uSMART Intel Features and Fractional Share Investing

If you recall my previous article on uSMART (click on link here to go to the previous article), there were a couple of features like its Daily Hot Stock picks or Featured Strategies that remain a mystery because an Intel Subscription was required in order for me to access it.

I decided to seek a Venture Capitalist (VC) to help fund the Intel Subscription package. After several rounds of fierce negotiations, I gave my closing statement to the VC I managed to arrange a discussion with and described how this subscription could provide me the advanced tools and knowledge to navigate the recent tumultuous markets and make us a fortune. This in turn will increase his daily school allowance.

With my impactful closing statement, a simple contract was drafted out and signed and my son gave me $1 from his piggy bank to help me fund the 1st month’s subscription fee for uSMART Intel.

I also convinced my backer (aka my 6-year old son) that it will be in his best interest to give me $5 every month, taken from his savings/allowance, to participate in fractional share investing using the uSMART app, the latest feature that this SMART broker has pushed out.

Before going into detail about these 2 features that the uSMART app can provide, let me detail the simple funding process that got me started using the uSMART app almost immediately.

Funding the account through e-giro

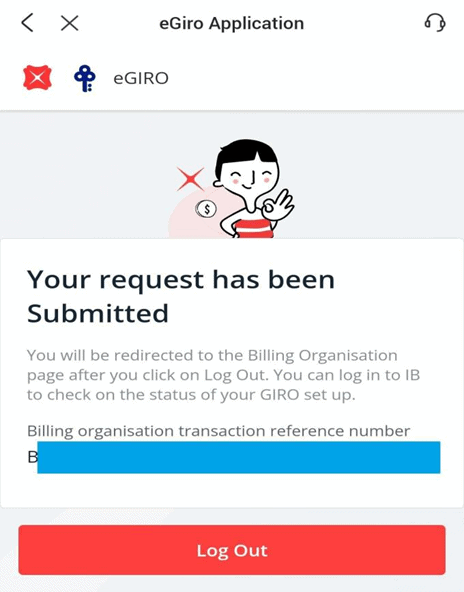

After banking in my seed money, I immediately logged onto my uSMART app because I assumed I would be able to fund my account right then to subscribe to the Intel Subscription through its e-Giro function and boy was I right.

All I had to do was log into my POSB/DBS mobile banking through uSMART, verify and select the account I wished to use.

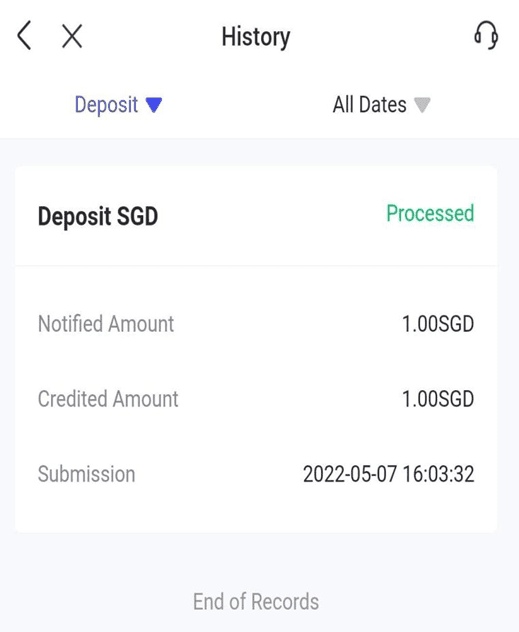

Immediately after that, I was able to deposit my funds which were processed instantaneously.

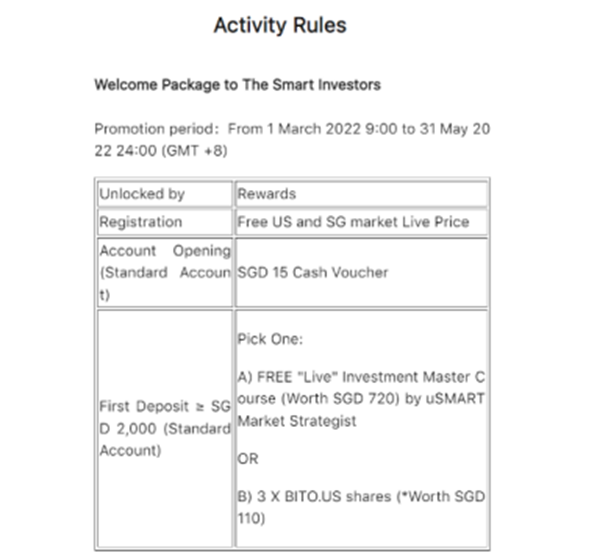

The whole process to fund $1 into my uSMART account using e-GIRO took about 1 minute. That is how efficient the funding process is. Do however note that one will be forfeiting the welcome gift if the 1st deposit is $1 as a minimum of SGD$2k is required to be entitled to the welcome gift package as summarized in the table below.

