Table of Contents

Oil Market in Turmoil?

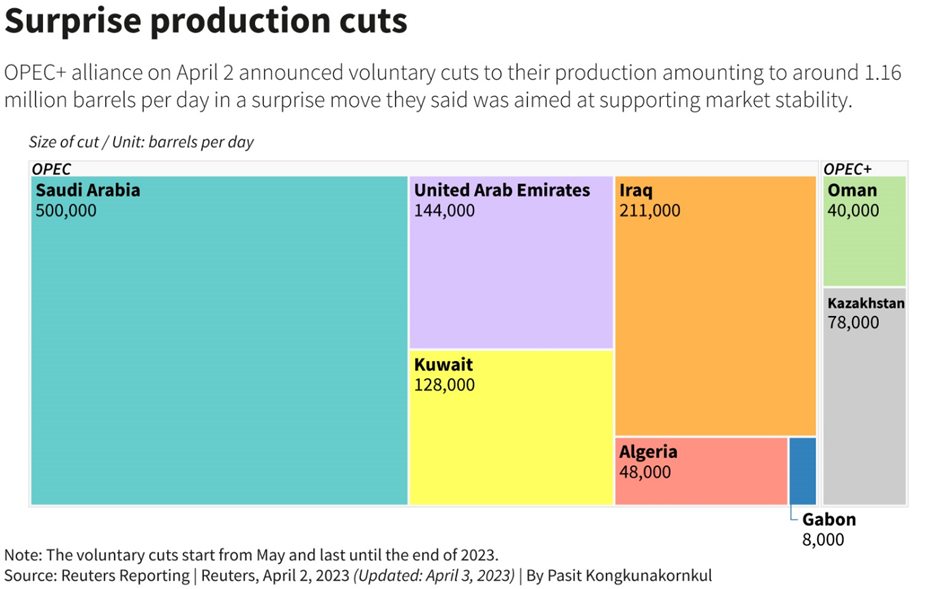

Is there going to be a skirmish between the US and OPEC+ over the latter’s decision to voluntarily cut a collective output of 1.16m barrels per day from May until the end of 2023?

We know that the oil market can be a volatile one. But the latest OPEC+ cut really took the world by surprise, sending shock waves through the market. Oil prices boasted their biggest daily gain over the past 1 year and the street is now calling for oil prices to head back to the $100/bbl major psychological barrier level once again.

A $100/bbl oil price will undoubtedly be a major boon for oil & gas stocks. In this article, I will be exploring which are the best O&G company stocks to buy now to position for an oil rebound.

Particularly, I will like to analyze which O&G company stocks performed the best in terms of their price appreciation when oil prices witnessed a strong bullish price momentum during certain periods over the past 5 years.

Besides knowing which are the best O&G company stocks that can act as a leverage play on oil prices, I will also like to share with my NAOF readers a strategy to market time the entry of these oil-related plays.

Finally, I touch on how I am personally looking to structure a trade on these O&G company stocks to minimize my overall risk exposure.

OPEC+ in direct conflict with the US?

It’s been well publicized that US President Biden is in favor of oil companies ramping up their production in a bid to reduce gasoline prices, a major factor contributing to rising inflation over the past 1.5 years.

The decision by OPEC+ to voluntarily cut output by 1.16m bbl/day, effective May 2023, just shortly after making a similar output cut of 2m bbl/day in Oct/Nov 2022, could be led by several factors:

- It could be a show of force to warn the West that they are no longer the major swing producer nation.

- An attempt to put a hard floor on oil prices. OPEC+ can and will likely initiate more output cuts if oil prices decline towards the $70/bbl level.

- Grow its revenue base, since OPEC+ nations remain highly dependent on oil resources for their income.

- Anticipating a drop in demand as a recession takes shape and hence this decision will help to cushion and pre-emptively limit the downside in oil prices.

- Show of support for Russia, perhaps as higher prices will likely spell more income for Moscow to fund its expensive war in Ukraine.

Well, the reality is that it could be a mixture of various reasons. Who knows? More importantly, what might be the impact on oil prices?

The street is now expecting oil prices to be pushed back to the key psychological level of $100/bbl. If so, that is going to be a party pooper for the US administration, where higher oil prices will likely counter their ongoing efforts to rein in inflation.

And the US has got no viable solution. For one, they are no longer the swing producers. A decade ago, US shale producers have been more than happy to ramp up oil and gas production to boost their revenue, amid rising oil prices.

Then the oil collapse came in 2016 and before the industry has had time to fully recover, COVID struck, and oil demand collapsed further.

Many of these shale producers find themselves in a tight credit position, having borrowed heavily to fund new production. With demand drying up and creditors knocking on their doors, many have since folded their operations.

The remaining survivors are now more focused on operational efficiency vs. chasing revenue growth. In addition, there are several handicaps that US shale producers are now facing. Limited equipment and workers, lack of capital, and increasing pressure from investors to return excess capital in the form of dividends etc are likely to limit their ability to respond to the latest OPEC+ cut.

With all that said and done, only time will tell if oil prices will indeed head back to $100/bbl and higher. Instead of waiting for that to happen, savvy investors will be looking to position themselves ahead of this price movement.

I am looking to do that in a 3-step process:

Step 1: Identify the oil & gas stocks most leveraged to oil prices

Step 2: Find the RIGHT oil & gas stock/s to buy at the RIGHT time

Step 3: Structure a trade that will minimize my risk exposure

I have done up a video for my students to explain these processes.

O&G Company Stocks most leveraged to oil prices

Pulling out the oil price chart, I identified 5 periods over the past 5-years where there was significant oil appreciation.

These periods lasted for typically 3-4 months.

Period 1: Dec 2018 to Apr 2019

Period 2: April 2020 to August 2020

Period 3: Nov 2020 to Mar 2021

Period 4: Aug 2021 to Nov 2021

Period 5: Dec 2021 to Mar 2022

The idea is to find some oil & gas companies that witnessed the largest price appreciation during these 5 periods.

I collated both the median and average price appreciation data of various oil & gas stocks. The table below shows the results (in % of price appreciation over the stated period)

| Stock Ticker | Period 1 | Period 2 | Period 3 | Period 4 | Period 5 | Median | Average |

|---|---|---|---|---|---|---|---|

| HAL | 17 | 112 | 102 | 34 | 67 | 67 | 66 |

| APA | 34 | 64 | 179 | 64 | 48 | 64 | 78 |

| DVN | 57 | 18 | 175 | 61 | 43 | 57 | 71 |

| MRO | 35 | 25 | 213 | 52 | 55 | 52 | 76 |

| CNQ | 31 | 61 | 91 | 37 | 48 | 48 | 54 |

| OXY | 3 | 5 | 226 | 47 | 84 | 47 | 73 |

| TS | 40 | -2 | 141 | 16 | 41 | 40 | 47 |

| PXD | 38 | 42 | 104 | 33 | 34 | 38 | 50 |

| IMO | 16 | 37 | 81 | 37 | 31 | 37 | 41 |

| COP | 8 | 13 | 105 | 36 | 39 | 36 | 40 |

| EOG | 19 | 7 | 118 | 42 | 36 | 36 | 44 |

| SU | 23 | 12 | 95 | 43 | 33 | 33 | 41 |

| SLB | 24 | 27 | 99 | 33 | 54 | 33 | 47 |

| TRGP | 12 | 118 | 114 | 31 | 28 | 31 | 61 |

| HES | 59 | 27 | 98 | 27 | 25 | 27 | 47 |

| EC | 17 | 27 | 41 | 13 | 34 | 27 | 26 |

| OKE | 30 | -1 | 71 | 27 | 10 | 27 | 27 |

| FANG | 25 | 25 | 224 | 64 | 26 | 26 | 73 |

| ET | 26 | 5 | 57 | 8 | 25 | 25 | 24 |

| WDS | 24 | 18 | 58 | 21 | 58 | 24 | 36 |

| PBR | 24 | 34 | 9 | -2 | 31 | 24 | 19 |

| LNG | 15 | 24 | 53 | 23 | 28 | 24 | 28 |

| BKR | 23 | 18 | 65 | 22 | 45 | 23 | 35 |

| VLO | 23 | 9 | 109 | 22 | 27 | 23 | 38 |

| WMB | 32 | 17 | 26 | 18 | 21 | 21 | 23 |

| MPC | 5 | 49 | 94 | 15 | 20 | 20 | 37 |

| XOM | 20 | -2 | 87 | 19 | 43 | 20 | 33 |

| KMI | 29 | -5 | 36 | 4 | 19 | 19 | 17 |

| CCJ | 6 | 18 | 62 | 56 | 9 | 18 | 30 |

| CVX | 14 | 4 | 58 | 18 | 48 | 18 | 28 |

| ENB | 23 | 14 | 30 | 10 | 17 | 17 | 19 |

| TPL | 107 | 17 | 179 | -6 | 5 | 17 | 61 |

| TTE | 7 | 21 | 60 | 16 | 4 | 16 | 22 |

| TRP | 30 | 8 | 16 | 16 | 22 | 16 | 18 |

| SHEL | 12 | -9 | 70 | 16 | 21 | 16 | 22 |

| EQT | 11 | 1 | 15 | 24 | 38 | 15 | 18 |

| BP | 17 | -1 | 71 | 15 | 10 | 15 | 22 |

| PSX | 14 | 6 | 90 | 14 | 18 | 14 | 28 |

| CQP | 13 | 15 | 13 | 2 | 36 | 13 | 16 |

| IEP | 41 | 5 | 22 | 1 | 6 | 5 | 15 |

The oil and gas companies in the table above are sorted based on their best median performances over the 5 periods.

Having identified some of the oil & gas stocks that are most leveraged to oil rebound, my next step is to determine the right timing of entering these stocks.

Should we be entering right now, or might it be too early as many oil & gas stocks are still in a medium-term downtrend? Has the tide finally turned for oil & gas plays with the recent bullish oil price movement?

Timing for a better entry using the TradersGPS system

The above table provides me with some useful data to identify which are the O&G company stocks that I can partake in to get the most “bang for my buck”, in the event that oil prices do indeed head to the $100/bbl level over the next 3-4 months.

However, I turn to the TradersGPS system to find stocks that are showing the right momentum/confirmation that a rebound has indeed taken shape and thus warrants an entry.

One stock that is looking rather interesting is Marathon Oil (MRO). This is an oil & gas stock that is one of the most leveraged to oil prices, with a high median return of approx. 40+% and an average return in excess of 70% during those 5 periods.

The TradersGPS platform acts as a market timing tool to help users identify stocks that are in the early stages of a rebound.

There is a positive BUY signal showing that MRO might be in the early stage of a share price rebound, from a technical and price momentum basis.

For those who are interested in finding out more about the TradersGPS System, do check out my comprehensive review in this article.

The next step is to execute the purchase of MRO and my favorite way of doing so is through options. Let me explain why.

Executing the purchase using options

The main reason why I would be taking a position in MRO through options is that it allows me to leverage my capital and thus directly reduces my at-risk capital. Let me explain.

Let’s assume I wish to take a 100 shares exposure in MRO. At its current price of $25.70/share, that will entail an outlay of $2,570. Not a big amount to some investors but to others, especially newbie investors/traders, it could still be a sizable capital outlay.

How can one then reduce the outlay while yet continue to maintain that same 100 shares exposure?

This is where options come into the picture, specifically the purchase of CALL Options, since I am positive about MRO’s price movement over the coming 3-4 months.

I am not intending to go into detail about the specific set-up of the call option purchase. One can refer to the attached video in this article for more information.

But suffice to say, the goal is to reduce my overall capital outlay (and hence my risk exposure) from $2,570 to approx. $200/options contract, all while maintaining exposure to 100 shares of MRO.

This amount of $200/call option contract is also my MAX risk exposure.

Now, even if I am wrong in terms of my expectations (and the street as well) for oil rebound back to the $100/bbl level and consequently, MRO’s price witnessed a strong decline, say to $20/share (near term key support level), my max risk is the loss of my $200 capital which I paid for my option contract vs. $570 loss ($25.70 – $20 = $5.70 * 100 shares) from the ownership of the 100 shares.

This is why for an extremely volatile stock like MRO, I like to use options to achieve both a leverage ROI (in excess of 100%) if I am right in terms of my price expectation of MRO over the coming months, as well as having a tight risk control over my at-risk capital (max loss of $200, in this example).

Additional Reading: 4 Options Trading Strategies for Beginners

Positioning myself in a High-Quality Growth Oil & Gas Stocks

I see the above MRO trade, and possibly future oil-related trades as more opportunistic in nature. A smarter way to play oil rebound using a data-driven approach, incorporating market timing features as well as trade structuring techniques to minimize risk.

There is, however, a high-quality growth oil & gas stock for which I am looking to position myself for a longer duration.

This stock fulfills some of these critical financial metrics such as revenue/earnings growth, operating leverage, high efficiency, strong cash generation profile, and low credit-related risks that warrant it to be a quality stock worthy of a longer-term investment vs. shorter term opportunistic trade.

This is the ONLY energy play that I am currently holding in my Alpha Blueprint Portfolio.

For those who are interested to learn more about the Alpha Blueprint methodology of selecting high quality growth stocks, do hit the button below for more information.