Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

Best Seasonal Stocks to Buy for February

In our previous article, we highlighted the 4 best seasonal stocks to buy in January. The stocks highlighted were counters that have historically performed strongly in January, based on data collated over the past 10 years.

Those 4 stocks highlighted in the article were (YTD 2023 performance highlighted in bracket, as of 27 Jan):

- AngloGold Ashanti (+8.3%)

- Netflix (+23.7%)

- Global Partners (+10.12%)

- Joyy (+9.56%)

The best-performing counter in this list was Netflix, which surprised the street positively in its latest subscriber count.

With a few more days to the start of a new month, I will be highlighting the 4 best seasonal stocks to buy in February.

Best Seasonal Stocks to Buy in February #1: Digital Turbine (Ticker: APPS)

The company’s share price has been beaten down by more than 80%, since peaking at ~$90/share back in 2021. This company operates in the digital advertising space, a very challenging industry to be operating in 2022, to say the least, with advertising spending declining substantially (just take a look at Meta).

The bears highlight that the digital advertising space remains a very challenging and highly competitive one heading into 2023. The bulls point out that APPS continues to grow its business and more importantly, EBITDA margins even in a down market.

With the disconnect between its fundamental performance and share price, APPS’s share price might surprise positively in February 2023. This could be partly driven by the better-than-expected quarterly earnings announcement, which is slated for 14 February.

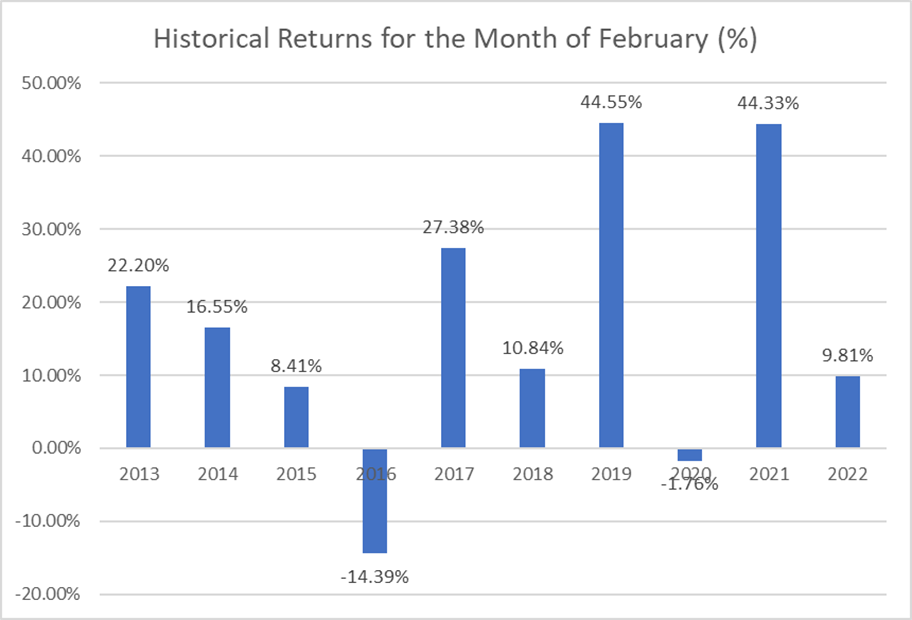

The company has a strong track record of outperformance in February, as seen from the chart below.

Over the past 10 years, the company has got an 80% success rate of a positive return in February, with the best returns amounting to more than 40% in February for 2019 and 2021.

Do note the elevated risk level associated with this counter, which remains a loss-making entity (it is profitable on an adjusted basis)

Best Seasonal Stocks to Buy in February #2: Criteo SA (Ticker: CRTO)

Yet another advertising firm, Criteo SA was founded and is headquartered in Paris. The company provides online display advertisements.

As mentioned earlier during our coverage of APPS, it has been a bad year for ad tech stocks. This industry can be loosely tracked with an ETF like the SmartETFs Advertising & Marketing Technology ETF, which was down more than 50% in 2022.

CRTO was down approx. 33% in 2022, outperforming its peers.

On a technical front, the company has just breached its 6 months high level, last seen back in September 2022, which might be interpreted as a positive momentum signal for the stock.

