Stock Rover Review 2023: Best Fundamental Stock Screener

Stock Rover is perhaps one of the most comprehensive fundamental stock screeners out there, an almost perfect ALL-IN-ONE stock screener that allows one to screen for fundamental results on the more than 6,000+ US and Canadian stocks/ETFs out there.

Unfortunately, it does not provide international stock screening. However, if you are into investing in the US stock market, then this fundamental stock screener is a MUST-HAVE in my opinion.

Stock Rover can also be used to back-test your screening strategy, an important element that allows you to gauge the effectiveness of your screening criteria. Let me show you how to do it in the post.

For those who are interested to find out how I use the Stock Rover platform to find stock gems based on the different investment strategies such as:-

- How to profit from a short squeeze? Finding the next AMC perhaps?

- How to screen for strong stocks in strong industries

- Finding value stocks that have consistently outperformed the market

- Finding some of the best thematic ETFs to invest in the US

PLUS many other strategies which I used the Stock Rover premium to give me an edge, do read on to the end of the article to find out how to receive this information that you will not be able to find anywhere else.

The following content contains a non-sponsored review but may contain affiliate links.

Who is Stock Rover?

Stock Rover is a powerful and efficient equity research platform designed to be the one-stop shop platform for serious investors. Stock Rover excels in both STOCK and ETF comparison, screening, and portfolio analytics.

It also provides a myriad of other capabilities such as advanced charting, real-time alerts, stock ratings, earnings calendars, brokerage integration, etc. Other benefits include a 10-year historical financial database as well as access to Morningstar analyst ratings.

Stock Rover also allows an individual investor the ability to perform portfolio correlation as well as some simple backtesting which I will provide an example later.

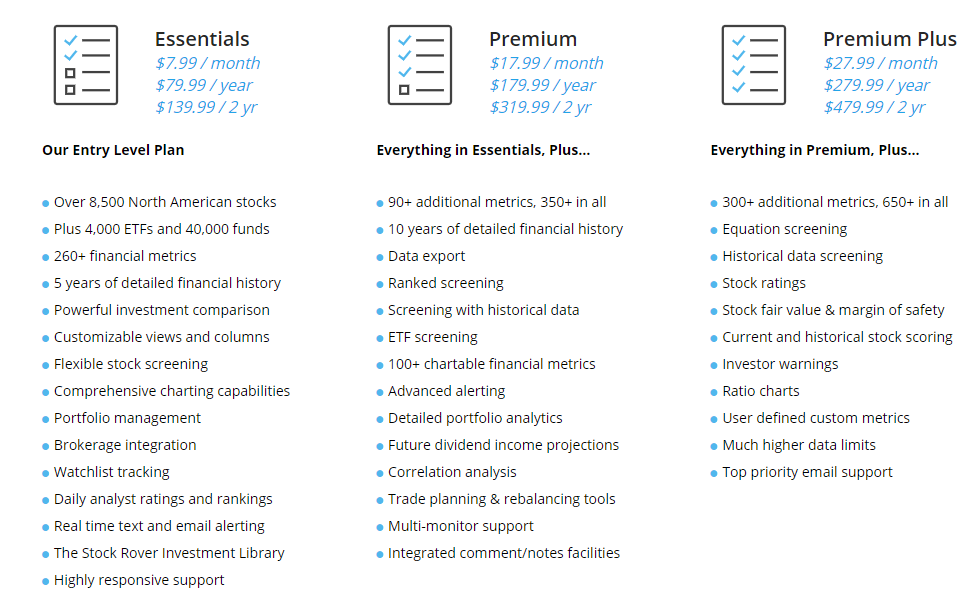

Stock Rover Pricing

While you can have Stock Rover for free, the real benefit is unleashed when you subscribe to stock rover Premium Plus Service for US$27.99/month or just US$1/day which is very affordable when you consider that you will be getting your hands on some of the most comprehensive financial data that would have easily cost 10-20x more if you use a premium subscription like Bloomberg or S&P.

How Much Does Stock Rover Cost?

I strongly recommend going for stock rover Premium Plus plan at $27.99/month which gives you access to stock rover’s research reports, equation screening, and historical data screening, later both can be used for back-testing your customized screeners.

However, you do will get access to Stock Rover’s proprietary Fair Value and Margin of Safety calculation which gives you a quick snapshot of whether a stock is trading at a “premium” or “discount”, according to Stock Rover’s intrinsic value calculation. It is based on the discounted cash flow methodology which can be rather subjective. Nonetheless, it is a good reference point for investors looking to gather a fair value opinion of a particular counter. Also, the stock rover library is a free online repository of screeners, portfolios, including guru portfolios, watchlists, views, and custom metrics, etc.

One can further “package” Stock Rover’s Fair value estimate alongside the street’s mean consensus target price which is also available in Stock Rover. If both metrics show a “BUY”, it will give greater confidence to an investor.

For those looking to do your fundamental stock screening for US or Canadian-based stocks/ETFs, Stock Rover is likely your best bet. Get a 14-Days free trial session now.

Let us now take a quick look at the product offering of Stock Rover.

Stock Rover Premium Review: Wide range of services and features

Today’s Market Panel

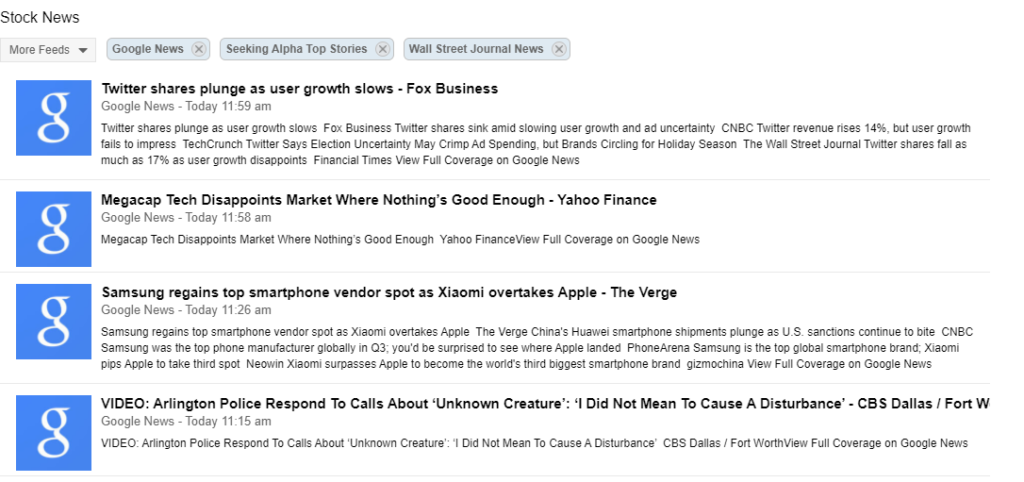

This is where you access your dashboard which you can customize according to your portfolio holdings. It will provide you information on some of your top stock movers etc, news related to your stocks, the value of your portfolio over time, dividend, and future income projection.

You can get pretty comprehensive stock news coverage from news sources such as Google News, Benzinga, Investing.com, Seeking Alpha, etc.

Display Panel

ALL

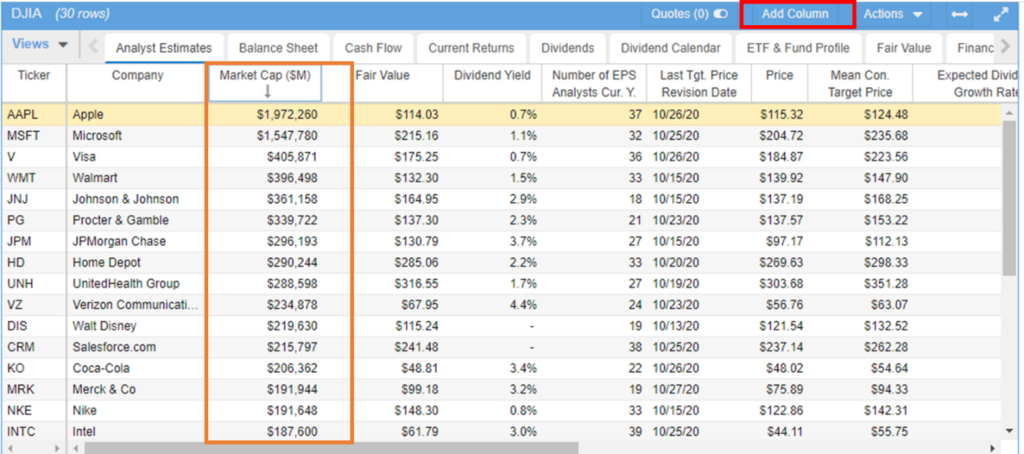

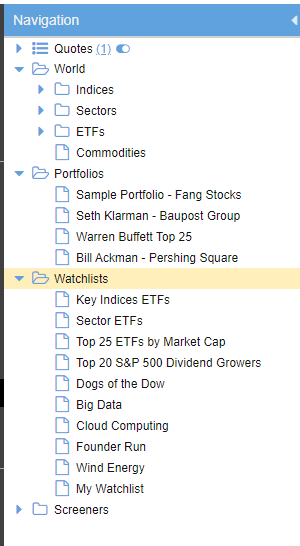

This is the key area where you will likely be spending the majority of your time. Most of the time I will select the “ALL” function in this panel. You will be able to see various folders under the “Navigation” segment to the right. Let say you click on Indices, for example, and select the DJIA. It will then show you the exact stock composition of the DJIA Index.

Nothing fanciful. When clicking on the individual stock in the main platform area, for example, Apple stock, in this case, you will see the stock performance of Apple stock showing at the bottom (and you can customize to compare its performance vs. a broader index or with any other stocks) and on the far right, you will see the “Insights” for Apple. I will go through this in more detail later.

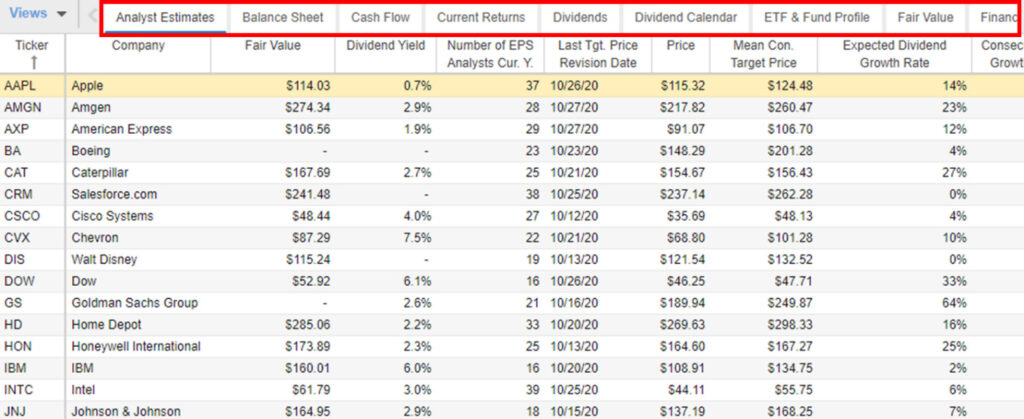

There is a LOT of information that you can glean in the main tab. Starting with “Views”, this is where you can obtain a wide variety of information on the list of stocks in question.

For example, you can find “Analyst Estimates” of the stocks, such as the mean consensus target price which we highlighted earlier or you can look at the “Balance Sheet” profiles or “Cash Flow” profiles of the stocks.

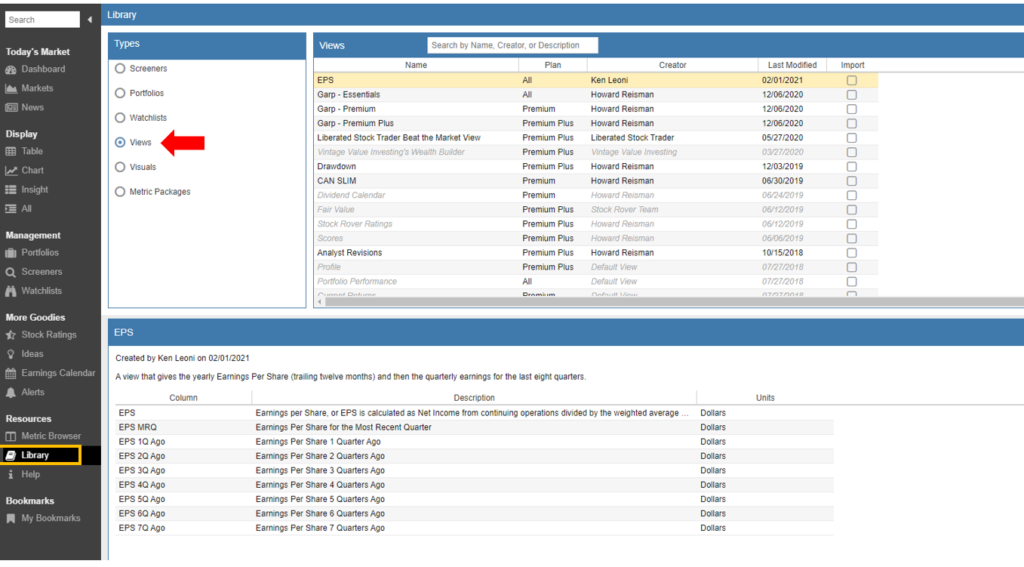

You can customize these “Views” according to your preference and insert additional “views” by clicking on the “Library” tab found at the most bottom left corner of the left-hand side panel under “Resources” and subsequently import new “views” into this dashboard.

The Stock Rover software is also very robust in that it allows you to customize and add new columns in a particular view.

For example, the above diagram shows the “Analyst Estimates” view. However, it is lacking a “market cap” column which allows me to filter the stocks according to their respective market cap. I can click on the “Add Column” found at the Top right-hand area which will consequently insert the market cap information (or whatever information that is available on the platform, which is A LOT) and allow me to sort the stocks according to their market cap.

This to me is a very useful function. I can also customize my own unique “view” with the relevant information that I most frequently use to evaluate the fundamentals of stocks.

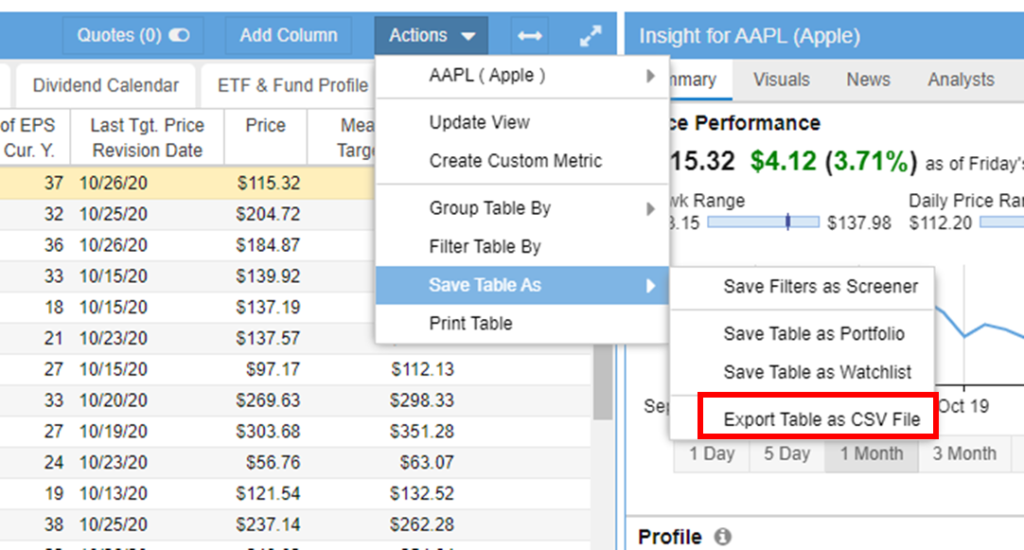

Lastly, with the stock rover Premium Plus plan, one can also export the research reports as a CSV file for further analysis using excel.

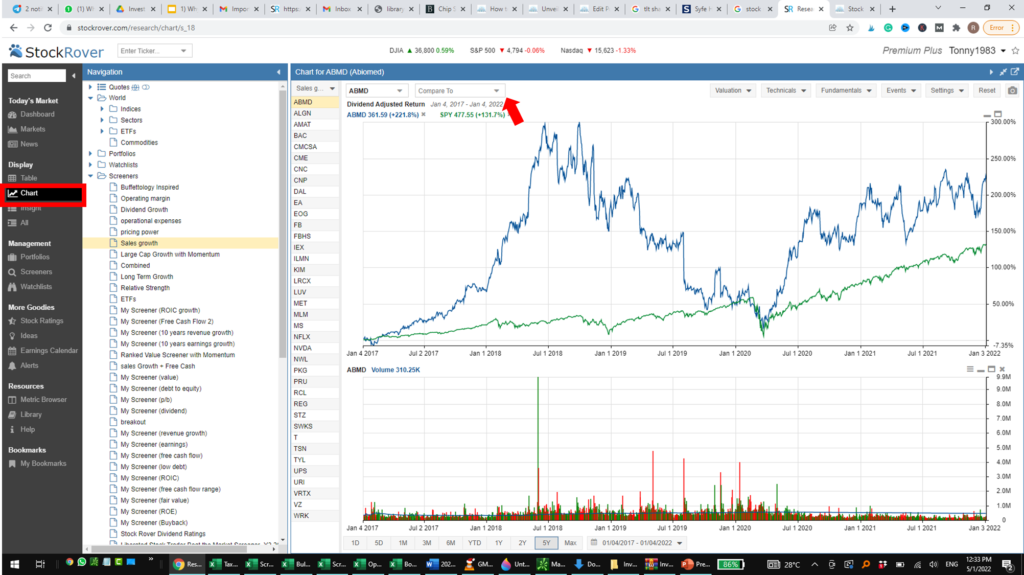

Charts

Jumping briefly to the layout area, this is where we can blow up the price chart performance of a particular stock that we might be interested in.

A nifty trick that I use to evaluate the strength of a particular stock is based on their “outperformance” relative to the general market index (S&P 500) as well as their respective sector/industry.

You can COMPARE a particular stock price performance by clicking on the compare bar and selecting the general indices or the particular stock’s sector/industry to see its price-performance vs. not just the market in general but also against its peers.

When I trade, for example, I want to only select the strongest sectors, ie those SECTORS that are outperforming the market, and identify the strongest stocks in those sectors.

In the example above, it comes as no surprise that the tech sector has been outperforming the market over the past 5-years and Apple has been outperforming its peers over that period. One would have been thus richly rewarded if one bought into Apple stock 5 years back.

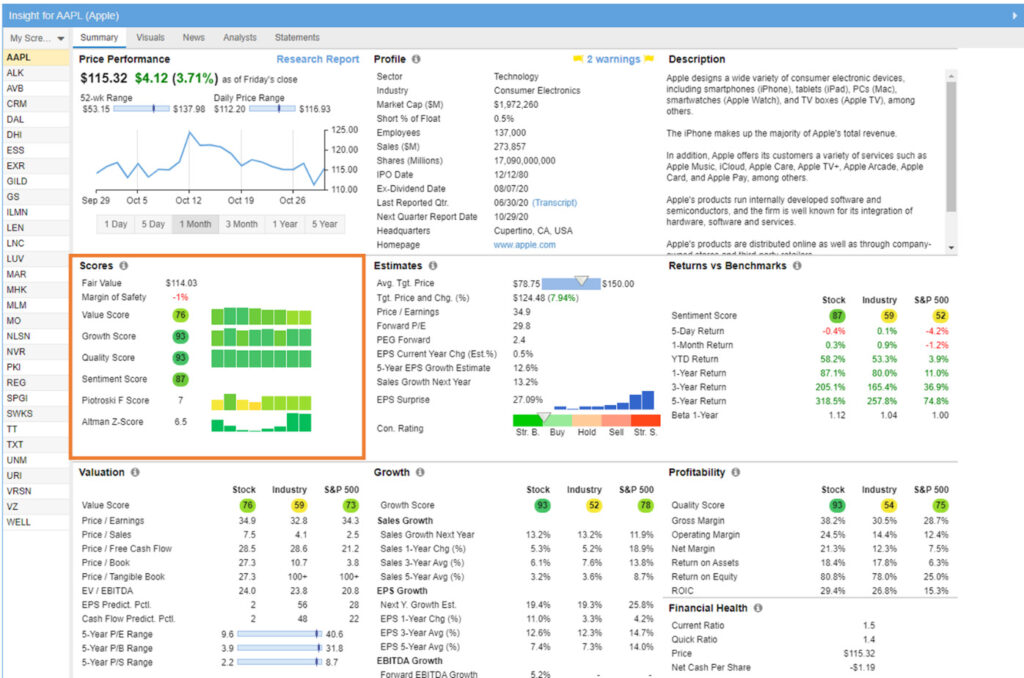

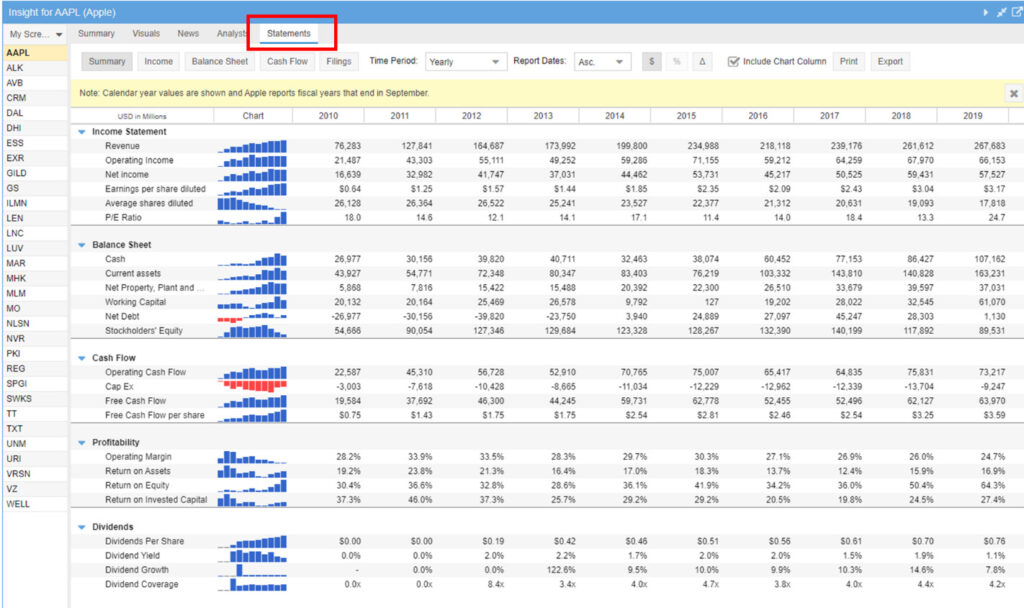

Insight

The insight tab is where you can have a quick summary snapshot of Apple’s profile, description, Stock Rover’s score, the street’s estimates and consensus rating, stock price return profile, valuation, growth, and more.

You can click on the statements tab and get the past 10-years financial performance of the stock in terms of income, balance sheet, and cash flow. This is a function that I use very often as well.

Management Panel

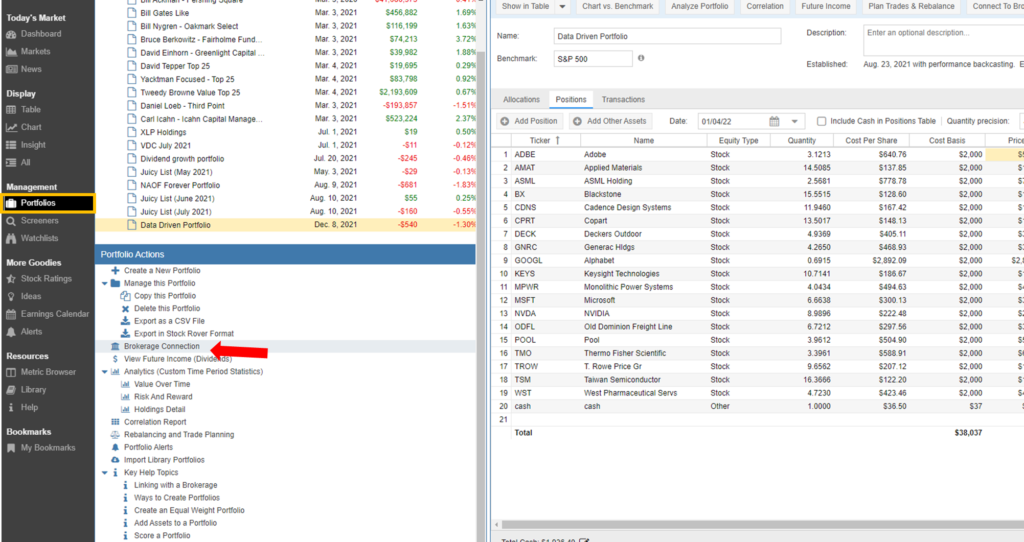

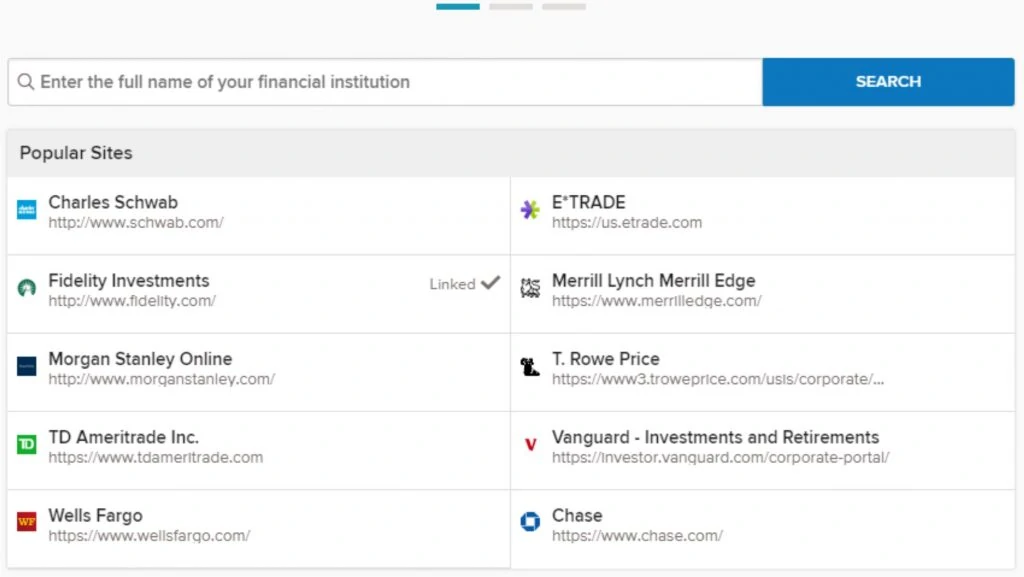

Next up is the Management panel where over here you can look to link up your brokerage with the Stock Rover platform. When you link your account, the software will automatically import your positions into a new portfolio and begin tracking your returns.

Stock Rover has grown its “Portfolio AUM” to more than US$4bn in 2020.

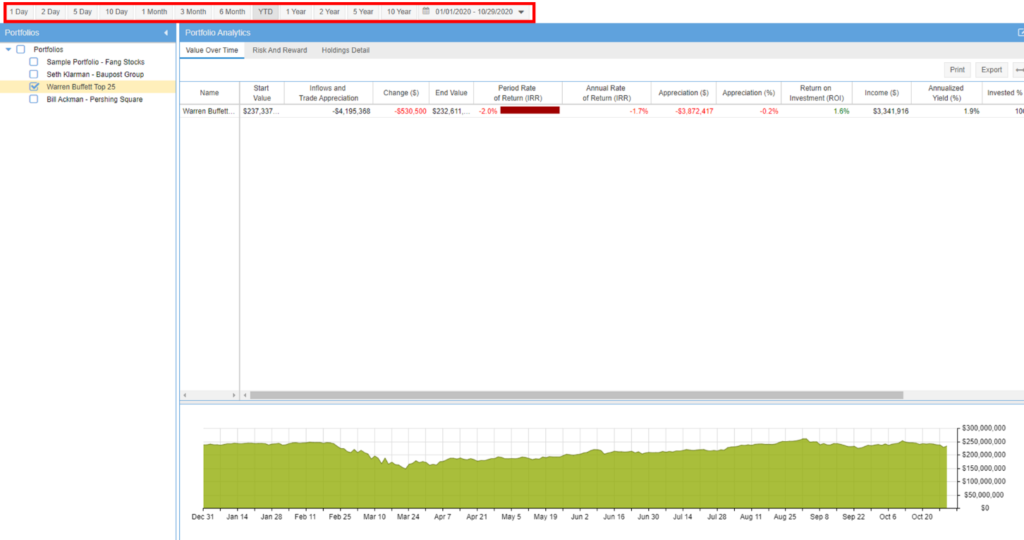

Even if you select not to link your Live Brokerage account with Stock Rover, you can also manually input your stock holdings by creating a new Portfolio and see how well that Portfolio has performed with just the click of a button. Let me briefly show you how that can be done.

Creating Portfolios and Watchlists

You can also create your portfolios and watchlist of stocks to monitor. Some of the customed portfolios and watchlists are pretty interesting as detailed below.

Again, you can head over to the Library tab and select other interesting “Portfolios” and “Watchlists” ideas to import into your navigational panel. For example, you can select “5G networks” in the Library segment under Watchlist to be imported into your navigational panel for further analysis.

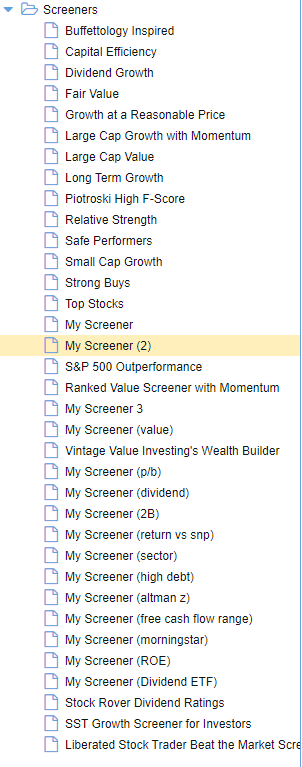

Screeners

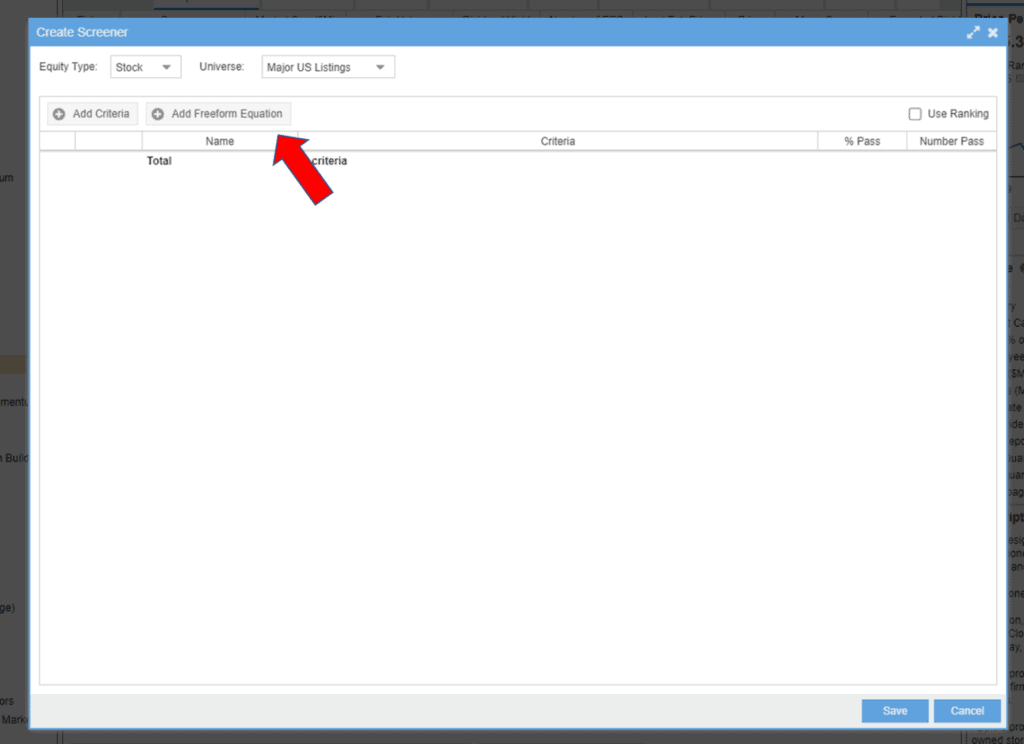

This is where you can click to screen for stocks and create your unique screening criteria.

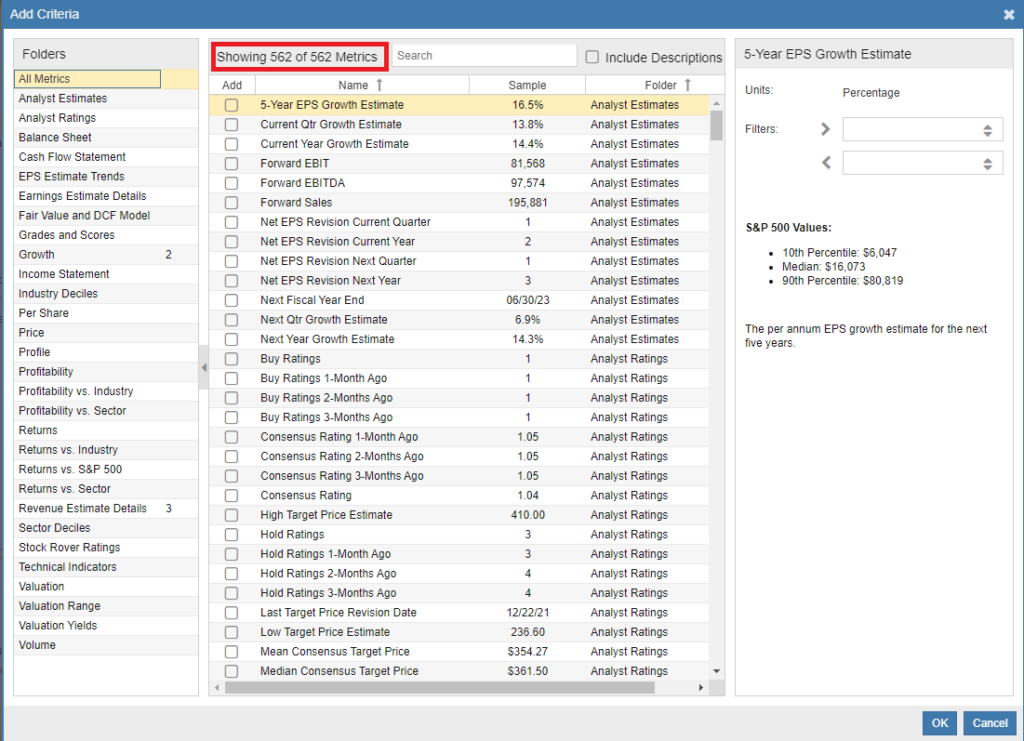

There is a number that is already pre-customized for you but I believe one of the unique strengths and value propositions of Stock Rover is its comprehensive list of screening criteria, with a total of 562 metrics that you can use to screen for stocks.

You can be screening for stock ideas based on Analyst estimates, analyst ratings, or even Stock Rover’s proprietary rating which covers a stock’s growth, value, momentum, quality aspects, etc.

You can even add a “freeform equation” where you can screen for stocks that meet your unique criteria, for example, screening for stocks whereby the earnings growth is > revenue growth, etc.

This is also where you can come to do some simple backtesting of your screening criteria. Let’s take a look at an example below

Backtesting

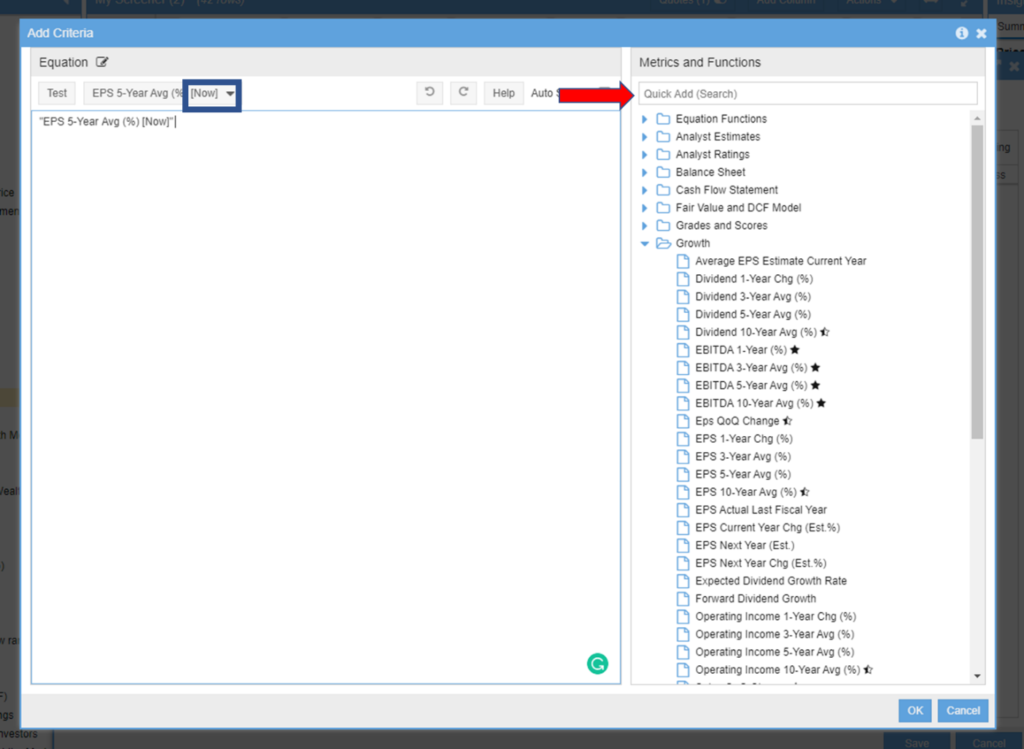

You might wish to screen for stocks that exhibit strong EPS growth over the last 5-years. Click on “add freeform equation” and type EPS in the Quick Add box and you will see a drop-down list of screening criteria that might be what you are looking for.

You can select the one which shows the EPS 5-year average (%). Once you click on that, it will be transferred to the left-hand side area.

Notice that this screening criterion has a “NOW” function which indicates that you are selecting stocks AT THIS POINT IN TIME that meet your criteria, say for example > 30%. What this means is you are only screening for stocks that have exhibited >30% annualized EPS growth over the past 5-years, ie stocks that grew their EPS by at least 30% every single year for the past 5 years.

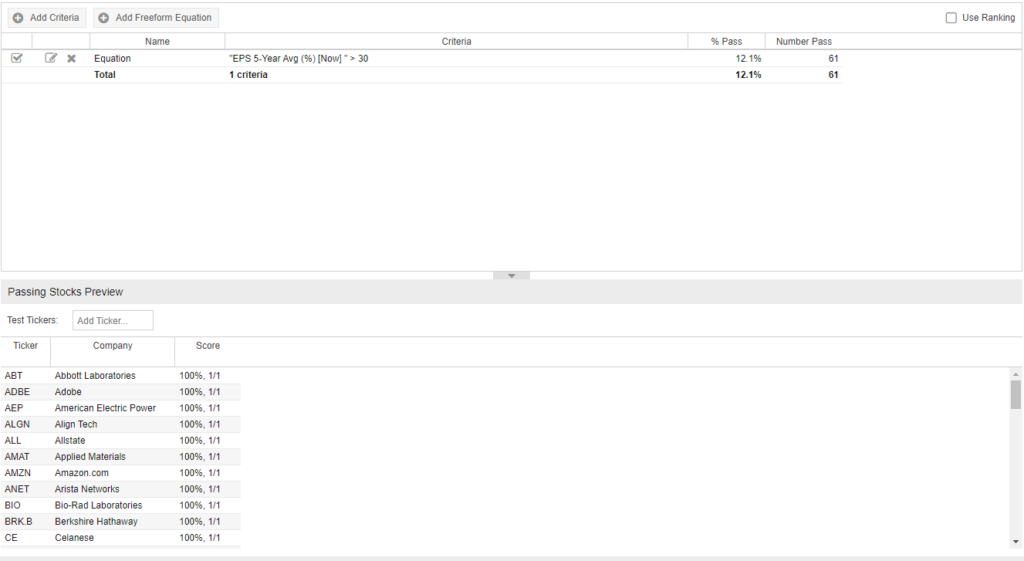

61 S&P500 stocks currently meet this criterion.

So how did this list of 61 stocks perform historically?

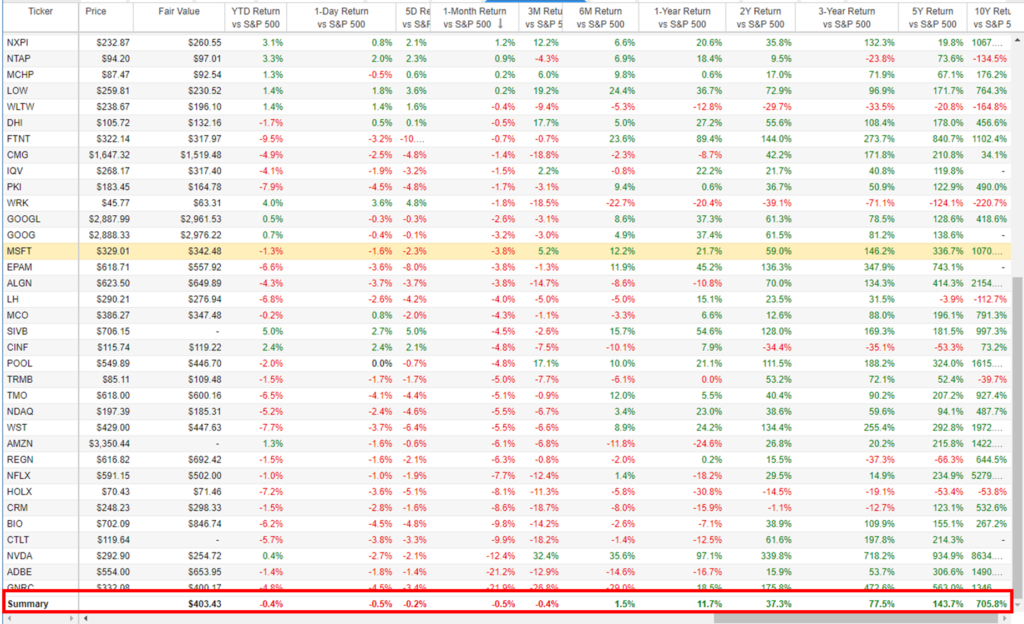

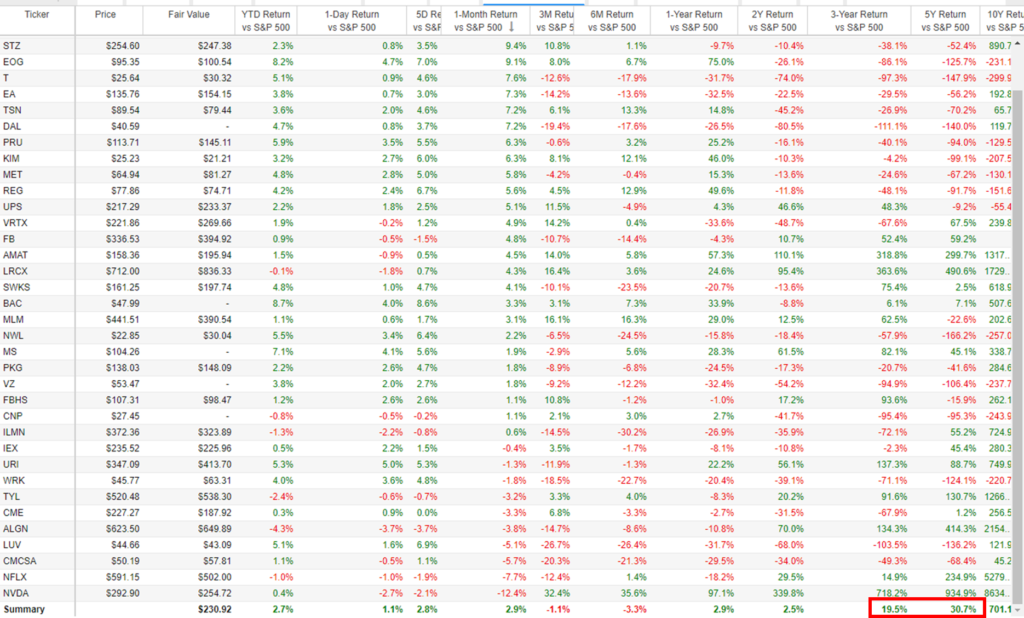

You can see many familiar names in this list, stocks like NFLX, AMZN, MSFT, ADBE, NVDA, etc, all the big tech stocks have all been able to grow their EPS by 30% on average annually over the past 5-years and their outperformance over the index (S&P500) was tremendous, generating > 140% return in excess of the S&P500 over the past 5 years.

So one would think that selecting stocks based on this simple criterion of a 5-years EPS growth rate > 30% is a market winner.

However, this is NOT “backtesting” the criterion. You are merely selecting stocks that currently meet this criterion which has shown to be extremely good performers over the past decade. What you should be testing is whether stocks that met this criterion X years ago, also demonstrated strong historical price performance? A quick illustration will further clarify this statement.

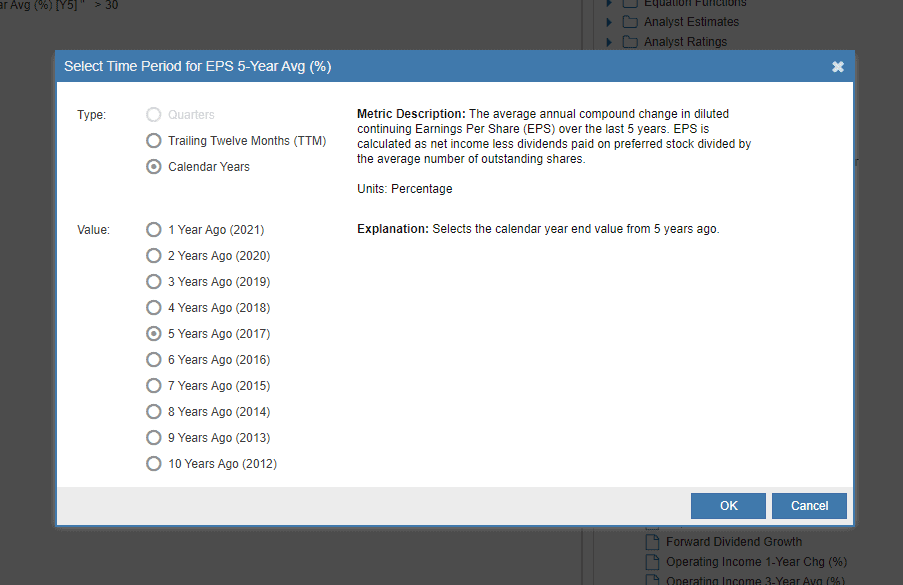

Let say, for example, we wish to find stocks that met this criterion 5 years ago, ie, identifying stocks back in 2017 that exhibit a 5-years EPS growth rate of 30% annually (from 2012-2017).

You can use the add freeform equation and this time around, instead of selecting “NOW”, you can select 5 calendar years ago.

So instead of selecting stocks that CURRENTLY meet this criterion, you are selecting stocks 5 calendar years (2017) ago that met this criterion (5-years EPS > 30%), meaning from 2012-2017, the average annual EPS growth of these stocks is 30%.

This would have given you a different list of stocks, now 38 of them. If you had purchased a basket of these stocks back in 2017 using this financial criterion (5-years EPS > 30%), how would they have performed from 2017 to 2021?

I would expect a basket of these stocks to have generated additional returns of between 19.5% and 30.7% vs. the S&P 500 from 2017-2021.

Their price performances are no longer as outstanding as when we first screened them based on today’s context.

Ideally, we want a criterion that consistently outperforms the index on all horizons, regardless of which calendar year we choose.

The Screener function is a very useful and important element of Stock Rover which I believe just this function alone is worth its weight in gold.

Stock Rover

See how I use the Stock Rover platform to screen for stocks that consistently outperform the market based on historical back-testing results.

Check out the 2 key screening criteria I used

More Goodies Panel

Stock Ratings

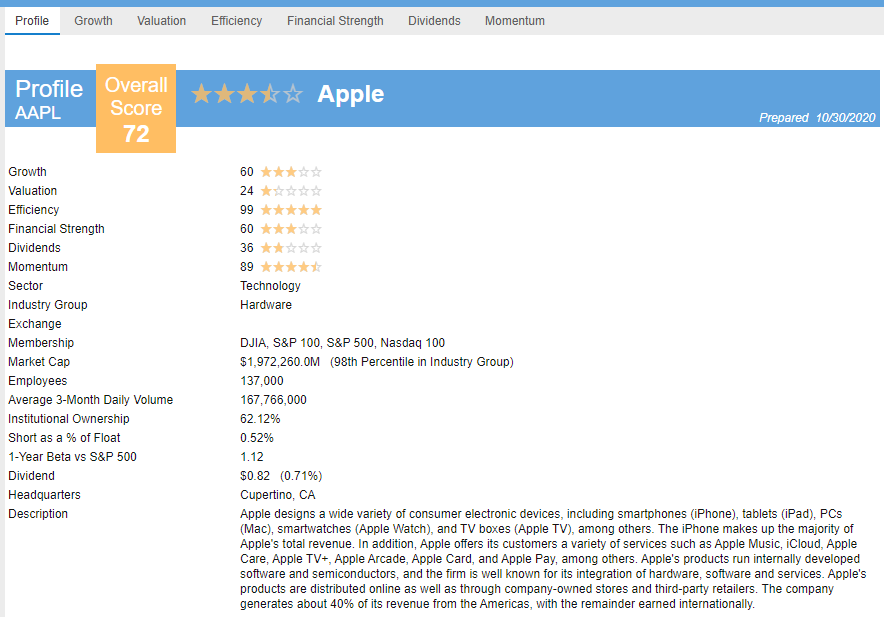

This is another interesting area, particularly the Stock Ratings where you can get a snapshot of Stock Rover’s proprietary rating covering six important areas:

- Growth

- Valuation

- Efficiency

- Financial Strength

- Dividends

- Momentum

These are shown as tabs at the top of the Stock Ratings view.

Stock Rover’s stock rating views are worth the subscription price alone. It will save you a lot of time and work.

Let me show you an example.

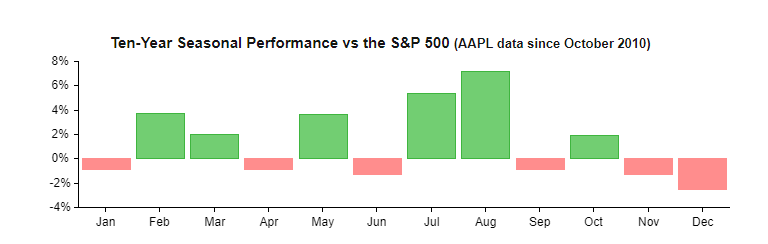

If you are a momentum trader and you wish to evaluate the strength of stocks based on seasonality, by clicking on the momentum tab, you can immediately check out how the stock usually performs in a particular month.

Take for example Apple’s stock. It tends to exhibit the strongest performance in August, based on historical performance over the past 10-years. So how was Apple’s price performance in August this year? Up 22%! This might not be relevant for just any stocks but for one which demonstrates strong seasonality, this is something to pay attention to.

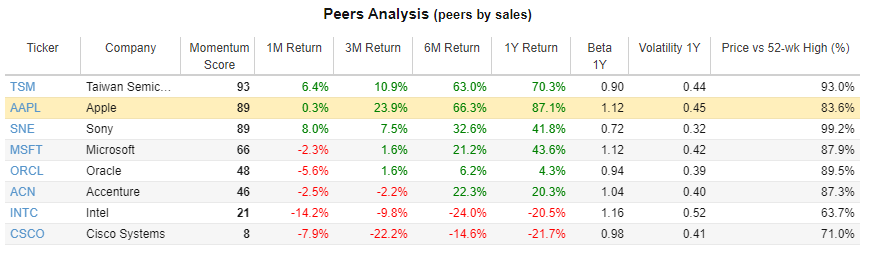

You can also take a look at some of the counter’s peers and their momentum score.

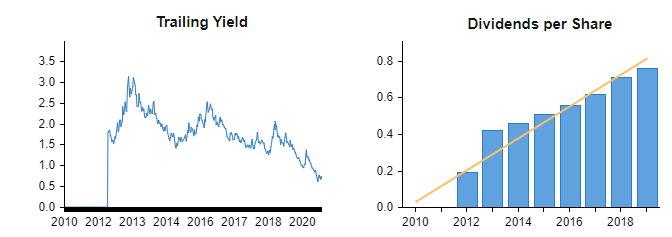

For dividend lovers, you can click on the dividends tab and find information such as its historical dividend trend as well as its dividend yield trend.

If you are a believer in the dividend yield theory, then Apple’s shares look to be overvalued from that perspective.

Ideas

For those who are running out of ideas, check out their Ideas on the left-hand side tab and it might give you some investment inspiration.

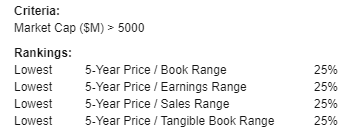

For example, this week, Stock Rover selected the cheapest large companies based on the following screening criteria and ranking:

The resulting stocks selection is as below

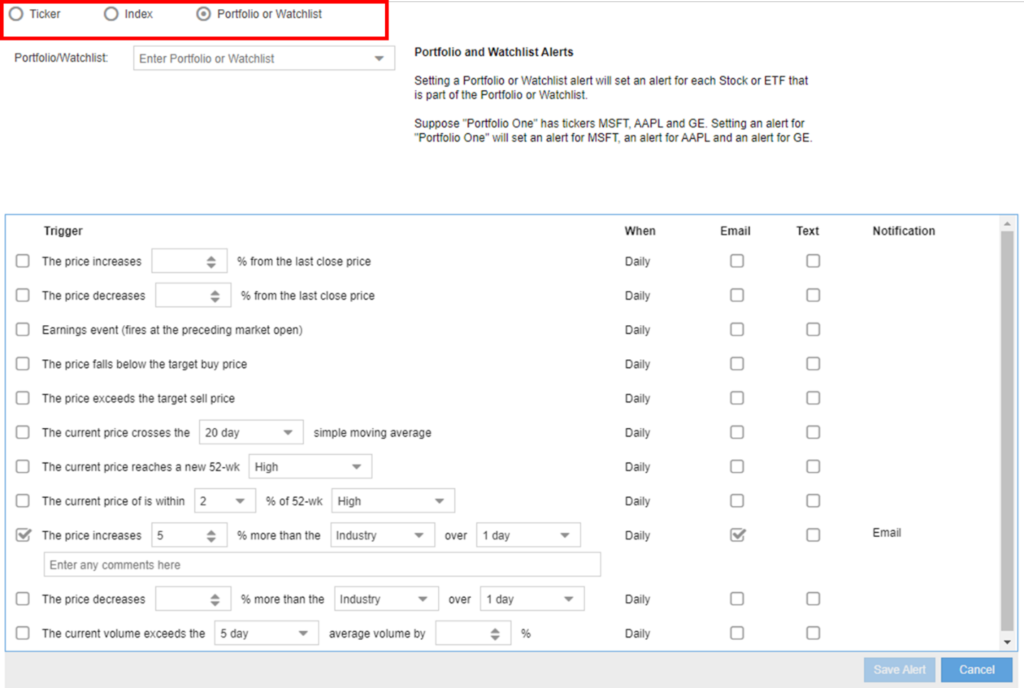

Alerts

Stock screening is generally the first step in the search for a winning stock. Not all stocks which meet your filter criteria are an immediate buy. Most of the time the stocks go on a watchlist and must meet a certain trade setup before an investment is triggered.

This is where alerts come in. For all of you busy workers out there who have no time to constantly track your portfolio of watchlist stocks, this is where you will find the Alerts segment very handy.

There are many options here from basic priced based alerts, price crossing a moving average, etc.

What type of trader is Stock Rover best for?

Stock Rover is built for fundamental analysis, although it is flexible enough to work well for some traders who use a combination of fundamental and technical analysis. While I might be a fundamentalist at heart, I also tend to use some of the technical information, such as seasonality, etc to time a better entry in stock.

The platform can cater to both beginner and advanced traders thanks to its mix of built-in tools and a highly customizable, logic-driven metric builder. However, for hardcore day traders, the platform likely does not have the kind of technical charting prowess to satisfy your requirements.

Using the Stock Rover platform for different investing strategies

For NAOF readers who are interested in a write-up on how I use the Stock Rover Platform to identify stock gems that might be “flying under the radar”, you can have exclusive access to this step-by-step pdf write-up when you sign up for the Stock Rover platform using my affiliate link below.

Sign up for the Stock Rover Platform now

Step 1: Sign up for the stock rover platform using the above affiliate link

Step 2: Drop me an email at newacademyoffinance@gmail.com

Once I confirmed that a sign-up has been made, I will forward the FREE pdf write-up to you where I will detail the various strategies that I use to give myself an edge using the stock rover platform, strategies such as finding the most consistent-performing value stocks in the market, trading short-term short squeeze candidates etc.

Conclusion

Hopefully, this Stock Rover Review has shown you why you need this platform. If you are an investor who relies on Fundamental data for research and stock screening, Stock Rover should be a critical tool in your investment arsenal.

For me, I spend quite a bit of time using its screening metrics as well as reviewing individual stock’s 10-year financial performance.

There are however a few areas of improvement in my view. First, its back-testing capabilities can be strengthened. If Stock Rover can provide an easy way to do a more comprehensive back-testing of various screening filters, it will be a major PLUS.

Second, I do hope to see that Stock Rover can extend its Alert function beyond “Portfolio” or “watchlist” to that of Screeners as well. For example, I might have found an ideal set of screening criteria that provides me with a good list of stocks. Instead of frequently running the screener, the alert tab can “sound out” when a particular stock drops out based on failure to meet those screening criteria or a stock that is being newly added into the list.

This will be particularly useful for an investor who wishes to follow a set of screening criteria closely and look to mimic his/her portfolio on the fulfillment of those criteria.

After all that is said and done, I believe that Stock Rover remains an essential tool for all serious investors looking to find that edge. It could be based on “passively” following Stock Rover’s stock ranking to that of creating your own “holy grail” screener, there is something for everyone.

Visit the Stock Rover Website and start your 14-days free trial today

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Inflation: Don’t ignore this silent retirement killer

- Inflation at 5% in May: Transitory or a structural problem

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only

8 thoughts on “Stock Rover Review 2023: The Best Screener for serious Investors”