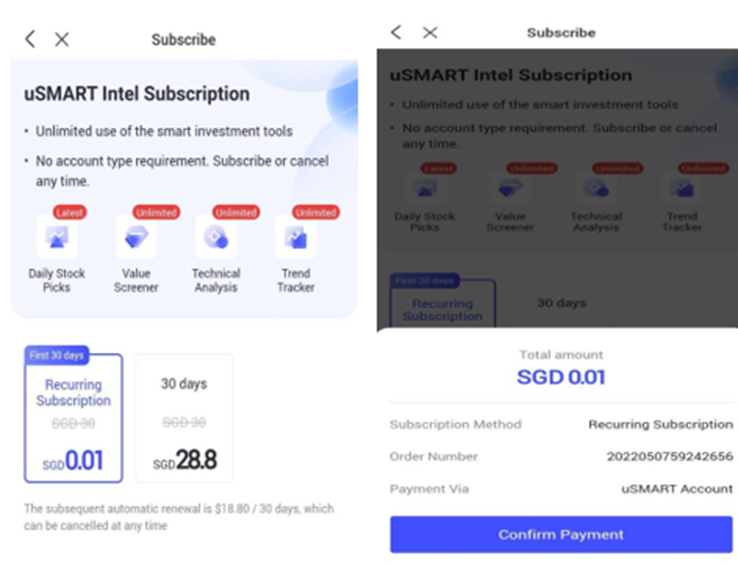

Next up would be to subscribe for its “premium” Intel subscription.

Signing up for Intel Subscription

Signing up for the subscription was even easier. All I had to do was to click a couple more buttons to confirm my purchase.

And in case you forgot, the first month’s subscription is ONLY $0.01! That means to say I will have extra trading capital from my remaining seed money after paying for the subscription! Talk about being shrewd!

Having funded my account and subscribed to its Intel services in less than 2 minutes from start to end, I now seek to venture into the premium services that will allow me to get an edge over the market.

The 5 Notable Features

Featured Strategy

The first notable feature is uSMART’s Featured Strategies which are thematic strategies constructed using a basket of funds, single stocks, or ETFs.

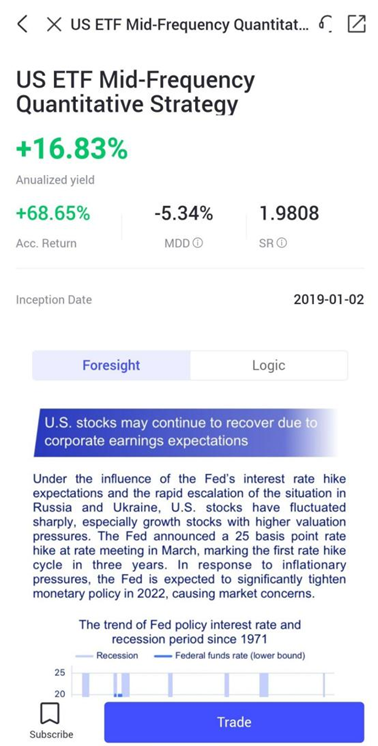

As an example, let us take a look at the US ETF Mid-Frequency Quantitative Strategy:

This strategy has generated an impressive 16.83% of annualized return!

Under Foresight and Logic, you will be able to understand the crux of the strategy. The great thing is that uSMART does not use overly complicated terms which is very friendly for retail investors like myself.

