In the past I wrote an article about the best predictor of stock price performance, according to a Morgan Stanley research. The team looked at 4,000 stocks going back to 1997 because that’s about when high-quality data first became available.

They looked at factors such as Price/Earnings, revenue growth, leverage, free cash flow yield, and share price momentum, a total of 81 screening criteria.

The conclusion then was that a strategy focusing on buying strong free cash flow stocks rather than strong earnings generated better performance.

For those who are not familiar with financial terminology, free cash flow is the money that a company collects after paying for big-ticket investments, typically termed as their capital expenditures or Capex for short.

Free Cash Flow = Operating Cash Flow – Capex

Why is free cash flow important? Currently the best stock price predictor, according to the research done by MS was Free Cash Flow divided by Enterprise Value (where enterprise value is defined as a company’s market capitalization adjusted for the company’s cash and debt)

Enterprise Value = Market Cap + Total Net Debt (or – Total Net Cash)

If a company has plenty of debt on its balance sheet, its Enterprise Value (EV) will be larger than its market cap. Conversely, if the company is in a net cash situation (more cash vs. debt), its enterprise value will be lower than its market cap.

Using Free Cash Flow / Enterprise Value (investing into companies with the highest ratios) beat the market by 8.3ppt over the past 22 years and 3.7ppt over the past 5 years. This compared much favorably to growth factors over the same horizon.

An alternative way to look at this equation is to flip both the numerator and denominator around, ie: Enterprise Value / Free Cash Flow. Such a formula is similar to the Price / Earnings ratio which most investors are more familiar with. Using the equation of Enterprise Value / Free Cash Flow, stocks with a lower ratio are favored over those with a higher ratio. From a value angle, these stocks are considered “cheap”.

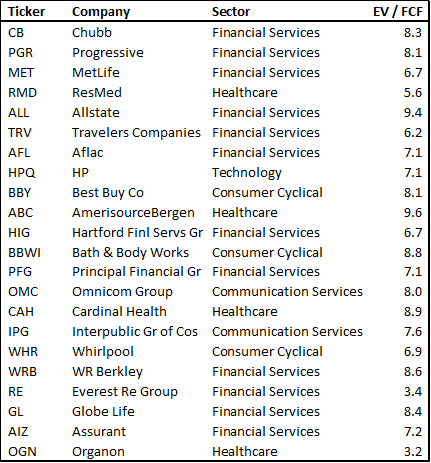

The table below shows the list of 22 S&P 500 stocks with Enterprise Value / Free Cash Flow less than 10x at present. These are the “cheapest” stocks that one can currently purchase using the Enterprise Value / Free Cash Flow ratio.

While this financial indicator has proven to outperform the market over a long horizon, it should not be seen as the “holy grail” of all financial indicators.

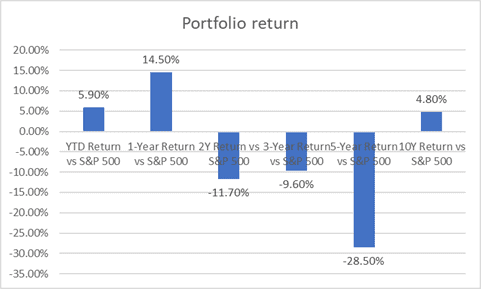

In the current global economy, if one purchased these 22 stocks over a 10 years horizon, the outperformance would have been a marginal 4.8% over the past 10-years, with a portfolio of these stocks massively underperforming the S&P 500 over the past 5 years.

A more robust free cash flow evaluator

I like companies that consistently generate a high free cash flow. The generated can add to a company’s cash hoard for future deployment (such as M&A) or return to shareholders in the form of a share buyback or cash dividends, actions which typically result in higher price performance.

However, beyond consistent free cash flow generation, there are 2 other financial ratios that I typically take into account:

- Forward sales growth

- Return on Invested Capital

I prefer selecting a company that is growing its sales instead of a mature company where sales have stagnated. I also evaluate a company based on its efficiency. I recently wrote an article about the efficiency of a company from the perspective of net income generation per employee. Another way to look at a company’s efficiency is through the Return on Invested Capital ratio (ROIC).

I wrote about the ROIC ratio in several articles such as this one: How to outperform the market by 100+%.

Additional Reading: 5 key financial ratios to identify good growth stocks.

The higher the ROIC ratio, the more efficient is the company in deploying its capital to generate profit.

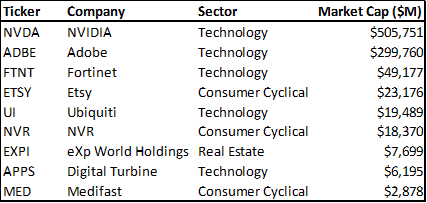

By combining forward sales growths and a high ROIC ratio alongside consistency in free cash flow generation, I screened out a handful of 9 stocks that meet these criteria.

Screening requirements:

- Sales Growth this year > 10%

- Sales Growth next year > 10%

- ROIC > 20%

- Growth in free cash flow generation for each of the past 5 years

There are some blue-chip names in the list such as Adobe and NVIDIA which are the two largest cap stocks in the list. Other familiar names include stocks such as Fortinet and Etsy.

The smallest cap stock in this list is Medifast which is a consumer cyclical stock that produces, distributes and sells products concerning weight loss, weight management and healthy living.

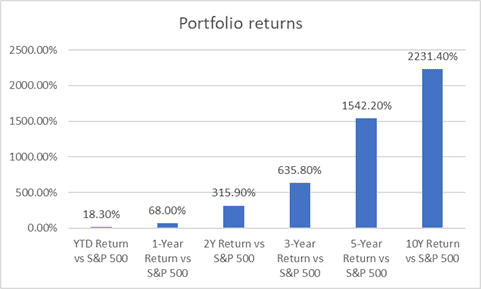

If one bought into a portfolio of these 9 stocks 5-years ago (some of these stocks lack a 10-years trading record), one would have outperform

ed the market by more than 1,500%. To put it in numbers, $100 invested in a portfolio of these 9 stocks just 5-years ago would have a value of more than $1,600 today.

That $100 invested in the S&P 500 would have “just” doubled your returns over this horizon.

This list of 9 stocks has generated one of the strongest outperformance over the past 10 years, with YTD outperformance vs. S&P 500 of c.18% (ie: the portfolio would have returned 43% vs. the S&P 500 18.8%).

Conclusion

Buying into “cheap” stocks based on the Enterprise Value / Free Cash Flow ratio has shown to be a strong outperformer over the long run, according to research data from Morgan Stanley. However, when one combines VALUE characteristics such as consistency in free cash flow generation with GROWTH characteristics such as sales growth alongside QUALITY characteristics such as ROIC, the results would typically be a lot more superior.

Some of the companies in this list are not highly profitable, companies such as Etsy and Digital Turbine, etc are still viewed and valued as growth companies. However, these are companies already profitable and looking to leverage their sales growth to further improve their bottom line.

These companies, in my view, are better positioned compared to “pure” growth companies which are far from generating any profits in the near horizon and are banking on a “sexy” growth story to sustain their upside price momentum.

In addition, despite their low profitability nature, companies such as Etsy for example are generating tons of free cash flow that can be recycled into growing its organic operations vs. seeking additional funds from the capital or debt market (typical of growth companies).

Buying into a basket of these consistent free cash-generating companies, while not exactly seen as “cheap” companies by traditional metrics, could reap strong returns if their consistency, both on a free cash basis and sales growth can be maintained in the coming years.

For those who are interested to screen for such stocks, using the Stock Rover screener is the easiest and fastest way to finding such stock gems based on metrics like free cash flow yield.

Stock Rover

One of the best stock screeners for US stocks, the stock rover platform is a “must-have” for all serious stock fundamentalists looking to uncover “gems” in the market

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only