US Blue Chip Stocks at 52-weeks high

The general U.S. market has been volatile these days; SPY ETF is down ~13+% YTD with many popular companies such as Amazon, Google, Tesla, etc. trading well below 10+% from their all-time highs (ATHs).

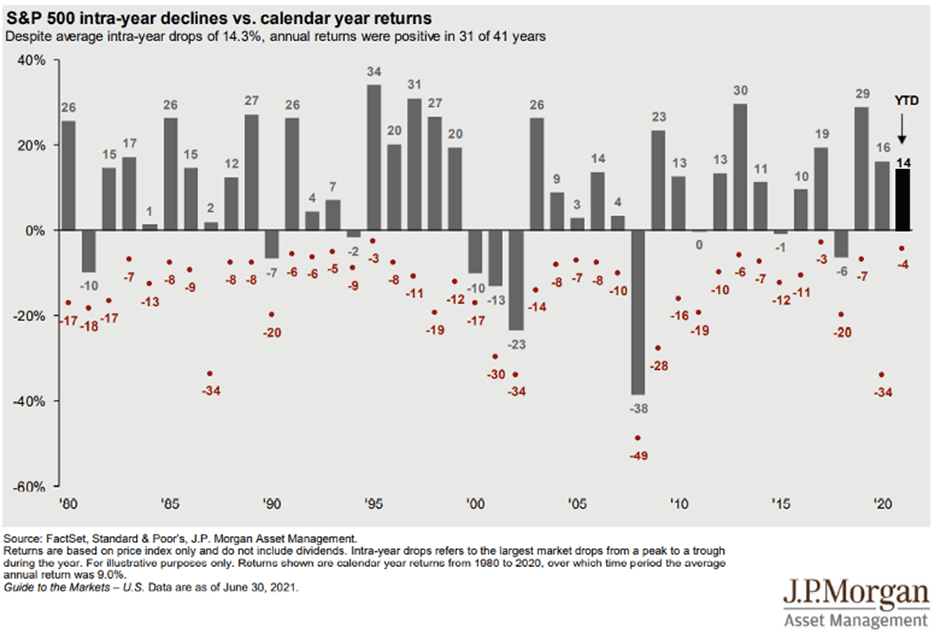

This may seem unfamiliar to new investors and traders who are not used to experiencing such big pullbacks in the general market and individual companies, especially for ones who only started investing / trading during the pandemic. However, it is pretty normal for the market to suffer such a pullback during the year.

As you can tell from the picture above, it is rather normal to experience intra-year drops of ~14.3% in the market for the past 40 years. Note that this includes the big bear markets of 1987, 2000, 2008, and 2020. So this drawdown of ~13+% SPY has experienced thus far is rather normal.

Reasons for market drawdown:

The many reasons for this market drawdown have been covered many times all over again both in my previous articles as well as in the mainstream media: sky-high inflation, high commodity prices, interest rate hikes, and quantitative tightening by The Fed, and geopolitical crisis in Ukraine / Russia. However, there is one more factor this year that would contribute to the volatility this year that does not get much traction: mid-term elections in the US.

Mid-term elections in the US are held near the midpoint of a president’s 4-year term of office where political seats in the House of Representatives and the Senate will be contested by Republicans and Democrats. This process usually has a pronounced effect on the market as a Democrat / Republican majority in either the House / Senate has a major effect on the financial markets.