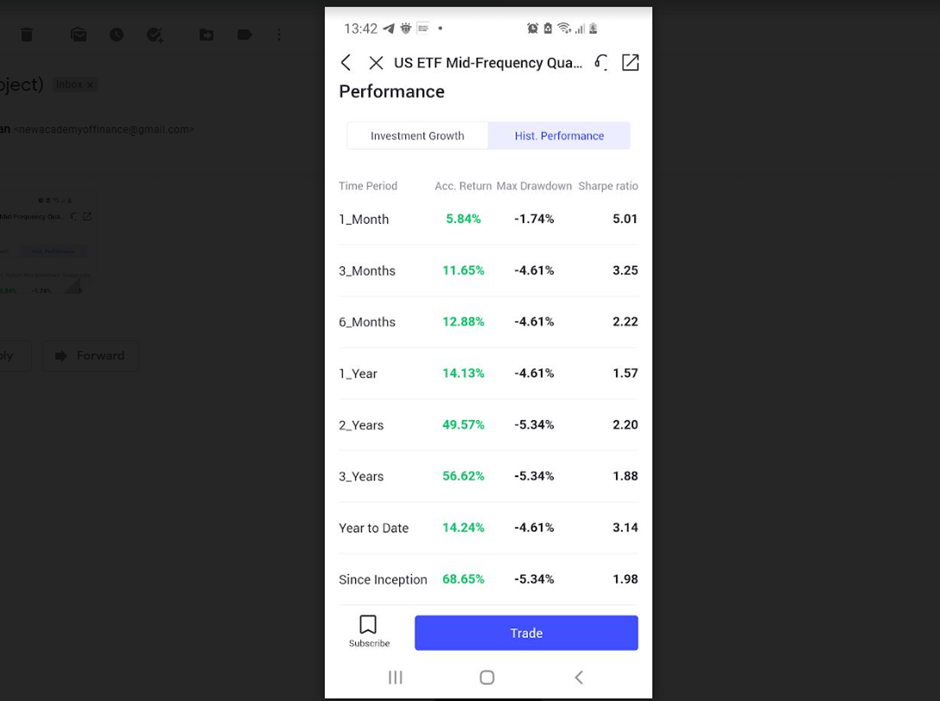

You can check out this strategy’s historical performance as well, which isn’t too shabby, particularly its positive returns over the past 1-3 months where the US and global markets alike have been significantly battered.

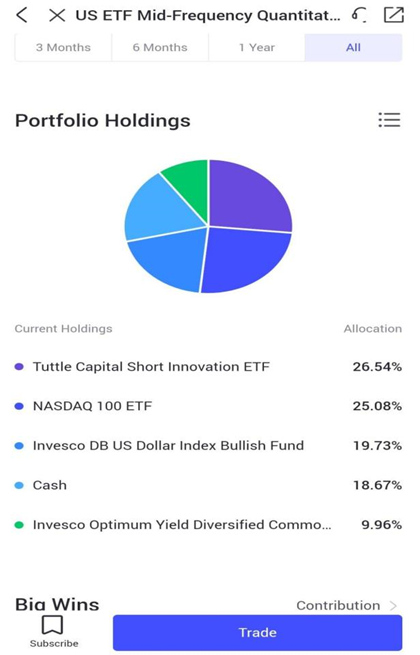

That aside, you will also be guided on how to construct the portfolio as it will give you the percentage holdings down to 2 decimal places of each component.

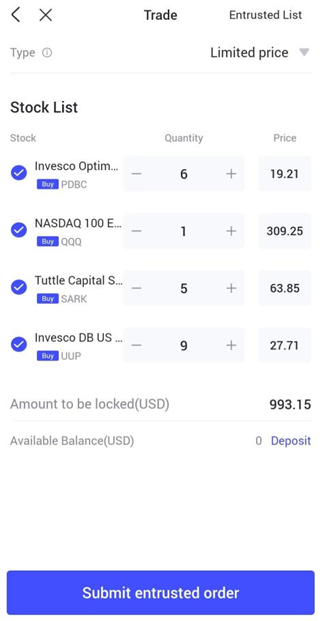

If you find the strategy sound and are ready to take the plunge, what I feel is great is that you do not have to calculate and purchase every component independently because the app helps you to make the purchase in equal parts based on your budget.

If you like the strategy but have a slightly different view, you can exclude some of the components as well.

What do I think?

Honestly, this is the first time I have seen such a feature on a brokerage app and I was impressed with it. Aside from the features, the first thing that comes to my mind as a retail investor is the performance of this strategy, particularly in recent months where the broad market has been rather unforgiving, with the Nasdaq firmly in the bear market territory.

This strategy, on the other hand, has managed to generate stronger performances of late despite the market sell-off, and that can be attributable to its “short” holdings in the form of Tuttle Capital Short Innovation ETF, which is an inverse ETF to bet against famed growth investor, Cathie Wood’s ARK Innovation ETF.

With growth stocks being sold off of late, particularly loss-making “innovative” companies which the ARK Innovation ETF holds, it is no surprise that this strategy has done pretty well.

Another of its featured strategies that incorporated an element of “shorting” to capitalize on the current bearish market sentiments is its US Dynamic Allocation Strategy which has an impressive return of 43% on an annualized basis.

This strategy allows uSMART to use dynamic allocation strategies which include holding inverse ETFs as well as maintaining an ALL-Cash position when it deems fits.

For both strategies, a client of uSMART can easily partake through a single click on the app.

Take, for example, if you wish to invest in its US ETF Mid-Frequency Quantitative Strategy, you can immediately partake in this strategy by forking out US$993.15 and clicking on the “submit entrusted order” as highlighted in the previous diagram. An order would be made to purchase the 4 ETFs that encompass the strategy based on the allocated quantity that you have set.

Do note that uSMART does not actively manage this strategy for you. Subsequently, changes made to this strategy by the uSMART team (a notification will be sent to you if you subscribed to the strategy) will need to be manually adjusted.

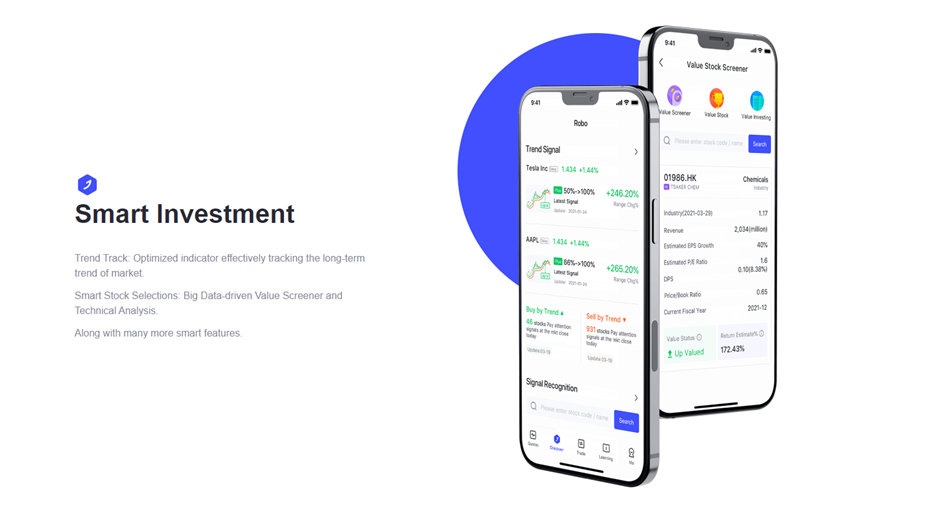

Trend Tracker

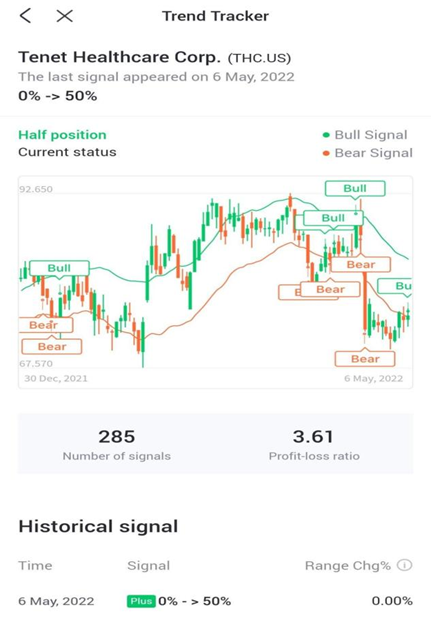

The trend tracker is an uSMART indicator “based on optimized moving average which can effectively track the trend”. Essentially, there are 2 bands that are labeled lower and upper bands and a strong bullish signal will be triggered when prices close above the upper band. It works the opposite way for bearish signals.

It seems like a moving average strategy just that it uses uSMART’s optimized time frames which likely would have been back-tested quite thoroughly.

Within the module, you will be able to look at the latest signal and its strength.

When you click on each stock, you will also be able to see its historical signal and profit and loss ratio which will give a good indication of the efficacy of the indicator.

From the screenshot above, we can see that the indicator has been triggered a total of 285 times so far with a profit loss ratio of 3.61 which I believe means to say that there are 3.61 winning trades for every 1 losing trade based on this indicator.

