents over-valuation and if the current yield is above its historical yield line, then the stock could be undervalued.

Think of it this way. If a stock price performance is dictated by earnings (higher earnings will drive the stock higher) and dividends are in turn dependant on earnings, then one can potentially infer that stock prices could also be tracking dividends as well.

Since dividends are less volatile than earnings and are an important component of total return for a dividend stock, dividend yield can be a more stable indicator of value vs. PER.

Dividend Yield theorists believe the stock’s yield will eventually revert to its longer-term norm, assuming nothing drastic has change pertaining to the company’s business model.

Historical Track Record of the Dividend Yield Theory

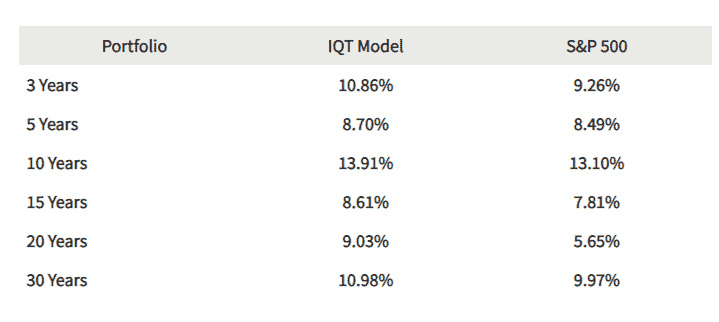

According to Mark Hulbert and The Hulbert Financial Digest, a site that tracks the performance of investment advisory newsletter since its inception in 1980, the IQT Model routinely out-performs the S&P500 as can be seen from the table below, with 15% less risk as compared to its benchmark, the Dow Jones Wilshire 5000 Total Market Index.

The model first looks for blue-chip stocks that meet its criteria. These stocks will achieve the designation of Select Blue Chip after it has met at least five of the six following qualifications and may remain with four criteria:

- Dividend increases 5 times in the last 12 years

- S&P Quality Ranking in the “A” category

- At least 5,000,000 shares outstanding

- At least 80 institutional investors

- At least 25 years of uninterrupted dividends

- Earnings improved in at least 7 of the last 12 years

Of the 15,000 publicly traded companies in the US markets, only approx. 350 companies meet these six criteria and of those 350, only 250-260 counters have clear-cut dividend profiles.

These stocks now fall under the Select Blue Chip category. The next step will be selecting these blue chips only when their stocks were historically undervalued (i.e. higher than average dividend yield based on historical trend), and then holding for the long term or until these counters became over-valued to warrant a sale.

Our own NAF Blue Chip

We look to replicate our own Blue-Chip stock portfolio which we termed as NAF Blue Chip (NAF represents New Academy of Finance) based on the following criteria:

- 5 consecutive years of dividend increase

- 4-5 Stars Predictability Ranking according to GuruFocus

- 5-years dividend growth rate of at least 7%/annum

- 5% earnings CAGR over the past 10 years

- At least US$10 billion in market capitalization

- Payout ratio not in excess of 1 (except for REITs)

There was a total of 46 US counters which met these criteria. We added HK stocks that met these criteria in the list which brought the total number of counters to 52 stocks.

These stocks fall under our NAF Blue Chip category.

Our next step is to filter these stocks based on the dividend yield theory, selecting stocks that are “undervalued”. In this case, we select stocks whose current yield is 0-40% below its Historical High Dividend Yield and above the average historical yield line

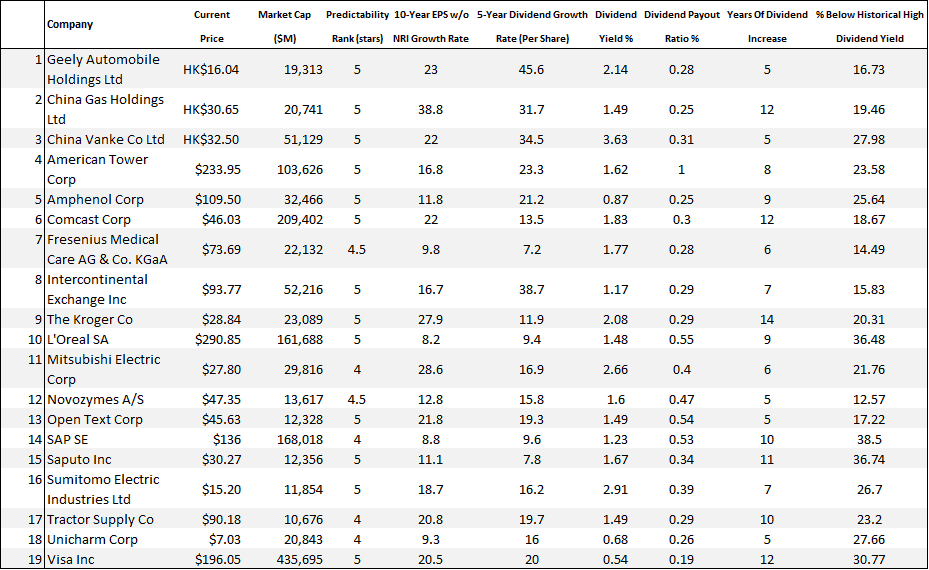

Out of the 52 stocks, only 19 stocks met this final criterion.

We present the list of stocks in the table below.

