Sequence of Returns Risk could be your major party pooper

Imagine a hard-working individual name John who started saving and investing early and amassed a nest egg of $1m in his stock portfolio at the age of 65. He proudly produces his bank book, showcasing the magic retirement “figure” clearly imprinted on it to his financial planner.

Based on the various calculations his financial planner has done for him previously, this magic figure will be sufficient to fund his annual expenses, FOREVER, set on the premise of the 4% WITHDRAWAL RULE. This rule is simple. You withdraw 4% of your portfolio (based on a balanced 60% equity:40% bond structure) during the first year of your retirement. In subsequent years, you adjust the dollar amount you withdraw to account for inflation.

Using this formula gives you a very high probability that you will be able to outlive your money during a 30-year retirement horizon.

For example, in John’s case, he has a portfolio at retirement that totals $1m. He could withdraw $40,000 in his first year of retirement. If the inflation rate is forecasted to run at an average of 3%/annum, he will give himself a raise of 2% in the second year, i.e. withdrawing $41,200 and so on over the 30 years horizon.

Just for illustration purposes, a $40,000 withdrawal on the first year will translate to c.$97,000 withdrawal on the 30th Year, based on an average annual inflation rate of 3%. Again, for illustration purposes, the total withdrawal by John over this 30-year horizon will amount to a hefty $1.86m.

This strategy might work on the backdrop of a record-setting bull-market we just experience in the last decade. Stocks, particularly US stocks, can seem to do no wrong over the past decade. Even bonds have performed tremendously well in the last decade, one where short-term interest rates were driven to record low and, in some cases, into negative territory.

However, it is worthy to note that this party isn’t likely to last forever. What goes up will ultimately come down (even if the long-term trend might still be up) and if a massive stock market correction lasting for years is to happen just after you enter retirement, that will undoubtedly have a devastating impact on your portfolio.

When stocks are undergoing a massive correction, that is the time to go on a bargain hunt. A retirement portfolio structured to sell stocks when stocks are at massive discounts is going to have a dramatic negative impact on your nest egg.

This is termed as “Sequence of Returns Risk”.

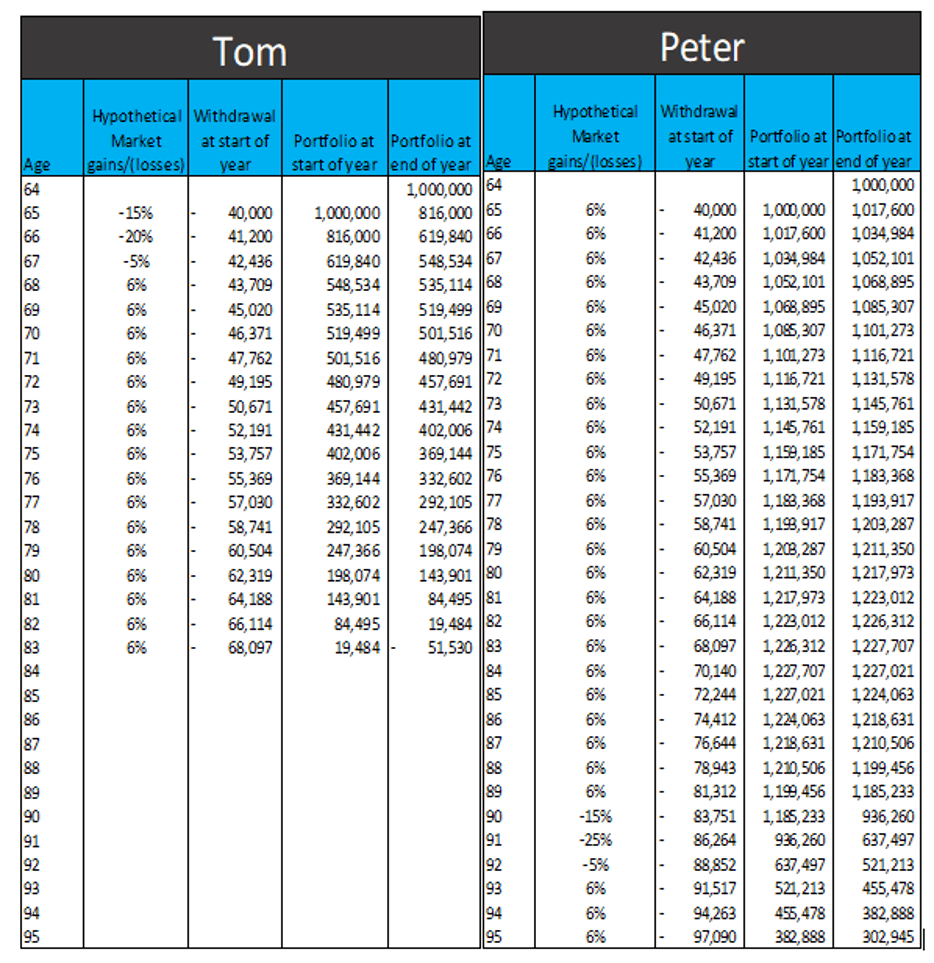

Let’s illustrate this concept using two hypothetical individuals, Tom and Peter. Each of them entered retirement at Age 65 with a $1m portfolio. Each of them withdrew 4% of their initial portfolio value and subsequent withdrawals were adjusted for a 3% inflation rate.

During this 30-years period, both experienced a massive 40% cumulated decline in the market over a 3 years horizon (First Year: -15%, Second Year: -25%, Third Year: -5%). The only difference was that Tom experienced this massive market drawdown right at the start of his retirement while Peter only experienced this market drawdown 25 years (Year 26) into his retirement. In other years, the average after-inflation return of the market was +6%.