The main drawback of this strategy I feel, in my view, is that the indicator only gave me a potential entry point but did not indicate my exit strategy which I feel is also relatively important. It got me to conclude that maybe such a feature is more appropriate for seasoned investors or traders where it is used as a way to spot potential setups for trades.

Daily Stock Picks

Like a regular human being cum Singaporean, I like the idea of this feature very much because it’s very straightforward. The app gives a daily stock pick for Singapore, Hong Kong, and US markets daily.

Along with the stock pick comes a very concise summary of their analysts’ studies. This eliminates you having to pore through pages of reports and charts to come out with a stock idea. Below is an example:

This is a pretty nifty feature as it gives users a place to start with its recommendations because sometimes the market can be so vast that it’s difficult to know which stock to research.

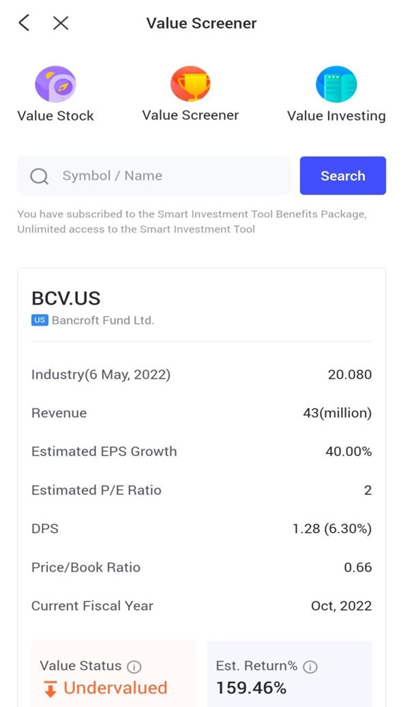

Value Screener

The value screener is a stock screener of sorts just that it has its own predetermined set of criteria.

This is probably more suitable for longer-term investors looking to sieve out undervalued stock gems “flying under the radar” vs. traders looking at more short-term picks (Daily Stock Picks).

The criteria for the screener circles more around a company’s revenue and earnings. Collectively, these criteria aggregate to filter out stocks that are undervalued. At the same time, the screener will then give you a projection of the stock’s potential earnings if held for the next 5 years.

It also shows you the breakdown of the company’s year-to-year revenue and earnings.

I suppose this would be helpful for investors who would like to buy and hold for the long run and not constantly have to monitor any charts or prices as they are too busy to do so.

However, unlike the other modules, this one does not have any historical statistics for your reference as it projects the forward potential of the company through its earnings and revenue.

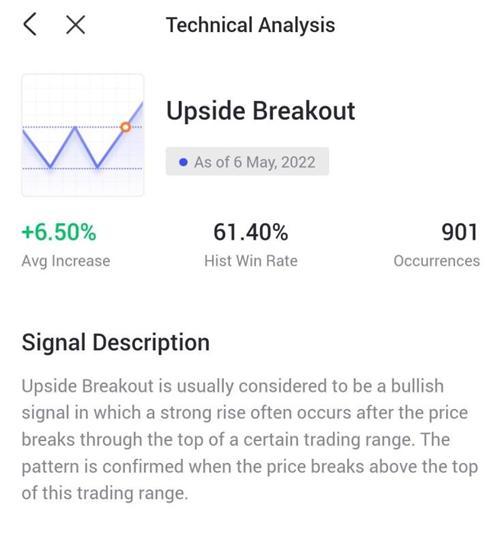

Technical Analysis

This is a pretty awesome module that is based on purely technical analysis where subscribers can look for long or short signals in the short, medium, or long term in Hong Kong and US markets.

All you will have to do is just select your criteria and a bunch of stocks that have certain signals triggered will show up for you to look into.

This helps investors save a lot of time. Instead of spending time on charts looking for patterns and indicators, this module in the app will already have that done up for you.

On top of that, it shows statistics with relatively decent sample sizes. For example, investors can see that there had been 901 occurrences of upside breakout spotted by uSMART’s smart technology. Out of these 901 occurrences, 61.4% were winning trades with an average increase of 6.5%.

With this kind of statistics, investors can then focus more on equally important things like position sizing.

