Investor Education Series: What are Stacker ETFs?

Most of you would be familiar with what Exchange Traded Funds or ETFs for short are. I have written about ETFs on several occasions and highlighted which are some of the best ETFs to buy in this article: “Thematic ETFs partaking in the hottest trends” as well as this article: “Best Performing ETFs which consistently outperform the S&P 500 over the past decade”.

In this article, I will be briefly highlighting a type of special ETFs that you probably are unaware of: Stacker ETFs. What exactly are they and is it something that you should consider having in your portfolio?

Before that, a brief introduction on what are ETFs.

What are ETFs

An ETF is a type of security that involves a collection of securities, such as stocks that often tracks an underlying index although they can invest in any number of industry sectors or use various strategies.

They are similar to mutual funds, a key difference being that they are listed on exchanges, and ETF shares trade throughout the day just like an ordinary stock.

One of the key advantages of ETF is its ability to allow an investor to partake passively in a broad basket of stocks, hence a popular choice for diversification.

There are different types of ETFs which could include Bonds ETFs, indexed-stock ETFs, Industry-specific Stock ETFs, Commodity ETFs, Currency ETFs, and Inverse ETFs, etc.

Pros and Cons of investing in ETFs are listed below

Pros

- Access to many stocks across various industries

- Low expense ratios unlike unit trusts

- Risk management through diversification

- Available to access thematic ETFs

Cons

- Some ETFs might have high expense ratios

- Single industry focus ETFs limit diversification

- Lack of liquidity might hinder transactions

All in all, ETFs remain a particularly useful asset class for a new investor to start his/her investing journey without the hassle of selecting individual stocks which will expose them to unsystematic risk. This is a risk that is inherent in a specific company.

By investing in a range of companies, unsystematic risk can be drastically reduced through diversification.

Investing in ETFs has become increasingly common as they are now easily accessible in all major stock exchanges.

Here in Singapore, one can partake in passive investing by selecting a handful of ETFs. I have written about the Best ETFs in Singapore to structure your passive portfolio which one can refer to through the link.

However, do note that ETFs available in Singapore is pretty limited as compared to the wide range of US-domiciled ETFs. There are however issues with investing in US-domiciled ETFs which a Singaporean investor should be aware of, something that I covered in this article.

With the basic introduction of ETFs out of the way, with plenty of suggestions as to what are some of the best ETFs to buy now for an investor (refer to the links), let’s refocus back to the topic for today: What exactly are Stacker ETFs?

Stacker ETFs: a basic introduction

Stacker ETFs are a new form of structured ETF that was only recently introduced (listed in Oct 2020) to the market by Innovator ETFs.

So what exactly is Stacker ETFs? Like what its name suggests, Stacker ETFs offer an investor a multiple of “stacked” exposure to the upside with a single exposure to the downside.

Still confused? Let’s start with an example.

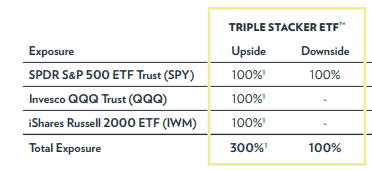

The TSOC ETF or Innovator Triple Stacker ETF seeks to provide triple upside exposures of 100% SPY + 100% QQQ + 100%IWM to a cap, and downside exposure to SPY only over a one-year outcome period.

The hypothetical examples below illustrate how Stacker ETFs can perform across various market scenarios for the entire outcome period.

So say, for example, all 3 indexes ETFs are down for the year. The TSOC ETF will see downside mimicking that of the SPY since it is only exposed to the downside of the SPY ETF. So if the SPY sees the greatest depreciation against the other two indexes ETFs, the TSOC will also witness the largest downside, as seen in the “Moderately Negative Scenario”.

However, if SPY’s returns are negative while that of the other two indexes ETFs returns are positive, the final return of TSOC will be the summation of all three indexes ETFs returns, as in the “Mixed Negative Scenario”.

Remember that TSOC has no downside exposure to QQQ and IWM, hence in the “Mixed Positive Scenario”, where both QQQ and IWM generated negative returns, TSOC returns will mimic that of the SPY.

When all three indexes ETFs generate positive returns, the return of TSOC will be the SUMMATION of all three indexes ETFs returns, subject to a cap, and in this case, the cap is at 18%. So if for example, in the “Highly Positive Scenario”, the return of TSOC will not be 62% (summation of all 3 indexes ETFs returns) but instead capped at 18%.

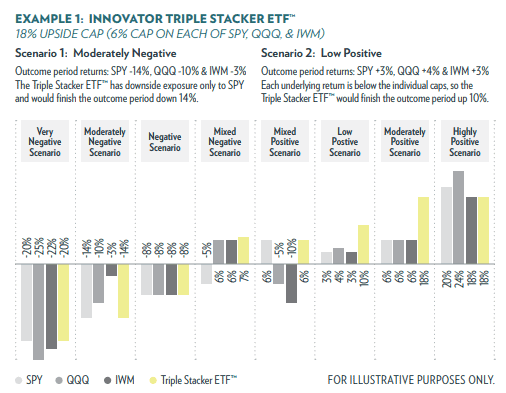

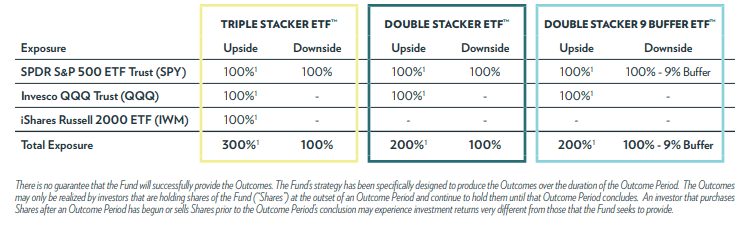

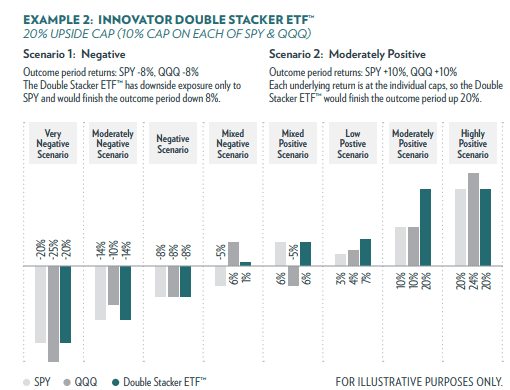

So hopefully, with this example, investors have a clearer picture of what exactly are they purchasing. Besides the TSOC (triple Stacker), Innovator is also introducing the Double Stacker ETF (DSOC) and the Double Stacker 9 Buffer ETF (DBOC).

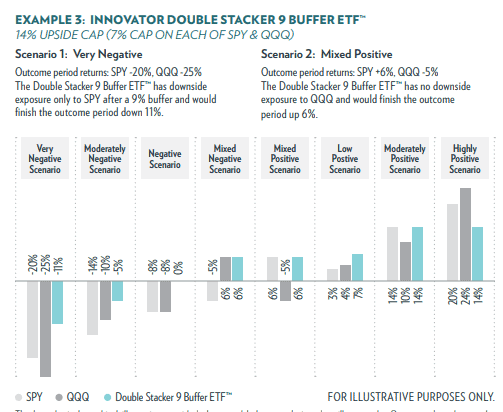

The key difference between the DSOC and DBOC is the 9% buffer on the downside. What this means is that instead of having the full downside exposure to the SPY, there is a buffer of 9%. So if SPY is down 20% for the period, the downside for DBOC is (20%-9%) at 11%. So if SPY is down less than 9%, the return on DBOC will be 0%.

So why would anybody select DSOC if DBOC (with buffer) has that additional downside buffer? Well, that’s because the upside of DBOC is capped at a lower 14% level compared to DSOC which has an upside capped of 20%.

Do refer to the examples below for DSOC and DBOC to get a better picture of the ETFs returns in the various scenarios.

Key Items to note for Stacker ETFs

There are a few points which investors should be aware of when it comes to Stacker ETF which is a very new structured product in the ETF world.

Key Benefits

The key benefits are summarized in the diagram below:

Compared to Leverage ETFs

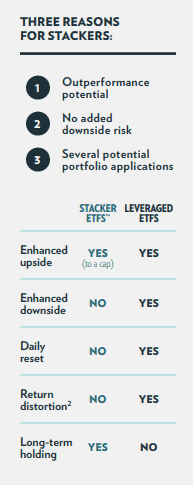

Note that Stacker ETFs are NOT leveraged ETFs. Leveraged ETFs suffer from several drawbacks, mainly 1. Require frequent, often daily rebalancing (which eats into the cost), 2. Credit Risk and 3. Levered downside exposure.

Stacker ETFs seek to address these issues by offering: 1. One-year outcome period, 2. No Credit Risk and 3. 1:1 downside exposure.

Created with FLEX Options

Stacker ETFs are created with FLEX options. FLEX Options allow for customized terms of an option, including strike prices, underlying reference assets, and expirations dates. They are traded on an exchange, listed on the Chicago Board Options Exchange, and backed by the Options Clearing Corporation (OCC).

The OCC is the guarantor and central counterparty with respect to these options. As a result, the ability of a buffered ETF to meet its objective depends on the OCC being able to meet its obligations.

In the unlikely event that the OCC becomes insolvent or is otherwise unable to meet its settlement obligations, the Fund could suffer significant losses.

Additionally, FLEX Options may be less liquid than standard options. In a less liquid market for the FLEX Options, the Fund may have difficulty closing out certain FLEX Options positions at desired times and prices.

Outcome Period

This is quite important and might not be well understood. Since Stacker ETFs use Options in its structuring, there is always a duration associated and in this case, it is typically over a horizon of 1-year, starting from 1 October 2020 till 30 September 2021. This is the Outcome Period and all the downside risks and upside returns are referenced to this Outcome Period.

For example, the DBOC was launched at US$25/share based on a certain value associated with SPY and QQQ. Let say on 1 Oct, the price of SPY is at 337. Remember that is a downside cap of 9% for this ETF. So if SPY drops by 9% from the referenced level of 337 on 1 October 2020, which corresponds to 307, theoretically the DBOC will not suffer any losses. The losses for DBOC will start when the SPY drops below 307.

However, the current price of SPY is at 350 (as of 9 Nov 2020). There will NOT be any buffer from the current level of 350 to 337, which is a 3.7% decline. The 9% downside buffer only kicks in from 337 onwards. Hence if SPY drops by c.20% from the period 1 Oct 2020 to 30 Sep 2021, the theoretical downside for DBOC is at 11% (20%-9%). However, if an investor purchases DBOC on 9 Nov 2020, the downside will be approx. 11% + 3.7% = 14.7%.

Hence do not get surprised when the downside risk for DBOC is “much more” than the calculated level.

Downside exposure to QQQ and IWM

I previously highlighted that the Stacker ETFs are not exposed to losses of QQQ or IWM (only exposed to SPY). However, that is before the Outcome Period has begun.

In the event, an Outcome Period has begun, and the QQQ or IWM ETF share price has increased in value, such an increase will be reflected in the value of the Fund’s purchased call option on the QQQ or IWM ETF.

An investor that purchases the ETF after the various Index ETFs has increased in value during an Outcome Period may be negatively affected by future decreases during the remainder of the Outcome Period.

So you might be surprised that your Stacker ETF will also have some downside risk associated with that of the QQQ and IWM, similar to the previous point I highlighted above concerning buying when the SPY is at 350 vs. when it was at 337 at the start of the outcome period.

Similarly, purchasing TSOC now (for US$26.71/share) will have included some of the upside associated with the appreciation of QQQ and IWM vs. their respective levels on 1 Oct. Hence, investors are also exposed to the QQQ and IWM ETFs downside risk.

However, if the purchase of TSOC was made say when QQQ and IWM are trading below their respective 1 Oct level, then there will not be any downside exposure risks tagged to QQQ and IWM.

Prices of Stacker ETFs may not “gel” with that of index ETF movements

These Funds are designed to provide point-to-point exposure to the price return of the Index via a basket of Flex Options. As a result, the ETFs are not expected to move directly in line with the Index during the interim period.

For example, the total returns for SPY, QQQ, and IWM might be 10% combined. The TSOC ETF should “theoretically” reflect a 10% appreciation level.

However, that might not be the case and usually, it will be a smaller value or the presence of “a lag”.

This is due to the time-value nature of the underlying options held by the fund; as such, the Stacker ETFs won’t maintain proportional betas of 1.0 to the reference ETFs in instances of positive returns for the associated equity benchmarks.

Though they provide simultaneous exposure to the upside of multiple benchmarks, the Stacker ETFs only seeks to provide the positive performance of the reference ETFs over the full Outcome Period, up to a cap, and/or 1:1 downside to SPY over the Outcome Period.

Stacker ETFs Investment strategies

There are normally four layers to the Stacker ETF FLEX Options strategy.

First, a call option is bought on the reference index for the future maturity date, normally 12 months ahead.

Second, to get the downside buffer the fund will purchase puts for the outcome period end date on the reference index.

Thirdly, to offset the expense of buying those puts, the fund will sell puts further down which corresponds to the ETF’s buffer level like for DBOC.

The fourth piece is selling a call option which caps the return of the ETF versus the reference index, this is how the cap level is determined for the outcome period.

In summary, the rate of return if bought at the beginning and held the full outcome period, the Stacker ETFs broadly depends on two factors: the underlying index return, and the terms of the FLEX Options at the start of the outcome period.

Timing of purchase

Investors can buy these Stacker ETFs at any point. They theoretically do not expire. Only the options do after a 1-year horizon, after which another set of options will be purchased/sold. So the ETFs will continue perpetually.

However, just like with other investments, your purchase price is especially important with Stacker ETFs.

Each Stacker ETF has a set share price on its first day of being issued. Just like a traditional ETF, a Stacker ETFs share price (NAV) will move as it tracks the underlying index.

For investors who invest at the start of the outcome period and hold for the entire outcome period, the stated cap and buffer levels apply.

For investors who buy intra-period after launch date and hold for the remainder of the outcome period, the remaining cap at the purchase price applies. In this case, if the current price is already near the “cap levels”, then there is limited or no upside while yet exposed to substantial downside risk as explained previously.

For investors who sell intra-period before the outcome date, cap and buffer levels do not apply. Returns will be based on the market value of the Stacker ETF and this amount will theoretically be less than the combined returns of the relevant ETFs in question.

How Investors can use Stacker ETFs

Conclusion

Stacker ETFs have an expense ratio of approx. 0.79% which is considered rather high when compared to passive ETFs such as VT and VOO etc. They are pretty much comparable to active-managed ETFs such as ARKW etc.

So is this one of the ETFs to buy for your portfolio?

I feel that there is still a “level of complication” associated with Stacker ETFs and one will need to understand that these structured products are created using options and option prices that do not exactly track the underlying asset performance during the tenure of the contract. There is also “time value” distortion.

There is high risk in certain scenarios when purchasing Stacker ETFs. For example, when the underlying ETFs (SPY, QQQ, IWM) have appreciated substantially from their 1 Oct referenced prices, there is NO incentive to purchase these ETFs as you will not realize any further upside. On the other hand, the downside will be very substantial.

An investor buying these structured ETFs will need to realize that. However, in reality, that is not going to be the case, with many investors likely tempted by the “Stacked” returns that these ETFs provide.

Again, on a personal level, I will probably consider getting my feet damp if the share price of the Stacker ETFs drops below their 1 Oct referenced price, likely at about US$25/share. In this case, I will not 1. Suffer additional downside risk (from SPY, QQQ, and IWM exposure), 2. Potentially generate the “full” returns as illustrated.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- How to outperform the market by 100+%

- How to prepare for a bear market. A simple 3-steps process

- Growth Investing: How to find growth stocks to invest in

- What exactly is a Poor Man’s Covered Call?

- Finding great companies with network effect

- Let the Power of Compound Interest help you reach millionaire status

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.