Kroger

Let’s look at an example:

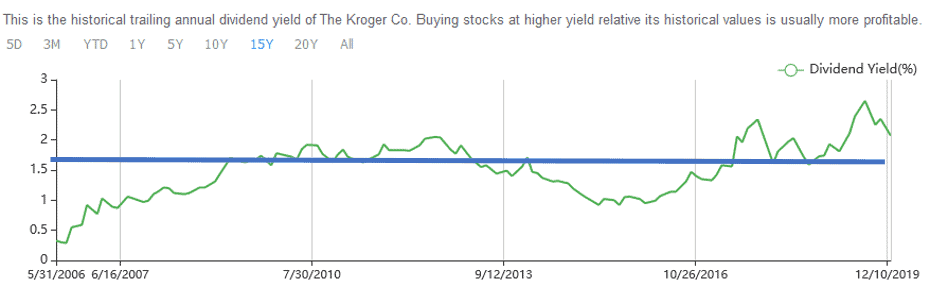

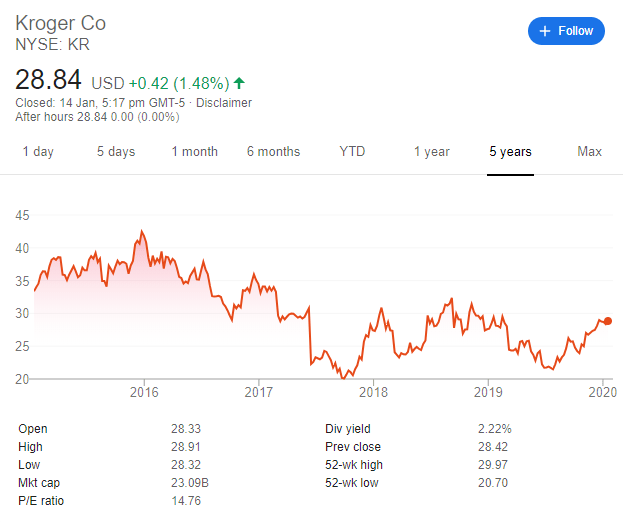

The following is the historical dividend yield profile of The Kroger Co. The company started paying a dividend back in 2006 and has been increasing its dividend payment every single year since then.

The yield of Kroger hit a low of 0.92% back in March 2015 when the counter was trading at c.US$38/share. Its highest yield was in early Aug 2019 when it yielded 2.65%. At the current yield of 2.07%, the counter is approx. 20% below its highest yield point.

Based on the dividend yield theory, Kroger could be undervalued, assuming that there is no significant change in its operational profile. How much undervalued?

Based on the Dividend Yield Theory, we can make a couple of assumptions to determine the fair value of Kroger:

- The counter has an average historical yield of 1.79%

- The company has a dividend growth rate of 10% (lower than the last 1 year and 10-year dividend growth rate)

- Based on 10% div growth rate, next year dividend amount will be $0.66/share

We can derive the fair value of Kroger as such:

The fair value of Kroger = Expected Dividend/average historical dividend yield

Fair value of Kroger = $0.66/1.79% = $36.9/share

Based on the Dividend Yield theory which assumes that a stable blue-chip dividend-paying counter will revert to its long term average historical yield, the fair value of Kroger can be derived to be US$36.90/share.

With the counter currently trading at US$28.84/share, there is an upside potential of 28% from the current share price level.

Is there really value in the counter of Kroger? Possibly. The counter has grown dividend strongly over the past 5 years, rising by an average of 11.9%/annum. This is backed by a c.28% CAGR in its EPS, hence its dividend increment is not debt-funded. In addition, Kroger’s payout ratio is less than 20%, which gives us plenty of comfort that its dividend payment can continue to rise.

While dividend yield theory can be an insightful valuation model, there are several important limitations that investors need to be aware of.

Limitations of Dividend Yield Theory

While the dividend yield theory has been proven to be a useful valuation tool, it tends to work best under long-term conditions (> 5-years), with quality dividend stocks that possess 1) Stable business model, 2) Stable dividend payments and 3) sustainable dividend profile.

The first point is self-explanatory. We want a blue-chip counter that is not exposed to an overly cyclical and potentially commoditized industry.

For the second point, we do not wish to see an erratic dividend payment history. For example, paying a dividend of $1 in Y1, dropping to $0.50 in Y2, increasing to $1.50 in Y3 and dropping back to $1 in Y4. We will prefer a steady increment, that is why in our screening criteria, we wish to see 5 consecutive years of a dividend increase.

Lastly, the counter needs to have a sustainable dividend profile. A growing dividend payment might not be sustainable if the payout ratio is consistently above 1 (meaning the company is paying out more in dividends than it earns). Hence, one of our screening criteria is to look for dividend counters where the dividend payout ratio is less than 1. Most of the final candidates in the list have a payout ratio of less than 0.50, which indicate safety in terms of dividend payments, with minimal risk of a dividend cut.

The Dividend Yield Theory will also not work for growth counters which do not pay any dividends or very minimal dividend payments. Growth-oriented companies will tend to re-invest its earnings to fuel further earnings growth vs. paying out in the form of dividends. Hence what will drive their share prices are earnings growth vs. dividend growth. Growth companies will be better evaluated with the PE ratio approach, which is a better valuation tool to capture the stock’s primary total return driver (i.e. earnings).

Conclusion

For long-term value investors, the dividend yield theory might be a useful stock selection methodology.

As long as the company’s business model is sound and stable, has a history of steady dividend payment which is sustainable based on the payout ratio, the stock’s dividend yield will often tend to mean-revert over a long enough horizon ( > than 5 years).

Hence, one can use a blue-chip stock’s historical dividend yield profile to derive a potential fair value estimate of the counter.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

5 thoughts on “Dividend Yield Theory – the Underappreciated Valuation Tool”

Great post, I have never come across this concept until now but it has sparked my interest a bit. one question where do you find the historical dividend yield profile from?

Hi Derek i use gurufocus which is a paid subscription. However you can get that information from macrotrends.com which is equally comprehensive

The correct web address is macrotrends.NET.