Checklist – Property Hotspot in Singapore

Here is a checklist of the top 6 points to identifying a potential property hotspot in Singapore.

- Areas being spotlighted in the Master Plan’s Region Highlights

- New hubs

- Enhancement in connectivity

- New amenities in the area

- New recreational spaces

- Ample new residential development launches in the area

Let’s take a look in detail for each point.

This is a post written by Farrand Hey which is reshared with his permission. I believe the article is useful for NAOF readers who might be interested in doing a little research on where the next property hotspot might be so as to make a better property purchasing decision.

I have also added additional content on some of the newest condos in areas that are identified as potential beneficiaries due to demand coming from HDB upgraders in the region + being in a growth hotspot region. Look out for it at the end of the article.

1. Areas being spotlighted in the Master Plan’s Regional Highlights

The starting point for any savvy Singapore property investor is to scrutinise the URA Master Plan.

This is the developmental plan that is created by Singapore’s urban planning authority – the Urban Redevelopment Authority (URA) – to guide Singapore’s development in the medium term over the next 10 to 15 years.

This means we can catch a glimpse of future developments that will potentially determine the value of properties and our quality of life going forward.

In this article, we are looking at this section of the URA website called Regional Highlights. There are five regions listed on URA’s website, namely, the East Region, North-East Region, North Region, West Region and the Central Region.

Hints of where future hotspots will be are rather prominently highlighted in the various region’s webpage. Take, for example, the East Region. Bayshore is noticeably featured with exciting new plans. Also mentioned were Tampines, Bedok, and Pasir Ris, with incremental improvements.

Another notable mention would be the Central Region, in particular, the Bukit Timah vicinity. Some of the exciting future plans we can look forward to in this locale includes Holland Plain, Bukit Timah Community Building, Botanical Gardens Gallop Extension, Bukit Timah-Rochor Green Walk, and the Integrated Transport Hub at Beauty World.

In addition, the Jurong Lake District in the West Region deserves a mention. Although this region started making the news as early as 2012, it is worthwhile to note that the Jurong Lake District is a major endeavor by the government. It even has its own website.

In the regional highlight, Jurong Innovation District, Jurong Canal Drive Extension, J-Walk, Tengah Town and Jurong Lake Gardens are highlighted. Although distinct, they seem to be interconnected in their planning.

Finally, it is worth noting that the Central Region includes CCR and RCR. Two of the three often used region classification when discussing residential properties location. Where CCR stands for Core Central Region and RCR refers to Rest of Central Region.

While the Master Plan other regions are all lumped under OCR, or Outside Central Region.

2. New hubs

In Singapore, we are infatuated with hubs. We strive to be the air hub to the world. We are well known as a shipping hub, a financial hub and a business hub. I think you get the picture.

Similarly, the government is replicating this hub concept to our towns.

Integrated Transport Hubs

Earlier, public transportation consisted of just buses. The central point where commuters could change to other buses were called interchanges. Then came mass rapid transit (MRT). With it came the relocation of bus interchanges so that commuters can transit seamlessly between the two modes of transport.

We have come a long way since those early days, but if you want an idea of what it was like, only Yio Chu Kang and Eunos remain archetypal.

Many of the current ones have a shopping mall and private residential attached. Having a mall brings greater convenience and comfort for commuters to shop and eat during their transit. This latest evolution gave rise to the term – integrated transport hub (ITH).

Here is a list of ITH present and future.

Past experiences tell us when the government upgrades or announces a new ITH, the surrounding properties will experience a boost in their attractiveness. Current hotspot for a new ITH is Beauty World.

Business Hubs

Another plus in the checklist is a Business Hub or Regional Centre. The urban planners have embarked on decentralization of the central business district as early as 1991. By creating three regional centres, one in the North, East and West.

These were simply named as Woodlands Regional Centre, Tampines Regional Centre and Jurong Regional Centre. Tampines was the first to take shape in 1992. And following its success, Jurong and Woodlands were developed in 2008 and 2014 respectively.

There are also sub-regional centres, although not formally named as such. They are Marine Parade, Paya Lebar, Serangoon, Bishan and Bouna Vista. Some of the current property hotspots arising from the business hub effect are Punggol Digital District, Woodlands, Jurong Lake District and Paya Lebar Quarter (PLQ).

Significant Landmark Buildings

Lastly, what I term as significant buildings or landmark buildings like Our Tampines Hub, Jewel, Singapore Science Centre, Jurong Lake Garden or Singapore Sports Hub will also enhance the nearby property value.

As these buildings serve to enhance the lifestyle of the residents by providing a one-stop location for their daily needs and their leisure.

