Worst market timing: Why that does not matter

Some NAOF readers are expressing their concerns over the current state of the stock market. The mismatch between economic “reality” and the stock market performance has been particularly glaring of late. Hence it comes as no surprise that one might be particularly cautious of waddling into the stock market at the current juncture.

I gave 3 reasons in this article: Are you still waiting for the stock market to crash in 2021? why one should not be timing a market entry, essentially waiting for a substantial market correction before “pulling the trigger”. This is despite the current “frothy” state of the market.

When it comes to investing, one needs to exhibit 2 characteristics to be successful, in my view. 1. To be forward-looking and 2. To be an optimist.

When you look at the past 50 years, the stock market has an outstanding track record of being an excellent wealth creation machine for those who embraced it with open arms. No doubt there has been ups and downs and volatility should be taken as part and parcel of long-term investing, investing with a long-term perspective in mind has rewarded disciplined investors who have been able to “follow the course”.

In this article, I will be highlighting a surprising FACT. That fact is that even if you are “blessed” with the worst market timing luck in the world, you can still be a millionaire by the time you retire.

The key assumption here is that you need to let the Power of Compounding work its magic. This is another topic that I have written extensively in the article below.

Additional Reading: Let the Power of Compound Interest help you reach millionaire status

Yes, the truth is that even if you are the WORST market timer ever (one who consistently only purchase at the peak of a bull market), your uncanny “ability” to invest only at the peak of the past 5 decades stock market peak will not derail you in becoming a millionaire when you retire.

I will provide 2 scenarios for further discussion on this topic.

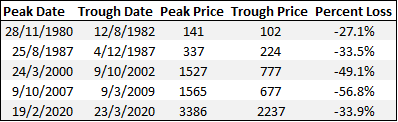

Before that, let me briefly highlight the past bear markets (correction of more than 20%) that happened over the past 40 years. There are a total of 5 instances where the market corrected by more than 20%.

This is based on the S&P 500 index. The table below summarizes the key bear markets from 1980.

There are concerns that the swift recovery seen in early 2020 due to COVID-19 is just a dead-cat-bounce and is a prelude to a larger and more prolonged market correction just waiting to happen.

With that in mind, many investors are currently taking a very cautious stance when it comes to investing in the market for fear of a drastic market crash.

I believe a good way to address such a fear is to try to evaluate what the worst that can happen if the market collapses big time on us.

What would be the returns for the unluckiest investor who only invest on a lump sum basis at the start of each of the last 5 bear markets from 1980-2020?

Can he become a millionaire with such “rotten” luck?

Scenario 1

Let’s imagine that we are now teleported back to 1980. Peter, who is aged 25 that year, has been conscientiously saving $1,000 /month for the past 3 years.

He decided it is time to put his savings “to work” and decided to invest in the stock market on 28 November 1980. He plows his $36,000 savings into the S&P 500 index which was trading at 141 on that very particular day (we assume that there is already a valid index tracker fund at that time and ignore the impact of dividends, taxes, trading fees, and expense ratios from index funds or ETF that is tracking the S&P 500).

Peter’s $36,000 allows him to purchase 256.2 units of the S&P 500 fund at that juncture, based on a per-unit price of 141.

Unfortunately for Peter, that particular day spells the peak of the S&P 500.

However, the good thing about Peter is that he is a disciplined saver and one who does not panic in the face of his investment portfolio declining in value every day.

After investing a lump sum amount into the stock market on 28 November 1980, Peter continues his savings regime amid all the fear that gripped investors during that particular bear market which lasted close to 2 years and saw a draw-down of 27% from peak to trough.

He continued to save $1,000 each month for the next 81 months.

By August 1987, Peter has accumulated $81,000 and is ready to begin investing this lump-sum into the market again. By now, his original investment which he invested approx. 7 years has already more than doubled in value.

On 25 August 1987, Peter took the plunge once again and invested his $81,000 into the S&P 500 which was trading at 337. His $81,000 allowed him to purchase 240.5 units of the S&P 500.

Alas, that particular day again spelled the start of the next bear market correction, which lasted from August 1987 to December 1987, with a peak to trough draw-down of 33.5%.

We follow this logic to the most recent sell-off that occurred in February 2020 with COVID-19 being the culprit for that major massive stock market correction of recent years. The table below shows the returns of Peter.

Peter invested a total of $507,000 over the past 4 decades and ended with a portfolio value of $2.6m on his retirement year at age 65 (40 years later).

Despite investing that figure at the worst possible time in each of the stock market cycles, he is left with $2.6m in his brokerage account. He became a multi-millionaire despite his rotten luck of always only investing at the top of the stock market cycle.

He does not need to identify and invest in market-beating stocks such as Microsoft, Apple, Netflix, Google, Amazon, etc.

All he does is simply the discipline to save consistently every month and ignore the fear that grips most investors when the bear rears its ugly head.

The assumption above does not factor in costs (commissions, expense ratios, dividend taxes, etc) associated with investing in the market. However, it also ignores the effect of dividends which I assume goes towards fully offsetting the costs associated with investing.

The key takeaway here is that you need not be an excellent stock market picker or stock market timer to retire well. This example shows that you can do extremely well even if you are the worst stock market timer on earth.

All you need is the discipline to stay committed to saving and investing for the long-term (30-40 years).

Scenario 2

It might not be realistic for someone to consistently save $1,000/month.