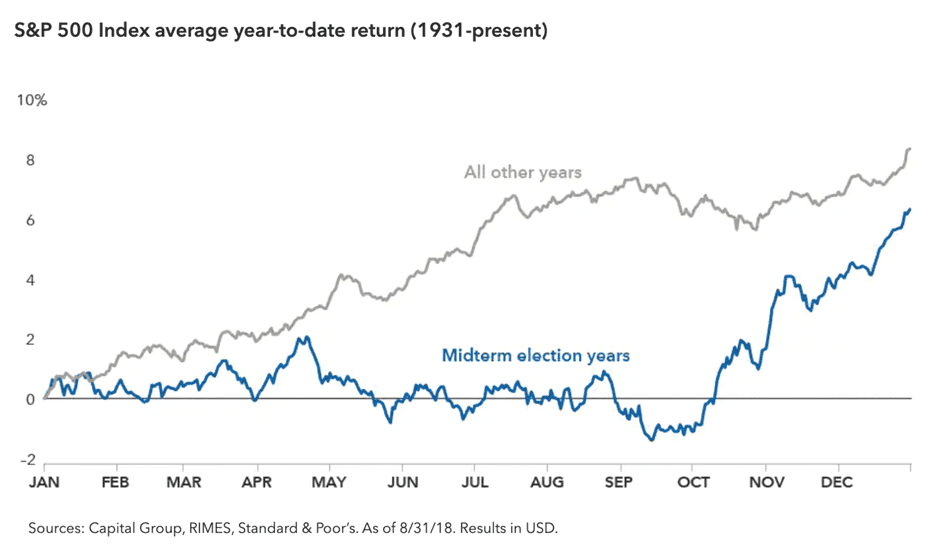

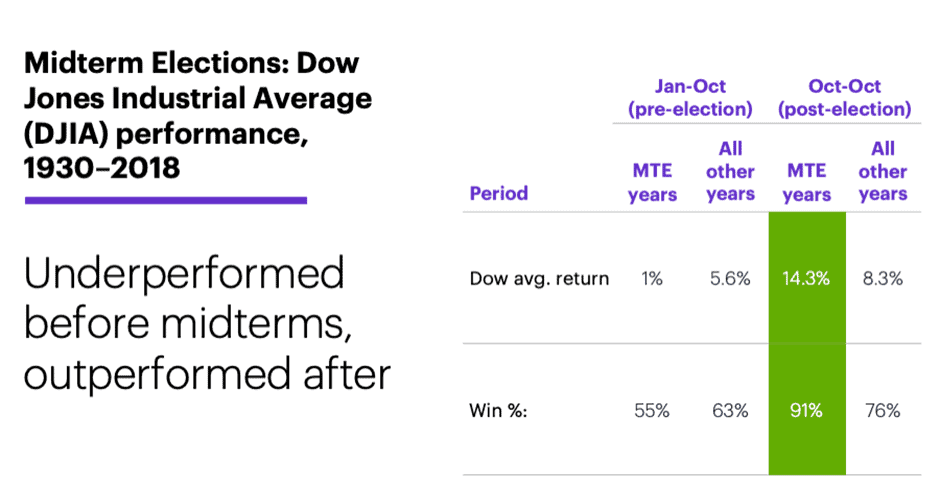

This comes in the shape of lower taxes and/or a more business-friendly legislative push by a Republican-dominated house/senate. A Democratic-dominated house/senate would try to push for more spending in certain industries (healthcare / social services) while trying to push for more business restrictive legislation. As such, mid-term years usually see more volatility in the stock market.

The good thing is that after the mid-terms, the market usually gets a strong rally. Will we see a rally this year even with the above mentioned factors? Nothing in this business is certain but over the long term, I am still bullish on equities.

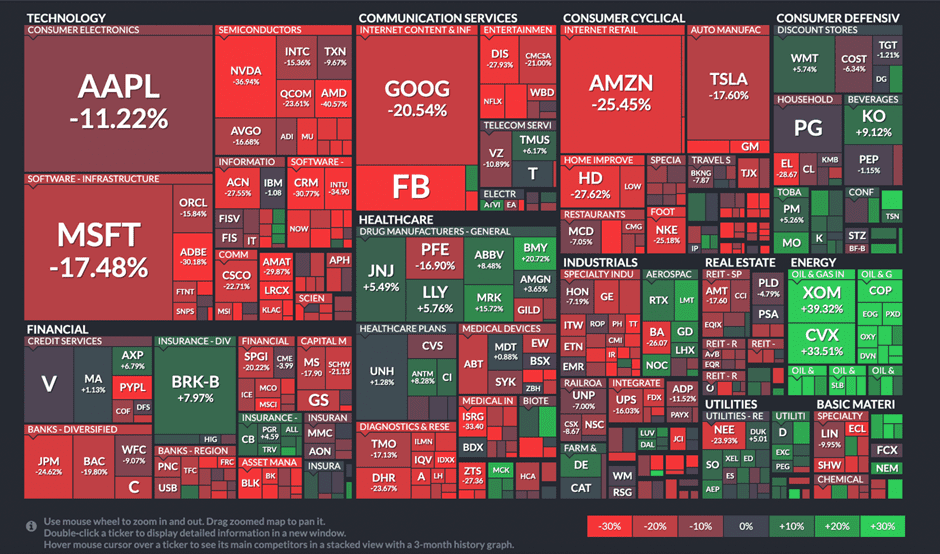

In this market, it can be hard to be bullish on equities given all the headwinds listed above as well as a possible recession on the horizon. Just take a look at the heatmap of the market’s YTD performance here:

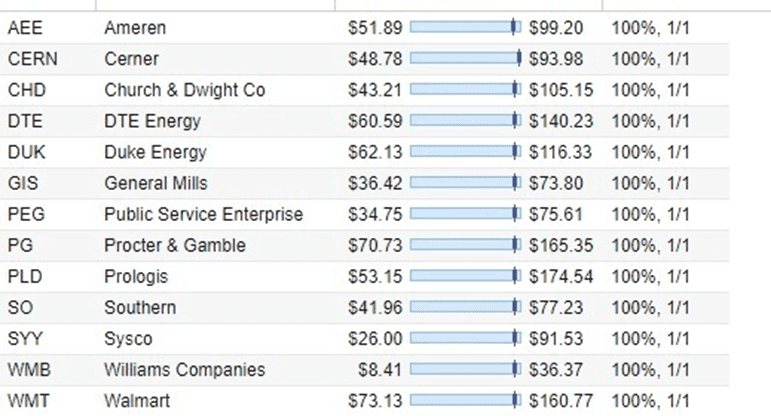

The winners of yesteryears have not been faring well thus far. However, it is not entirely hopeless as certain stocks are holding up well so far. These names are mostly in these sectors: Healthcare, Energy, and Consumer Defensives. Some of them are trading near or at their ATHs. Here is a list of these companies:

As expected, most of these names are Consumer Defensives or energy companies with the odd utility and healthcare names rounding up the list. What is noteworthy is that all of these companies pay dividends and have a relatively healthy balance sheet. This is important, especially in such uncertain times. So the question here is: Do these names provide value?

I confess I stay away from commodities as understanding and valuing commodity companies requires intimate knowledge of how the industry and the commodity cycle work which is connected to many other factors such as political decisions (Russia / Ukraine crisis and OPEC’s decision to produce and sell more oil). These can be fairly unpredictable and subjected to inexplainable political decisions that do not make economic sense.

As such, I shall focus on the consumer defensive companies. In particular, I will take a look at Church & Dwight Co (CHD), General Mills (GIS), and Walmart (WMT).

Church & Dwight Co (CHD):

CHD might not be a familiar name to Asians but it is a fast-growing US consumer packaged goods company that has been operating since 1846. It serves a variety of household and personal care products across North America, Canada, France, Australia, the UK, Mexico, and China. Attached is a photo of their portfolio of brands:

At first glance, these brands might not seem familiar to you, but if you take a closer look you might recognize the Trojan condom brand. Shareholders of this company can be assured of the fact that these brands have been gaining market share over the years which has resulted in significant growth in revenues, profits, and cash flows. This has resulted in a significant increase in dividends and share price appreciation over the years.

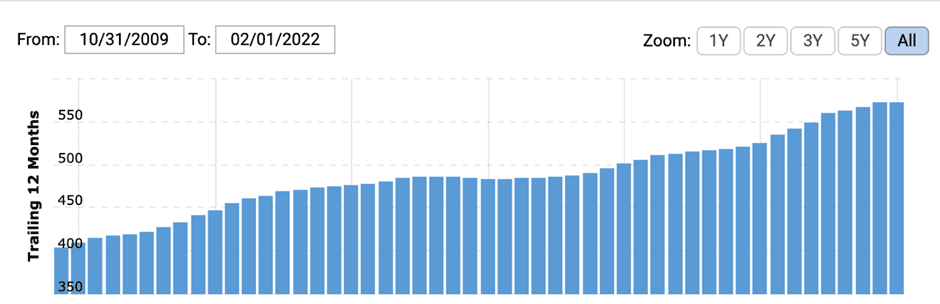

Rev growth of CHD over 10 years (in billions):

Growth in Gross Profits:

