Table of Contents

Companies with Highest Profit Margins

In every well-run business, profit margins matter. Profit margin is the percentage that a company generates in profits for every dollar of revenue.

Profit margin = Profit / Revenue

Take for example, a company that can earn $20 in profit for $100 of sales will have a profit margin of $20/$100 = 20%.

Now, some of you might be wondering, is there a “magical figure” that dictates profit margin excellence in a company?

Unfortunately, judging if a company’s profit margin is good might be rather subjective and could also differ from industry to industry.

Take, for example, a company operating in the software system industry with a 20% profit margin that might be seen as average to mediocre, perhaps. However, that 20% figure, when generated by a company operating in the wholesale industry, is almost “too good to be true”.

One will also need to define the meaning of profit margin here. The three key profit margins are 1) Gross margins, 2) Operating margins, and 3) Net Margins

Comparing Company A’s gross margins vs. Company B’s net margins will also result in an erroneous conclusion.

In this article, I will look to highlight some of the companies with highest profit margins, in terms of gross, operating, and net.

Which are the best of the best?

Highest Gross Margin Companies

When evaluating the “profitability” of a certain group of stocks, the street typically compares their gross margins.

This is particularly relevant for stocks that are operationally loss-making (hence no operating and net profit).

Hypergrowth stocks with a focus on top-line growth, regardless of how much “red” it generates on the bottom line, are often evaluated based on gross margins. And many of these loss-making entities have got fantastic gross margins to boast of.

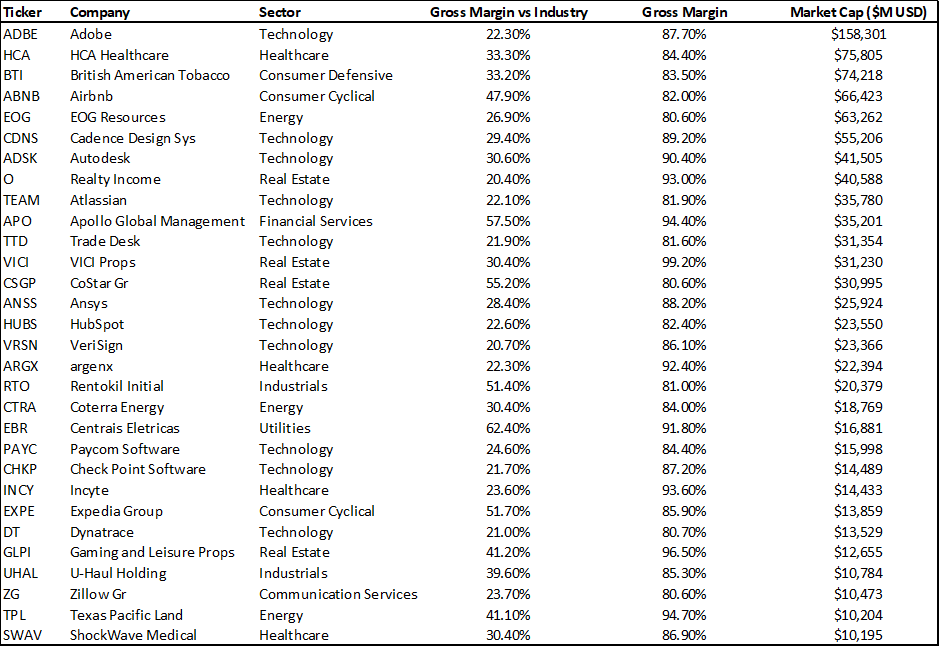

The table below shows some of the stocks with not just the highest gross margins, but their gross margins are also significantly above the industry’s average.

Here are the screening parameters using the Stock Rover screener:

- Market cap > USD$10bn

- Gross Margin > 80%

- Gross Margin vs. Industry average > 20%

For criterion #3, we subtract the company’s gross margin from the industry average gross margin to see the excess margins and only select those where the excess margin is greater than 20%.

As mentioned earlier, it is more relevant to compare a high-margin business vs. its industry peers.

Here is a list of high gross margin companies whose margin is also significantly superior vs. industry peers.

The largest market cap stock in this list is Adobe (ADBE), with a gross margin of 87.7% and an excess gross margin of 22.3% when compared to industry peers.

The smallest market cap stock in this list is Shockwave Medical (SWAV).