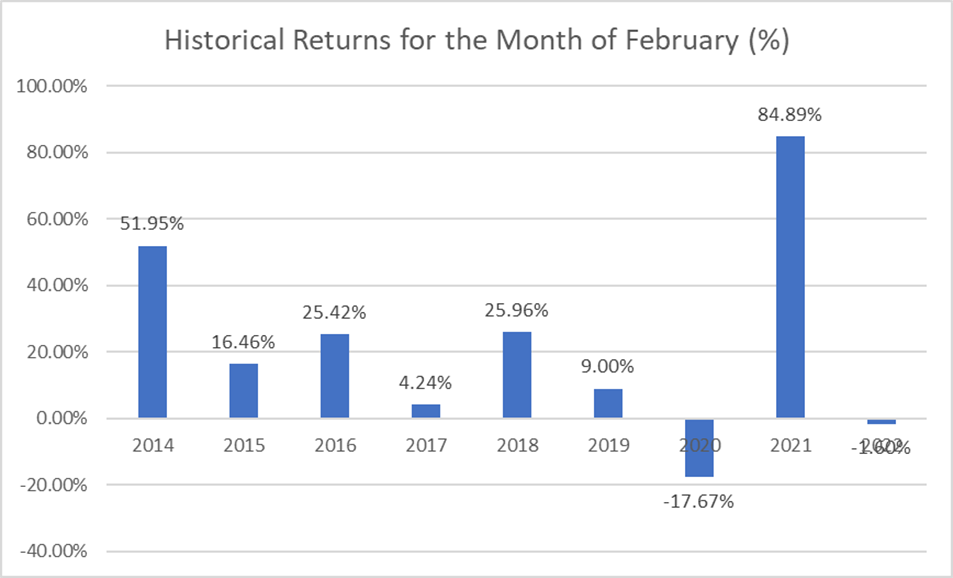

The company has done particularly well historically in February, with its share price appreciating by as much as 85% in Feb 2021 alone. However, that was characterized by a bullish year for ad tech companies.

Despite Feb 2022 being a much tougher year (the start of the bear market) in comparison to the year before, the drawdown in its share price has been a marginal -2%.

With the market starting 2023 on a bullish note, the upcoming February month might once again heap strong returns for CRTO.

Best Seasonal Stocks to Buy in February #3: Enphase Energy (ticker: ENPH)

Enphase Energy is a relatively more well-known company vs. the first 2 counters in our list. Sporting a relatively large market cap of $28bn, this company delivers smart, easy-to-use solutions that manage solar generation, storage, and communication on one platform.

While the company bucked the bearish trend in 2022, with its stock appreciating by 45% last year, the start of 2023 tells a different story, with the counter being THE worst-performing stock on a YTD basis in the S&P 500.

This makes buying into this stock at present a higher risk nature vs. both APPS and CRTO, based on current market sentiments for the counter.

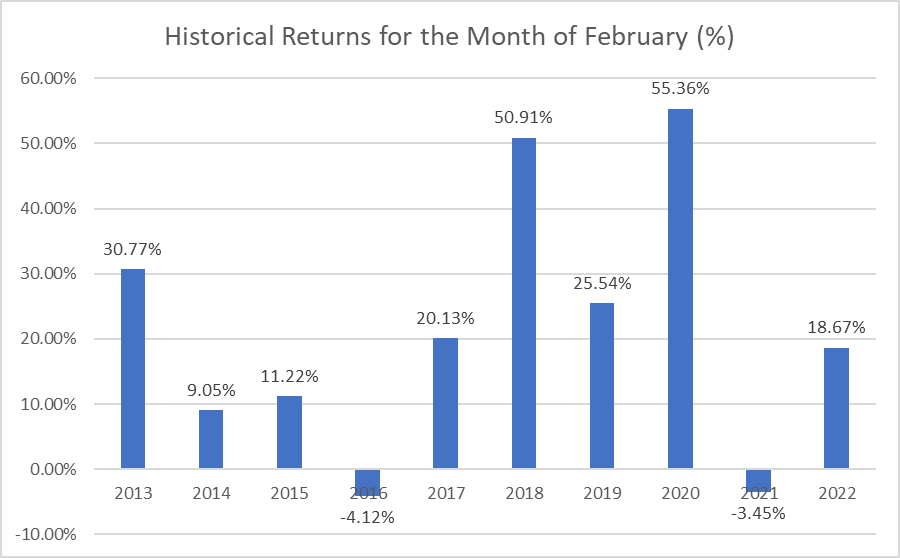

Nonetheless, February has historically been a very good month for ENPH. Not only has the counter generated positive returns 8 out of 10 times over the past decade, but the largest drawdown in a down year was also just -4%, making this trade a highly attractive one based on its Sharpe Ratio of 1.06

