Beginners guide to cryptocurrencies

Cryptocurrencies are slowly becoming the new alternative investment asset in eyes of the public. The concept of digital currencies may be daunting to investors that are accustomed to traditional instruments such as Equities, Bonds, Commodities, or even properties. With the rise of cryptos over the past year, we need to embrace the new wave of investments and capitalize on any potential gains!

So what are cryptocurrencies and how do we get started with them? Check out this Beginners Guide to Cryptocurrencies

What are cryptocurrencies?

Cryptocurrencies are digital currencies mainly used as an investment or a form of payment for goods and services. In essence, these currencies are strings of alphanumerical characters in the programming language. But what’s so special about Cryptos and why are people paying astronomical amounts for them? The answer is Blockchain and Cryptography!

Blockchain

Before jumping into Cryptography, we’ll first talk about the technology behind cryptos – Blockchain. It is essentially a decentralized public ledger consisting of a network of computers that record transactions while providing buyers with proof of authenticity and ownership. Any cryptocurrency that you purchase is tagged with a unique signature that allows for ownership that can be traced and verified by anyone.

Apart from being a public ledger, it is not controlled by any single user or entity. Instead of having your traditional regulators such as the central banks, auditors, or lawyers, the blockchain is built on computers serving as nodes, validators, or miners. Further, the complexity in the layers of encryption and hashing makes the blockchain immutable and hard to hack!

Cryptography

It refers to a method of protecting information through the use of codes. In the blockchain, there are two different ways that this is done via algorithm – Encryption or Hashing.

Encryption is where the blockchain is protected by a set of keys generated by the algorithms. Instead of having a locksmith mold a key to unlock the information as we do in reality, the encryption keys in blockchain are mathematically generated by algorithms! Without boring you with the math formulas, it would take the world’s most powerful computer more than a trillion years to hack the key!

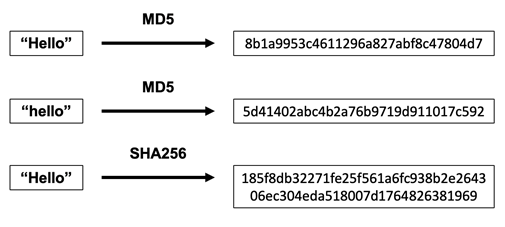

Hashing can also be done to provide a layer of security within the blockchain. It is a mathematical algorithm that converts any input to a unique and fixed-length output.

An illustration can be seen below using MD5 and SHA256 as the hashing tool:

From my input of “Hello”, the hashing system converts it to a unique alphanumerical output! Any change in the capitalization of letters or spacing would completely change my input! One key future of hashing is that you’re not able to retrieve the input from the output that you receive! This is normally used to verify the authenticity of the documents you receive.

Fun fact: Companies use hashing to store your passwords on their database so that in an event of a system hack, your actual passwords will not be compromised!

Putting together encryption and hashing complements the decentralized technology of blockchain. Servers are spread across many computers that record, validate and share transactions done over a particular digital currency. As of 2021, it was reported that there are over 1million bitcoin miners! Imagine having the layers of security intertwined between over a million servers!

Imagine being in a class of 40 and you want to collaborate with another student to cheat in a test. Normally this might be an easy feat for some. However, when encryption is intertwined between all 40 students, you’ll have to convince everyone to cheat with you to be successful! Let’s say you’ve managed to work your magic and everyone is on board.

However, the answers are hashed in alphanumerical strings and you have to figure out if your answers generate the same output! By the time, most would have already given up and focus on studying on the test instead! This is the idea of blockchain and cryptography that provides investors with a strong sense of security.

Besides security, are there other advantages of blockchain and cryptocurrencies?

Advantages of Cryptocurrencies and Blockchain

Being a decentralized system, cryptocurrencies such as Bitcoin and Ethereum are not issued by any central authority. This means that such digital currencies will be immune to any government interference or manipulation! Other advantages include transparency, traceability, and enhanced security due to the infrastructure and public ledger of the blockchain.

After knowing what cryptocurrencies are and the underlying structure of blockchain, what are the other digital currencies available in the market?

Categories of Cryptocurrencies

In the world of Cryptos, there are two key categories of digital currencies – Stablecoins and Coins.

Stablecoins

Stablecoins such as USD Tether (USDT) or DAI have low volatility and are typically used to hedge against fluctuation faced by coins. To achieve stability in their value, the coins are pegged in two different ways. It can be pegged to a particular asset such as FIAT currency, commodity, or other cryptocurrencies. Another method of maintaining its value would be through algorithms where its value is handled by machines!

But why would one buy stablecoins if they can’t earn through price appreciation?

Uses and Advantages of stablecoins

Extreme Inflation and Strict capital control – Countries such as Venezuela or Zimbabwe utilize stablecoins to hedge against their domestic situation.

Transaction speed and cost – Blockchain does not require any third party to verify transfers unlike your conventional movement of money. Therefore, stablecoins offer quicker and cheaper transactions! Therefore, stablecoins such as Tether (USDT) are commonly seen as crypto-pairs on exchanges. Furthermore, USDT is used in 40% of transactions in Binance and 80% of transactions in Huobi!

Smart Contracts – Stable coins such as DAI are used in Deapps (Decentralized Applications) and Defi (Decentralized finance)! It is compliant with ERC-20 which allows it to be operated in any application running on the Ethereum blockchain!

Coins

Coins are identified as your commonly traded digital currencies such as Bitcoin and Ethereum which are normally purchased for investment or speculation purposes. These coins are highly volatile which brings about a high risk, high reward outcome!

In this article, we will be focusing on Bitcoin which is commonly used as an investment asset with the largest market capitalization among digital coins!

Bitcoin

Having the largest market capitalization among digital currencies, Bitcoin is often used as a barometer to gauge the success and sentiment of digital currencies. As seen in the picture below, Bitcoin has seen a rise of 928% since March last year!

In the past, many were skeptical of cryptocurrencies as it was mainly used in black markets or for laundering purposes. Even today, this is echoed by the Treasurer of the United States, Janet Yellen. However, this did not deter companies and accredited investors from digital currencies and bitcoin! Just a month ago, it was reported that Telsa bought $1.5billion worth of bitcoin with plans to accept them as a form of payment. Further, the likes of Apple, Visa, and Paypal have begun accepting Bitcoins.

With the growing acceptance of digital currencies, are they a good investment alternative?

Why are cryptos a good option for investment?

Devaluation of FIAT Currencies

The global economy has not been spared due to Covid-19 and countries have moved into unprecedented territories with unlimited Quantitative Easing (QE). It refers to a monetary policy in which central banks increase the money supply of the economy. This is normally done by making purchases on long-term securities from the open market such as bonds!

With more money being circulated in the economy, it seeks to encourage lending and investments among corporations and citizens to spur the economy. However, this serves as a double-edged sword as well! With more money in circulation, it also devalues the domestic currency.

Let’s take the United States as an example. Just last year, the Trump administration passed a $2.3 trillion Covid-19 relief package. The impact it had on USD can be seen in the chart below! The USD/SGD pairing fell from 1.456 last year to 1.317! This means that instead of paying 1.456 SGD per USD, it would cost you 1.317 SGD!

Growing Acceptance & Adoption of Cryptos

Apart from having large corporations like Tesla have a stake in cryptocurrencies, the general public has begun to be more receptive to Cryptocurrencies and blockchain technology.

Today, Non-Fungible Tokens (NFTs) built on Blockchains have taken the investment world by storm. People are paying astronomical amounts to acquire the digital ownership of GIFs, pictures, tweets, and video clips! It is no doubt that digital assets are here to stay and will have a significant impact on the investment landscape! To learn more about NFTs, click here!

Income Generation

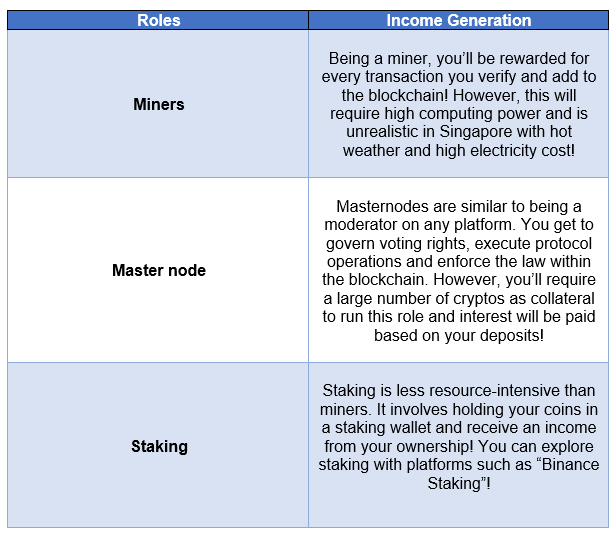

Do you know that you can generate passive income from digital currencies? Apart from actively trading cryptos, you can receive passive income within the blockchain system!

Like how you can participate in securities lending of your SGX shares, you can do the same in peer-to-peer crypto lending platforms like Binance Lending to earn interest on your holdings! Another way to generate income is to play a role in the blockchain. Here are three examples that you can do so!

Conclusion

Digital Currencies have gained a foothold in the investment world throughout the past year. If you are looking to diversify your portfolio, I believe you should never put all your eggs into one basket! You may consider allocating a small proportion to cryptocurrencies to gain exposure to the world of blockchain!

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Best commodity asset of the decade and why Bitcoin might prosper in 2020

- Bitcoin Prediction: 5 reasons why its rise this time round might be sustainable

- 15+ Stocks to ride on ARK Invest Top 15 Big Ideas of 2021

- How to prepare for a bear market. A simple 3-steps process

- Thematic ETFs partaking in the hottest trends

- Top 5 analysts of the decade and their current favorite stocks

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.