As the saying goes; “where there is a will, there is a way”.

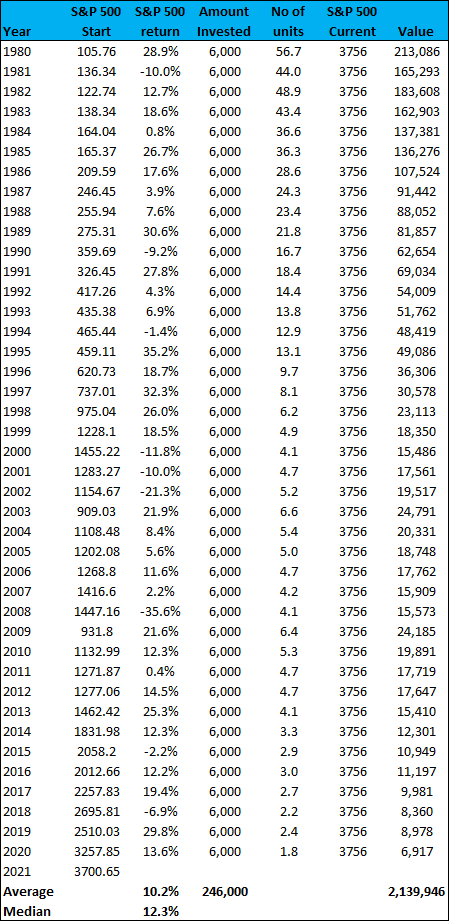

But let’s assume that Peter can only afford to save $500/month. In Scenario 2, we assume that he sets aside $500/month and invest a lump-sum of $6,000 at the start of each year from 1980 to 2020.

In total, he would have invested $246,000 during these 40 years and generated an ending portfolio value of $2.1m.

The table below provides the detail of the yearly returns of the S&P 500 from 1980 to 2020

Scenario 2 is a more likely scenario for what might one’s portfolio returns look like for the mass majority of investors who wish to consistently invest a sum of money passively into the stock market.

While past performance is no guarantee of future results, here are some key takeaways from Peter’s story:

- Start saving consistently. For young wannabe-investors, the first step to take is to engage a disciplined saving approach. While $500/month savings might not be achievable at the start of one’s career, the key is to get started regardless of how small that initial savings amount might be and have that disciplined in place to consistently save up “come high or dry”

- Avoid worrying. Many wannabe investors worry too much and are hesitant on taking that first step because they are afraid of a stock market crash. I have illustrated in this article that even if you have the worst market timing luck in the world, you can still retire a millionaire as long as you “tune out the noises” and stop worrying that a market correction is imminent. While that might be the case, as long as you have time on your side, you will be just fine. That brings us to the next point.

- Start investing early and consistently. You should start investing early where the magic of compound interest will be the most impactful. Again, I have shown that having the luxury of time trumps even for someone “blessed” with the worst stock market timing luck ever. Don’t try to time the market and only invest when a massive correction comes “to get the best price”. That day might never come and even if it does, you will always find another “excuse” not to invest in a terrifying market drawdown.

- Invest using a dollar-cost approach. While valid factors are favoring the usage of lump-sum investing over a dollar-cost approach, with the former generating higher returns in general, there is always that psychological impact at play when it comes to investing a huge sum of capital all at once for fear of a major correction. Despite “dispelling” the notion that being a bad market timer does not matter, it is only human nature to worry. A dollar-cost average approach based on Scenario 2 example is a possible work-around.

- Stay the course. Your temperament is the greatest factor in your portfolio’s returns. By simply staying invested for years on end, you will likely do much better than most.

NAOF Investing Series

Empower yourself with the knowledge to start your investing journey in 2021. The NAOF Investing Series is a quick start guide specially designed for new investors.

Conclusion

There is no point in living in fear of a market correction. One that is currently stopping you from inculcating a disciplined approach to investing TODAY.

Yes, a major market correction might be on the cards and could happen in 2021 or it might not. While I have looked to herald a guess in previous articles, stating that based on the current context of easy money and continual monetary stimulus, a massive market correction may only materialize in the event of an unexpected rise in inflation, it is all but guesswork/speculation on my part.

And that isn’t important if you have a plan to save and invest consistently through a dollar-cost savings approach.

The key is to start early and stay the course. Be hopeful of what the future may behold. It will help you to stay the course and not sell when there is widespread fear in the market (in fact that is the best time to invest although most won’t). This is the most important recipe to invest successfully, even assuming you have the worst market timing ever.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- Best Stock Brokerage in Singapore [Update November 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “How to become a millionaire even with the worst market timing”

That’s a great example. I do have one point I have to make. My actual first year of employment was the same as your hypothetical Peter. I made $18,000 a year as a chemical engineer that year, over $70K in today’s dollars. The median household income was closer to $15,000 that year. So only the very highest income people could have saved $1,000 a month and still paid rent and bought groceries. On the other hand as I received raises I increased my savings rate so eventually I was saving several thousand a month and easily passed Peter’s numbers.

Hi Steve, Thanks for dropping by. Yes i know that the 1,000 savings example might be a little high for most, actually even in today’s context. But the key idea is that one should not be too worried about investing at the peak as long as you are disciplined in your savings regime and engage a long time horizon. You might not start with 1,000, maybe a figure much lower. But my example also does not take into account any rise in savings over the 40-years horizon.