Highest operating margin companies

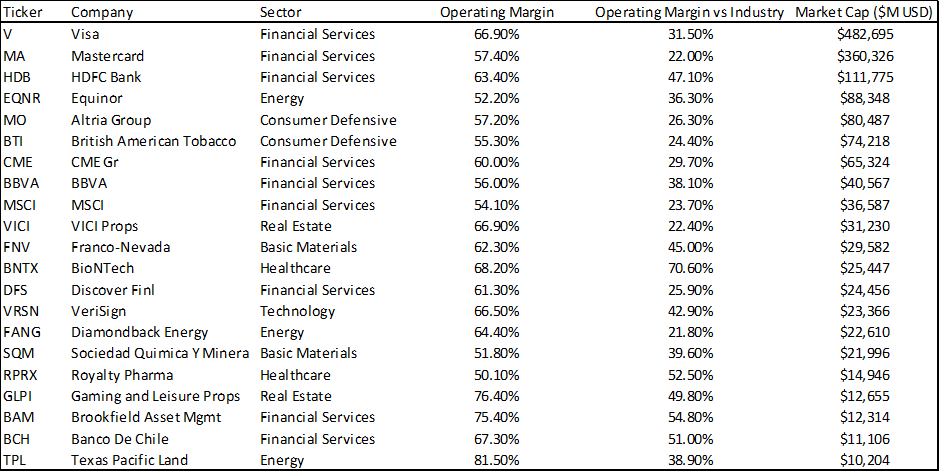

Now, how might this list differ when we compare the highest operating margin companies instead?

Using operating margins as a comparison tool vs. gross margins is more useful in my opinion, but such a metric would likely exclude high-growth but operationally loss-making companies.

Using the below screening parameters:

- Market cap > USD$10bn

- Operating margin > 40%

- Operating margin vs. industry average > 20%

I derive a new list of high-operating margin companies as illustrated in the table below.

While Visa and Mastercard might not be the largest-cap companies with the highest gross margins, they are one of the highest operating margin companies in the world.

As can be seen, there are many financial services companies on this list.

Highest net margin companies

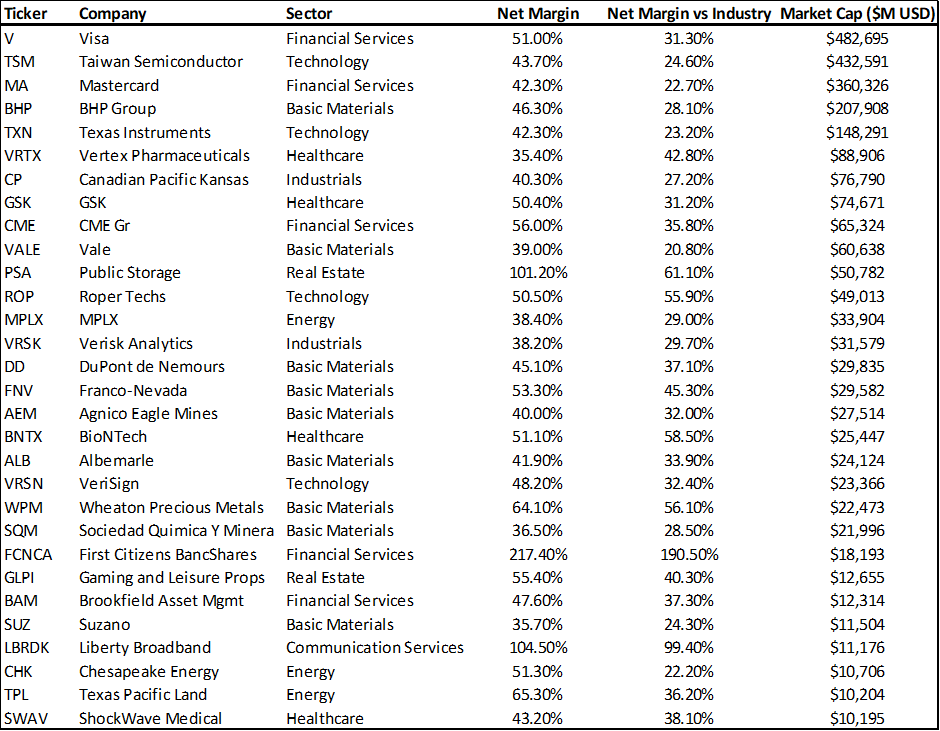

Finally, we come to sieving out companies with the highest margins from a net profit basis, which can be seen as the most important profit margin figure.

