Bitcoin prediction: 2017 vs 2020

Bitcoin seems to be getting a resurgence in interest of late. One might recall the asset class spectacular rise back in 2017, followed by an equally dramatic collapse in its price shortly after. Is the digital currency rise this time around any different? At the start of the year, I wrote about why Bitcoin might prosper in 2020. So far, that bitcoin prediction is going well.

Bitcoin’s phenomenal rise in 2017 was proclaimed as a bubble by naysayers and they were ultimately proven right. The speed at which the bitcoin bubble ramped up in late-2017 was really a sight to behold as we have never seen anything as “widely followed” and as “bubblish” in the current information age.

I recalled I was in my hotel room preparing for a meeting and instead of focusing on the work at hand, my eyes were glued to the Bloomberg TV screen as the commentator relished about the rise in Bitcoin prices while I quietly “cursed” myself for not being in the party and not able to do anything about it due to “work commitments and compliance issues”.

The subsequent crash, where Bitcoin prices collapsed more than 80% in the aftermath of the bubble, saw skeptics proclaiming “I told you so. This is just like the Tulip bubble of 1637?”

Post its spectacular crash back in 2017, I have since opened a bitcoin account and place a small percentage of my portfolio in this digital currency. Do I have absolute certainty of what will happen with bitcoin or cryptocurrencies in general over the coming decade? No.

Do I think its rise this time round is on much better footing as compared to 2017? Yes.

Here are 5 reasons why I believe Bitcoin’s rise this time round might be more sustainable vs. 2017.

Reason #1: Less retail, more institutional

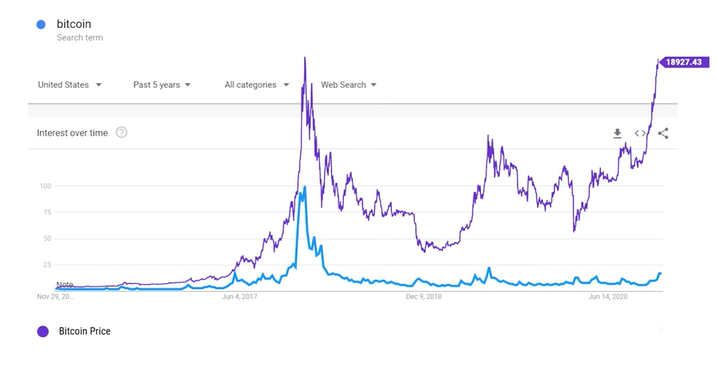

The chart above maps the Bitcoin price (purple) vs. the Bitcoin google search term (blue) and you can see that the dramatic rise in bitcoin prices in 2017 was followed by an equally dramatic rise in interest (based on google search) in the digital currency by retail investors.

And this crowd can be extremely fickle. They are there for the quick gains and the moment Bitcoin shows any form of price weakness, these guys will be clamoring for the exit and that is exactly what they did.

This time around you can see that the rise in interest is more muted. It could be because many retail investors have been badly burnt by the dramatic collapse in bitcoin and hence “sworn” to never be involved in this bubble again.

So who is buying Bitcoin this time around? The big money, not the Ferrari-obsessed millennials have been the ones driving the recent rally. Long established billionaires and public companies are also holding Bitcoin now and are discussing it publicly.

In August, Business analytics firm MicroStrategy announced that it had invested $250 million in Bitcoin, purchasing 21,454 Bitcoin as part of a capital allocation strategy.

These investors are willing to accept Bitcoin’s volatility. To them, Bitcoin serves as an inflation hedge due to monetary debasement brought on the Fed’s easy money policies (more on that later). That gives institutional credibility and reveals the increasing acceptance of Bitcoin as a hedge against currency devaluation.

It is not just the institutions that are buying (Square and Paypal are highlighted as the new whales in the crypto market). Governments and government-linked entities are joining the bitcoin party as well with the rise of central-bank digital currencies or CBDCs. We see China’s ambitions to launch a digital yuan and here in Singapore, we see our very own DBS bank creating buzz with its plan for a cryptocurrency exchange.

The involvement of institutional players this time around, instead of purely the man-in-the-street helps add credibility to Bitcoin’s rise.

Reason #2: Currency debasement

Amid COVID-19 which has indeed devastated global economies in 2020, governments all over the world have started their printing presses, magically creating billions if not trillions of dollars “out of thin air”. The US is leading this race of monetary debasement with its easy-money policies that have resulted in trillions of dollars being “printed” thus far, a necessary evil to stimulate its economy.

It is not just the US but central banks all around the world are unlikely to change their accommodative stance in the near to medium term as it will take time for a vaccine deployment and a pick-up in growth, inflation, and labor market.

