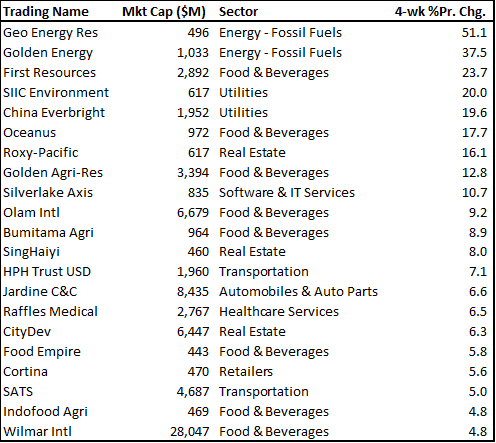

SGX top gainers over the past 1 month

Investors who are interested in SG counters can use the SGX stock screener function to identify stocks that meet certain criteria. In this article, I look to identify which are the SGX top gainers over the past 1 month and to evaluate if that momentum can be sustained using the TradersGPS platform.

According to SGX, there are a total of 21 SGX counters that meet the following criteria:

- Market Cap > SG$400m

- Capital Appreciation >= 4% over the past 4-weeks

The table below shows the SGX top gainers over the past 4-weeks.

Sitting in pole position is Geo Energy Resources which generated a return of approx. 51% over the past month. Rank 2 is Golden Energy with a return of 37.5% and in 3rd place is First Resources with c.23.6% return.

The top 5 SGX performers over the past 1 month were all resources play. They are entities that are linked to coal, palm oil and wastewater management.

Of the 21 SGX top gainers in this list, 10 of them are resources play.

The 4 largest entities in this list by market cap is Wilmar, (SG$28bn), followed by Jardine C&C (SG$8.4bn), followed by Olam ($6.7bn) and lastly City Development (SG$6.4bn) with returns of 4.8%, 6.6%, 9.2% and 6.3% respectively.

Why is coal plays so hot?

Coal prices are at multi-years high

Coal prices are currently at multi-years high which is good for coal producers such as Geo Energy and Golden Energy and not so ideal for utility companies that depend on coal as their fuel source.

For example, the bulk of Sembcorp Industries’ power plants in India depend on coal as the key source of fuel. The company also made a major impairment to one of its key power plants in China last quarter as a result of the closure of a key coal source.

Underinvestment in coal resources coupled with strong demand for coal

The focus has been on renewables and green energy, thus resulting in the underinvestment of coal resources. This has translated to the lack of coal supply which is further exacerbated by rising coal demand due to the rebound in global economies, a harsher winter due to climate change and less than ideal energy production from green energy.

Potential for high yield

Stocks like Geo and Golden Energy are currently bolstered by the possibility of the companies paying bumper dividends as a result of their expected strong earnings performance in 2H21. For example, Geo has already paid out 1cts in dividend for 1H21 which translates to a yield of 2.6% at its current elevated price.

Assuming a bumper 2H21 where profits in 3Q21 alone might exceed the entire 2H21 amount, the company could be looking at a dividend yield possibly above 10% in 2021 as a result of its dividend policy of paying out at least 30% of net profit.

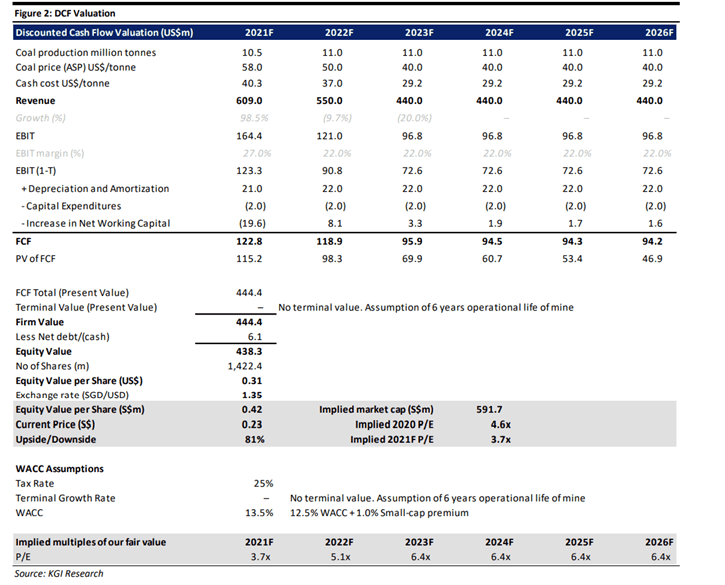

Bullish target by the Street

According to KGI Research which is one of the few covering analysts for Geo Energy, despite the counter’s recent strong share price performances, Geo Energy is still trading “cheaply” in terms of its forward PER multiples (2020F: 4.6x and 2021F: 3.7x).

Key risk

A play on coal stocks which have rallied substantially over the past 1 month is ultimately a play on the sustainability of coal prices. Just like how COVID-19 has resulted in a strong rally in rubber glove prices and consequently the share prices of glove makers such as Riverstone and Top Glove, the subsequent decline in these “raw material” prices will also have a drastic impact on these companies’ price performances.

Top Glove, for example, has declined from a high of S$3.18 to its current price of just S$0.88, a 70% decline over just a 1-year horizon.

Investors and traders need to be wary of the fact that if and when coal prices start to decline, that will also likely trigger a sell-off in commodity counters such as Geo Energy and Golden Energy whose financial performances are directly linked to the prices of the commodity.

Which are the stocks on my trading watchlist?

The Top SGX gainers highlighted in this list have all generated at least a 5% return over the past 1 month. However, the more important question is, can these gains be sustained over the rest of 2021?

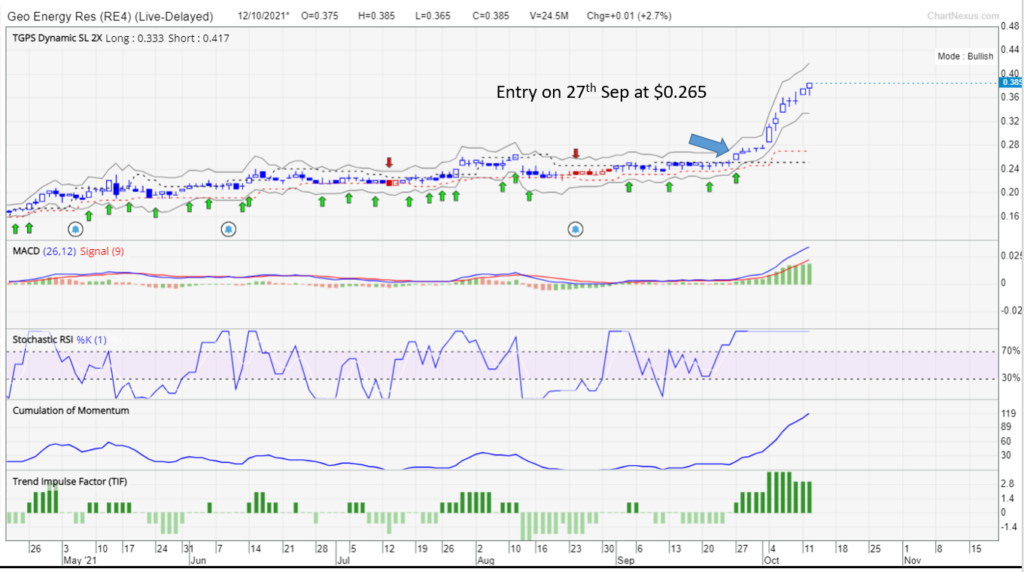

In the case of Geo Energy, an early investor with some knowledge of the positive fundamentals driving the company would seek to enter a position in the counter when the strong momentum in its price appreciation was “confirmed”.

That would have been 27th September when its share price was trading at $0.265, looking to breach the key resistance level at that same price.

There was a signal to enter long into the counter using the TradersGPS platform and that would have resulted in a gain of approx. 40% over the past couple of weeks.

Hindsight is, however, always perfect. More importantly, are there any counters in this list of 21 stocks that have gained momentum but are still possibly in the early innings of a rally unlike Geo where the counter has already appreciated by > 50% over the past month (no saying, however, that the rally cannot continue henceforth)

I will look to highlight 3 stocks in this list which is in my watchlist for a potential trading entry using the TradersGPS platform as an entry signal (technical angle). These stocks might also benefit from fundamental tailwinds.

Disclaimer: This is just an idea-sharing session and not an inducement or recommendation to BUY any of these counters.

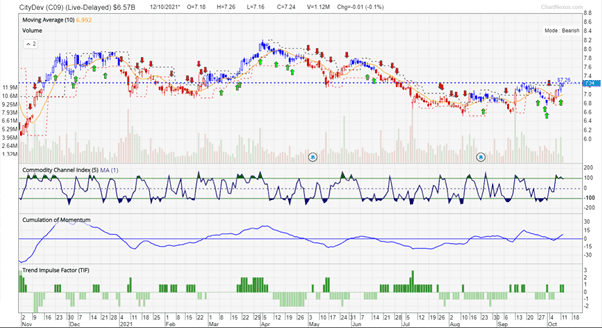

Stock #1: City Development

Technical angle: The counter has found strong support at the $6.60 level and is now looking to breach its near-term key resistance level of $7.25. Despite the counter still being in a bearish trend, there is a positive entry signal given by the TGPS system at its current price level which implies that momentum is gaining for the counter and if a successful penetration is made, the stock could look to trend higher to the S$7.80-$8.00 level which is approx. 10% upside.

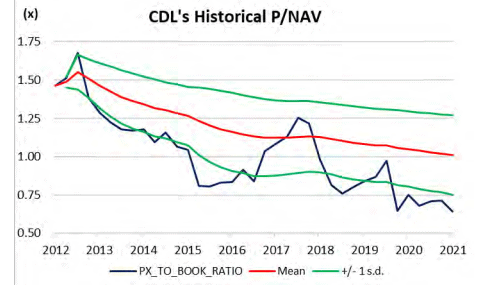

Fundamental angle: According to estimates made by CIMB and Philips analysts, they see City Development has an undervalued property development company with an RNAV estimate of $14.14-$16.30 vs. its current share price of $7.25.

It is also trading at a substantial discount to its historical P/NAV value (currently below -1 SD). Hence investors buying into the counter now is not overpaying for the counter when viewed in terms of its book value. They are currently purchasing it at the lowest P/NAV multiple over the past decade.

While there is no certainty that there will be a re-rating in terms of a higher P/NAV multiple, City Development is a blue-chip counter that is inexpensive and could benefit from the current buoyant SG property market environment.

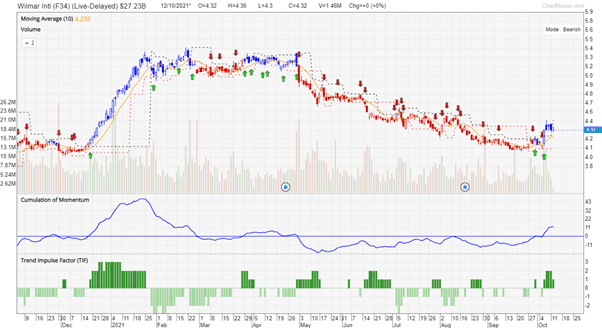

Stock #2: Wilmar

Technical angle: The counter has been in a bearish trend since the end of April despite positive developments such as the listing of its China entity, Yihai Kerry last year. However, there are initial signs that a bottom has been reached and according to the TGPS signal, there was a positive entry in the counter on 6th October at an entry-level of $4.33 which is where its share price is currently residing as well. A successful rebound could see the stock trending to the $5 level which is the counter’s next major resistant level. That is a potential 15% upside from its current share price.

Fundamental angle: Wilmar is looking to list its India entity through an IPO listing which could be the next short-term catalyst for the company. While the company is not exactly a direct beneficiary of higher palm oil prices unlike companies such as Golden Agri and First Resources, it remains a good inflationary hedge play, in my view. The street is generally very positive of Wilmar with target prices mostly over $6/share although the market seems to “disagree” at this current juncture with its share price in “dormant” mode since April.

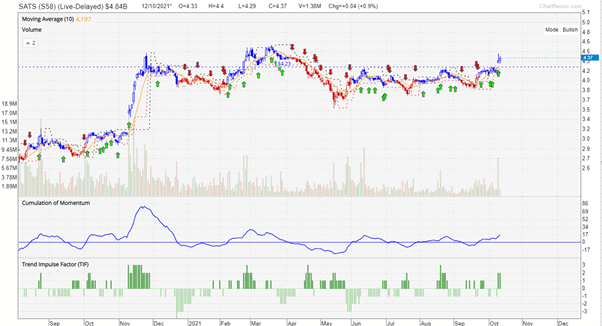

Stock #3: SATS

Technical angle: SATS has been trading in a relatively tight channel of between S$3.70 – $4.20 since May. However, the counter managed to break out of that channel on 11 October. There is not yet a positive entry for the counter but that could change over the coming days which implies a retesting of the next resistant level of $4.60. If the breakout turns out to be a false one, one can also look to exit when the price drops below $4.20.

Fundamental angle: Re-opening and aviation-related stocks saw a strong boost in their share prices when the government announced the expansion of the vaccinated travel lane or VTL for short to a total of 11 countries. This has boosted not just the sentiments for aviation-related counters such as SATS and SIA, but also actual demand for air travel which should reflect in the earnings of these companies in the coming quarters.

It is still uncertain if the rising COVID-19 cases in Singapore will hamper re-opening efforts in the months ahead. Nonetheless, the trading strategy for SATS is pretty clear, with an exit strategy triggered if momentum tapers and the counter dips back below the S$4.20 level in the coming months.

Conclusion

These are the 21 SGX top gainers over the past 1 month (counters with a market cap of more than S$400m). Almost half of these SGX top gainers are resource play who have benefitted from higher material prices in a global environment currently faced with the prospect of rising inflationary pressure.

There is no certainty, however, that the price momentum of these 21 SGX stocks will continue in the coming months ahead.

The top 2 performing SGX stocks, Geo Energy and Golden Energy have been counters related to coal production. With coal prices at an all-time high, these counters are primed to announce record earnings in 2H21. The key question, however, is whether strong future earnings performance has already been factored into their current elevated share price.

3 blue-chip stocks that are on my trading watch-list are City Development, Wilmar and SATS, with all 3 demonstrating strong price momentum according to the TGPS platform.

For those who are interested to trade using the TGPS platform, I have written a comprehensive review of this top-rated trading platform that one can access through this link.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- SG stocks to buy – Lendlease REIT, Ascendas REIT, Genting Singapore (July 2021)

- Best Performing Singapore REITs [Update June 2021]

- Merger between Keppel Corp and Sembcorp Marine

- 3 Singapore Blue Chip stocks to watch [May 2021]

- SIA MCB: A Great Way to Financial Engineering?

- 7 Singapore Blue-Chip stocks still yielding more than 4% [June 2021]

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.