What was the result of this hypothetical study?

Because Tom kept withdrawing money from his portfolio which was massively losing value from the stock market correction right from the start, he ran out of money at age 83. Peter, on the other hand, managed to “weather” through the massive 3-years bear market despite suffering a portfolio drawdown of $664k during this period, ending the 30-years horizon with c.$303k in value. This was because the larges losses came in later in retirement and his portfolio already had decades to amass a substantial value.

How should one avoid the negative impact of the Sequence of Returns Risk?

It is scary to realize that after years of scrimping, saving and investing, the success or failure of our retirement ultimately comes down to something that is totally out of our control – market performance.

However, there is actually a pretty simple solution or two, to avoid the negative impact of Sequence of Returns Risk. We just have to make some adjustments to our retirement portfolio.

Cash component

First, we got to ensure that our retirement portfolio composition is not entirely made up of stocks or bonds.

This will entail an “emergency fund” component that consists of mainly cash or cash equivalent assets such as capital in money market funds etc. Ideally, one will have 3 years of cash and cash equivalent.

This is because the typical bear market could take 3 years to bottom. During this period, one should be funding his/her daily expenses using this cash component instead of selling stocks at rock-bottom prices to fund retirement expenses. Investment assets should be left alone to allow them to benefit from the full impact of the subsequent upturn.

In our hypothetical example, Tom, who suffers from the Sequence of Returns Risk, could look to have a separate Cash Component which he can drawdown in the early years without having to sell his stocks/bonds.

Let’s assume that he has additional cash and cash equivalent assets totaling $130k.

He funds the first 3 years of his retirement expenses which totaled c.$124k with his $130k cash reserves. Subsequently, when the market recovers in Year 4, he withdrew $43,709 as annual retirement expenses. The withdrawal each year thereafter is again adjusted for 3% inflation.

Unfortunately, despite Tom’s best effort to preserve his portfolio (by not selling down at the worst time possible), he still ran out of money at age 86.

This is because the market recovery process might not be as swift as the drawdown, hence withdrawing money from Year 4 onwards (when his cash component was depleted) is not the ideal scenario as his investment portfolio is not given the opportunity to recover. Tom is effectively still selling his stocks at the low-end of the long-term trading range.

Hence, having a cash component is still not sufficient. We need to supplement the portfolio with another component called the income component or what some might termed as income shield.

Income component

This is the component of the portfolio that generates interest or dividends.

In our prior example, we were a bit extreme when we assume that the portfolio generates no dividend income (stocks) or interest income (bonds). In reality, it is highly likely that your portfolio will be able to generate a certain level of interest and dividend income.

Let’s now assume that Tom’s $1m portfolio generates a dividend/interest yield of 3%. For simplicity’s sake, we assume that this portfolio yields 3% consistently. Dividend/Interest income is generated based on the ending portfolio value of the prior year, i.e. the value at the end of Age 64 is $1m hence $30,000 (3.0% of $1m) in dividend/interest income is generated for Age 65.

Dividend/interest income generated in the first 6 years totaling $137,598 will be used to offset the annual retirement expense from Year 4-6 (Recall that Year 1-3 expenses were being offset by cash) such that no stocks/bonds need to be sold for the first 6 years. This will allow the portfolio to have sufficient time to recover from the 40% market drawdown.

Subsequently, dividend/interest income generated from Year 7 onwards will go towards partially offsetting the annual retirement expenses.

With this additional component, instead of his portfolio running dry at Age 86, Tom’s retirement portfolio (consisting of $130k in cash and $1m in a stocks/bonds that generate a yield of 3%/annum) is now able to last the whole 30-years (an additional 9 years) stretch despite suffering from the unfortunate negative impact of Sequence of Returns Risk in his early retirement years.

What is more, the ending value turned out to be close to $1.27m!

Hence, having an income shield could be seen as a critical component to buffer against the negative consequence of a market correction in the early stages of one’s retirement. This could be structuring your portfolio to be vested in high-dividend yield stocks, strong dividend growers or REITs for example.

A possible solution could also be to have a heavier weighting in bonds which typically generates higher interest income vs. dividend yield from a basket of index stocks vested through a passive index ETF. However, the appreciation potential of bonds tends to be much lower than that of stocks over the long-term.

In our example, we assume a 6% average inflation-adjusted return on the portfolio for all years (except during the 3 years of -40% cumulated drawdown). Having a portfolio that has a higher than average weighting in bonds might result in weaker-than-expected (<6%) long-term returns on the portfolio.

For those curious as to how the “more fortunate” Peter’s portfolio has performed using the above same assumption, with the exception that his “emergency cash” need not be deployed at all, a starting portfolio value of $1m turned into a “legacy” portfolio of slightly more than $3m or $3.07m to be exact at the end of the 30-years period.

Conclusion

We all want to be like Peter and end up with a lot more money at the end of our retirement period and possibly leave a huge monetary legacy for our kids/grandkids. Sometimes that comes down to pure luck and in this example, Peter is extremely lucky that the downturn happened 25 years after he was officially retired, giving him the opportunity to amass a significant fortune before that.

Tom, unfortunately, has no such luck and while he might bemoan his lack of lucky stars, he really does not need to worry about running out of cash if he is better prepared for his retirement.

It is not just the case of amassing that “magical” retirement number. How one goes around structuring his/her retirement portfolio will play an equally critical part in determining the ultimate success/failure of their retirement journey.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.