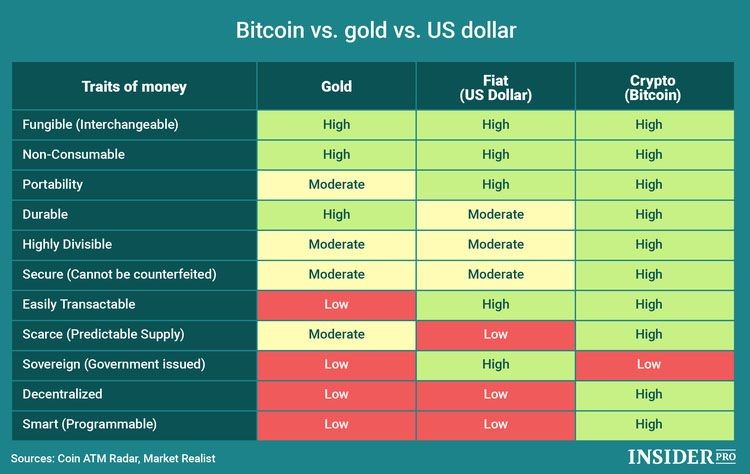

Traditionally, Gold tends to be the major beneficiary in such a scenario since you can’t “print gold”, an asset that is finite in amount although strong gold prices will incentivize gold miners to “dig for gold” more aggressively.

There is now another alternative to gold in such a scenario. Bitcoin.

The supply of Bitcoin is currently kept at 21m bitcoins that can be mined in total. Once bitcoin miners have unlocked all the bitcoins, the planet’s supply will essentially be tapped out. The current supply of bitcoin is estimated to be at 18.5m today (after 10 years of mining). This means that only 2.5m is left to be mined.

However, that does not mean that these 3m bitcoins will be mined within 1-2 years. It will take another 120 years to mine the remaining 2.5m bitcoins due to Bitcoin halving.

We will not be talking about that the bitcoin halving phenomenon in this article but just to highlight that unlike fiat currency where governments can simply turn on the printing press, bitcoin’s supply is finite as of now until someone changes the 21m cap. Satoshi perhaps?

In 2017, there was no need for accommodative policies by the Fed. In 2020, things are very much different, all thanks or no thanks to COVID-19. The printing press will have to continue to chug along and this will only incentivize investors to look at alternative assets to hedge against inflation and currency debasement.

Reason #3: Easier access to bitcoins

Investing in bitcoins can be a complicated process, something which I will blog more about in the future.

However, cryptocurrency investing/trading is now made easier with the introduction of fintech players like Robinhood which allows the man-in-the-street to invest in bitcoins easily through their Robo advisory platform which is gaining traction from millennials due to their zero-cost commission structure.

As more and more Robo advisors, as well as fintech brokerage firms, allows for the trading/investing of bitcoins directly on their platform without the need for your digital wallet or through a formal digital currency exchange, this will aid in providing easy access to retail investors.

While Robinhood allows one to invest/trade in bitcoins, it is the introduction of payment platforms such as Paypal and Square which allows the purchase of bitcoins and subsequently the payment of goods and services using bitcoins that will change the whole dynamics and value proposition of bitcoins (more of that in Reason 4).

In 2017, Paypal, Square, Robinhood, and all the other Robo Advisors are not in the cryptocurrency picture in a big way. For most people who wish to have access to bitcoins, it can be quite a tedious and complicated process.

One might need to transact in a crypto exchange such as Coinbase and having a separate wallet to store your cryptocurrency separately in 2017. Most bitcoin exchanges now provide bitcoin wallets for their users but may charge a fee for this service.

With so many crypto exchanges popping up, which might be the better one to go for? Some considerations will include the level of transaction fees being charged as well as the foreign exchange spreads. All this depends on how liquid the bitcoin exchange is.

The introduction of Paypal, Square, Robinhood, and likely more reputable payment/fintech firms ahead will aid in the overall purchase and ownership of bitcoins for the man-in-the-street.

Reason #4: Alternative form of payments

Some see bitcoin as just a “store of value”, similar to gold. For gold, you can buy physical chunks of it and keep it under your pillow and have sweet dreams every night that its price will skyrocket. That is all you can do.

You can’t eat it and you can’t use it for payment in a simple manner. So far, I don’t recall any shops that accept gold as payment besides your typical pawnshops?

The introduction of corporations such as PayPal and Square who allows their clients to transact using bitcoin currency is potentially revolutionizing traditional payments.

The usage of bitcoin as an alternate form of payment is like a chicken and egg scenario. Without merchants supporting or accepting bitcoin currencies in exchange for their products/services, there is little incentive for buyers to accumulate bitcoin for purchasing purposes.

Paypal and Square are making it easier for first-time buyers to purchase bitcoin through a mainstream app and subsequently transact with it. Starting in early 2021 PayPal’s 26 million merchants will be able to accept crypto as a payment method.

They are essentially creating new demand by taking down a barrier to entry as highlighted in Reason 3.