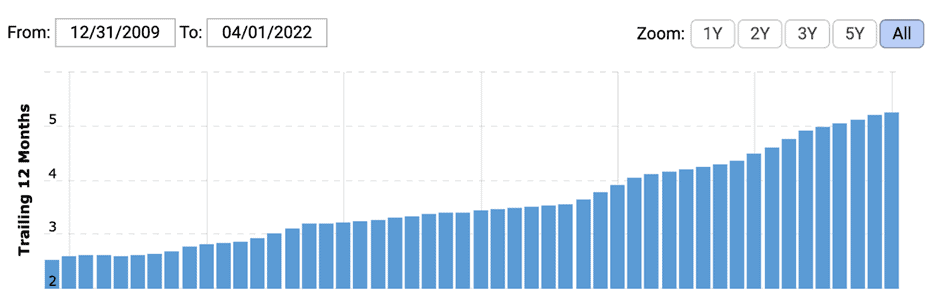

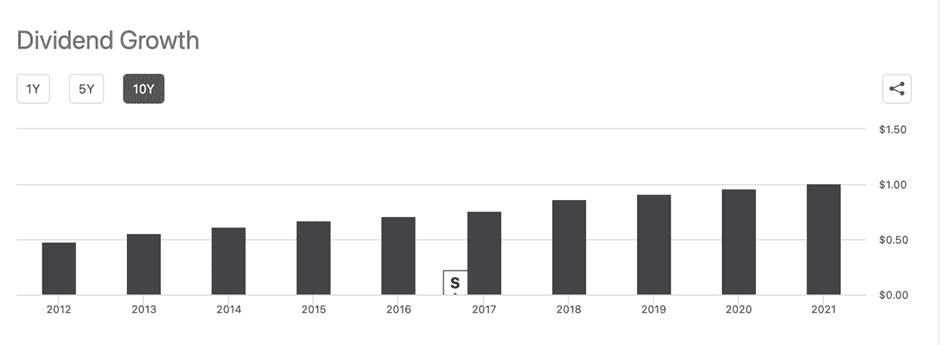

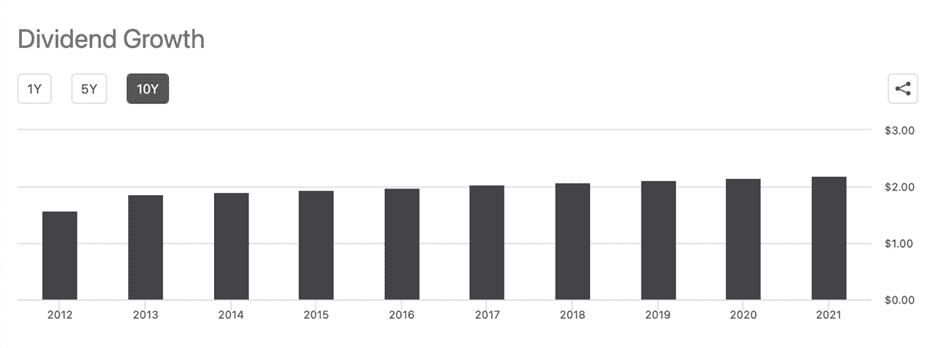

Dividend Growth:

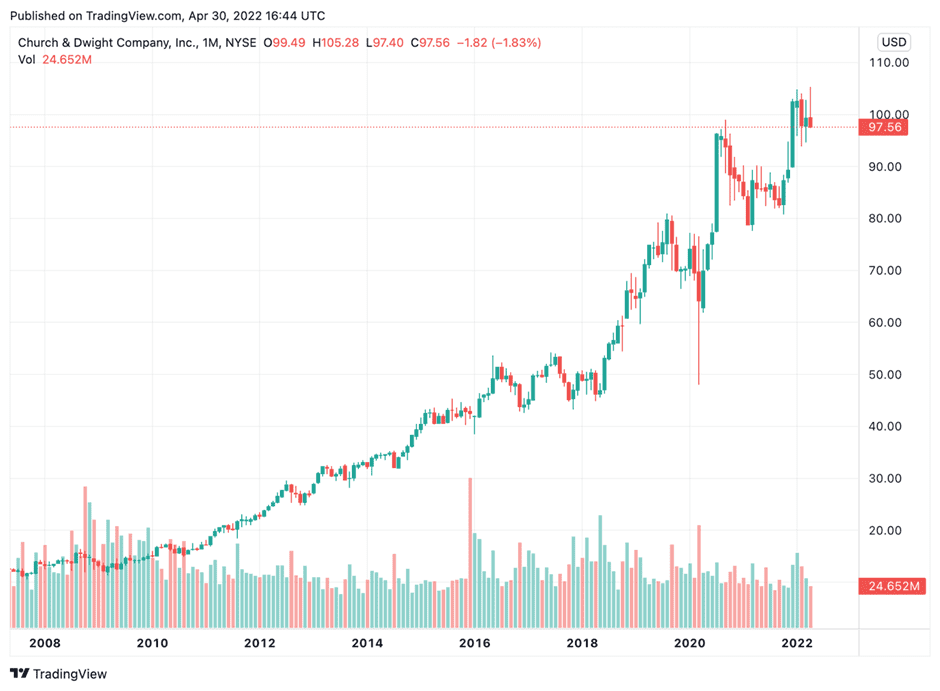

Stock Price Appreciation:

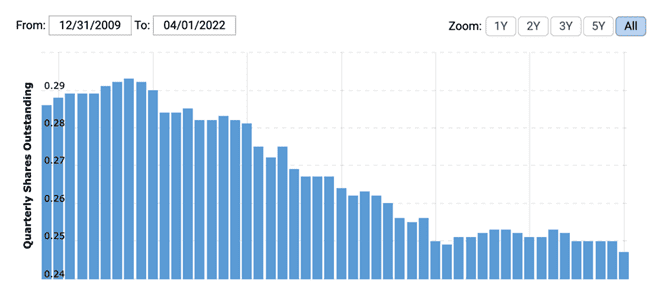

Buying CHD would grant you ownership of a stable slow-growing consumer staples company in which you would benefit from growing dividends and capital appreciation over some time. Management has gone on record stating they are focused on growing the business organically and growing the dividend as well as rewarding shareholders by buying back shares when they are deemed undervalued by management.

Shares outstanding:

Management has been certainly putting their money where their mouth is which has resulted in the market bidding up the company’s stock to near-record highs even when the general market has been selling off. CHD is a stable company with a solid balance sheet, which would do well in inflationary/recessionary times due to its product offerings, and one that is growing its dividends over time. However, is it trading at fair value now?

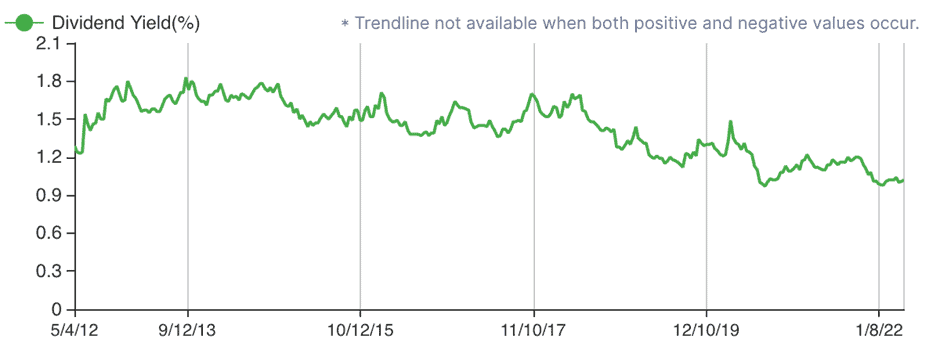

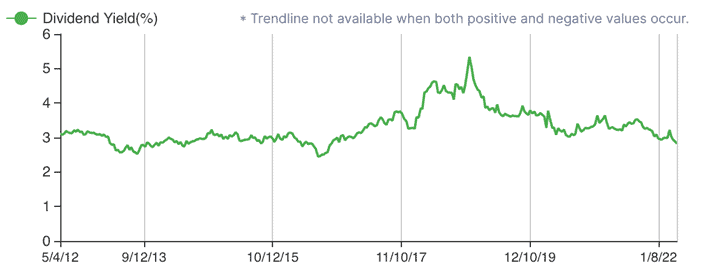

Applying the Dividend Yield Theory, we can figure out if CHD is undervalued. More information about the theory can be found in a previously written article:

CHD has a 10-year average dividend yield of 1.46%. Based on today’s price of $97, the company has a forward dividend yield of 1.08%. CHD is a solid company that would do well in today’s difficult macro conditions but it is too pricey for me to consider at the moment.

General Mills (GIS):

General Mills is another storied US company that is famous for making and providing general food items for the public since 1866. Here are some of its iconic brands:

You will no doubt be familiar with some of these names: Cheerios: the popular breakfast cereal, Nature valley: the maker of delicious protein/granola bars, and my personal favorite: Haagen-Dazs ice cream. These brands have delighted consumers all around the world for years and this can be seen in General Mills’ operating history over the years.

