DBS Vickers – An in-depth review

Taking the first step to any activity is always daunting with so much information and tools available around us. Let’s take picking up music as an example. One will have to decide on the choice of the instrument followed by the myriad of brands and models available in the market.

Along the way, many would’ve given up and move on instead. One’s first step into investment is no different! With an increasing number of brokerage firms entering the market, one will have to cross the hurdle of picking one before facing a wall of thousands and thousands of listed companies.

This article seeks to simplify the process of selecting a brokerage firm so that you have one less worry while investing! I’ll share with you how I ended up choosing DBS Vickers securities – Cash upfront and my experiences with it. With one less hurdle to face, you’ll be a step closer to your investing journey. Sounds good?

Personal investment profile

The very first step before embarking on your investment journey is to understand why you’re investing. By charting out your investment objectives, you’ll be able to select the right tools to maximize your returns. For example, one can either focus on achieving capital gain or dividend yield. After identifying your profile, you can finally begin your search for a suitable brokerage. (This is where you’re another step closer to trading!)

Three key components essentially shape the offering of a brokerage firm – Market Assess, Custody of shares, Brokerage fees. But how can we apply this? Let me first share my investment profile and how it guided me to DBS Vickers!

For me, I’m looking to allocate 40% to 50% of my portfolio into Singapore listed shares for dividend yield. With a time horizon of 5 years and beyond, I will not be looking to actively trade this allocated amount. Therefore, it will be ideal for me to have these shares transferred into my CDP account.

My investment profile can easily be applied to what a brokerage firm can offer:-

- Custody of shares

- Gaining access to the Singapore equity market

- Low brokerage fees

For more details of brokerage firms in Singapore, one can refer to this article: Best brokerages in Singapore. Attaining low costs and access to your desired market is self-explanatory. What about custody of shares? In the next section, I’ll briefly share my views and experience regarding it.

Why custody of shares is important to me

When investing through a brokerage firm, your shares can either be held under their custody or with your CDP account. But why does it matter? Two brief pointers!

Corporate Actions

Last year alone, we’ve seen waves of corporate actions such as preferential offerings from Singapore-listed REITs. But how does it relate to where our shares are held?

To simplify the corporate action process, it can be broken down into 3 steps:

The company sends an instruction à Investor receives it à Replies before the deadline

When shares are held in your CDP, you are responsible for the entire corporate action process without any 3rd party involved. When the instructions are sent directly to you, it gives you the luxury of time to participate in them!

On the flip side, shares held by custodians will mean that the entire corporate action process will involve a 3rd party. Firstly, instructions will be sent to them before being rerouted to you.

On top of bearing the risk of receiving these instructions late, the custodians will also require you to get back to them before the stipulated deadline. Ultimately, this leaves you lesser time to react. I’ve even heard of friends not being able to participate because the letters came after the deadline. Imagine having your shares diluted just because of the post!

Dividends

Another noticeable difference due to the custody of shares would be dividends. When shares are held in your CDP, dividends will be directly deposited to your account in a timely fashion. If it is held by a custodian, a 3rd party will be involved which slows down the process.

As I’m looking to take a long position on my holdings, it makes sense for me to have the shares deposited into my CDP account. It allows me to exercise a higher level of autonomy in terms of any potential corporate actions.

My choice of DBS Vickers – Cash upfront account

After assessing what is offered in the market, DBS Vickers – Cash upfront ticks all the boxes of what I’m looking for in a brokerage firm. On average, a brokerage firm charges around $25 for trades that are placed into one’s CDP account. However, with DBSV – Cash upfront, this amount is more than halved at only a minimum of $10 per trade!

However, the catch is that settlement via the cash upfront option requires a prefunded account. Apart from ensuring that your accounts are sufficiently funded before executing trades, buy orders made will result in funds being removed immediately. Is this trade-off worth it? I certainly think so! If it fits your investment profile too, here’s how you start your cash upfront journey.

What do I need for DBS Vickers Cash upfront account?

Opening of necessary accounts

To trade via DBS Vickers securities Cash upfront, you’ll have to open these accounts:

- CDP Account

- DBS Multicurrency Account (MCA)

The DBS bank Account serves as your “prefunded account” to carry out trades in the platform. To prevent facing any potential hiccups in your trades, remember to keep this one funded!

Steps to trade via DBS Vickers Cash upfront account

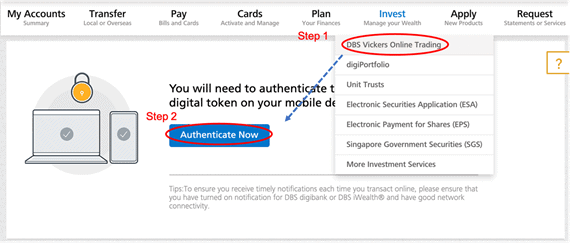

Step 1: Log into your DBS iBanking Account

To trade using the Cash upfront settlement method, you must enter DBS Vickers site using iBanking.

After logging into iBanking and authenticating your access, you should be able to enter the DBS Vickers platform.

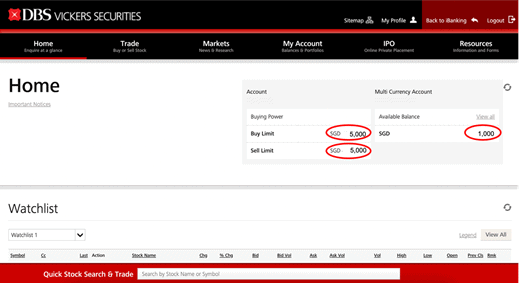

Step 2: Knowing your account balances and the amount available to trade

To make trades, we have to first know how much we have in our accounts. When you’ve entered into DBS Vickers securities, you’ll be greeted with this screen:

In this screen, you will be able to know your Buy / Sell limit as well as the amount you have in your Multi-Currency Account. You might be wondering how the buying and selling limit is set? It is determined by an algorithm that is highly dependent on the balance of your MCA account.

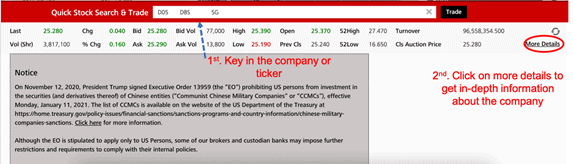

Step 3: Searching for companies

To search for potential companies to invest in, you can either key its name or ticker at the red bar found at the bottom of the screen.

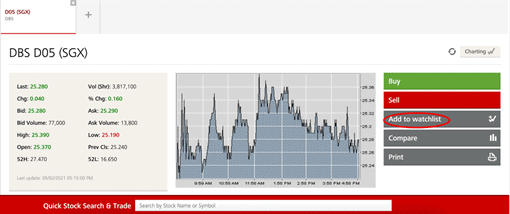

Step 4: Creating your watchlist

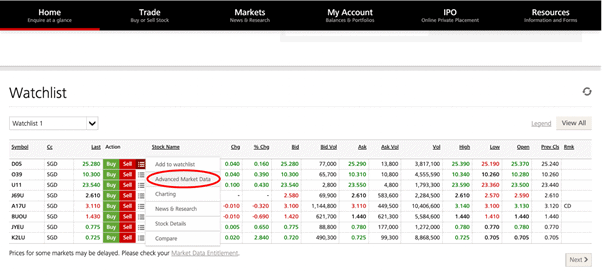

Upon clicking on “more details”, you’ll be able to look at the price and volume of the share. The picture below is the screen that you will see! If you’ve decided to track the share, add it to your watchlist for ease of reference. Once your watchlist is good to go, you will be able to find it on the main page after logging in.

Step 5: Looking at real-time trading volume and prices

Once you have successfully constructed your watchlist, you’re probably interested in the market price to place your buy order. To assist your decision-making process, wouldn’t it be good if we know the current trading volume and prices? Click on “Advanced Market Data”!

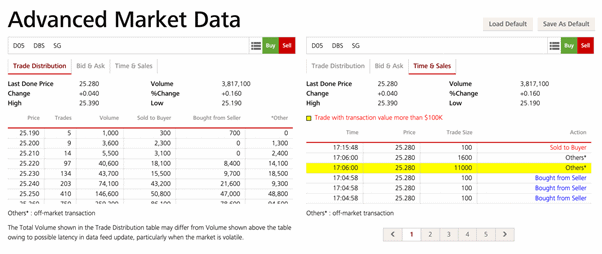

This is what advanced market data will show you:

“Trade distribution” shows you the distribution of transaction prices for the particular trading day. On the other hand, “Time & Sales” shows you the latest transaction prices at a particular point in time.

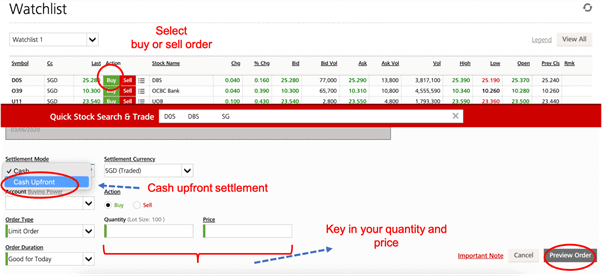

Step 6: Making buy or sell order

Once you’ve decided to go ahead with investing in a firm, it is finally time to proceed with a buy order! Remember to select the cash upfront settlement while finalizing your trades!