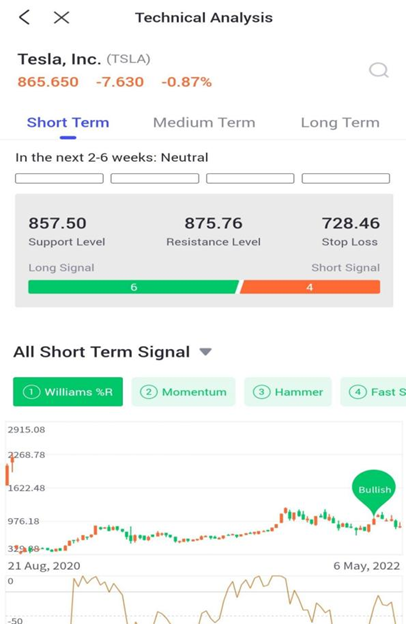

If the list of stocks does not interest you and you have some degen genes, one can look up a stock that you are interested in within this module.

For example, I searched Tesla and it immediately gave a study of the short, medium, and long term outlook of the stock.

The app will run a series of different indicators to derive whether it is bearish, neutral, or bullish for the different time frames.

This can be very helpful for users to form a basis and direction on the stock he is researching on and then strategize accordingly.

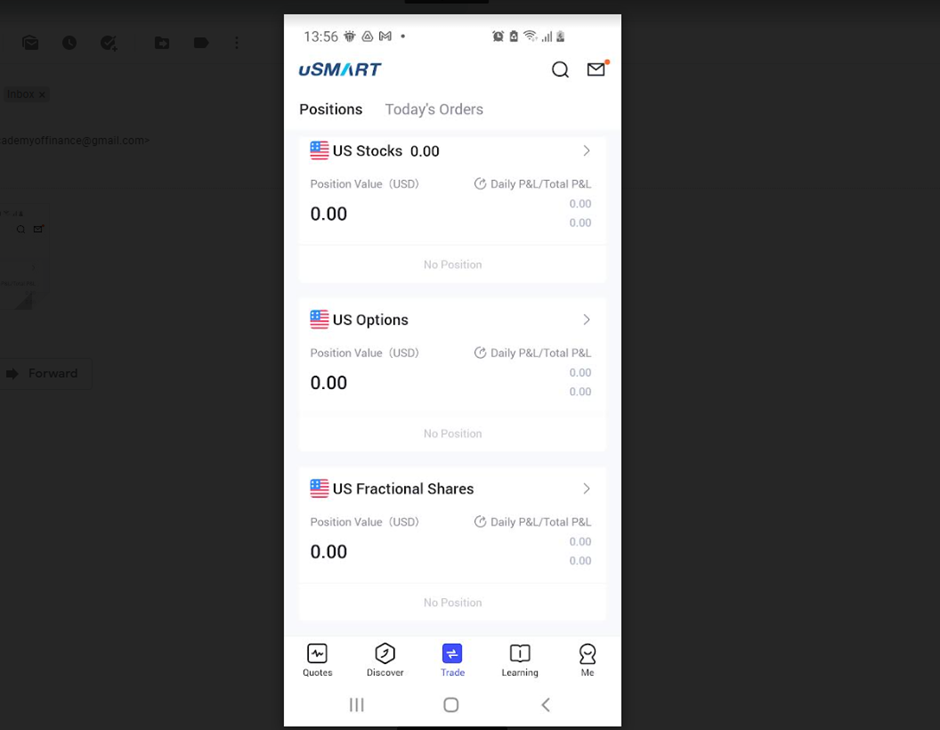

Fractional Investing using uSMART app

This is the latest feature to the uSMART app, one which is “beginner-friendly” and allows a new investor to start investing even if he/she has got a $1.