With Paypal and Square acting as intermediaries and providing easy access to buyers to get their hands on bitcoins, more merchants will likely sign up to accept bitcoin as one of their forms of payments.

Here are some of the more popular stores that accept bitcoins as a form of payment, according to this site.

There are also studies being made that merchants that accept bitcoin attract new customers and sales.

As demand increase for bitcoins, this will further incentivize merchants to offer payment through bitcoin as one of their mainstream payment solutions.

The cycle continues.

All this will not be made possible without intermediaries such as Paypal and Square providing easy access to their clients when it comes to bitcoin purchases. More and more financial and payment institutions are going to jump on this bandwagon ahead. That is not something prevalent in 2017?

The big questions, however, remain on the volatility of bitcoin. Is that something palatable for merchants who might have to accept wide swings in their margins if they accept bitcoin or cryptocurrency payments? This issue will be solved if their suppliers allow for the transaction in bitcoin.

Will we see the day that digital currency fully replaces the global fiat currencies?

Reason #5: Regulators coming on board

Investing in cryptocurrencies still has one major risk. The fact that governments and regulatory authorities can come in anytime to clamp down on the digital currencies.

However, the fact that there is more oversight in 2020 than there was in 2017 is a good thing for this asset class. It means that governments are increasingly receptive to such digital currency and are not planning to shut it down outright but will prefer them to be regulated in a proper manner that is beneficial to investors.

The European Union anti-money laundering rules now extend to crypto exchanges and US regulators also allow banks to offer cryptocurrency custodian services. In Singapore, DBS is planning to run its digital currency exchange for qualified investors once it receives regulatory approval.

These are all baby steps taken to ensure that crypto will ultimately become mainstream and becoming part of our everyday lives.

Even the most devout supporters, who wish nothing more than to see crypto succeed on a mass scale, could agree that the growth of this industry depends, in part, on the establishment of safe, fair, and reliable market conditions.

Regulation is not the process by which users are deprived of the liberties and benefits essential to cryptocurrency. Rather, it is a necessary condition by which they can be made available to everyone. We are seeing increasing regulations in 2020 vs. 2017 and that is not such a bad thing after all.

Conclusion

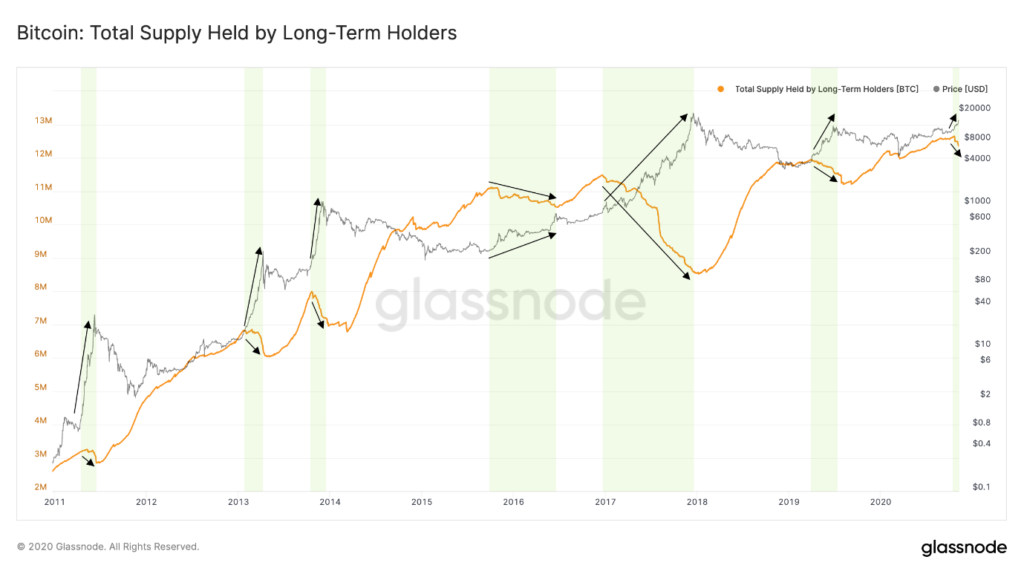

Let me end this article by showing a diagram by glassnode.

It shows the Long-term holder supply (LTH) vs. the price movement of bitcoin. Every time, there is a dip in LTH supply due to profit-taking from long-term holders, the share price of bitcoin tends to rally.

At the current moment, the LTH supply has started to decline – pointing to the early stages of a new bull market, a bitcoin prediction made by glassnode.

Is the current rally in 2020 going to end badly just like in 2017 or is this just a prelude to a possible stronger rally in 2021, you decide?

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Best commodity asset of the decade and why Bitcoin might prosper in 2020

- How to prepare for a bear market. A simple 3-steps process

- Thematic ETFs partaking in the hottest trends

- Top 5 analysts of the decade and their current favorite stocks

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.