Time to buy Chinese Stocks?

Back in May 2021, I wrote this article highlighting the best China ETFs to buy. I highlighted my personal favorite China ETF in that list which was the iShares MSCI Taiwan ETF (ticker: EWT). The ETF isn’t a pure-play on China stocks but instead to Taiwan stocks, with its largest exposure being Taiwan Semiconductor which encompasses a massive 21% stake in the fund.

Amid the current bearish sentiments seen with regard to China stocks, it is surprising that the EWT ETF is still able to generate total returns of +19.2% YTD and +2% from the time I wrote the article in early May 2021.

Among the large-cap China ETFs with a market cap over $1bn, the uber-popular KWEB ETF, which focuses on China tech names, is the worst-performing of the lot, with total YTD losses of 35% and a peak to trough drawdown of > 50%.

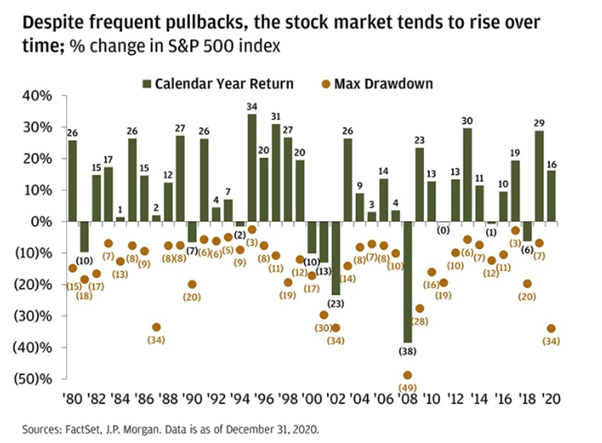

Just a point of reference. The S&P 500 peak to trough drawdown back during the heights of COVID-19 in early 2020 was 34%. The worst S&P 500 peak-trough drawdown dating back to 1980 was the 49% decline during the GFC in 2008, where the max decline reached 49% (the S&P500 ended down 38% in that year).

The current peak-trough decline seen in the KWEB ETF is showing a magnitude of extreme bearishness. Might that be an opportunity when blood is splattered all over the street?

I still like my exposure to the Taiwanese market through the EWT ETF where I take an indirect exposure to TSMC as well as many other Taiwanese companies that could stand as beneficiaries concerning the current semiconductor chip shortage issue.

However, the substantial decline in many of the China ETFs, especially KWEB ETF is now catching my attention and a plausible strategy could be to dollar-cost average into these ETFs, as risky as it might sound in the current context.

Is it the right time to catch a falling knife amid the Chinese government’s relentless “crackdown” on its stocks?

Beijing crackdown on Chinese stocks

Chinese stocks have been hogging the headlines and experiencing pricing pressure ever since Alibaba ran afoul of regulators in late 2020, with the government opening probes into internet platforms with monopolistic powers such as Alibaba and directly suspending the much-anticipated Ant Group IPO, which would have been a “bumper harvest” for Alibaba’s shareholders.

Alas, it was not meant to be and Alibaba’s Ant Group was forced to restructure its business, with many areas of its operations being curtailed in a bid to comply with regulators’ demands. Alibaba was also fined $2.8bn for anti-competitive actions.

Next up was the highly-awaited DiDi Global IPO in early July 2021 which was one of the biggest US IPOs in years. This was a highly popular IPO among US investors with James Cramer, the host of CNBC television saying that one should “try to get as many shares as you can” on DiDi Global.

China’s cybersecurity subsequently ordered app stores to remove DiDi Chuxing, just days after it IPOed, saying that the company violated restrictions on the collection and usage of personal information. A big accusation but small in specifics. That came days after announcing a probe and ordering Didi to suspend new users’ sign-ups.

That is how the Chinese government roll and get companies to “fall-in-line” and know their places.

More broadly, China will impose cybersecurity reviews on internet companies listing overseas (specifically targeting US listing), with Hong Kong listings being exempted. This suggests far fewer Chinese companies listing in the US in the foreseeable future.

Such a move could invariably result in a “cold war” between the US and China.

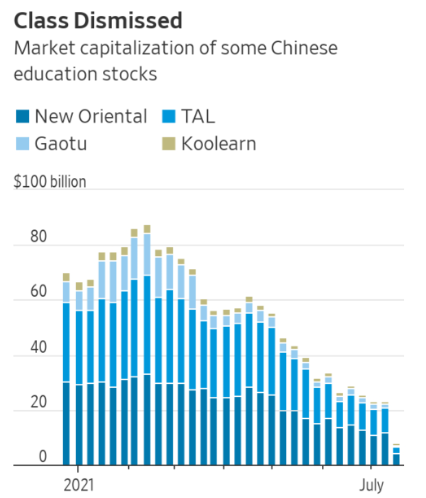

Then on July 23, Beijing mulled whether to make after-schooling tutoring firms nonprofit, resulting in for-profit school operators such as New Oriental Education (EDU), TAL Education (TAL), and Gaotu Education (GOTU) crashing on the last day of the week.