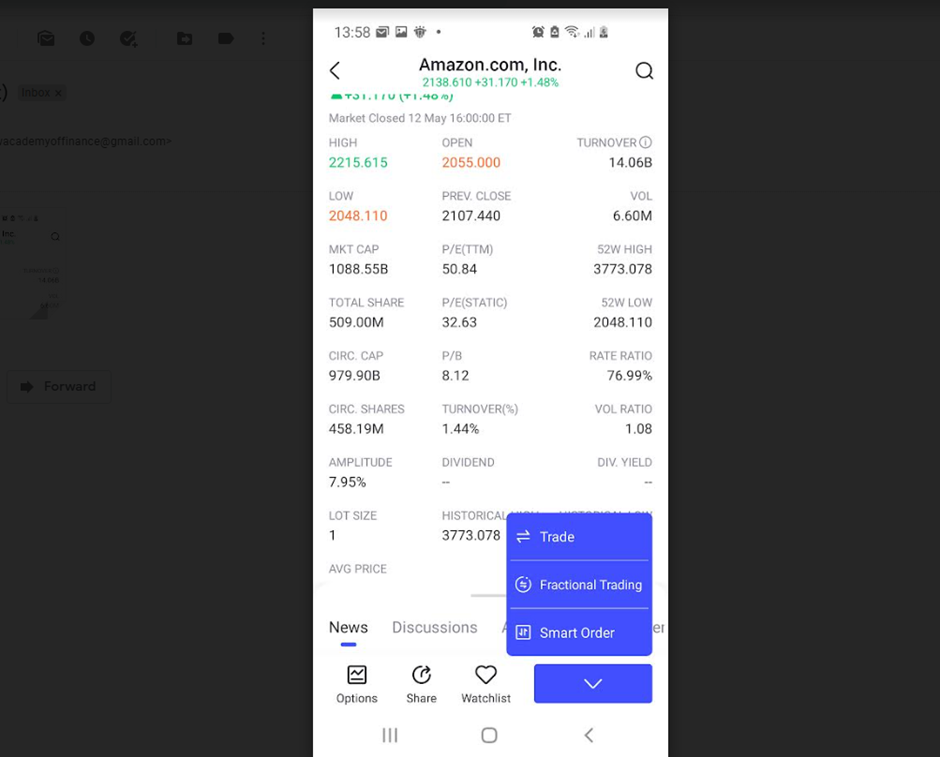

Fractional share investing is where a user gets to purchase a stock, not based on the min per-share price but based on his capital amount. For example, a broker that does not offer fractional share investing will require an investor to fork out a minimum amount of US$2.2k if he/she wishes to buy an Amazon share, given that 1 share cost about US$2200 at present.

A broker that offers fractional share investing, like uSMART for example, now allows an investor to become a proud Amazon shareholder even if he/she has US$1 to spare (floor limit of at least 0.0001 shares).

With US$1, he/she will be able to purchase 1/2200 ~ 0.0005 (up to 4 decimal place) Amazon shares, which still makes him a legit shareholder of Amazon.

In my case, I will be using my kid’s $5 monthly contribution to help him partake in fractional investing in the US market through a blue-chip US stock of his choice.

Getting started on fractional investing using uSMART

Getting started on fractional share investing is pretty simple using uSMART. First, you need to make sure that you have USD since fractional share investing is made available only for US stocks.

This can be done simply through its FX Exchange function which will allow you to convert your existing SGD fund into USD easily. Once you have USD, you can simply search for any US stocks of your choice, take, for example, Amazon, click on the Trade button, and an option will be made available for you to select Fractional Trading.

Put the amount you wish to invest in, for example, US$1, and the app will show you the respective shares that you will be owning. In the Amazon case, it will be 0.0005shares.

It’s as simple as that to get started on fractional share investing immediately using the uSMART app.

There is thus no more “money no enough” excuses to be made for not investing in the stock market to begin your wealth accumulation journey.

Do however note that the normal US market charges apply, for fractional shares investing. Hence, while I will like to get my kid started on fractional shares investing immediately, it really isn’t cost-effective if the monthly recurring Dollar Cost Average amount is just $5.

Conclusion

Honestly, for the price I paid to try out the subscription, I feel that nothing bad can be said about it. To put it in perspective, 1 cent literally cannot buy you anything aside from uSMART’s Intel Subscription. Besides, being more informed in our increasingly data-driven economy will only likely do more good than bad for us.

Beyond subscribing to its premium Intel services immediately, an investor with limited capital should also fully take advantage of uSMART’s fractional share investing function, which allows a young investor to begin his/her investing journey with capital as low as US$1 (or perhaps even lower).

This is thus the ideal brokerage app to get started for a newbie investor. Not only does it provide a cheap avenue for proprietary data that was only made available to high net-worth individuals in the past but is now accessible to the man in the street, it also has a fractional share investing function that removes all barriers to entry pertaining to an individual’s limited financial resources.

P.S If you have found this article to be helpful, you can use my referral link to sign up. On top of you receiving the Welcome Package, I will be entitled to a $88 stock voucher.

Get started by signing up for a uSMART account today by clicking on the link below:

Additional Reading: uSMART review: U R Smart enough to invest

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Discord channel for an active discussion on all things finance!

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats