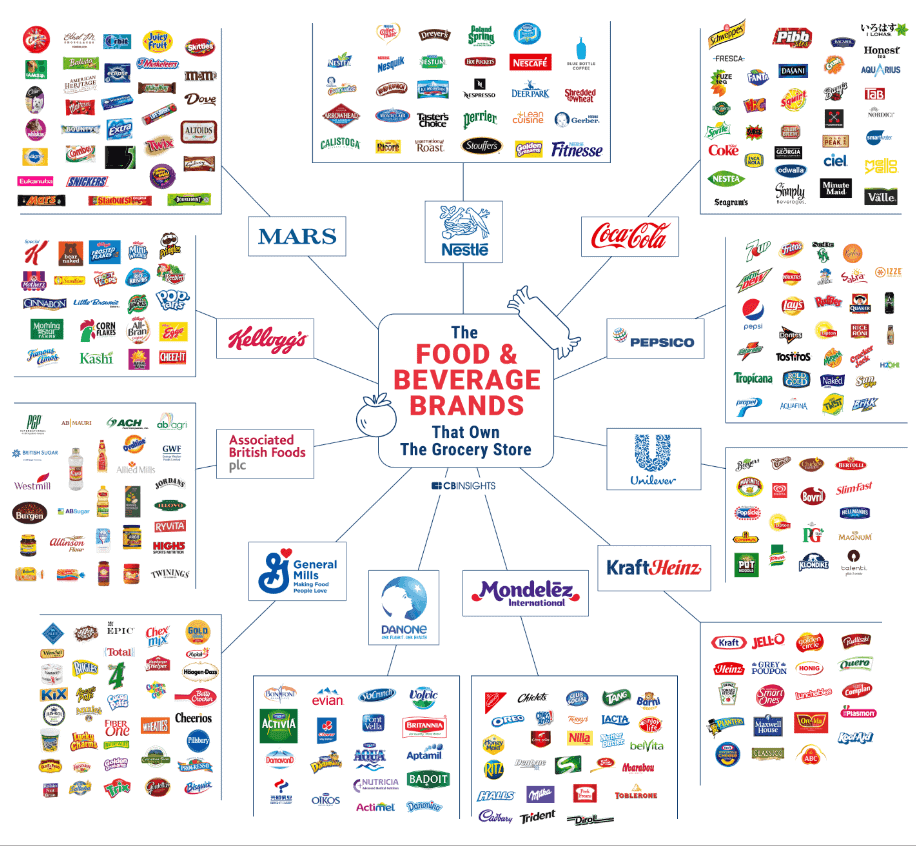

I recently came across this dated study (2017) of “The Food & Beverage Brands That Own The Grocery Store”.

While there are plenty of startups pushing forward new food trends, the market still largely belongs to a handful of companies. Nestle ranks top with a market capitalization of approx. USD310bn and revenue of USD92bn.

These stocks are ideal candidates for consideration in one’s portfolio, given their strong brand holdings that make them almost recession-proof. “Almost”, as there are always exceptions such as the downfall of Kraft Heinz.

Following Kraft acquisition of Heinz back in 2015, the company 1) failed to grow its top-line, 2) its cost-cutting initiatives got swamped by falling margins and 3) it continues to spend big on Capex but did not see the corresponding returns.

Since its share price peaked in Feb 2017 at around USD97/share, its share price has fallen by more than two-third and currently sits at USD31/share. Is there value at its current level?

We did a simple analysis of the above top consumer brand companies, evaluating them based on their current market cap relative to their revenue and earnings generation. This will provide us with some basic idea of how “expensive” these consumers stocks are.

The companies are ranked based on their current market capitalization. We exclude MARS in the list as it is a privately-held company.

No. 10: Kellogg’s

With a market cap of approx. USD22bn, Kellogg ranks No.10 in the list based on market capitalization. The company generated USD13.5bn in revenue for 2018, with a net profit of USD1.34bn.

Price to Sales (2018) = 1.6x

Price to earnings (2018) = 16.4x

Price to earnings (2019E) = 16.7x

No. 9: Associated British Foods plc

With a market cap of approx. GBP19.5bn (USD25.2bn), Associated British Foods is 9th on our list. The company generated GBP15.6bn in revenue for 2018 with corresponding earnings of GBP1bn.

Price to Sales (2019) = 1.25x

Price to earnings (2019) = 25.2x

Price to earnings (2020E) = 17x

No. 8: General Mills

With a market cap of approx. USD32bn, General Mills sits at No. 8 in terms of market capitalization of the top consumer brand companies. General Mills generated USD16.9bn in revenue for 2018 with a net profit of USD1.75bn.

Price to Sales (2018) = 1.9x

Price to earnings (2018) = 18.3x

Price to earnings (2019E) = 15.7x

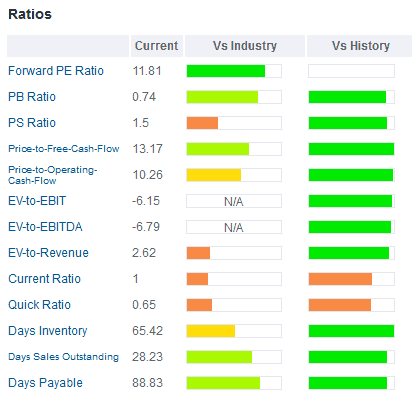

No. 7: Kraft Heinz

Following a hefty two-third reduction in its market capitalization, Kraft Heinz now sits at No.7 on the list with a market capitalization of USD37.9bn. The company generated USD26.3bn in revenue for 2018 and incurred losses of USD10.2bn. If we assume a similar profit level in 4Q19E vs. 3Q19, the company would generate total earnings of USD2.6bn.