Beijing followed up over the weekend, confirming for-profit restrictions, triggering continued huge losses in Chinese school stocks when the market opens on Monday. That also drag down many of the blue-chip US-listed China stocks such as Tencent, Alibaba, and JD.com.

Although there were earlier “signs” that the for-profit education sector in China could see increased regulations with President Xi Jinping flagging back in March that the continual advertisement by these companies targeting parents who cannot afford such high tuition fees for their kids is a “social problem”, this is essentially a “worst-case scenario” for these educational players.

Beijing then followed up issuing new regulations to tighten oversight of the country’s massive food delivery sector, causing Meituan Chuxing to plummet 15% on 26 July. The counter has now tumbled almost 50% from its peak in Feb.

Is the whole China saga going to end with the latest fiasco by the Beijing government? I will not bet on that. Ongoing clampdowns on everything from internet platform operators to commodities producers and China’s massive real estate industry suggest more room for surprises.

The next 3-6 months remain a window for regulatory tightening by the Chinese government. However, it is unlikely that such stringent regulations will continue indefinitely and the government will likely focus on its target of doubling gross domestic product by 2035.

With prices coming down so drastically, now might be just the opportune time to “dip your toes” cautiously into China stocks.

How to buy Chinese stocks now

Is it the right time to be catching a falling knife? That is likely the question that investors who are looking to “score a bargain” are thinking.

I do think that for those who have yet to have any significant investments in China, this is a great time to think about allocating some funds to China.

To further reduce one’s risk, an investor can engage a dollar-cost approach instead of a lump sum investing approach for China-related stocks. Hence, instead of investing say $10,000 into a China blue-chip stock such as Tencent or Alibaba, one can break that amount up into five equal “installments” of $2,000 each, investing consistently over the next 5 months, for example.

If China stocks continue to see pressure, you get to buy more shares of these stocks. If China stocks rebound, you still get to partake in their upside, although the gains will not be as substantial as a lump-sum approach.

For even greater diversification and risk mitigation, instead of focusing on a single stock such as Tencent or Meituan (both listed in HK which will also require more capital outlay due to min shares purchased required), one can get diversification through ETFs such as the KWEB ETF (mostly tech counters which have seen the largest drawdown) or a more broad-based ETF such as the iShares MSCI China ETF (MCHI) which seek to invest beyond just China tech counters but also large-cap banks and insurance companies.

Beyond dollar-cost averaging into a basket of China stocks through ETFs, one will also need to extend his/her investment horizon and be prepared to “stick with” these China companies over the next 5-10 years.

As mentioned earlier, the incessant regulatory “attacks” on China companies ain’t going to last, in my view. Once these big corporates have all fallen “in-line”, the government will start implementing growth initiatives to spur its economy. A diversified China portfolio betting on the growth of the Chinese economy over the next decade remains a sound strategy.

For those investors with shorter horizons, or looking at the situation from a trading angle, then the opportunistic investments need to be aligned with the government policies.

Areas such as green technology, demand for luxury goods (as disposable income rises), travel, semiconductor, etc are all industries with which the central government has no issues but have similarly been impacted by negative sentiments.

These counters might see a swift rebound when China’s sentiments improve.

Alternatives for Singaporean investors

For Singaporean investors who do not wish to purchase these US-domiciled China ETFs, one can look closer to home.

There are now 2 key ETFs that are exposed to the China market that Singaporean investors can purchase. They are the 1) Lion-OCBC Securities Hang Seng Tech ETF (HST for SGD denominated and HSS for USD-denominated) as well as the 2) Lion-OCBC Securities China Leader ETF, a product that is expected to be listed on the Singapore Exchange on 2 August 2021.

Lion OCBC Securities Hang Seng Tech ETF

Jointly launched by Lion Global and OCBC Securities, this will be the first ETF that will be invested exclusively in technological companies domiciled in China. Investors who choose to buy this ETF will essentially be investing in a diversified portfolio of the 30 largest China-domiciled technology stocks listed in Hong Kong via the SGX.

This ETF will be listed in both SGD as well as USD. For Singaporean investors who do not wish to have exposure to currency-related risk, he/she can select to invest in the SGD-denominated ETF (HST).

The expense ratio of 0.68% is also substantially lower than that of 3033HK.

