US ETFs for Beginners to get started

In this article, I will be highlighting 4 basic US ETFs for beginners to get started on their investing journey. A combination of these 4 US ETFs will provide the necessary geographical and sectoral diversification for a new investor.

At the end of the article, I will also be highlighting a couple of methods in which a new Singaporean investor can invest easily in these 4 US ETFs, either through a lump sum approach or through a dollar-cost averaging approach.

Before proceeding to highlight the 4 best US ETFs for beginners in my view, it is noteworthy to bring your attention to certain additional fees associated with investing in US ETFs which some of you might not be aware of.

These additional fees are more indirect vs. the expense ratio (a direct fee that is often quoted). Hence, if you are a non-US investor, it pays to be aware of these additional fees which you will probably incur.

3 Additional Fees Incurred When Buying US ETFs from Singapore

Buying US ETFs is a popular way to make low-cost, high reward investments. However, as Singapore-based investors, there are three major complications you must be aware of before making your investments.

1. Dividend withholding tax

As a Singapore investor, you are liable for a 30% tax on all your dividends. This may change in the future if the US enters into a tax treaty with Singapore.

The substantial dividend withholding tax is one major reason why investing in US dividend stocks is not that popular here in Singapore. However, there is a simple method to “artificially” increase a dividend stock’s yield which I detail more in this article: Philip Morris. How to put its 6% yield on steroids

2. Estate tax

The estate tax only takes effect on these conditions:

1. In the event you pass away while holding on to US-listed ETFs.

2. You are holding assets worth more than US$60,000.

If these conditions are met, you will be liable for an estate tax of 18-40% on your returns.

While not often highlighted, these estate tax duties might be a major issue for some. One “workaround” could be to invest in non-US domiciled ETFs such as UCITS ETFs.

Additional Reading: UCITS ETFs taxation. Are they that cost-efficient after all?

3. Exchange rates

You will be charged a total currency conversion fee of about 1.5% per transaction by your broker (defers from brokers to brokers). Additionally, there could be currency risks involved if the USD depreciates against the SGD. On the flip side, if the USD appreciates against the SGD, your profits will increase.

Exchange rate risk is unavoidable if one wishes to have exposure to foreign-denominated stocks.

4 Best US ETFs for Beginners

Despite these additional fees, investing in US ETFs could still be a lucrative “business” when done right.

When it comes to long-term investing aimed at growing your account balances over time, it is best to keep things simple. Funds that work well in the long term are typically easy to understand and cheap to buy. They also tend to be well-diversified, actively traded, and have a history of returning close to the benchmark return over five years.

The four ETFs for 2021 listed in this article not only fulfill these criteria but have the potential for returning gains well after 2021 has passed.

Best US ETFs for Beginners # 1: VOO

Type: Large-cap blend

Assets under management: $172.5 billion

Expense ratio: 0.03%, or $3 annually for every $10,000 invested

Dividend yield: 1.6%

One-year return: 50.5%

Five-year return: 122%

Ten-year return: 280.2%

(Total annual returns as of 12/04/2021)

Vanguard S&P 500 ETF (VOO) is Vanguard’s version of the largest ETF in the world – the SPDR S&P 500 ETF Trust (SPY).

Between the two, SPY has a longer history, but both funds fundamentally track the same index – the S&P 500, which measures the stock performance of the 500 largest publicly traded companies in the US.

The reason why VOO is on this list instead of SPY is because of its lower expense ratio – 0.03% compared to SPY’s 0.095%. In the long run, VOO can outperform SPY with a 0.06% higher compound annual growth rate. That difference may seem minuscule, but it can stack up over long years.

However, SPY has a higher volume and a tighter bid-ask spread, making it the better choice for active traders and options trading.

Why buy this S&P 500 ETF?

History has told that 89% of active large-cap funds, managed by professional stock pickers including Warren Buffet, have underperformed the S&P 500 over the past decade.

This should come as no surprise, given the S&P 500’s commendable record of 8-10% returns per year on average.

If you had invested $10,000 in the S&P 500 in 1990, it would have multiplied more than ten-fold to about $150,000 today:

When this kind of return compounds over time, it can build up to substantial wealth if you simply buy and hold for a long period.

For this reason, if you want to grow your money in the US market, the simplest approach for a beginner investor is not to try and pick individual stocks but to put your money into a cheap and effective fund like VOO.

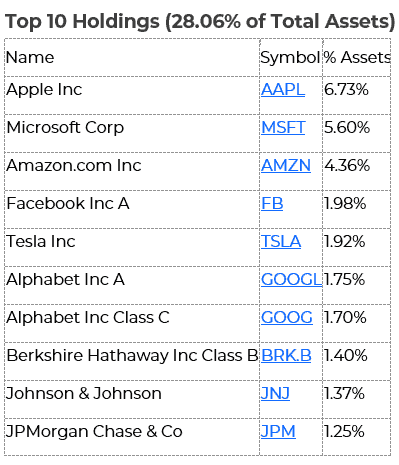

This is not to say that VOO is without its flaws. At writing, the VOO was more than a quarter invested in tech stocks like Apple and Microsoft and had only 2% of its investments in energy stocks such as Exxon Mobil. Besides sector imbalances, the fund is also market-cap weighted and thus heavily leaned towards already-large companies like Amazon and Tesla, adding risk if investors rotate out of these heavily weighted firms.

That being said, it is futile to try and predict the future. What we can observe, though, is that investors are typically well-served by having low-cost and straightforward exposure to the general US stock market. And VOO is one of the best ETFs to help you achieve that.

Best US ETFs for Beginners # 2 QQQ

Type: Large-cap growth

Assets under management: $145.65 billion

Expense ratio: 0.20%, or $20 annually for every $10,000 invested

Dividend yield: 0.55%

One-year return: 68.9%

Five-year return: 222.6%

Ten-year return: 555.2%

(Total annual returns as of 12/04/2021)

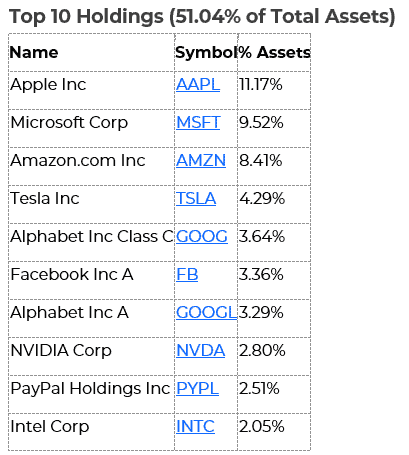

The S&P 500 might have seen impressive gains, but the Invesco QQQ Trust (QQQ) is one ETF that has consistently beaten the SPY in the past decade. Invesco QQQ benchmarks the Nasdaq-100 Index, which represents the 100 largest non-financial companies listed on the Nasdaq.

The fund is composed of the largest 100 tech counters listed in the US, with just these 2 stocks, Apple and Microsoft, comprising more than 20% share of the portfolio.

As such, the total number of stocks in the Nasdaq-100 is much smaller than that in the S&P 500, which allows it to focus on fewer high-growth firms which have made huge returns in the past years. However, the volatility in this index is also substantially higher than that of the S&P 500.

Since QQQ’s inception in 2010, the fund has returned 536% through a historic, sustained bull market, compared to VOO’s 228%.

As one of the most traded ETFs in the US, it is highly liquid, and a high concentration in tech and growth stocks leads to more volatility and higher upside. This has given the QQQ a good resume over the long run, but investors also need to beware of larger drawdowns during turbulent markets.

Long-term investors may also want to look at the Invesco Nasdaq 100 ETF (QQQM). This recently launched ETF is essentially the same as the QQQ but charges a slightly lower expense ratio of 0.15% and has a lower share price which makes it slightly easier for beginner investors to partake in.

Best US ETFs for Beginners # 3: VTV

Type: Large-cap value

Assets under management: $61.4 billion

Expense ratio: 0.04%, or $4 annually for every $10,000 invested

Dividend yield: 2.7%

One-year return: 41%

Five-year return: 86.8%

Ten-year return: 204.1%

(Total annual returns as of 12/04/2021)

Value investing has a lengthy pedigree. According to the Bank of America, since 1926, value investing has yielded 1,344,600%, outperforming the 626,000% gain by growth investing.

However, in the past decade, things have taken a turn. After the financial crisis in 2007, growth has trounced value. The prices of tech-related growth stocks such as Facebook, Apple, Amazon, Netflix, and Alphabet have soared to unprecedented heights.

Last year, amidst the COVID-19 pandemic, while the Russell 1000 Growth Index returned 38.49%, the Russell 1000 Value Index returned a paltry 2.8%.

These trends have sparked debates on whether value investing is becoming an obsolete strategy in recent markets.

However, 2021 might just be the year for value to flip the script.

With rising US interest rates and strong progress on COVID-19 vaccines, growth-oriented ETFs have experienced an uncharacteristically rough time since the beginning of 2021. For scores of value investors, this could be a long-awaited sign of a long-term, multi-year rotation towards value investing.

Vanguard concurs, noting that “value-oriented sectors are projected to have somewhat higher returns after an extended period of significant underperformance.” Historical evidence also shows value outperforming growth in every economic recovery since 1929.

How to capitalize on this potential trend?

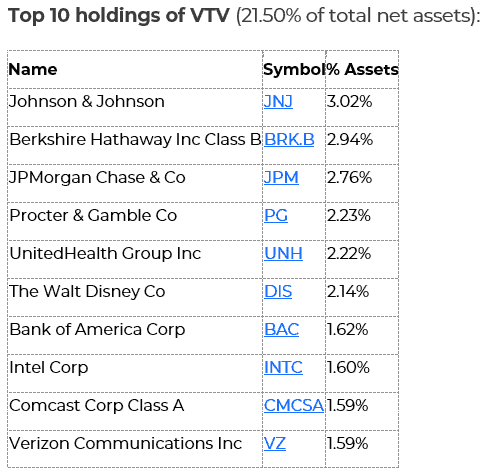

The Vanguard Value ETF (VTV) could be the most straightforward way to do so. As the largest value ETF in the world, it is also one of the cheapest, with a mere 0.04% expense ratio.

It holds about 300 US large- and mid-cap stocks that are attractive in terms of their low price-to-earnings (P/E), price-to-book (P/B), price-to-sales, and price-to-dividends ratios.

This fund is light on technology stocks – with the bulk of its assets in the financials, healthcare, industrial, and consumer sectors. Top holdings include megabank JPMorgan Chase & Co. (JPM), health care giant Johnson & Johnson (JNJ) and not to mention Berkshire Hathaway (BRK.B), helmed by Warren Buffett himself.

Michael Bell has once warned that “Investors with a big bias towards growth stocks over value stocks are vulnerable to recession, reflation, and regulation.” In the long run, good exposure to both value and growth stocks could be the optimal strategy for investors.

VTV ranks among the best ETFs for 2021 for its low cost, simplicity, and exposure to a projected hotbed of returns in the year to come. It is suitable for income-minded investors who value stability and are not opposed to hanging on to it long after 2021 comes to a close.

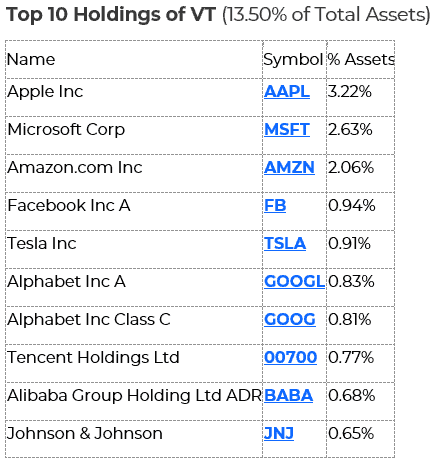

Best US ETFs for Beginners # 4: VT

Type: World stock

Assets under management: $25.1 billion

Expense ratio: 0.08%, or $8 annually for every $10,000 invested

Dividend yield: 1.62%

One-year return: 52.8%

Five-year return: 97.4%

Ten-year return: 151.3%

(Total annual returns as of 12/04/2021)

If you could only invest in one single ETF for the rest of your life, there is a good case for it to be the Vanguard Total World Stock ETF (VT).

This fund is designed to track the performance of the FTSE Global All Cap Index. This means that it invests in both US and international stocks, giving you broad exposure to developed and still-developing regions, from Europe to Asia-Pacific and to emerging markets like China and India.

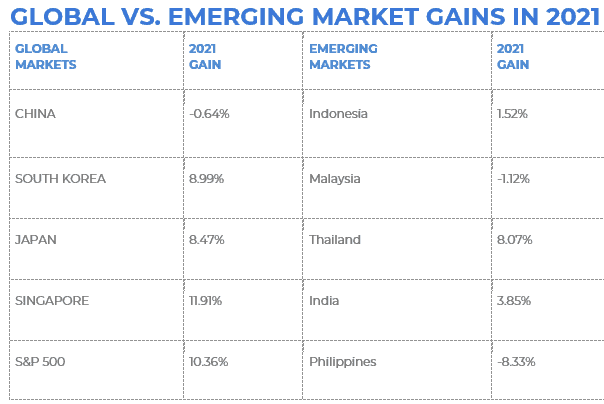

Emerging Markets are countries with rapidly growing economies but are generally less developed than economies such as the US and those of western Europe. Countries including China, India, Russia, Brazil, and Mexico are considered emerging markets.

VT is the worst-performing US-domiciled ETFs within this list, with a 10-year total of “just” 151.3%. This is predominantly because VT has substantial foreign-stock exposure as compared to the other 3 US ETFs. Non-US stocks comprised about 44% of the portfolio holdings.

However, it is noteworthy to point out that the US stock market is experiencing its longest bull-run in history and has been a major outperformer compared to other foreign stock markets (emerging, developed). Can this outperformance continue?

While the US market has underperformed its global counterparts in the earlier part of 2021, it has since caught up and has proved to be as resilient as ever, even in the context of inflationary risk, with the USD strengthening against other major currencies of late.

2021 could, however, be the year for you to start increasing your international exposure.

Brewing signs of growth in emerging markets, where many stocks trade at relative discounts, present a possible opportunity for investors. Coupled with inflationary risk in the US and a more trade-friendly Biden administration taking over in the US, having some exposure to international markets could do you good in the years to come, despite the higher risk of short-term volatility.

So international stocks can zig when the US market zags – but you are probably also bombarded with advice that the performances of small-caps and large-caps undergo rotations and that sometimes growth stocks will outperform, while other times, value prevails.

Having a well-diversified portfolio of stocks and ETFs is a cumbersome process for the average investor.

The easiest way to get around all that trouble is to invest in a broad-based fund like the VT. It is an ultra-simplified way to get low-cost exposure to thousands of US and international stocks.

If investing in SPY/VOO is akin to betting on the economic growth of the US economy, then investing in the Vanguard Total World Stock ETF (VT) is like betting on the economic progress of the entire world.

Best ways to invest in US ETFs for Singapore investors

Lump-Sum Investing

There are many options for a Singaporean investor who wishes to start investing in US-domiciled ETFs such as the 4 highlighted above on a lump sum basis.

The cheapest is through TD Ameritrade which is the first brokerage to introduce ZERO commission cost trading to Singaporean investors.

That means you do not incur any commission costs when purchasing these ETFs, even if you are purchasing just 1 share of the ETF.

TD Ameritrade is probably the cheapest way to get started on a lump sum basis. However, the downside of trading through this brokerage account is that the account opening time is pretty lengthy and could stretch as long as 3 months.

Additional Reading: TD Ameritrade thinkorswim review. A comprehensive write-up on this zero cost brokerage firm

An alternative might be to select a low-cost (not zero cost) commission brokerage firm such as Tiger Brokers where the account opening process is extremely fast.

Tiger Brokers

One of the cheapest and fastest growing fintech brokerage firm in Singapore, Tiger Brokers allows a beginner investor to invest cheaply in low-costs US ETFs

I have done a brokerage comparison which a Singaporean investor might find useful in the below article.

Additional Reading: Best Stock Brokerage in Singapore

Regular Savings Plan (RSP)

Investing on a dollar cost average approach, or often termed as investing through a regular savings plan (RSP) is a good way for a young investor with limited capital to get started.

Without the need for large capital, most RSP plans allow an investor to start investing with a capital outlay of as low as $100/month. The idea for RSP is to make investing an 1) affordable and 2) recurring approach without any elements of market timing.

Such a disciplined investing approach plays well to the magic of compound interest and will see a portfolio value increase substantially over a long period, even with an “insignificant” monthly contribution.

The simplest and cheapest way to start investing in ETFs using an RSP approach is through the FSMOne platform. Its ETF RSP list currently consists of 57 ETFs which a beginner investor can start investing with a recurring plan as low as $50/month.

Additional Reading: Step by step guide to open your FSMOne account and start trading

However, not all the above 4 ETFs can be invested on an RSP approach using the FSMOne platform. The VOO and VT ETFs can be found as part of the 57 ETF offerings made available to RSP. However, the QQQ and VTV ETFs are not available for RSP on the FSMOne platform.

Conclusion

These 4 US ETFs for beginners are ideal candidates for a diversified portfolio. It combines elements of growth and value stocks as well as US-focused and international stocks.

These ETFs all have low expense ratios, which ensures that one does not “over-pay” for these ETFs which are mostly passive and tracks a broad-base index. While these expense ratios might seem “negligible” over a 1-year horizon, left compounded over a long period and the outperformance seen in a low expense ratio ETF vs. an actively managed high expense ratio ETF will be extremely evident.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Thematic ETFs partaking in the hottest trends

- Best China ETFs to buy [2020]

- Best performing ETFs which consistently outperform the S&P500 over the past decade

- Best ETFs in Singapore to structure your passive portfolio

- Lion-Phillip S-Reit ETF: Should you be buying this REIT ETF?

- Top 5 Best Growth ETFs that beat ARK funds in 2021

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.