Using the below screening parameters:

- Market cap > USD$10bn

- Net margin > 35%

- Net margin vs. industry average > 20%

Here is the list of the highest net margin companies that fit the parameters.

Visa is the largest cap stock in this list, with Taiwan Semiconductor also an entity with one of the highest net margins in the world.

It is interesting to note that there are some companies with a net margin figure that is lower than the industry’s figure.

This will imply that the average company in that industry is loss-making.

Take for example, Vertex Pharmaceuticals (VRTX) has a net margin of 35.40% while the difference between its net margin and the industry average is 42.8%.

This will imply that the typical average pharma company is loss-making, with net margin losses of around -7.4%

Best high-margin companies

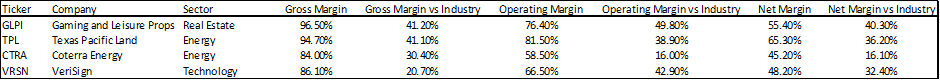

Are there any companies that fulfill all the parameters set up for gross, operating, and net margins?

There are just 4 companies or just 0.2% of the US stock universe that fulfill the following financial parameters:

- Market cap > USD$10bn

- Gross Margin > 80%

- Operating Margin > 40%

- Profit margin > 35%

- Gross, Operating & Net margin vs. industry average > 20%

These high-profit margin stocks might make for good long-term holdings.

However, this might not be the best way to screen for WINNING high-margin stocks as setting a criterion, for example, requiring gross profit > 80%, might be extremely restrictive.

Instead, we want to be able to identify companies that have excess margins vs. their industry peers. This might be a more relevant way to screen for winning high-margin stocks.

Hence, by focusing on the following parameters:

- Gross margin vs. industry average > 20%

- Operating margin vs. industry average > 20%

- Net margin vs. industry average > 20%

We might be able to get a better list of winning high-margin stocks.

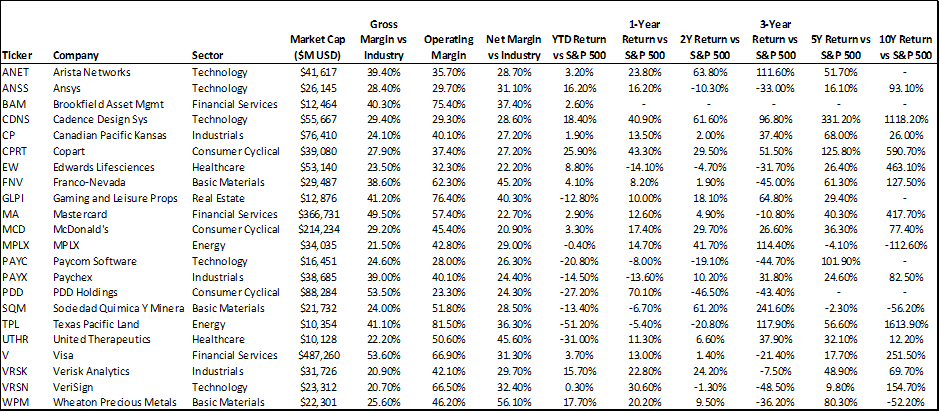

The list below is of stocks with excess margins vs. their industry peers.

There are many familiar names in this list of blue-chip high-profit margin stocks.

Most of these companies have been significant outperformers vs. the S&P 500 over the past 10 years, except for 3 materials/energy stocks.

While there is no guarantee that these high-profit margin stocks can continue to outperform the broader market over the coming decade, it might be a simple strategy for a long-term investor to adopt.

Among this list of the highest profit margin stocks, there are a handful of names that are also Alpha Blueprint candidates.

Selecting Winning Stocks the Easy Way – Alpha Blueprint Stocks

High-profit margin stocks such as Paycom Software (PAYC), Paychex (PAYX), Texas Pacific Land (TPL), Visa (V), etc are also stocks that fit the stringent profile I set for my alpha blueprint counters.

These are stocks that have some of the most robust fundamentals you can expect in a stock. They are also often market leaders in their respective industries and have excellent operational efficiencies, which create a strong “moat” around their operations.

For readers who are interested in screening for such stocks (THE RIGHT STOCKS) and knowing exactly when to invest in the (THE RIGHT TIME), do click on the button below to read more about what exactly are alpha blueprint stocks and how you can start investing in them immediately!