Our Tampines Hub is a good case in point. Originally, it was a just sports complex with sporting facilities like a track, a field, a swimming pool, and a gym. Currently, however, it has consolidated the nearby library and added a community club, a hawker center, and retail shops.

Such buildings give rise to meaningful community engagement, enriching residents with multiple activities and enabling them to build a sense of ownership in the community.

3. Enhancement in connectivity

Properties in the core central area often command a higher price, be that of a town, a city or country. One of the main reasons is convenience. Central areas tend to have the most developed transportation networks.

Thus, when plans are announced to improve transportation. Either in the form of new roads or through road widening. Or by adding new bus services, or a new train line, all these will serve to boost property values.

Of late, much of such enhancement in connectivity focused on reducing the reliance on the car and also the improvement for the last-mile journey. Thus we see numerous announcements of cycling paths and numerous covered walkways being built.

Do check out the Convenient and Sustainable Mobility theme from URA’s website to gain a deeper insight into what is in store for us in the future.

One notable feature is the implementation of Transit Priority Corridor (TPC). This aims to enhance the travel experience by public transport and the pedestrian environment. After initiating this on a smaller scale in Bencoolen Street, the next major undertaking would be the North-South Corridor.

It will run seamlessly from Woodlands to the central business district for an amazing length of 21.5 km! This will become Singapore’s first integrated transport corridor when it is completed in 2026. Featuring continuous bus and cycling lanes.

Also, watch out for new bus interchanges or MRT stations being added. A past example would be the Canberra MRT station. This station was added to an existing mature train line, but it brought a good measure of lift to the prices of the surrounding properties.

It bears repeating here although many are familiar with the so-called “MRT effect”. Once a station’s location is announced, the surrounding properties will experience a rise in its price. And when the construction of the station is complete, it will again appreciate some more.

But not all stations are the same. Of course, those closer to the central region will be more sought after. Take the announcement of the Downtown Line as an illustration.

Yet another important factor is the connectivity of the station. When the Cross Island Line (CRL) was announced, many were excitedly watching where the hotspots will be. Interest was revived for properties launched prior to the announcement of Hougang and Serangoon North stations. Stay tuned here for updates on the hotspots when the western half or phase 2 of this line is revealed.

4. New amenities in the area

Sticking with the convenience theme. We all love to live in a particular location because it has all our favorite hangouts. We get to go about our daily lives effortlessly, like grocery shopping, having our favorite meals, or taking our child to the doctors.

That is why mature housing estates, with a plethora of amenities, are the most sought-after. More businesses would have established there, offering a myriad of services that even residents from other towns will travel just to patronize.

We also prefer to have these amenities located in a single location or if not, at least, in close proximity. Therefore, we see ITHs with larger and larger malls offering huge hyper marts and even housing other amenities like public libraries, childcare centers, and even polyclinics or hospitals are so much in favor these days.

Let’s take a look at the Jurong East ITH as an example. There we have 5 malls, namely, Westgate, JEM, J Cube, IMM and Big Box. There is even a cinema that runs midnight shows, and as far as I know, the only one outside of Orchard Road that has it.

These buildings are rather seamlessly connected by an elevated pedestrian walkway known as J-Walk, pedestrians can walk from one building to another in comfort. Also connected by J-Walk are office buildings like Vision Exchange, JTC Summit, JEM, Westgate and the International Business Park.

Other buildings in this network are the Genting Hotel, Ng Teng Fong General Hospital, Jurong Regional Library and the only private residential building within a 5-minute radius, J Gateway.

One of the most recent ITHs that is keenly watched is the one at Bidadari. The first batch of Built-to-Order (BTO) HDBs in that area was launched at the end of 2015. Residents have started moving in a year or two ago.

The prices then were averagely half a million dollars for a 4-room flat and as high as $681,000 for a 5-room flat!

And how about private properties? There is one private condominium, Avon Park, that almost exactly coincided with the history of the MRT. This condo was completed in 1991, and while the North-East Line was first mooted as early as 1986.

Nonetheless, the earliest transaction prices I had dates back to 1995. Then the average transaction prices were between $530psf to $650psf. Although this MRT line opened in June of 2003. Woodleigh MRT station, which this condo, merely steps away, remained unopened!

This led to a public outcry and calls of this and Buangkok MRT stations as “White Elephants”.

Woodleigh was finally opened on 20 June 2011, 8 years after the line started operations. Although there was a huge price boom thereafter, much of it could also be attributed to the sharp recovery after the Global Financial Crisis. Prices of the private condos there hit an all-time high of $2,331psf in May of 2019. While Avon Park achieved an all-time high of $1,470psf just in April during the Circuit Breaker lockdown!

Seeing this chart and also recognising Bidadari as a potential hotspot, if you were to choose among these three condos that are at Woodleigh MRT, which would you choose?