By following these 6 simple steps, you should be able to navigate around the platform with ease!

My thoughts of DBS Vickers – Cash upfront

After using the platform for over a year, I’ve summarized what I like about it and the potential room for improvement.

Positive Experiences

Overall, I find the interface pretty intuitive and once you get a hang of it it’s quite easy to use. Further, their server is very stable and at times of high volume, users are still able to log in to carry out trades. For example, there was a flash crash just last year before the US presidential election.

My friends using the cheaper brokerages were unable to log in due to high volume and held heavy losses throughout the day! While enjoying these perks of using DBS Vickers, the final icing on the cake would be the low minimum fee per trade!

Room for improvements

This trading platform isn’t ideal for the overseas market due to high costs and undesirable FX spread. Further, the mobile version of DBS Vickers is not user friendly. With other brokerage firms focusing on their mobile platforms, DBS is miles behind them. This is something that they can work on to improve the user experience.

Thoughts of the trading landscape

Over the years, we’ve seen an influx of fintech firms expanding and gaining a foothold in our local market. The likes Tiger Brokers, IBKR, and Saxo has been shaking up the trading scene. On top of low brokerage fees and good FX rates, they provide access to the overseas market for a cost of only 2USD per trade or even lower!

Tiger Brokers

A fintech brokerage company backed by Xiaomi, Tiger Brokers allows Singaporean investors to start investing in SG, HK, CH, US markets at an extremely low cost

Personally, I believe that it might be a matter of time before investors begin to flock over to these providers even for local trades. It’ll be interesting to see if traditional players like DBS would lower their charges to compete with them. No matter what, the competition will always be good for consumers and we’ll stand to win with greater market access and lower costs!

FAQs that you might have with DBS Cash upfront

Q1. If I purchase my shares via Cash upfront, can I sell my shares on the same day before the settlement date?

Ans: As long as your orders are filled, you will be able to sell your shares on the same day!

Q2. Am I able to see the bid-ask spread?

Ans: You have to hit a monthly commission of $200 to be able to see the bid-ask spread!

Q3. What if I press “sell contra” instead of just selling the shares?

Ans: As long as you own the shares before selling, selling on either option is fine.

Q4. Despite enabling cash upfront, I can’t seem to find the “Cash upfront option while trading”?

Ans: Enter DBS Vickers through your ibanking! It’ll work afterward.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

6 thoughts on “DBS Vickers – Should you be trading using this brokerage account?”

Thanks for sharing this. Over the past couple of months, I went in deep with Tiger Brokers, investing in quite a few S-REITs using them. I’m now beginning to regret this decision, for mostly the same reasons as you highlighted above. I’m now contemplating whether an exit strategy might be in order.

Kevin, do you care to elaborate what are the main issues with Tiger Brokers you are facing?

To be fair to them, it’s nothing really serious, and very touchy-feely impressionistic.

Even though I have been investing for rather a few years now, I don’t actually trade very often, and so I still feel like a relative newbie. Tiger’s UI makes me feel like it would be very easy to make some kind of mistake, and if that happens, their email communications, the design of their website, the design of their app, does not inspire confidence in me that they will respond to enquiries and requests for assistance promptly, especially not in English (which perhaps is fair enough).

Their super low fees seem a bit too good to be true. I wonder how much of it is sustainable, and how much I’m going to be locked in later if/when they change their fees, their terms of service, etc. I’m sure there are explanations for how such low fees can work, and I’ve read a few of those explanations, although i don’t know which ones apply specifically to Tiger. It’s not enough to make me want to stop using the platform right away, but it does make me a bit uneasy.

And then you bring up the point about the benefits of having your shares held in CDP, which makes a lot of sense to me, especially with REITs, right?

How Tiger makes money is typically through providing you with leverage on your account. So not so much from commission charges but the margin levied if you so decide to buy more shares than your actual cash account value.

There are also other products such as futures etc there is mainly using leverage that they make money from.

Yes, there are some benefits of shares being held in your CDP as indicated in the article.

Could you comment on custody fees charged by Vickers, in comparison to other brokers, for non-SG exchange tickers?

I think for Vickers it is SGD 2/month/counter (unless trading more than a few times per quarter).

not sure about others.

Yes there is a custody fee for those stocks as you mentioned $2/counter/month, waived if there are at least 2 transactions in a month or 6 transactions in a quarter. Capped of max $150