Domino’s: Generating a return of $16,700 When it comes to fast-food restaurants, McDonald’s takes the top spot as being the largest and most widely recognized fast-food restaurant brand in the world. However, a $1,000 investment in McDonald’s a decade ago would have translated into an investment value of just $3,490 today, underperforming the broader S&P … Read more

RT

RT

SGX top gainers over the past 1 month Investors who are interested in SG counters can use the SGX stock screener function to identify stocks that meet certain criteria. In this article, I look to identify which are the SGX top gainers over the past 1 month and to evaluate if that momentum can be … Read more

New IPO Stocks: Does it make sense to invest in them? Record stock prices in the US have resulted in a boom in initial public offerings or IPOs for short as companies capitalize on the market euphoria to get their companies listed. As of 8th October, traditional IPOs have raised approx. $155bn YTD, up 184.7% … Read more

Is the Options Wheel Strategy the holy grail of passive income investing? The wheel strategy is an options strategy that is based on the notion of option selling. For those who are not familiar with options, option selling is a very common strategy used to generate income. Unlike stocks where selling short a stock (stock … Read more

Sector Investing: How to engage in sector investing through ETFs Sector investing is a form of targeted investing strategy by gaining exposure to only a selected group of stocks in specific segments of the economy, for example, healthcare, energy or Information technology (IT), etc. It is similar to thematic investing although thematic investing often cuts … Read more

Is China Evergrande stock the “Lehman” moment for China? In this article, I will not be going in-depth into China Evergrande stock problem since its debt issue has already been widely publicized and blogged about by the community. Instead, I will give my brief thoughts on whether China currently presents an opportunity from a “value” … Read more

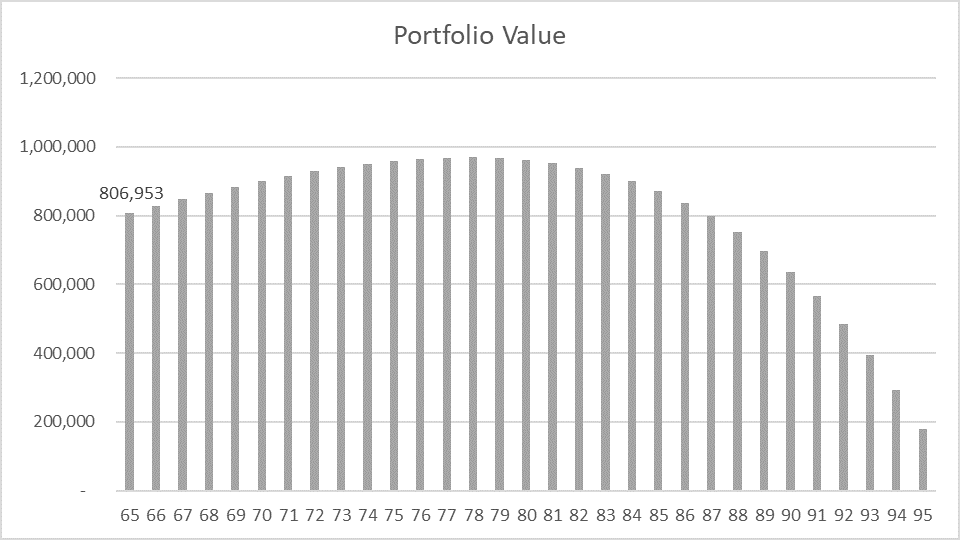

Are retirement expectations too high? Retirement is a pretty touchy topic for most people and here in sunny Singapore, it is no exception. While most of us will like to retire in comfort, without having to worry about $$$, how realistic is this dream going to be in a nation where the daily living expenses … Read more

Pricing Power Stocks Warren Buffett once said: “If you have got the power to raise prices without losing business to a competitor, you have got a very good business. And if you need a prayer session before raising the price by a tenth of a cent, you have got a terrible business.” What Warren Buffett … Read more

Small-Cap US Stocks flying under the radar There are many US companies with an illustrious track record of growing their dividend payment every year. The crème of the crop are those companies termed as “Dividend Kings”. These companies have grown their dividend payments for 50 consecutive years. There are currently 32 Dividend Kings and one … Read more

I have previously highlighted some software companies for my readers who might be interested in finding cloud-based companies with good revenue growth to invest in. Those who are interested can check out the two articles below, where I highlighted the SaaS stocks with gross profit margins in excess of 70% and looking to grow their … Read more

Best Performing Hedge Funds Which are the best performing hedge funds of the past 3 years? While most people will be familiar with popular hedge fund names such as Berkshire Hathaway (Warren Buffett), Bridgewater Associates (Ray Dalio), Greenlight Capital (David Einhorn), Renaissance Technologies (Jim Simons), Pershing Square (Bill Ackman), these hedge funds are NOT among … Read more

Shareholder Yield vs. Dividend Yield Most investors would be familiar with dividend yield. It is simply the notional amount of dividend issued by the company divided by its market capitalization. It is often easier to calculated dividend yield on a per-share basis. For example, if a company pays a dividend of $1/share and its current … Read more

Compounder Stocks that could be the next Amazon? Companies such as Amazon that can generate double-digit compound growth in both revenue and earnings, year after year are rarities. Growth investors looking for the next Amazon seek to identify companies capable of generating double-digit compound growth, ideally in both revenue and earnings for years to come. … Read more

In the past I wrote an article about the best predictor of stock price performance, according to a Morgan Stanley research. The team looked at 4,000 stocks going back to 1997 because that’s about when high-quality data first became available. They looked at factors such as Price/Earnings, revenue growth, leverage, free cash flow yield, and … Read more

Finding efficient companies using the profit per employee metric The Fortune 500 is an elite club of the biggest American businesses, which combined to generate over $31.7trn in revenue, based on the last survey done by Fortune. While it is Walmart that takes the pole position when it comes to generating the largest amount of … Read more