5. New recreational spaces

Possibly ranking slightly below amenities would be new recreational spaces. But then, with an increasingly sophisticated lifestyle demanded by today’s consumer. This could be the differentiating factor when almost all towns and regions are so well catered to in terms of amenities.

So, what are recreational spaces? These are parks, playgrounds, malls, lifestyle establishments, and even tourist attractions?

Parks and green spaces are increasingly sought after as urbanization is creating denser and denser living spaces. Moreover, the demand for a biophilic lifestyle that is close to nature that promotes wellness is ever more important in this stressful modern life.

We are seeing consumers paying top dollar for units that are facing greenery or projects that are located beside parks.

A case in point would be the ever-popular East Coast Park. Properties along the East Coast Expressway (ECP), which runs parallel to the park, are highly sought-after. This is despite most of those facing the park also faces the expressway and being exposed to the road noise.

Another favourite is the Bukit Timah residential enclave. At Bukit Timah, you also have nature trails that link you to other nature reserves like the Dairy Farm Nature Park, Bukit Batok Nature Park and the Rifle Range Nature Park. And if your legs are strong, you could even hike all the way to MacRitchie Reservoir Park and the Peirce Reservoir Parks!

Sticking with Bukit Timah, let’s look at some examples of lifestyle establishments that are highly cherished by their residents.

The row of eateries along Cheong Chin Nam Road may not be as famous as Holland Village or Serangoon Gardens, but it does have its fans and they travel from all around Singapore just to taste the food served along this bustling street. Yet another lifestyle venue is The Grandstand. Here you are able to engage in all manner of sports and interesting activities like axe throwing.

Some of these interesting amenities and recreational activities are detailed in the condo reviews from the Mr Bukit Timah website.

6. Ample new residential development launches in the area

This is a point that is occasionally overlooked by less seasoned property hunters. To most people, they fear the multitude of new launches that seem to beset their neighbourhood. Raising the supply and dampening the prices.

However, this is conversely true. Of course, the caveat here is that there must not be a genuine oversupply that far exceeds the population and economic growth.

New launches tend to bring rejuvenation and attention back to once stagnant markets. This is because when there is a new development being launched for sale, there is much hype and interest drummed up during the marketing phase.

This casts the spotlight towards the location of this new development and in turn, will cause home seekers to pay attention to what is on offer in the secondary market too. In the following phase of the actual launch for sale, prices will be revealed and this will also spur homeowners in the surrounding areas to adjust their price upwards.

Lastly, when the sales are clocked in, that would give an indication to property hunters sitting on the fence the confidence to commit when they were once just waiting and observing.

And when there is a succession of new launches, very similar to what happened in Tampines for properties such as The Tropica, Waterview, Q Bay, The Santorini, The Alps Residences and the most recent, The Tapestry. We see progressively higher and higher prices.

The keyword here is progressive. If the launches are not staggered, there might be a short-term oversupply and that will depress prices. Or if the project is massive, say about 1500 units, then in the short term, price appreciation might be challenging especially in this current climate.

HDB Upgraders + Growth Hotspot = Winning Combination?

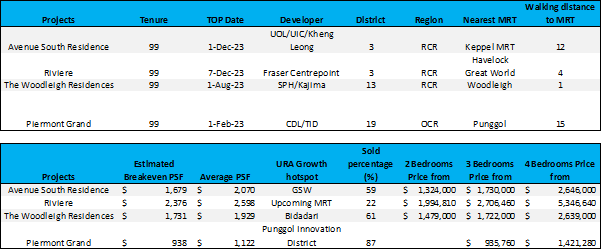

NAOF: The good people over at Navis have compiled a list of recent condo launches (yet to TOP) that might be beneficiaries from a pool of HDB upgraders in the region plus the fact that they are situating in a growth hotspot region as well.

The below 4 properties highlighted are just a small subset of the new launch Condos/ECs that might see strong demand.

Conclusion

If you identify a place that fulfills all six of the above points, it is highly likely that you would have identified a property hotspot. Good luck and wish you the best in your property hunt!

If you find the above article informative and wish to have Farrand review your existing situation and highlight some of the potential growth hotspot for your next property purchase consideration, do fill out the short questionnaire below and we will get in touch with you as soon as possible.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- HPS Singapore: Why pre-paying your home loan in 2021 is a mistake with Home Protection Scheme in place

- Upgrading From HDB Flat To Condo in 2021: Buy First or Sell First?

- Singapore Property: JP Morgan says a fall of 10% is likely. To buy or not to buy now?

- 12 Tips To Select A Good Unit At A New Launch Project

- The average salary in Singapore 2021: Can you afford a condo with your income?

- ABSD Singapore: Methods to Beat ABSD and Own Multiple Properties in 2021 (Updated)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.