Small-Cap US Stocks flying under the radar

There are many US companies with an illustrious track record of growing their dividend payment every year. The crème of the crop are those companies termed as “Dividend Kings”. These companies have grown their dividend payments for 50 consecutive years. There are currently 32 Dividend Kings and one can access the full list through the suredividend site.

While there are probably hundreds of US companies that have demonstrated the ability to grow their dividend payments for 10 consecutive years, it is probably a more uncommon feat to generate 10 years of consecutive earnings growth.

14 S&P 500 companies have successfully grown their earnings consecutively for 10 years. This will likely be an article for another day. Instead, what I will like to highlight in this article are 5 small-cap US stocks you have never heard of before that have achieved this accolade of growing their earnings for 10 consecutive years.

These companies have a market capitalization of less than US$10bn and if they can mimic their past earnings performances, their share price runway will likely be a long one. Do note, however, that due to their small market cap nature, these stocks tend to exhibit greater volatility vs. their blue-chip counterparts.

This article is not meant to be a recommendation to BUY into these counters but a reference point for further stock investigation/evaluation.

Without further ado, let’s reveal the 5 small-cap US stocks with an impeccable earnings growth record over the past decade.

#1 Small-Cap US stocks: Otter Tail (OTTR)

The first small-cap US stock in this list, in no particular order, is a company called Otter Tail. Otter Tail is a US energy company that primarily operates in the electric (produces and sells electricity), manufacturing (fabricates metal components), and plastic segments (pipes for water uses).

The company primarily conducts its operations and acquires the majority of its revenue in the U.S. in the states of Minnesota, South Dakota, and North Dakota, but also generates some revenue from its operations in Mexico, Canada, and Panama.

The majority of the company’s revenue is derived from the Electric segment and commercial customers, although it generates revenue from residential and industrial customers, as well.

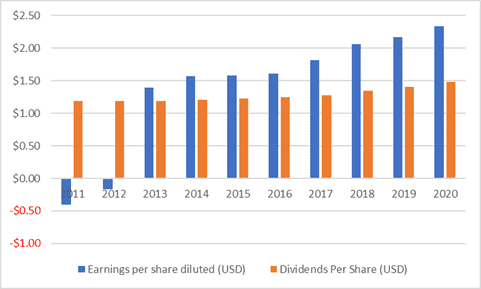

Being in the utility sector, OTTR can be considered a defensive counter and this is pretty evident from its earnings track record. The company was marginally loss-making in 2012 but since then, it has managed to turn the corner and generated earnings growth every year thereafter.

Being a utility company, it is not surprising that the company is also a regular dividend payer, with its dividend per share increasing every year since 2013 and currently yields 2.8%.

One key risk to take note of for the counter. OTTR has generated negative free cash flow for the past 2 years and this trend is expected to continue in 2021 as CAPEX remains elevated. That has also resulted in a rising net debt trend.

OTTR has appreciated by c.30+% in YTD 2021 and is currently at an all-time high level. Investors who believe that its rising net debt level and negative free cash flow situation is not a major cause for concern might wish to ride on the bandwagon of this utilities counter in 2H21.

#2 Small-Cap US stocks: UFP Industries (UFPI)

The second small-cap US stock in this list is UFP Industries (UFPI) that operates in the Basic Materials sector and the Lumber industry to be specific. UFPI has a current market cap of US$4.6bn.

The company produces and sells lumber and treated wood products in three main customer categories: retail, industrial, and construction.

The retail category, which generates the most revenue, sells lumber products to retailers, including big-box home improvement retailers. The industrial category sells wood pallets, boxes, packaging crates, and other containers used for industrial shipping. The construction category sells manufactured housing and building materials to the construction industry.

The vast majority of the company’s revenue is generated in the United States.

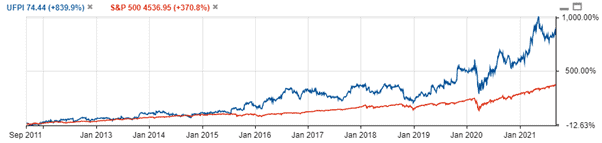

UFPI has been affected by the volatility seen in lumber prices of late. Nonetheless, the counter is still up an impressive 35% YTD2021 and over the past 10 years, have generated a return of 840%, crushing the S&P 500’s 10-year return of 371%.

During this period, UFPI grew its earnings consistently every year from $5m in 2011 to $247m in 2020. The street expects UFPI’s earnings to be at a record level in 2021 as a result of surging lumber prices in 1H21 but that earnings momentum will likely taper off in 2022.

Besides growing its earnings consistently over the past 10 years, UFPI has also been growing its dividend payment, from $0.13/share in 2011 to $0.50/share in 2020, with an impressive dividend growth CAGR of 39% over the past decade.

UFPI is an interesting candidate to play the current US housing boom. Although lumber prices can exhibit significant volatility, UFPI has been able to maintain its impeccable earnings growth over the last 10-years which is no easy feat.

#3 Small-Cap US stocks: Grand Canyon Education (LOPE)

The third small-cap US stock in this list is Grand Canyon Education (LOPE). This company is an American for-profit education company that operates a private university in Phoenix, Arizona, as well as online educational programs.

The company offers undergraduate and postgraduate degree programs, including business, education, nursing and health, and liberal arts.

Grand Canyon Education’s on-campus program enrolls approximately 15,000 students, while its online program enrolls over 50,000 students. The university’s undergraduate programs enroll approximately 60% of its overall student base and are the largest revenue driver for the company.

The education industry is largely seen as a defensive business. The exception is if your education business is based in China.

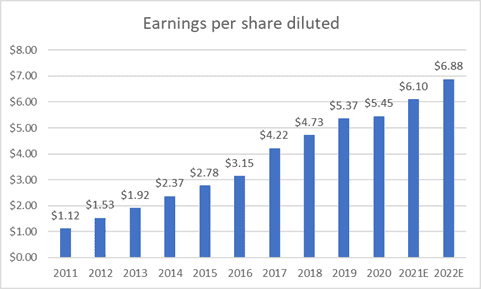

Consequently, LOPE has been able to grow its earnings from $51m in 2011 to $257m in 2020. The street expects LOPE to maintain that earnings growth momentum heading into 2021 and 2022, with the company’s EPS forecasted at $6.10 and $6.80 respectively.

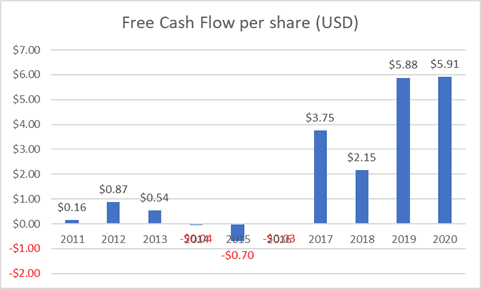

Unlike OTTR, LOPE has been able to generate a ton of free cash flow over the past 3-4 years as a result of tapering Capex requirements. Consequently, the company can fund its growth through organic means without the need to raise equity nor debt substantially.

While the company has underperformed the market substantially in YTD2021, this is a counter that has caught my attention and is worthy of further investigation.

#4 Small-Cap US stocks: First Finl Bankshares (FFIN)

The fourth small-cap US stock in this list is First Finl Bankshares (FFIN) which is a financial and bank holding company.

The company conducts a full-service commercial banking business with operations primarily located in Texas. Although the company operates under one bank charter, it manages operations in a decentralized manner through local staff and advisory boards.

The company primarily serves small and midsize nonmetropolitan markets and has grown organically, through de novo branch openings, and acquisitions.

A majority of its loan portfolio is in real estate.

