Singapore Dividend Stocks with rock solid dividend paying track-record

It is pretty rare for Singapore stocks to have a consistent track record of paying dividends. Unlike in the US where there are hundreds of companies classified as Dividend Aristocrats (companies that have increased their dividend payments for 25 consecutive years or more) and a handful of Dividend Kings (companies that have increased their dividend payments for 50 consecutive years or more), Singapore stocks typically do not have a good track record of consistent dividend payments.

In this list of 4 Singapore dividend stocks, these companies exhibit rising or stable normalized dividend payments (excluding special dividend payments in certain years) over the last 10 years. I believe their dividend payment streak could continue in 2020, a year ravaged by COVID-19 which has seen the operations of many businesses being significantly impacted.

Take for example Straco, a company which should have been in this list (but not) because 2020 is likely going to be a huge loss-making year for the company, one where revenue is going to witness a major drop-off as global tourism comes to a stand-still. There is a likelihood, however, that the company might still maintain its normalized dividend due to its huge cash hoard.

One of the key reasons why I believe some of these Singapore dividend stocks can extend their dividend-paying track record is because their balance sheet is in a pristine condition, one where there are almost no financial liabilities and they are in a very comfortable net cash position to continue rewarding shareholders through dividends.

You might also be interested in: TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

Without further ado, here is the list of the 4 Singapore Dividend Stocks that could potentially extend their solid dividend-paying track record into 2020.

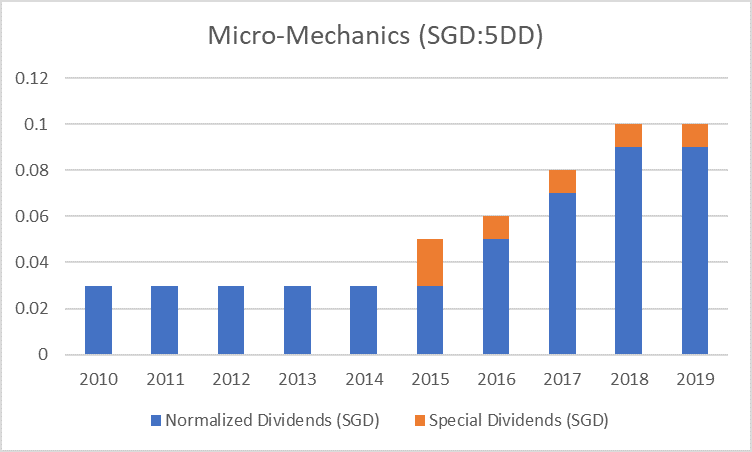

Singapore Dividend Stocks #1: Micro-Mechanics

Most of you might not be very familiar with Micro-Mechanics, which is considered a mid-cap stock (SGD$250m market cap) here in Singapore. The company designs, manufacture, and markets high precision parts and tools used in process-critical applications for the semiconductor and other high technology industries.

The company announced a decent set of 2QFY20 results with net profit increasing 14.4% YoY. Nonetheless, 1HFY20 still witnessed a 10.3% decline in net profitability.

The company has S$19m in cash and cash equivalent and no financial liabilities. Concurrently the company generates around S$15m in free cash flow per annum. With a dividend payment of $0.10/share in 2019 (including special) equating to an amount of c.S$14m, Micro-mechanics remains in a very comfortable position to maintain their dividend payment in 2020, despite a relatively high payout ratio over 100%.

For those interested to take a quick snapshot of its past 10-years Income performance, you can refer to the table below which is provided for your convenience.

However, do take note that the counter is rather illiquid and hence one should have a longer-term view of the stock if you wish to vest in the counter.

At the current juncture, with the semiconductor industry still looking relatively robust, I do not see much concern on its business falling significantly off the cliff. The company has announced a surprising increase in its 1HFY20 DPS to S$0.05 from the previous level of S$0.04 which provides greater assurance that FY2020 normalized DPS can at least be maintained at S$0.09 although my base case assumption is for total DPS (including special) to increase to S$0.11/share in 2020.

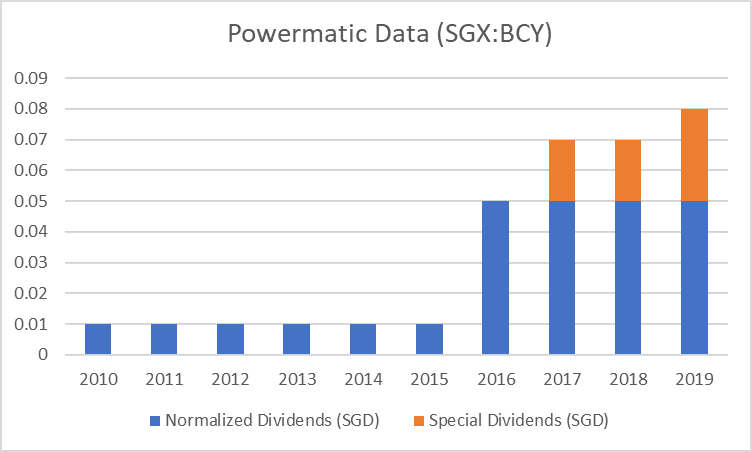

Singapore Dividend Stocks #2: Powermatic Data

A small-cap stock that is not likely to be in your radar unless you are a value-investor, Powermatic Data is a small-cap stock with a S$90m market cap whose main business is in the manufacturing and sale of wireless connectivity products and related services. Their products include high-performance wireless radio modules, embedded boards, indoor and outdoor access points, and wireless antennas.

The company’s key client is Qualcomm Atheros.

The company announced a very strong set of 1HFY20 results, with net profit jumping by 109% to S$5.9m. In its outlook statement, the company highlighted the growing demand for connected devices and digital services, coupled with easy availability of the internet and the advent of smart homes, smart cities and smart wearable devices offer good potential for the Group to grow its core business.

Nonetheless, its sole plant in Suzhou at the moment is an area of concern due to US-China trade war relations. The Group’s 2nd production plant in Kulai, Malaysia, is expected to start operation in the last quarter of the current financial year.

Assuming its first-half performance can be extrapolated and representative of 2HFY20 performance, the company could be looking at a net profit level of close to S$12m. With a market cap of S$90m, that represents a forward PER of just 7.5x

Add to that a robust balance sheet of S$34m in cash with no financial liabilities plus the fact that the company generated c.S$8m in free cash flow in FY2019 (FY2020 likely to be lower due to investment into its 2nd plant) and one can be relatively assured that its S$0.05/share in normalized dividends, which translates to just a paltry S$1.8m in dividends, is at absolutely no risk.

Even including its special dividend of S$0.03/share, a total dividend of S$0.08/share which translates to S$2.8m in dividends paid represents a conservative payout ratio of just 23%.

I believe there is plenty of bandwidth for the company to continue increasing its dividend payment ahead which will increase the attractiveness of its dividend yield, currently at 3.2%.

A potential catalyst beyond a good set of future results is the divestment of its Harrison building which the company highlighted in this announcement that it is currently under review.

For those interested to take a quick snapshot of its past 10-years Income performance, you can refer to the table below which is provided for your convenience.

Powermatic Data is again another stock that is highly illiquid hence not suitable for trading. However, those with a dividend angle should consider this counter where I believe its dividend payment is likely to be rock-solid, taking into consideration its financial performance, balance sheet status, and cash flow generation.

I have not done an in-depth study on the counter but it does seem like the company could benefit from a more interconnected world ahead. The revolution of 5G could be a tailwind to drive the company’s wireless products ahead.

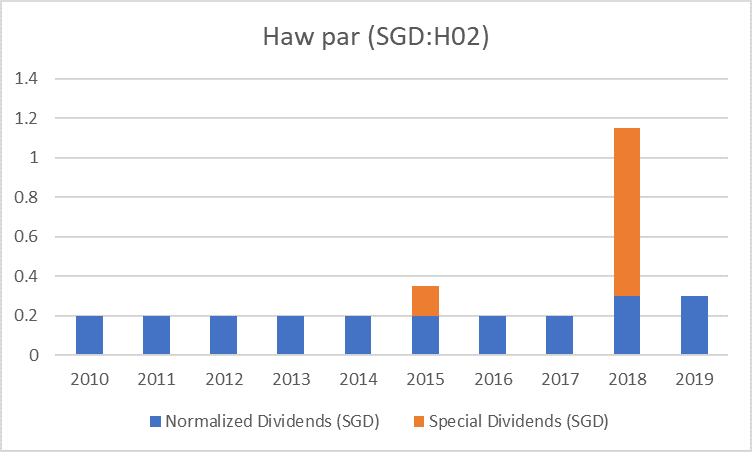

Singapore Dividend Stocks #3: Haw Par

Haw Par Corp has been listed in the SGX since 1969 and celebrated its 50th anniversary in 2019. Many might have heard or be associated with this company from its Tiger Balm Brand but do you know that the company was recognized by the Financial Times in the FT 1000 High growth Companies Asia pacific 2018 and 2020 and by The Straits Times in the ST Singapore’s Fastest Growing Companies 2019 and 2020?

I never would have associated Haw Par with being fast-growing.

A quick look at its financials doesn’t present the “fast earnings growth” rate that one might expect. The company grew its top line by 2.6% while net profit grew by 1.8%. The company has S$465m in cash with borrowings at a mere $8m as of end-2019.

Net cash position represents about 21% of its current market cap of S$2.2bn.

On a normalized basis, the company generates around $65-70m in free cash flow and receives about $50m in dividends from its investments. This brings total cash income to approx. S$120m/annum.

On the other hand, the company pays a normalized dividend of S$0.30/share which translates to a dividend amount of S$66m which is well-covered by its typical annual cash inflow.

Assuming that the company generates a similar amount of profit in 2020 vs. 2019 of c.S$180m, that will translate to a forward PER of approx. 12x. The company can be seen as an investment holding company with stakes in UOB and UOL.

For those interested to take a quick snapshot of its past 10-years Income performance, you can refer to the table below which is provided for your convenience.

While its top line has been growing steadily, the same cannot be said of its bottom-line which is likely impacted by volatile mark-to-market valuation of its properties as well as interest income from its investments.

Nonetheless, interest income generated from investments and cash flow from core operations will be more than sufficient to cover its normalized dividend payments.

If one were to analyze its 5-years share price performance with its key investment holdings such as UOB and UOL, one can see that Haw Par has outperformed its key investment holdings, although I would say that a 5 years return of c.11% is rather paltry.

Taking into consideration its lower normalized yield compared to UOB over the past few years (except for 2018), the overall returns are rather similar.

Haw Par’s share price has fallen rather steeply since peaking at c.S$14.40 back in 2019. With its current price at a share below S$10, there could be strong downside support from the current level. The counter is trading at approx. 0.7x P/NAV which is at the lower band of its historical trading range of between 0.6-1.0x P/NAV.

Haw Par is a stock that has fallen under the radar due to the lack of liquidity and analyst coverage. However, I see this counter as one with a strong balance sheet and cash flow to continue supporting a normalized dividend payment of S$0.30/share. At the current price of S$10, that equates to a decent yield of 3%.

Is this a better buy compared to UOB which spot a higher yield? I reckon that Haw par has the propensity to increase its dividend payment with a cash balance of S$465m as of end-2019 with almost no debt at all. With additional diversification from its core healthcare business, UOL stake, and rental income from other property holdings, I would say that Haw Par is a safer bet with a lower downside risk profile compared to UOB in the current recessionary environment.

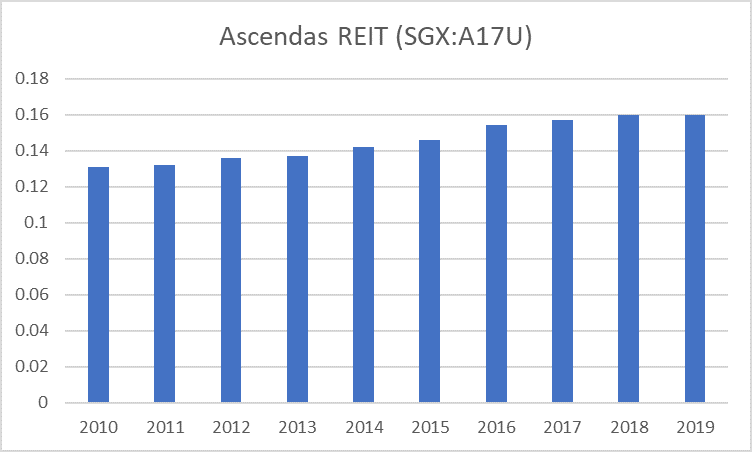

Singapore Dividend Stocks #4: Ascendas REIT

Ascendas REIT is one of only a handful of S-REITs in Singapore that has consistently increase its DPU payment. Back in Feb this year, I wrote an article titled: Which S-REITs have the best record of dividend growth?

Ascendas REIT is one of the few that has almost an unblemished track record of growing its DPU consistently since 2010.

Despite S-REITs under heavy selling pressure during the COVID-19 driven market sell-down, Ascendas REIT has swiftly rebounded and is now looking to breach its all-time high price of S$3.48. The current stock price is S$3.28.

Being the largest S-REIT in Singapore, Ascendas REIT has a stable and diversified portfolio of industrial properties which will likely remain resilient despite the threat of COVID-19. Analysts believe that the negative impact of COVID-19 on Ascendas REIT is largely manageable and there will be minimal impact from rent waivers, according to DBS

As an S-REIT, it will be difficult to assess the counter’s ability to maintain/grow its DPU the traditional way such as analyzing its balance sheet strength, etc. It is also more challenging to find a S_REIT with a strong dividend growth track record compared to a US REIT due to the differences in how distributions are mandated to be paid out.

Ascendas REIT has done a fantastic job thus far and amid the current challenging operating environment, DBS forecast its 2020 DPU payment to be flat at S$0.16 vs. 2018 (do note that the company changes its financial YE from Mar to Dec, hence 2019 DPU of 11.5 cents only consist of 3 quarters.)

Phillip Securities believes that its DPU can hit S$0.167 in 2020 while OCBC has a more conservative estimate of S$0.159.

For those interested to take a quick snapshot of its past 10-years Income performance, you can refer to the table below which is provided for your convenience.

Ascendas REIT competitive cost of capital and strong balance sheet with a potential debt capacity of >S$800m will allow the counter to take advantage of its strong sponsor pipeline assets.

The REIT just made an announcement on 1 July that it will be acquiring a new logistic property in Sydney for A$23.5m. The net property income yield for the first year is approx. 6.2% and 5.8% per-transaction costs and post-transaction costs respectively which is still accretive considering its current yield of closer to 5%.

While Ascendas REIT has the highest variability among this list of 4 Singapore Dividend Stocks to further grow/maintain its dividend profile in 2020, I feel that Ascendas REIT has among the strongest operational profile within the S-REIT universe and even COVID is unlikely to derail the REIT’s long-term earnings and dividend growth trajectory.

Conclusion

Notice that I did not include the 3 local banks in this list, although all 3 have a solid 10-years track record of not cutting dividends. I do believe that there is quite a high likelihood that DPS for our local banks will at least be maintained for 2020. MAS has “regulated” that our local banks stop their share repurchase mandate to conserve capital and further support SMEs in their fight against COVID-19 and potential insolvency.

There is however that outside chance that dividends could be curtailed if the unemployment and bankruptcy situation worsens in 2H20. So far we are not at that stage.

The above 4 Singapore Dividend Stocks, except for Ascendas REIT are stocks that are flying under the radar at the moment and investors might not realize that they are strong dividend payers over the past decade.

With a strong balance sheet and a business that is not likely significantly impacted by COVID, I believe that all 4 Singapore Dividend stocks have the propensity to continue their solid dividend-paying track record in 2020 and beyond.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

- DIVIDEND INVESTING STRATEGY: COMBINING KEY RATIOS WITH ECONOMIC MOATS

- TOP 5 RESILIENT SINGAPORE STOCKS TO BUY AMID COVID-19 UNCERTAINTY

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “4 Singapore dividend stocks with increasing dividends for the last 10 years. This streak could continue in 2020”