Best Seasonal Stocks to Buy in February #4: Zillow Group (ticker: ZG)

The last counter in our list with a seasonally strong February price performance is Zillow Group. ZG has seen a strong recovery in its share price in January, appreciating by 29% since the start of the year, making this counter our best-performing one, based on its momentum heading into February.

ZG is a tech-real estate marketplace company that was founded in 2006. The company offers solutions in four main categories: buying, selling, financing, and renting.

The company has a disastrous 2021 after shutting down its iBuying business, which sank investor confidence and months of restructuring.

A rising interest rate environment in 2022 also has not bode well for the US real estate market and consequently ZG’s operations last year.

However, homebuilder sentiment is on the rise for the first time in over a year as mortgage interest rates dropped in early 2023. That has likely led to an improvement in sentiment for real estate stocks such as ZG, as evident by the counter’s strong performance YTD 2023.

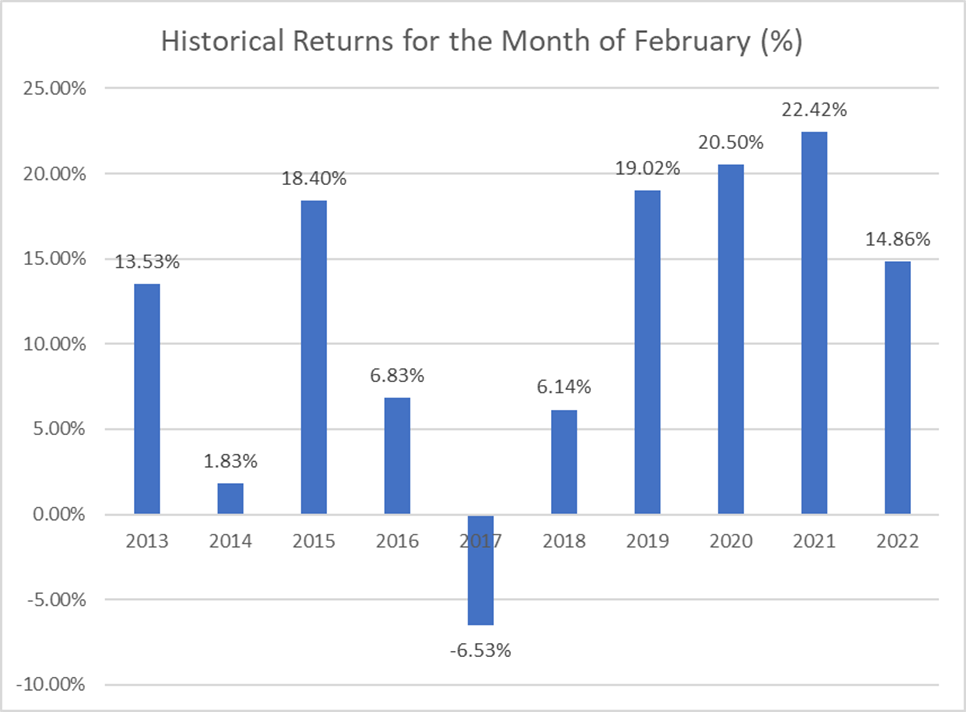

Among the stocks in our list, ZG boasts the best performance in February, with only a single down year for February over the past decade. Compared to its mean return of 11.7% in February, its largest drawdown (in 2017) amounts to -6.5%, making this trade the most attractive in terms of its Sharpe Ratio of 1.25.

This is a stock worth considering for a short-term trade in February. With investors’ sentiments and expectations near an all-time low for the counter, there is a good chance that the counter could surprise positively once again when it announces its quarterly results on 15 February.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for education and reference only.