Besides the elimination of foreign currency risk as well as lower expense ratio, the other benefits of purchasing this ETF listed here in SG is that the ETF is traded in board lot size of 10 units which makes the minimum investment a lot lower as well as the fact that these ETFs can be purchased without a custodian account (kept in your CDP) and hence there will not be any custodian fees.

Another benefit is that the ETF can also be purchased using your SRS account.

For those who are interested to find out more about the Lion-OCBC Securities Hang Seng tech ETF, you can read up more from this website.

Lion OCBC Securities China Leader ETF

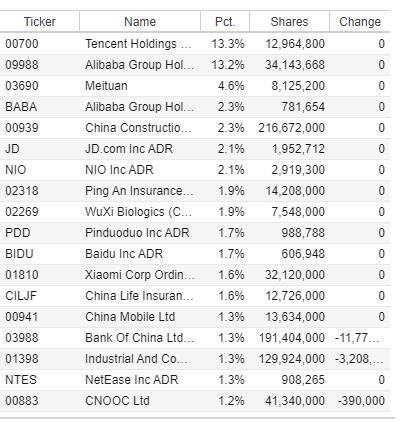

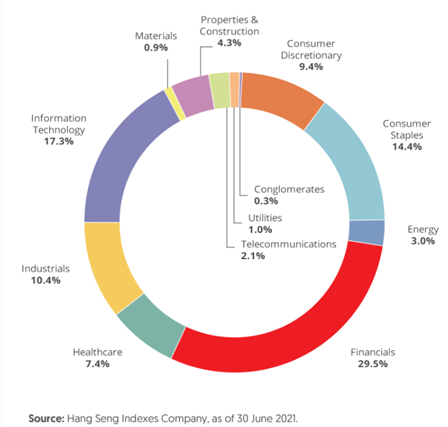

This is an ETF that is newly introduced to Singaporean investors, allowing one to partake in China’s growth through exposure to 80 of the largest Chinese names. The objective of the ETF is to replicate as closely as possible the performance of the Hang Seng Stock Connect China 80 index.

This index measures the performance of the 80 largest Chinese companies in terms of market cap listed in Hong Kong and/or China that are eligible for Northbound or Southbound trading under the Stock Connect Scheme.

Every single company’s weighting is capped at 8% while the overall industry weighting is capped at 40%, hence unlike the Lion OCBC Securities Hang Seng Tech ETF which mostly consists of companies in the tech sector, there is additional diversification for the China Leader ETF.

The Top 10 holdings of the company and sector breakdown are shown in the table below, as sourced from OCBC.

Like the Hang Seng Tech ETF, Singaporean investors can also use their Supplementary Retirement Scheme (SRS) to invest in the ETF on top of using cash. The ETF will be available in both SGD and RMB.

Buy Chinese Stocks through a Robo advisor like Syfe

A Singaporean investor can also look to partake in the Chinese market indirectly through the Syfe Robo advisor platform. I have written about Syfe and its latest Core Portfolios offering where the Robo advisor allows its investors to partake in the growth of China through its stake in the MCHI ETF and KWEB ETF.

For those who are interested, you can check out the detailed write-up on Syfe’s offering in the article below:

Additional Reading: Syfe Review. Is this now the most comprehensive Robo Advisor in Singapore?

Conclusion

There is no doubt that Chinese stocks are out of favor at present. There is blood on the street which is just the time that Warren Buffett loves to start investing. For those who are savvy enough to invest in individual stock counters, look for companies that will continue to maintain their market leadership position in their respective industries and have game-changing products and services.

This is evident from both sales and earnings growth that consistently beat/meet expectations. For stocks that are not profitable, make sure that these counters possess a superior product and are growing their top-line rapidly such as Nio.

For a simpler way to invest without taking on too much unsystematic risk, one can dollar cost average into a China-related ETF. A dollar-cost approach reduces the psychological risk associated with investing a huge sum of money (either at the market peak or when trying to catch a falling knife). An ETF product diversifies one’s exposure to individual counters and/or industry.

Now might seem like the worst time to invest in China stocks, with negative news flow hitting the market almost daily and there is no assurance that this is the end.

However, for new investors with a longer-term timeframe, now might just be the time to take advantage of market fear and buy blue-chip China stocks at the cheap. A broad-based diversification strategy using ETF is a more ideal solution for a new investor as it removes the higher volatility inherent with investing in individual stock counters.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

- TOP 5 RESILIENT SINGAPORE STOCKS TO BUY AMID COVID-19 UNCERTAINTY

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- BEST ETFS IN SINGAPORE TO STRUCTURE YOUR PASSIVE PORTFOLIO

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.