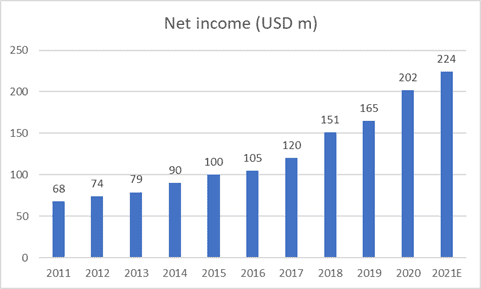

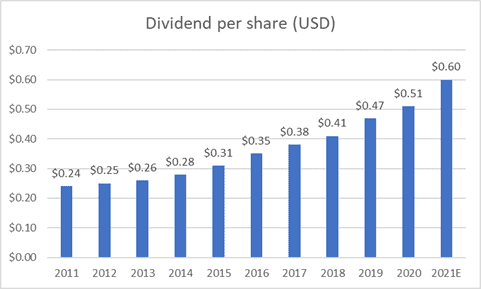

As can be seen from the chart below, FFIN has been very impressive in growing both its top and bottom-line over the past decade. Net income grew from $68m to $202m in 2020, with the street expecting that momentum to continue into 2021.

Beyond just growing its net income, FFIN is also a consistent free cash flow generator, with its free cash flow hitting $194m in 2020 (similar to net income level).

Consequently, the company has been able to also grow its dividends per share from $0.24/share in 2011 to $0.51/share in 2020 and currently sport a dividend yield of 1.3%.

#5 Small-Cap US stocks: LCI Indus (LCII)

The last small-cap US stock in this list is LCI Indus (LCII) which operates in the recreational vehicles industry. The company supplies domestic and international components for the original equipment manufacturers of recreational vehicles and adjacent industries including buses; trailers used to haul boats, livestock, equipment, and other cargo.

It has two reportable segments the original equipment manufacturers segment and the aftermarket segment.

The OEM Segment manufactures or distributes components for the OEMs of RVs and adjacent industries, including buses; trailers used to haul boats, livestock, equipment and other cargo; trucks; pontoon boats; trains; manufactured homes; and modular housing.

Its products are sold primarily to major manufacturers of RVs such as Thor Industries, Forest River, Winnebago and other RV OEMs, and to manufacturers in adjacent industries.

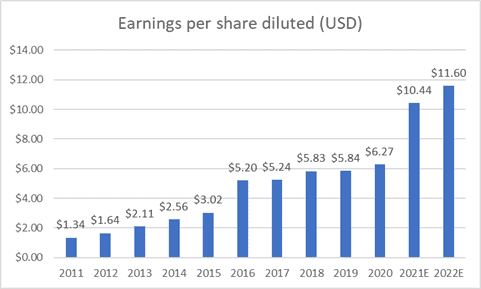

Despite a slight dip in net income generated in 2019 from $149m to $147m, LCII was able to grow its EPS marginally from $5.83 to $5.84 as a result of its share buyback policy. This is made possible because the company is consistently generating free cash flow.

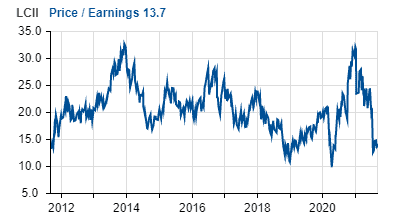

This is a small-cap stock that the street loves, with an average target price given by the street at $169/share, 20% higher than the current level. The street expects LCII EPS growth momentum to continue in 2021 and 2022, achieving a forecasted record EPS of $11.60 in 2022.

If that EPS can be achieved, the counter will be trading at a forward 2022 PER of 12x vs. its historical average PER multiple of c.20x. This gives plenty of re-rating opportunity for this small-cap US stock with an impeccable earnings growth track record.

Conclusion

Small-cap stocks can be extremely volatile. However, the rewards can be tremendous as well when you select the right counter to stay vested for the long term.

The 5 small-cap US stocks highlighted in this list all have a solid track record of earnings growth over the past decade. While no one can be certain that their consecutive earnings growth trend can be maintained over the coming decade, it might be worth your attention to investigate these counters in more detail as they could very well turn out to become multi-baggers stocks.

Among the 5 small-cap stocks, I do intend to study LOPE, FFIN and LCII a little more in-depth as these 3 stocks have the greatest potential to maintain their earnings growth in the next 3-4 years, in my view.

Once again, this list of stocks is for your reading pleasure and reference and not an inducement for purchase. Please do your necessary due diligence, particularly considering that these stocks could exhibit greater volatility vs. your typical blue-chip counters.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only