SG Stocks to buy in August – Analyst upgrades

Can we trust analysts’ reports? Throughout the years, we occasionally see analysts flip-flopping between buy and sell calls within several weeks. As investments are highly subjective to one’s view, the difference in perspective is understandable. However, it led to certain controversies as investors argue that there may be a hidden agenda behind them.

A recent example would be in March 2021 when the market was hit with fears of higher interest rates. I recalled analysts at JP Morgan issuing an “underweight” position on both S-REITs and industrial REITs. This fuelled the fear in investors and caused a further sell-off in REITs. However, some investors saw it as an opportunity to “buy the dip” and the counters such as Mapletree Industrial (SGX: ME8U) swiftly rebounded by 7% the following week!

Analyst reports provide you with a useful source of information but investors should not solely rely on them to make investment decisions! In this series, we’ll look to analyze three upgrades and downgrades made by analysts in the current month.

Summary of picks

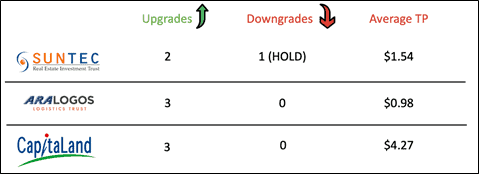

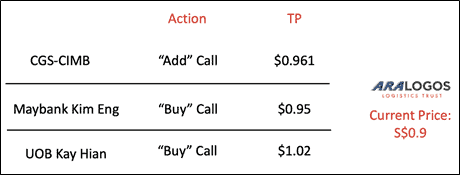

For our July picks, these are the stocks that we will be analyzing – Suntec REIT (SGX: T82U), ARA Logos Logistic Trust (SGX: K2LU), Capitaland (SGX: C31). This is a quick summary of the analyst buy and sell calls for July.

As shown in the picture below, analysts were generally upbeat on the counters despite a rollback to Phase 2 Heightened Alert. Comparing the three, Suntec REIT caught my eye as the analysts had contrasting views.

Here’s our breakdown of the analyst reports:

Suntec REIT (SGX: T82U)

Quick Introduction to Suntec REIT

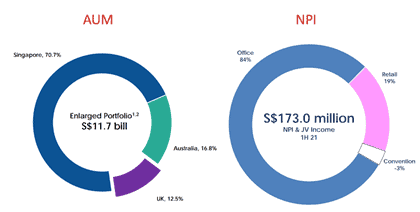

Suntec REIT operates in both the retail and office spaces with an Asset Under Management (AUM) of S$11.7billion. Throughout the pandemic, they have been divesting and acquiring assets in Singapore, United Kingdom, and Australia. Apart from their diversified portfolio, Suntec REIT is one of five companies on STI’s reserve list. With the largest market cap amongst the companies, they are poised to replace any constituents that might be removed at the index’s next review.

The REIT just announced their 1H2021 results and here’s a summary:

Financial Performance

- With the general reopening of economies, the REIT’s performance improved across the board

- Comparing 1H of 2021 and 2020:

- Distributable income up by 14.6%

- Dividend per unit up by 26.1%

- Net Property Income up by 23.9%

- Announced a dividend of 4.154cents for 1H2021

Portfolio Performance

- As of 1H2021, overall portfolio occupancy for both office and retail stood at 95.9% and 90.2% respectively.

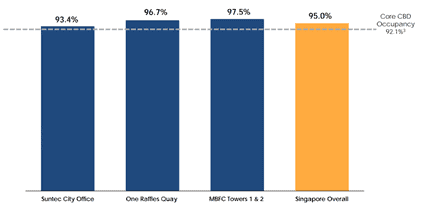

- Contributing to 70% of Suntec’s portfolio, these are the performances of their Singaporean assets

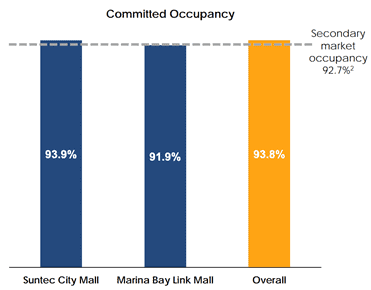

- Occupancy rates outperformed the industry averages

- Office spaces came in at 95%, outperformance of 2.9%

- Retail spaces came in at 93.8%, outperformance of 1.1%

- Rental reversions were mixed for 1H

- Office spaces seemed to have bottomed with a +1% rental reversion

- Retail spaces saw new tenants such as Don Don Donki with a -15.3% in rental reversion

- Occupancy rates outperformed the industry averages

- Less desirable Weighted Average Lease Expiry (WALE) for the REIT

- Singapore office WALE stood at 2.73 years

- Singapore retail WALE stood at 2.53 years

- High gearing at 43.1% leaves little space for acquisitions

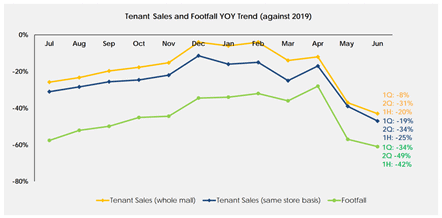

- Tenant sales and footfall has been less resilient compared to suburban retail malls

Recent Upgrades / Downgrades by Analysts

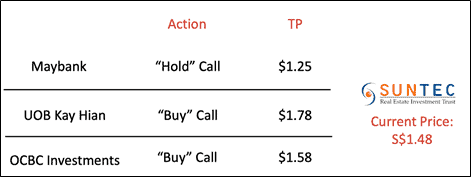

For July, analysts were generally mixed on Suntec REIT. In the next section, we’ll analyze their key rationale.

Key Rationale of Analysts and My Views

Accretive Divestments and Acquisitions

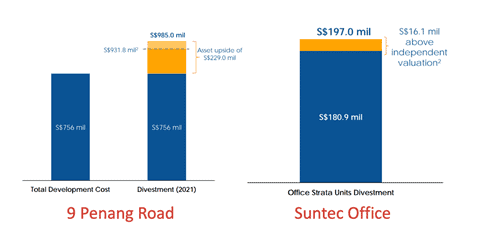

In 2021, Suntec REIT announced two key divestments – 9 Penang Road and Suntec office strata units. Firstly, 9 Penang Road was sold at a 5.7% premium of its latest valuation. In totality, it provided the REIT with a 305% return on investment and an approximate 2.27cents gain per unit. As for the office units in Suntec, the property was recycled at a premium of 8.9% to provide a gain of S$13.9 million. The recycling of both assets strengthened the REITs balance sheet which provided some headroom for acquisitions.

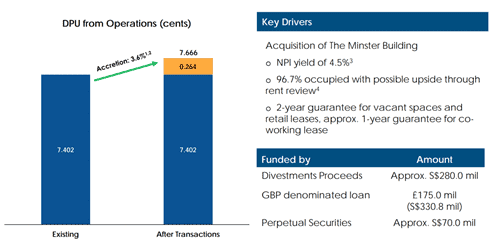

Concurrently, the REIT acquired a 100% interest in a Grade A Office in London. With a 999 year leasehold and a WALE of 12.3 years, it is set to provide a DPU accretion of 3.6%. One key feature I like about these acquisitions is the guarantee of rental income for vacant spaces. Through the recycling of assets, shareholders can enjoy higher returns and a healthier balance sheet.

Power of Diversification and resilience of Singapore Properties

In 1H2020, Suntec REIT was able to reduce its overall exposure to Singapore from 76% to 70.7%. This move allowed the REIT to cushion any setbacks caused by the rollback of Phase 2 (HA) in Singapore. Instead of softening results, the newly acquired assets in Australia and the UK contributed to the growth in gross margin and NPI by 11.6% and 23.9% respectively.

Coupled with the guaranteed income from vacant spaces overseas, Suntec might be more resilient compared to REITs that have 100% exposure to Singapore.

High gearing and possible Covid-19 setbacks

Despite the aforementioned divestment in assets, gearing stood at a rather unhealthy level of 43.1%. To put this number into context, the average gearing level of all REITs in Singapore is approximately 38.1%. Suntec recorded the 4th highest gearing at 5% higher than average. Due to the pandemic, MAS raised the maximum gearing level for REITs from 45% to 50%.

In my opinion, operating in a low-interest-rate environment serves as an ideal position for REITS to position themselves for the future with accretive assets. Unfortunately, Suntec will not be able to fully capitalize on this opportunity. Furthermore, Suntec will also be vulnerable to any setbacks due to Covid-19.

Will I buy Suntec REIT?

Adding on to the above-mentioned pointers, it was also announced in May that Suntec REIT will be removed from MSCI Singapore Index. This will negatively impact the REIT due to the lower visibility and liquidity of the counter. Coupled with the high gearing level, I wouldn’t be keen on opening a position on Suntec REIT. I’d rather look into REITs with (1) Similar yield with a healthier balance sheet or (2) Higher yield with a similar balance sheet.

ARA Logos Logistics Trust (SGX:K2LU)

Quick Introduction to the ARA Logos

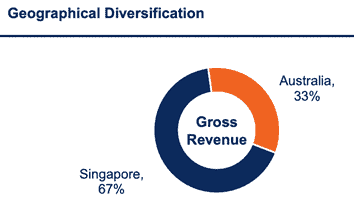

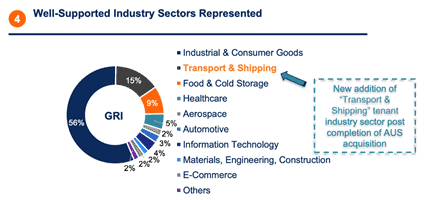

ARA Logos is one of the largest Asian logistics REITs listed in Singapore. Under the management of ARA – one of the largest real asset managers in APAC, ARA Logos has an Asset Under Management (AUM) of S$1.6billion across Singapore and Australia. Furthermore, the REIT completed several acquisitions and remained resilient amidst the pandemic due to the nature of its assets.

The REIT just announced their 1H2021 results and here’s a summary:

Financial Performance

- Remains resilient amidst the pandemic with strong results

- Comparing 1H of 2021 and 2020:

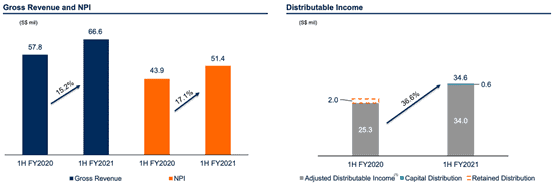

- Gross revenue up by 15.2%

- NPI up by 17.1%

- Distributable income up by 36.6%

- Increase in DPU by 10.6% with 2.57cents per unit

Portfolio Performance

- As of 1H2021, average portfolio occupancy stood at 98.2% with a positive rental reversion of 2.4%

- Healthy WALE of 4.4 years based on the net leasable area (NLA)

- Long leasehold on assets with a weighted average land expiry of 47.8 years

- Gearing stood at 39.5% with room for further acquisitions

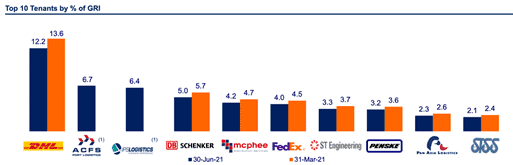

- Total tenant base of 77 tenants with rather high concentration – Top 10 tenants making up 49.4% of gross rental income

Acquisitions

- In 2Q2021, ARA Logos was able to divest low yielding and older assets for modern and prime logistics building

- Apart from being an accretive acquisition, it further diversifies the tenant mix of ARA Logos

Recent Upgrades / Downgrades by Analysts

For July, there were three analyst reports on ARA Logos with all issuing a “buy” call. In the next section, we’ll analyze their key rationale.

Key Rationale of Analysts and My Views

Accretive Acquisition

Diving deeper into the portfolio transformation made by ARA Logos, there were two key divestments sold on a premium – Findon Road in Australia and ALOG Changi DistriCentre 2. The older assets were replaced with four logistics assets, 49.5% stake in LAVIS Trust and 40% stake in Oxford property fund. In 1H2021, the contribution of the newer assets was evident to investors:

- Occupancy in Australia improved from 98.3% to 99.7%

- WALE of Australia properties increased from 2.5 years to 10.6 years

Ability to capitalize on a strong pipeline

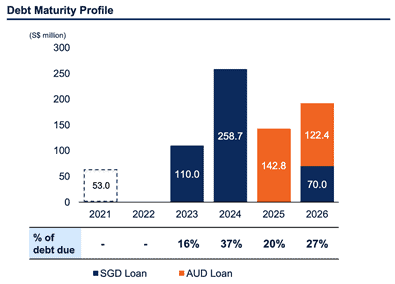

In comparison to Suntec REIT shared above, ARA Logos’ gearing stood at 39.5% with ample headspace for acquisitions. As seen in the picture below, the REIT has a very healthy debt maturity profile with no financing requirement until 2023. Furthermore, they were able to capitalize on the low interest-rate environment to lower their financing cost from 3.22% to 2.92%.

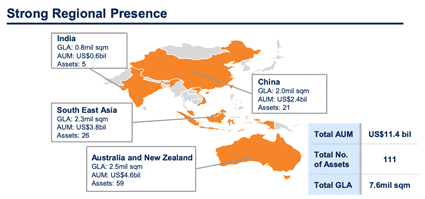

By acquiring a stake in both LAVIS Trust and Oxford property fund, ARA Logos has pre-emptive rights over their remaining assets. Furthermore, their sponsor has an AUM of US$11.4billion with 111 assets across the region. It is highly speculated that the REIT would capitalize on the strong sponsor to acquire assets in Australia, China, and Singapore.

Strong portfolio performance

In 1H2021, the REIT renewed most of their leases due in 2021 with only 3% remaining by net leasable area. This was done with a positive rental reversion of +2.4% which is relatively strong for the REIT.

Will I buy ARA Logos?

Throughout the year, logistics has proven its resilience to the pandemic and I would prefer ARA Logos compared to Suntec REIT. The former has a healthier balance sheet which opens up for acquisitions through its sponsor. Therefore, I share the same view as the analysts.

Capitaland (SGX: C31)

Quick Introduction to Capitaland

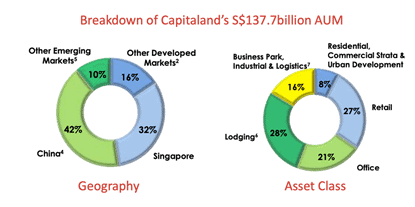

Capitaland is one of Asia’s largest diversified real estate groups with an AUM of S$137.7billion. Backed by Temasek with about 52% of ownership, Capitaland’s portfolio is diversified among real estate classes across the world. Emphasizing Singapore and China, the company manages six listed REITs and over 20 private funds.

More importantly, it was announced early this year that Capitaland is looking to privatize its development business. It is to note that base on the management’s proposal, the fair value of the company is pegged at S$4.102 per share. This will be elaborated on in the later sections.

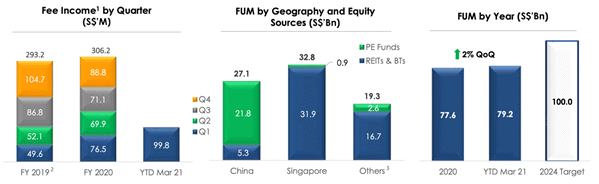

Here’s a quick summary of Capitaland:

Financial Performance

- The company’s bottom-line was impacted despite showing resiliency

- Year on Year comparison based on FY2020 numbers:

- Revenue up by 4.8% YoY

- EBIT down by 95.4% YoY

- Operating cash flow was at an impressive S$1,528million which allowed the firm to see through Covid-19

- Q1 FY2021 results:

- Fee Income outperformed pre-covid levels in 2021. Driven by:

- Improved market sentiment and transaction activities

- Larger fund under management due to acquisitions

- Fee Income outperformed pre-covid levels in 2021. Driven by:

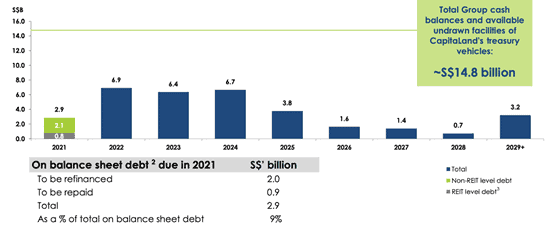

Strong Balance Sheet

- Capitaland recorded S$14.8billion worth of cash and equivalents

- Gearing stood at 65% which is 5% lower than the firm’s target of 70%. This provides a S$1.8billion headroom for acquisitions

- Average debt maturity of 3.5 years with only S$0.9billion of debt to be paid in 2021

Recent Upgrades / Downgrades by Analysts

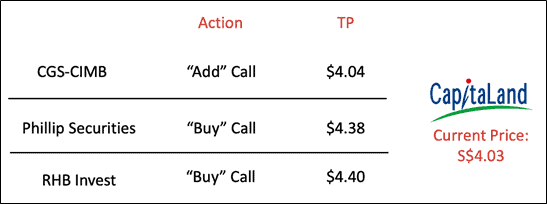

In July, analysts are generally bullish on Capitaland with considerable upside based on Phillip Securities and RHB’s views. In the next section, we’ll analyze the key rationale of the analysts.

Key Rationale of Analysts and My Views

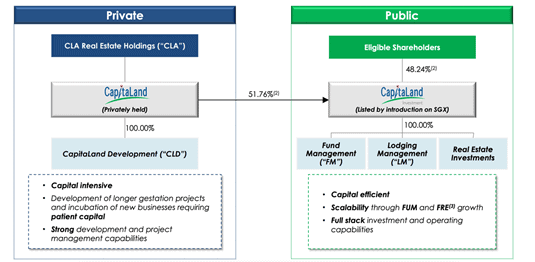

Privatization deal for investors

In March 2021, Capitaland proposed to split its business into two key segments – Capitaland Development and Capitaland Investment Management (CILM). The former represents the private arm that handles the development of assets. On the other hand, the latter will hold REITs, assets, and funds owned by the firm.

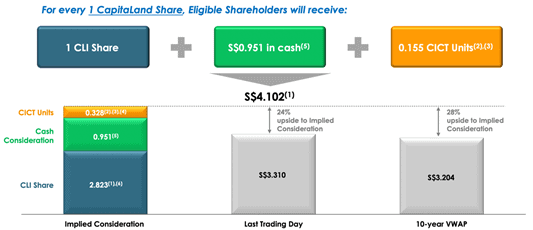

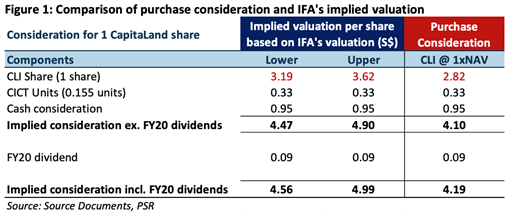

What is it in for investors? For every share owned by investors, Capitaland is providing a package worth S$4.102 per share based on their valuation. Here’s a breakdown of what investors will receive:

- One CILM share valued at $2.83 per share

- 0.155 CICT unit valued at $0.328

- S$0.951 in cash per share

Putting the deal together, it may seem like a no-brainer to buy Capitaland at $4.02 now. However, the valuation of CILM is not guaranteed as the market may disagree with its valuation. Furthermore, investors will face the issue of odd lots in both CILM and CICT which can be undesirable.

So you might be wondering why are analysts bullish on this counter? An Independent Financial Advisor gave CILM a valuation of $3.19 to $3.62 per share. By plugging the numbers into the package provided by Capitaland, the deal now provides investors with an additional 8% to 18% upside.

Low Gearing with Growth Potential

CILM’s Pro-forma gearing is expected to be at 56% compared to Capitaland’s 68%. As the management intends to target a 70% gearing level, there is a large headspace for CILM to expand and enhance its assets.

Will I buy Capitaland?

Judging by the valuation report, Capitaland is indeed undervalued based on its market price. However, the eventual price of CILM is never guaranteed and market conditions can change with a snap of the finger. I believe that the decision to acquire Capitaland depends on one’s risk appetite and willingness to even up your odd lots of both CICT and CILM.

Conclusion

At NAOF, we will be looking to provide monthly analysis on analysts’ reports to help you in your investment decisions! Stay tuned and all the best in your investments!

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- SG stocks to buy – Lendlease REIT, Ascendas REIT, Genting Singapore (July 2021)

- Best Performing Singapore REITs [Update June 2021]

- Merger between Keppel Corp and Sembcorp Marine

- 3 Singapore Blue Chip stocks to watch [May 2021]

- SIA MCB: A Great Way to Financial Engineering?

- 7 Singapore Blue-Chip stocks still yielding more than 4% [June 2021]

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “SG Stocks to Buy in August – Suntec, ARA Logos, Capitaland (Aug 2021)”

Hi TC, may I know your views on AIMS APAC Reit vs ARA Logos Reit? Hope to have a clearer idea of which reit is a better buy. Thanks!

David