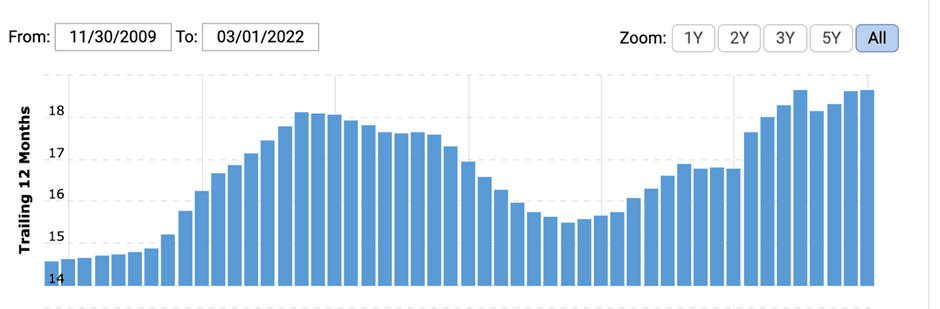

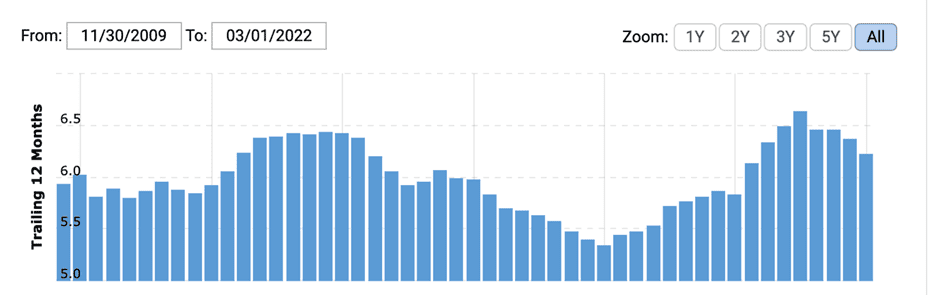

Revenue and profit growth has been on a general uptrend over the past 10 years except for the period between 2014 – 2018 when the company took a significant hit as it lost market share for its food items to restaurants and other competitors. Since then, revenue and profit growth have resumed and even surpassed its former highs in 2014.

10-year Revenue in billions:

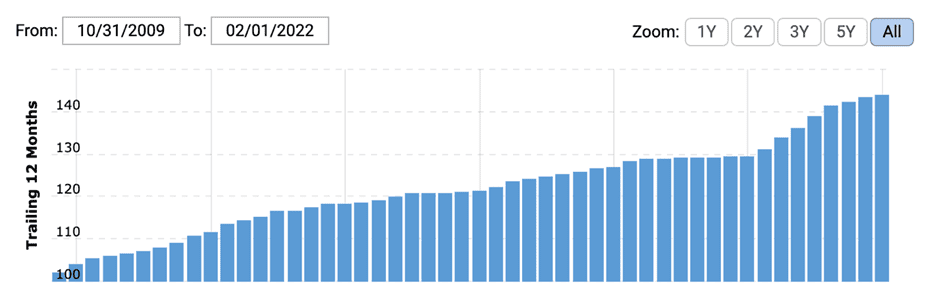

10 year Gross Profit in billions:

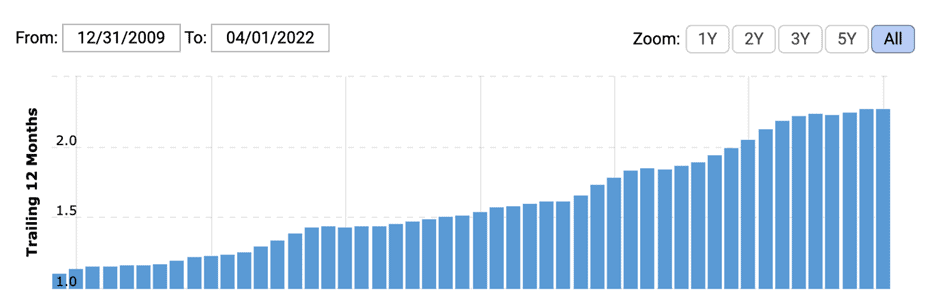

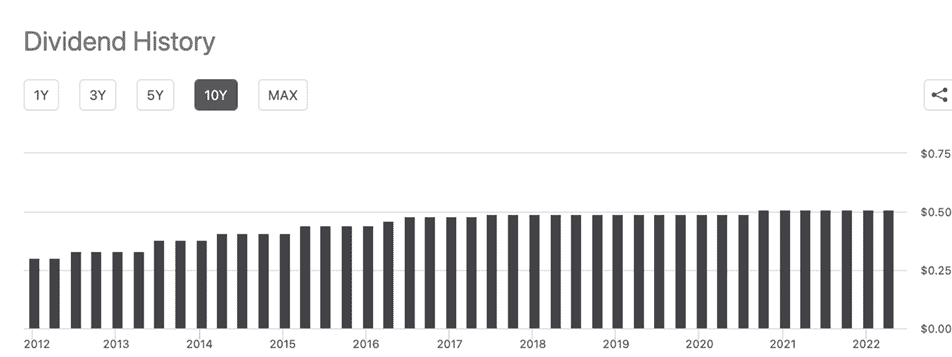

10-year Dividend History:

I think it is rather impressive that even through the significant decline in revenue and gross profit from 2014-2018, the company has managed to slightly increase its dividends paid and maintain such a payout during such lean times. It is a testament to management’s judicious governance of the company’s finances as well as their ability to bounce back from such a big setback.

In my opinion, management has learned from the setback suffered in 2014-2018 and is unlikely to repeat mistakes that would lead to a loss in market share again. General Mills’ products should still significant demand even during times of high inflation and/or recession. But is the stock trading at fair value?

Once again, I will look to apply the Dividend Yield Theory to check the company’s valuation. General Mills has an average 10-year dividend yield of 3.3%. At a current forward dividend yield of 2.88%, the stock falls short of being undervalued. As such, I will only look to keep this company on my watchlist but I would not add shares of it at the moment.

Walmart (WMT):

The symbol of America and the poster child of capitalism in the 1970s – 1990s, Walmart is an American multinational retail corporation that operates hypermarkets, discount department stores, and grocery stores all over the US. It has operations in other countries such as Canada, Chile, South Africa, Mexico, etc. It is the world’s largest company in terms of revenue with $548.74 billion in 2020 through its 10,593 stores and clubs in 24 countries.

You can get just about anything from a Walmart: groceries, family apparel, home furnishings, electronics, toys, sporting goods, gardening and pet supplies, health and beauty aids, and even weapons such as firearms! Talk about a one-stop-shop for everything. No matter what happens in the US, Walmart will always enjoy significant business as it provides necessities and discretionary products at affordable prices. Think of it as their version of NTUC, except it provides way more products.

For all the talk about Amazon going to eat WMT’s lunch, the company has done relatively well in the past 10 years. For such a behemoth, growth is really slow compared to smaller younger companies but WMT is a stable anchor, especially in times of uncertainty.

10-year revenue growth in billions:

10-year growth in Gross Profit in billions:

10-year Dividend History:

While the company has been slowly growing revenue and gross profits, its dividend growth has been non-existent as the company is more focused on buying back shares.

As mentioned earlier, Walmart is a solid stock that will provide great stability in times of uncertainty in the market but is it a great value? Walmart has a 10-year average dividend yield of 2.24%. At a current forward dividend yield of 1.46%, the stock does not appear to be undervalued based on the Dividend Yield Theory. Hence, I am not interested in owning Walmart at the moment.

Conclusion:

In this article, I have shared an additional reason behind the volatility seen in the general market thus far this year. While it has been scary, it is all part of the general market cycle, especially during a mid-term election year. I have also shared a list of companies that have been defying the market’s downturn by making all-time highs in recent days.

These consumer staple companies have been doing great over the past 10 years and would continue to do well even in inflationary/recessionary times. However, the market’s recent enthusiasm for these companies has resulted in relentless bidding of these shares to price levels where they might be overvalued in relation to their valuations.

Of the three examples listed above (CHD, GIS, WMT), GIS seems the most likely to reach its fair value should the market selloff eventually reach these names. As such, it is the stock to monitor most closely for a possible entry position. As of now, I would not be starting a position in any of these names. Ironically, there are a couple of big technology companies that are approaching very attractive valuations.

As always, this is my personal opinion of the companies and I would like to highlight that you should always conduct your due diligence before deciding to purchase shares of the companies mentioned above.

If you enjoy my writings and would like to participate in a financial community of like-minded individuals discussing personal finance and investing, you can join my discord at: https://discord.gg/Vhmjky4XEe

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Discord channel for an active discussion on all things finance!

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats