Stock market to crash in 2021?

2020 has been an eventful year, to say the least. When COVID-19 strikes, we witnessed the stock market entering into a bear market territory in record time. At the height of the COVID-19 driven market sell-down back in March/April 2020, few would have expected an equally “fast and furious” stock market recovery amid a global recessionary scenario.

I wrote an article back in April 2020 titled: When to buy stocks in a recession? The ideal time to pick a bottom.

I provided 3 concrete scenarios where one can look to pick a bottom in the stock market.

Needless to say, I was one of those that was totally caught “off-guard” by the swift recovery of the stock market. I will provide an update on this matter later.

Many who exited the market during the March/April 2020 COVID-19 driven market sell-off is still sitting on the sideline, waiting for the stock market to crash to better time an entry.

Are you one of them? Is the stock market crash happening in 2021?

In this article, I provide 3 reasons why you should not be in FULL cash, waiting for the stock market to crash so that you can deploy your capital.

I will first start off with a summary of what I have written previously back in April 2020 pertaining to timing a market entry in a recession.

Next, I will highlight 3 reasons why you should not wait for the stock market to crash before entering.

Lastly, I will detail the 3-steps plan that one should take when a stock market crash does in fact happen in 2021.

When to buy stocks in a recession?

In my article which I written back in April, I provided 3 scenarios in which one can “time” a market entry during a recession like the current one, which has yet to end.

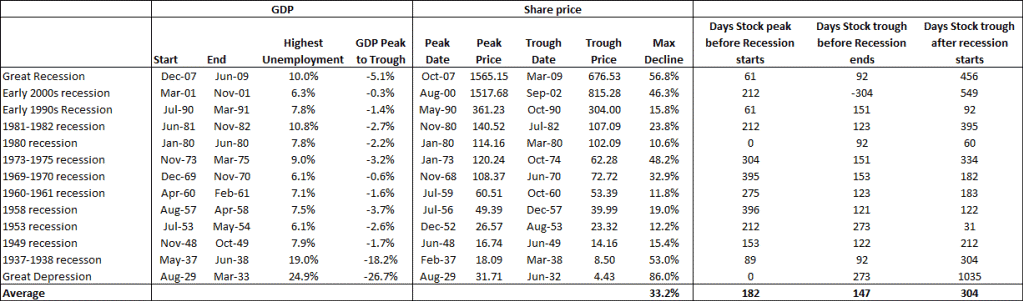

In that article, I compiled a list of recessions (13 of them) since the Great Depression and the stock market reaction to it. There were some mild recessions like the 1960-61 recession where the maximum stock market decline from peak to trough was only c.12% while the most severe one was undoubtedly the Great Depression itself with the stock market cratering by 86% from peak to trough.

On average, the stock market would have peaked 6 months before the recession begins.

However, if we were to compare the latest 5 recessions, that figure shrinks to just 3 months. So if the peak of the stock market happens on 19 Feb 2020, we should expect the current recession to start sometime in mid-late May.

According to the National Bureau of Economic Research (NBER), it was formally announced (more on that later) that the US entered into a recession back in Feb 2020, thus ending the 128-months economic expansion.

On average, it took close to 10 months from the start of the recession to the trough in the stock market. This is also a similar duration if I was to take the average of the last 5 latest recessions.

With that data, I suggested 3 ways in which one can better time a stock market entry.

Scenario 1.Using 10 months from the start of the recession as a reference point

This is based on the historical data that we have compiled, using the average time in which a market finds the bottom from the onset of the recession. That could mean a bottom in Dec 2020.

For a pretty severe recession such as the Great Depression, the 1937-38 recession, the 1969-70 recession, the 1973-75 recession, the early 2000s recession, and the Great Recession of 2008, the average time the market takes to find a bottom from the start of the recession is approx. 1.3 years.

That could mean that the stock market might only bottom sometime in May-June 2021.

The COVID-19 driven recession apparently started in Feb 2020, according to the NBER. The stock market peaked sometime in mid-Feb 2020 and found a bottom only after 1 month (late March 2020).

Based on the historical averages, one should expect a bottom sometime in Dec 2020, after 10 months.

No one could predict that the worst global recession since the Great Depression of the 1920s would have resulted in a market meltdown duration of just 1 month!

With the benefit of hindsight, we now know how erroneous such prediction might be based on historical numbers.

Scenario 2.Based on the maximum peak to current market decline

The average peak to trough for the past recessions was approx. -33%. For the severe recessions that we highlighted above, the average peak to trough drawdown is -54%.

The S&P500 peak (mid-Feb) to trough (late-March) in 2020 was approx 34% drawdown.

On hindsight, that would have been a good opportunity to enter the market. However, most would not have entered, preferring to engage a “wait-and-see” approach for a better entry level, possibly around the 50% drawdown level which is associated with major global recessions.

Well that boat has sailed and left way before the 50% level was hit.

Scenario 3.When the NBER calls for the start of a recession

When the NBER calls for the start of a recession, that might be the time to start buying! This seems counterintuitive but notes that it takes the NBER organization a long while to collate data and finally confirm the start of a recession. By that time, the bulk of the recession is likely over.

For example, the great recession which started in Dec 2007 was “officialized” by NBER in Dec 2008, one year after the start. The market subsequently trough in Mar 2009.

Before that in the 1981-82 recession which started in July 1981, the NBER officially declared the start on Jan 1982. The stock market trough in July 1982.

This time round, the NBER officially declared the start of the COVID-19 driven recession on 8 June 2020. The S&P500 was at a level of 3,232 on that day. Buying into the S&P500 at that level would have resulted in a 18% return over the course of the next 7-months to-date.

Based on the above 3 scenarios, one would have totally missed the boat using Scenario 1, possibly entered at the bottom using Scenario 2 (but most likely would also have missed the boat totally due to fear of more market drawdown and waiting for a better entry point), and generated a decent return of 18% to-date using Scenario 3.

Still waiting for the stock market to crash?

If you find yourself in Scenario 1 and possibly in Scenario 2, you might be lamenting your “bad luck” for not entering into the market when there was “blood everywhere on the street”.

The big question now is however, should you be entering into the stock market now when prices are “so high”. In fact, they are at record levels.

Data has shown that an all-time high market tends to move even high. This is the same as stocks. This is because rising prices attract more buyers which will in-turn lead to higher prices. This tends to continue until a major or “black swan” event comes along and knocks this cycle off its course.

Unfortunately, no matter how robust historical data might be, this argument cannot be won with just data alone. As humans, we tend to let our feelings dictate our actions more often than what the hard numbers are indicating.

When the stock market is at an all-time high, it is natural that we wish to protect our “nest egg” from the possibility of a severe market correction.

That “fear of the unknown” is what keeps most wannabe investors “grounded”, never entering the market because they are still waiting for the stock market to crash before they start investing.

This might be a terrible idea and I will list down 3 reasons why it might be so.

Reason 1: A mentally exhausting exercise

Imagine waking up every day waiting for the world to end, so that you finally have an opportunity to “buy into the bottom of the market”.

That is an exhausting way to lead your life. I don’t personally wish for another COVID-19 pandemic to manifest itself so that I can buy into the market when it collapses.

That might mean possibly millions more lives lost. I don’t wish to have a smile on my face because I have finally entered the market at a “good price”, while millions of people are suffering as a result of the new virus.

While the stock market can crash for a myriad of reasons, not necessarily one that necessitates thousands or even millions of lives lost, it is a tiring affair to always “pray” for disaster to happen so that one can capitalize on it.

I am not implying that one should always stick with a bullish attitude without being mindful of the financial/ monetary risks that could manifest themselves “all of a sudden”.

What I suggest, however, is that one should always be prepared for a market meltdown and know what to do in such a scenario instead of waiting for one to materialize before entering the market.

Too many people run out of time before they run out of money. Don’t spend your time waiting for the market to crash but be prepared and know what to do when that scenario actually happens.

Reason 2: You most likely will not buy into a stock market crash

While many are waiting for the stock market to crash so as to better time an entry, the hard truth is that many will not buy into a stock market crash unless they are absolutely disciplined in following their prior plan.

When a stock market correction comes, the fear of not knowing where the bottom is and wishing to only “bottom-fish” will result in many missing the boat. While I previously tried to “timed a market entry” using historical data to “quantify” and rationalize my entry or lack thereof, there is a reasonably high probability that it will not be successful.

With the benefit of hindsight, it is easy to look back now and say that you should have enter into the market when it has corrected by 30%.

However, the market remains in an absolute free-fall and there was no telling when it would actually end. If you were waiting for your “prayers” for a disaster to come true, congratulations, it came true.

Now, if the notion that everyone is running FOR an exit from a theater on fire while you alone is running INTO it is what you believe you will be doing, then you are just kidding yourself.

This is unless you “tune-out” from all the noises around you and set your market entry on automation mode. Most people don’t have that discipline.

Before you know it, the opportunity to buy “on the cheap” was gone, with the stock market rebounding in a flash.

Your next “excuse” would be that this rally is a “dead-cat-bounce” and you will now FINALLY be ready to capitalize when the market dips again.

This “dead-cat-bounce” is still continuing till date, 9-months after the stock market bottomed back in March/April 2020.

Reason 3: That stock market rally might last WAY longer than your expectations

There is the famous saying that “What goes up must come down”. This likely still holds true today but the hard truth is that no one can accurately call the top of a stock market bubble.

The only people who claim to be able to nail the top (and bottom) of the stock market are liars and lottery winners.

I recently wrote this article: Are we in a bubble? where I highlighted some concerns of famed investor Mr. Jeremy Grantham who believes that we are currently in the late stage of a stock market bubble and the “stars are aligned” for a correction to happen. Grantham, however, admitted that accurately calling for a stock market peak is almost impossible, with his firm GMO, often being too early in “predicting” a top.

I concur that there are signs of “bubbliness” in today’s market, especially when you look back at some of the IPO performances (SPACs included) in 2020.

While there are clear “discrepancies” between economic fundamentals and stock market prices, that mismatch can continue way longer than expectations, especially with easy monetary policies currently being pursued.

What is to stop the government from printing many more $2,000s as hand-outs to the masses? What is to stop the Fed from keeping interest rates permanently at ZERO? What is to stop the Biden administration from cancelling billions worth of student loans, thus putting more capital into the hands of the Robinhood retail investors to pump into the market.

It is easy to come from a fundamental and economic perspective to warrant caution of a substantial stock market correction. However, we are currently in unprecedented times where unprecedently actions were being taken to “sustain” this market momentum.

I am cautious of a market peak happening “at any time”. The difference between myself and someone who is still praying for a market correction to happen is that I never “pray” when it comes down to investing.

I always have a PLAN.

3-Steps Plan for a stock market correction

In all honesty, I have got absolutely no clue if a stock market crash is about to happen in 2021. For those who are “mislead” to read thus far in the article, I apologise.

What I do KNOW is the plan I will take when that stock market crash happens.

Step 1: Review your portfolio to see if a rebalancing is in order

Step 2: Stay the course but look to reduce exposure to low-quality stocks

Step 3: Have your “shopping list” ready

Let’s go through each step in more detail.

Step 1: Review your portfolio to see if a rebalancing is in order

Take a hard look at your portfolio. Is your portfolio well-diversified across different asset classes and geography? If your portfolio is well diversified heading into this recession, you are likely in a much better position than most and there is nothing to panic about.

Look at rebalancing your portfolio. If you are holding a mixture of stocks and bonds, you might consider selling some of your bonds which will likely gain in value as fund flows into safe-havens amid market uncertainty and using those proceeds to reinvest in stocks. By rebalancing your portfolio periodically, you avoid substantial exposure to certain asset classes.

Rebalancing on a DIY basis can be done in two ways:

- Sell some of one investment and use the proceeds to buy some of the other investments as detailed above. If your bonds have done better, this will mean taking profits on some of your bond holdings and using the money to invest in your stock fund. This is a “Sell High, Buy Low” re-balancing strategy that when done repeatedly, should result in a better overall portfolio performance compared to one without rebalancing.

- Use new money that you are investing to re-balance your portfolio back to your target weightings. This will mean investing more into the asset class that has “declined in value” relative to your other investment class.

After an 11-year bull run, most investors without a proper portfolio rebalancing plan might, however, find themselves significantly exposed to stocks. If you are uncomfortable with being overweight to stocks at present due to election uncertainties, you can consider rebalancing your portfolio into other asset classes.

I do not recommend bonds at present due to the already low-interest-rate environment. Nonetheless, bond values can still increase amid global uncertainties as well as the push towards a negative interest rate environment.

However, my preferred asset class will be Gold as well as some bitcoin exposure. I have written about Gold as an inflation hedge numerous times and while inflation concerns currently are still benign, don’t be caught flat-footed with a sudden spike in inflation as a result of incessant money-printing activities as well as natural disasters, the latter already translating to food inflation of late.

Bitcoin is getting a bit of a resurgence of late. In the latest turn of event, JP Morgan joins in the party with its own cryptocurrency JPM Coin. For years, JPM was skeptical of Bitcoin, with its CEO Jamie Dimon publicly commenting back in 2017 that Bitcoin was a fraud. In a subsequent interview with CNBC, Mr. Dimon said he regretted calling Bitcoin a fraud and highlighted that the blockchain technology is real.

Reputable organizations such as Square, PayPal, and recently our very own DBS Bank are jumping onto the bitcoin bandwagon.

Well, I guess that leaves Warren Buffett still not at the party.

Step 2: Stay the course but look to reduce exposure to low-quality stocks

If you are vested in a portfolio consisting of ETFs which in itself is a diversified basket of stocks, this step might not be very relevant to you. All you have to do is to continue staying the course and engage a dollar-cost averaging (DCA) approach to buying INTO the downturn.

I recently chanced upon an interesting website called The Measure of a Plan. It has an interesting market timing simulator. This tool allows you to compare the performance of two investing strategies:

#1: investing in the stock market in a regular monthly cadence — regardless of the current market price

#2: ‘timing’ the market by keeping your savings in cash and delaying your entries into the stock market until the price is ‘low’ (for example 5%, 10%, or 20% below the all-time high price)

Does the route to riches rely on time in the market or timing the market?

Well, you would have guessed that the evidence likely points favorably towards “time in the market” vs. “timing the market”.

For those who invest in individual stocks, take this opportunity to relook at your stock portfolio, and reduce your exposure to low-quality stocks. These are stocks that are unlikely to survive the next economic downturn, characterized by a high level of debt and insufficient cash flow generation.

Some of these stocks are already seen as “zombie” stocks. Stocks that struggle to perform well during good times. What is going to happen to them when the going gets tough?

Instead of praying for a miracle, bite the bitter pill and cut your losses while there is still “value” in these stocks. The capital from the sale of these low-quality stocks can be re-deployed opportunistically in beaten-down high-quality counters.

This will be highlighted in Step 3.

Step 3: Have your “Shopping” list ready

As Warren Buffett famously coined: “Be Greedy when others are fearful”, a market downturn provides the best opportunity to buy into high-quality counters at a discount.

Instead of following the masses who are gripped with fear, look to deploy capital into beaten-down high-quality blue-chip stocks selling at a discount. This might mean having ready “cash on hand” to double down on such opportunities or as I previously mentioned, selling zombie stocks to reinvest your capital into fantastic companies trading at a discount, those that have a much higher probability of surviving a prolonged economic downturn in one piece, or even emerge stronger out of the crisis as they take market share away from their debt-laden peers.

Make a “shopping” list of your stocks that you always like to own but hesitated due to their valuation. A “crisis” driven NOT by the deteriorating company fundamentals but more by the broader market sentiments (such as election uncertainty) is an opportunity not to be missed.

“Never let a good crisis go to waste”, popularized by former White House Chief of Staff and Chicago mayor Rahm Emanuel who famously said it during the Great Financial Crisis, one should look beyond the current loss of portfolio value and take advantage of good companies selling at a discount.

Conclusion

It is always good to have some dry powder on the side. That helps you to capitalize on opportunity when it presents itself, just like in Step 3 of the plan detailed above.

Just make sure you don’t become addicted to your dry powder. Cash on the side does you no good if it always stay on the side.

You should not believe that you have the ability to buy at the exact bottom. That’s not how investing works. You will either be early or late when it comes to buying into a stock market crash.

That still beats not doing anything at all.

I would rather be kicking myself for jumping in too early than kicking myself in the long-run for never putting my money to work in the first place.

Just make sure you have a plan in place when a stock market crash materializes and not be like a “deer frozen in headlights”.

Regardless of when you buy or rebalance into the pain of a falling market, know that TIME is your friend. Don’t be too hasty in following the masses “blindly” or what I often term as FOMO (fear of missing out) but neither should you be overly-cautious/lazy and do nothing.

You might be right in “predicting” a market top but without taking any action to capitalize on your “brilliant foresight”, there is no difference between you and the man-in-the-street.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- Best Stock Brokerage in Singapore [Update November 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “Are you still waiting for the stock market to crash in 2021?”

We dont -pray for market crash to profit. that sound good and feel good, But if u want to make 1$, someone must lose that 1$, and the loser is always painful. Imagine u are the one who lose to me, How u feel.???