Price to sales (2018) = 1.4x

Price to earnings (2018) = N.A

Price to earnings (2019E) = 14.3x

No. 6: Danone

Danone has a market capitalization of EUR51.6bn (USD57bn), making it No. 6 on the list. The company generated EUR24.6bn in revenue and EUR2.35bn in profits in 2018.

Price to sales (2018) = 2.1x

Price to earnings (2018) = 22x

Price to earnings (2019) = 22x

No. 5: Mondelez International

Mondelez has a market capitalization of approx. USD76.4bn, making it No. 5 on the list. The company generated USD25.9bn in revenue for 2018 with corresponding earnings of USD3.38bn.

Price to sales (2018) = 2.9x

Price to earnings (2018) = 22.6x

Price to earnings (2019E) = 21.5x

No. 4: Unilever

Unilever has a market capitalization of GBP123.7bn (USD160bn), more than double that of Mondelez but still sitting at No. 4 on the list. The company generated EUR51bn (GBP43.6bn) in revenue and core profits of EUR6.4bn (GBP5.5bn) for 2018.

Price to sales (2018) = 2.8x

Price to earnings (2018) = 22.5x

Price to earnings (2019E) = 23.2x

No. 3: Pepsico

Pepsico has a market capitalization of USD187bn, leapfrogging Unilever in market capitalization ranking over the past 2 years. The company generated USD64.7bn in revenue for 2018 while earnings came in at USD12.5bn. However, on an adjusted basis, the company only generated c.USD7.9bn in core earnings.

Price to sales (2018) = 2.9x

Price to earnings (2018) = 23.7x

Price to earnings (2019E) 24.4x

No. 2: Coca-Cola

Coca-cola, one of Warren Buffett’s favorite stock, currently sits at No. 2, with a market capitalization of USD227bn. The company generated USD31.9bn in revenue and earnings of USD6.4bn for 2018.

Price to sales (2018) = 7.1x

Price to earnings (2018) = 35.5x

Price to earnings (2019) = 25.2x

No. 1: Nestle

Nestle maintains its No. 1 ranking spot in the list with a market capitalization of USD310bn. The company generated USD92bn in revenue and earnings of USD10.1bn in earnings for 2018.

Price to sales (2018) = 3.4x

Price to earnings (2018) = 30.7x

Price to earnings (2019E) = 24.6x

Paying a premium for recession-proof consumer brands

Consumer brands are generally trading at a significant premium to the market as can be seen from the simple analysis above based on Price to Sales multiple and Price to Earnings multiple.

The largest brands such as Nestle, Coca Cola, and Pepsico have all seen valuation re-ratings in the past two years as their market capitalization accelerated at a much faster rate as compared to the smaller brands in the list.

As a general observation, the Top 6 consumer brands in this list trades at a much higher sales and earnings multiples compared to the next 4 brands.

The cheapest brand based on Price to Sales (2018) = Associated British Foods plc

Most expensive brand based on Price to Sales (2018) = Coca Cola

The cheapest brand based on Price to earnings (2019/20E) = Kraft Heinz

Most expensive brand based on Price to earnings (2019/20E) = Coca Cola

While Kraft Heinz looks to be the cheapest consumer brand stock based on a forward PER multiple of only 14.3x, the street is expecting earnings to deteriorate progressively over the next 2 years. Looking at its current key ratios vs. their respective historical trading range, according to data from Gurufocus, the company can be considered a valuation play. At today’s price of c.USD$31/share, investors are buying it at a 39% discount vs. Warren Buffett’s average cost of USD51/share.

General Mills, with a forward PER multiple of 15.7x and earnings growth of 2-5% over the next 2 years, seems to be a cheaper bet based solely on earnings. Associated British Foods plc also ranked well in terms of price to sales and spot a forward PER of only 17x with potential earnings growth of 3-7% over the next 2 years.

Coca Cola, a key Warren Buffett stock, trades at a premium in terms of both Price to sales multiple as well as forward PER multiple. The company is expected to have forward earnings growth of 7% over the next 2 years vs. 8% for Pepsico and 6% for Nestle. In this perspective, Pepsico seems to be the cheaper buy but not by much.

Conclusion

The large consumer staples companies are mostly trading at a premium, the most “expensive” of them all is Coca Cola, based on the simple ratios of Price to Sales and Price to Earnings. Their businesses are generally recession-proof, but there are also instances that a shift in consumers’ dietary habits could have a prolong secular impact on the company’s business (Kraft Heinz being impacted as consumers shifted away from processed food).

Recession-proof as they might be, these big consumer staple stocks are probably too pricey (with the exception of Kraft Heinz and General Mills) for my liking at their current levels but I will be sure to keep a lookout for any form of significant price corrections.

Are there any of these stocks that you are currently keeping in your portfolio? Which is your favorite food brand?

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER WRITE-UPS

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

- SEMBCORP MARINE 3Q19 LOSSES BALLOONED TO S$53M. WHAT YOU SHOULD KNOW

- VENTURE 6% PRICE DECLINE POST-RESULTS; SATS’ 2QFY20 COULD REMAIN WEAK

- YANGZIJIANG’S SHARE PRICE IS UP 7%. CAN MOMENTUM PERSIST POST-RESULTS ON 7TH?

- HOW TO PLAY THE PARTIAL OFFER FOR KEPPEL?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.