Regular Savings Plan or RSP for short, is a disciplined approach to invest a fixed amount of money every month into buying shares or unit trusts. For example, you can set up a RSP account to automatically deduct S$100 each month to invest in a basket of Singapore Blue Chip Stocks.

RSP removes the need to 1) be correct in selecting individual stocks nor to 2) try and time the market. Your S$100/month (or whatever amount that you are comfortable with, usually with a minimum of S$50/month) will be debited from your account automatically on a particular date each month (say on the 15th of every month) to invest into the stock market.

Just set up your account once and each transactions from then on will be automated. Simple and Easy.

What are the options available?

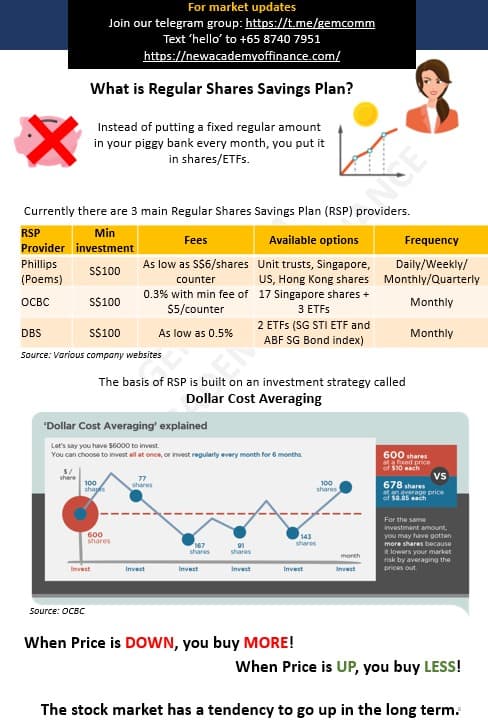

In the pictorial table above, we highlighted 3 key RSP plans offered by our 3 local brokerages, namely 1) DBS, 2) OCBC and 3) POEMS. You can see their pricing and different product offerings in the picture above.

In short, DBS offer the least products (now expanded to 4 vs. 2 previously) but is the most price competitive for RSP amount of S$500/month and less. OCBC and POEMS have pretty similar fixed cost pricing which is costly if your RSP amount is low but becomes increasingly attractive when your RSP amount is S$1,000 and more.

The latest new kid on the block to partake in the RSP game is FSMOne, whose low cost offering of only 0.08% commission rate basically blows the competition away. In addition, FSMOne also provides a myriad of global ETFs that one can now have cheap access to. Their entry, together with the rise of robo-advisors, will likely drive commission prices lower (good for us investors) in the coming years.

Using a Dollar Cost Averaging strategy

As mentioned, a RSP essentially builds on the investment strategy of Dollar Cost Averaging. Meaning that you use a fixed amount of funs to buy into shares/ETFs every month. If the price is higher for that stock for that particular month, you buy lower units. If the price is lower, you buy more units.

Such a strategy lowers the overall market risks and allows one to consistently partake in the market regardless of their volatility.

Conclusion

For new investors looking to kick start their investment journey, using a RSP approach is the simplest and most disciplined manner to start saving regularly. Just set up your account once, choose an investment product that suits your needs and risk profile, automate the debit process and you are good to go.

Which RSP to choose? Well, seems like the new kid on the block FSMOne is the cheapest solution by far.